How to stop chasing the price

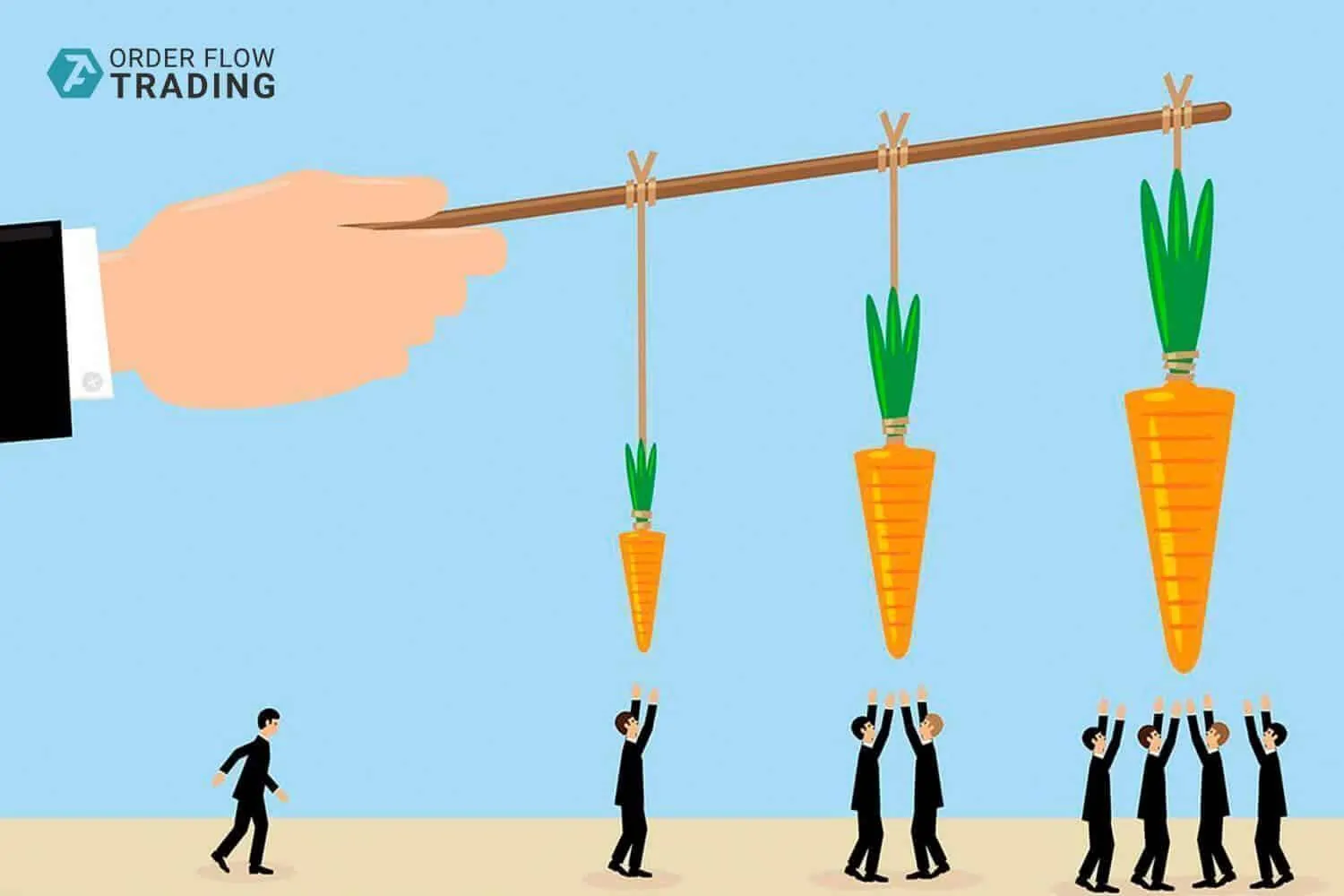

Dear friends! Let’s remember something before you get acquainted with the Footprint chart and watch several videos demonstrating its wide possibilities. Most probably, you know a picture of a donkey that follows a carrot which hangs on a stick in front of the animal. It looks rather funny until a retail trader starts to understand that institutional traders do the same with him.

For many years retail traders were not able to do anything with such tricks of institutional traders in the financial markets. The books taught retail traders to follow the asset price and apply it to the whole huge ‘wealth’ of lagging indicators for the search of the best entry and exit points. And even when their trades managed to ‘bite off’ a small piece of profit from the carrot, it was just a small piece. You will learn from this article why the profit slipped away from you and how to avoid it.

In this article:

- Why did the profit slip away from you?

- What has changed this time?

- It’s time you turned a carrot into a carrot cake.

Why did the profit slip away from you?

