Specific features of ATAS Sim.

Demo accounts are advertised all over the Internet and people, who visit financial web-sites, often come across a multitude of ads, which try to stimulate them to open a demo account.

Read in this article:

- What is a demo account?

- What does it demonstrate and what for?

- Advantages and disadvantages.

- How to switch from a demo to real account?

- The ATAS platform demo account functionality.

Demo accounts

A demo account is an equivalent of a brokerage account for trading on the exchange. Its main feature is that the money on the demo account is not real.

As a rule, demo accounts are used by:

- beginners for gaining experience and knowledge;

- professionals for testing a new strategy or a new market.

Brokers willingly open demo accounts in order to attract new customers. The procedure of opening a demo account for this purpose is very simple and the ‘drawn amount’ on the account helps to attract beginners by their desire to feel a big profit.

History of demo accounts

Using a demo account could be considered a modern form of old-fashioned paper trading. Its idea was to note down all entries and exits in the notebook and make an estimate later whether your method works.

The term is still valid and, sometimes, ‘demo trading’ is called ‘paper trading’ and the money on the account – ‘paper money’.

This is how a teenager Jesse Livermore started his way to acquire the status of the greatest speculator at the beginning of the 20th century.

The situation somewhat changed in the 21st century – the idea is the same but the format of ‘imaginary trading’ is based now on the use of computers.

Owing to exchanges, platforms and brokers, you can open a demo account today just making some clicks. And this is not its main advantage.

Key advantages

Let’s note some key pros of demo trading and will see how it accelerates the learning curve, so that beginners would have sufficient experience when they make a decision to start real trading.

6 advantages of demo trading

- No risk. You will not lose real money if you make losses due to wrong decisions.

- Self-analysis. Working on a demo account allows you to identify all your shortcomings in market analysis, trading decisions and strategy.

- No stress. Real trading causes emotions of greed and fear. They often do not allow traders to see the key information, required for efficient risk management. Paper trading keeps away from the emotional roller-coaster, that is why a beginner trader can completely concentrate on the strategy.

- Practice. A beginner acquires experience in every element of the trading process – from preparation for a trading session to the final registration of a profit or loss. If traders have access to a demo account, they learn how to use software for trading real money in an easy mood, where pressing incorrect buttons wouldn’t result in a financial catastrophe.

- Confidence. Making a number of complex decisions, which are rewarded with a hypothetical profit, has a big significance for building confidence, so that a beginner starts to feel that he could do the same when real money is at stake.

- Statistics. Trading papers from several weeks to a month allows to collects useful statistical data about a new strategy and market approach. Bare figures will help you to come back down to earth or, vice versa, to prove applicability of your strategy and suggest ways of its optimisation.

Key disadvantages

It is easy to open a demo account. Now let’s note cons of paper trading and how it could harm a beginner.

4 disadvantages of demo accounts

- Slippage. As a rule, orders on a demo account are executed ideally – at the price which was registered in the most recent trade. Consequently, beginners may get a feeling of false confidence in their success. The matter is that, in the real market, an order will be executed depending on the offsetting order availability. For example, a trend share, which you buy for USD 50 on demo, may cost you USD 50.5 or more in the real world. This is especially critical for non-liquid instruments. In order to understand this paragraph better, read about order matching.

- Commissions. Real account traders have a lot of expenditures on the part of the broker and exchange. Not all demo accounts take into consideration this expenditure item, which increases significantly in real trading.

- Psychology. Demo trading doesn’t cause real emotions, which you experience when you make a profit or loss on your real account. In the real world, many traders reduce profit and allow losses to grow due to the absence of the market discipline. As a result, a trader under pressure could make such decisions, which he didn’t allow himself to make on the demo account.

- Adjustment. Demo traders are inclined to idealise their results, justifying themselves or inventing the reasons why real trading will be better than the demo one. Sometimes, due to many factors, it is difficult to understand whether you would be able to execute a completely similar trade in the real market. Adjustments could be done for entries and exits and that is why the demo account results would be a bit subjective at the best case and absolutely wrong at the worst one.

How to make demo trading more realistic?

In order to obtain results, which are not critically different from your expectations, you need to clearly understand the difference between demo and real trading. And you need to take it into account when you start development.

The idea behind and usefulness of demo trading is discussed in this webinar from a professional trader.

We will also give you 3 recommendations.

Recommendation 1. Calculate everything possible

Trading on a demo account online is vulnerable because traders could make various assumptions and keep statistics and conduct analysis without proper self-control. The market doesn’t forgive casual attitudes, especially in the long run.