Every time you were close to a profit you felt assured that it will not slip away from you the next time. However, for some odd reason, the story repeated again and again. But why?

Institutional traders always had access to the order flow data in real time on the basis of which they carried out the market analysis for executing profitable trades, while retail traders were guided by the signals of lagging indicators, such as Simple Moving Averages (SMA), and used trend lines. Using this approach to trading in the financial markets, retail traders reacted to the price change 6-10 ticks later than institutional players.

The truth is that the only way to have a stable income in the futures market is getting an access to those market data, which institutional traders use. Only this way you will be able to trade with them without trying to catch up with them or, even worse, trade against them. However, how can a regular retail trader get access to these valuable data?

What has changed this time?

In the past, one needed expensive and complex software for getting access to the order flow data and their interpretation in real time. Today, any retail trader can use these data and instruments of their analysis in the trading and analytical ATAS platform. This platform increases informative value of market data which results in a clearer understanding of market tendencies and, as a consequence, in a better trading performance. To do it, you just need to download the ATAS platform free of charge using the link at the beginning of the article.

However, access to the data used by institutional players by itself doesn’t mean that you will be able to see absolutely the same details which their trading systems provide to them. And, of course, you will have to make trading decisions by yourself depending on what you see in the Footprint chart.

Today, trading platforms allow retail traders to see the order flow data in real time instead of ceding 6-10 ticks to institutional players.

And even more than that, advanced instruments of the order flow analysis (Time & Sales), Level II data (Depth Of Market or Smart DOM) of the ATAS platform allow retail traders to see what institutional players do in real time. It’s time you stopped chasing the price relying on unreliable data of lagging indicators. Instead, join the world of professional traders through using the ATAS platform as a unified efficient system of the order flow, cluster and market profile analysis, which allows to look into the market from inside and understand what drives it. Namely this professional understanding of the market will help you to trade on the side of institutional players rather than against them.

It’s time you turned a carrot into a carrot cake

You will have to get used to some things when you pass from the price chasing to the trading by the order flow data, which are reflected in any chart of the ATAS platform in real time. On the other hand, you can easily acquire the skills required for efficient application of the platform’s analytical instruments and their setting.

Lagging data, which you used in the indicator trading, would have never brought you a stable income, since, working with them, you tried to identify actions of institutional players, whose monitors showed the current market information of the order flow. Institutional players knew that the majority of retail traders used lagging indicators and, having such a handicap in time ahead of the retail world, they cunningly tempted you into a trap. They laughed at how you followed the carrot, which hangs in front of you, on their way to a major bank where they worked.

Mainly institutional players own trading platforms that use the order flow data in real time. It so happened that regular retail traders trust the lagging indicator data and believe that they are the best way to achieve success in the financial markets.

Retail traders believe that they will take the profit, which is owed to them, from the market through their trades. But in reality, the best thing they can rely on is their ability to react to the price change 6-10 ticks later than the rest of the market. Besides, they have to fight with all their strength for the desired profit against millions of other retail traders using the same outdated indicator weapons.

The only way to have a stable income in the futures market is trading on the side of institutional players. Do not expect profit if you trade against them. Apart from the fact that they want you to believe that you are able to make a quick profit, they also push you to execution of a large number of trades and, consequently, to an unjustified risk. It allows them to lure you into loss-making trades and your trading capital continues to melt away while they continue to make a profit.

You will continue to miss out a profit while you trade using lagging indicators and pursue a goal of making quick money in the form of a carrot hanging in front of you. Institutional players will never stop teasing you with the carrot. The smartest ones win in trading and institutional players are not stupid at all. Moreover, they create entire market movements with their big orders and they know it. Understanding of this fact is a must for any retail trader.

You can continue to consider the futures market a place where you can become rich very fast and continue to fail unsuccessfully trying to make a living by trading. You may achieve a long-term success in trading only when you stop trying to beat invincible institutional players, whose ‘deep purses’ contain hundreds of millions or even billions of dollars, and start trading with them on the same side of the market.

No one has yet managed to become rich in one day using even the most profitable trading techniques which guarantee survival and prosperity under the modern market conditions. However, the profit you will take from the market ‘biting’ even small pieces off the carrot instead of chasing it, will gradually but reliably increase your trading capital. You will be able to enjoy trading while other retail traders will continue to use outdated methods of indicator trading, leaving profit outside the reach of their trades.

Join the traders who trade with the use of the instruments of advanced technical analysis, market profiles and volume analysis of the ATAS platform right now. You will be able to analyze historical data, carry out cluster and portfolio analysis, set alternative frames for the charts and set unique formulas for spreads with its help. Due to a complex of specialized indicators and instruments of analysis, you will get a possibility to study the history in detail and quickly react to the tiniest changes in real time. Happy trading!