We want to remind you 3 famous phrases:

- measure thrice and cut once (proverb);

- train hard, fight easy (Alexander Suvorov);

- hope for the best, prepare for the worst.

Be honest when you execute trades on the demo account. Try to take into consideration all possible factors – slippages, commissions, personal qualities and technical failures. Note down all figures and conclusions in your trading plan.

Recommendation 2. Develop psychology and discipline

Register your demo account free of charge. But do it in such a way as if you work with real money. And do it to the extent possible. Control your emotions and the way how trades influence you psychologically until you feel these emotions.

A professional trader trades with a cool head. And if a trader breaks head over a loss on the demo account, how would he act on the real account? Most probably, he would make wrong decisions.

One of the ways to develop discipline and emotional balance for a trader is to:

- limit yourself in something you like if your trade wasn’t executed in accordance with the plan;

- reward yourself for observing the trading plan (independent of the result – whether you made a profit or loss).

Keep a very detailed trader’s log when you trade on demo. It will help you not to transfer your errors from the paper to real money.

Recommendation 3. Do not hurry to start real trading

Barber Lee, a scientist, carried out an interesting study, the results of which he published in his paper ‘Do Day Traders Rationally Learn About Their Abilities’ (2010). He found out that:

- 80% of day traders leave during the first two years;

- 13% continue day trading after the first three years;

- 7% continue day trading after the first five years.

Think twice before you deposit money to your real account. The markets will not disappear. Opportunities are born every day. Are you really ready to try to take advantage of them?

If you are firm in your decision, start real trading step-by-step with small amounts. Your goal is rather long-term than short-term.

Opening a demo account in ATAS

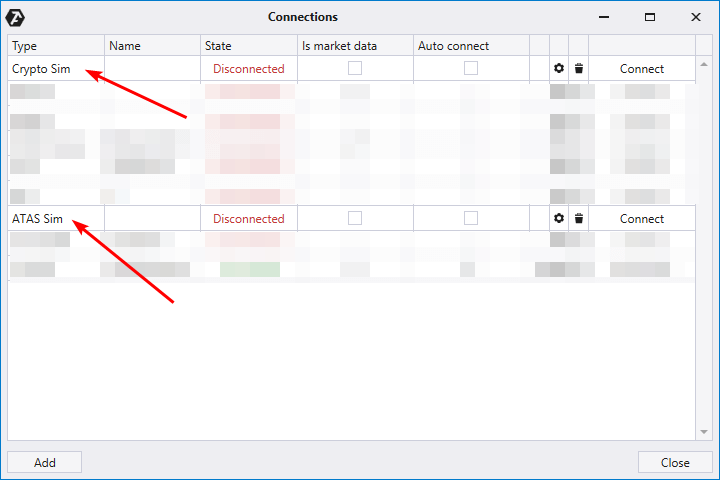

We understand the significance of demo accounts, that is why they are a part of the ATAS platform functionality.

You can add them pressing the Connections button in the platform’s main window. The Simulators section contains demo servers for trading simulation:

- Crypto Sim – a demo account for trading in cryptocurrency markets;

- ATAS Sim – a demo account for trading futures and stocks.

You can open demo accounts in ATAS and use them for as long as you wish. Crypto Sim and ATAS Sim do not have time limitations.

A detailed instruction of how to connect Sim is available in the respective article in our Knowledge Base.

The ATAS platform Sim (demo account) advantages:

- you do not need to contact your broker to open a demo account (however, you might need to fill in some documents);

- opening takes place very quickly and the money is already on the account;

- you can set up commission keeping (instruction);

- a built-in module with log functions for automatic collection of the trading result statistical data.

Statistical data are displayed in 2 formats:

- Real time – trading data are refreshed in real time.

- History – here you can set up the data display of a selected period from the past.

Conclusions

It is not difficult to open a demo account on the exchange.

Demo accounts may bring an important value to a professional for optimization of his strategies. As regards beginners, they can:

- get acquainted with the trading platform;

- get an idea of how the market works;

- develop their own method from asset selection to the criterion of exiting a position.

The problem is that the simulated results will not necessarily correlate with real trading results.

That is why a trader, who opens a demo account, should know that execution, emotions and other aspects of demo trading may differ from real trading. It is important to take it into account when planning to switch from demo to real.

Download the ATAS platform. Use its ATAS Sim and Crypto Sim functions to open a demo account without contacting your broker.

Analyse results of your demo trading, eliminate shortcomings and find your strengths. Make sure that you have an advantage and know how to use it in real trading.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.