What you should know about the forward contract

In simple words, a forward contract is a non-standard agreement for a future delivery of an asset at a set today’s price. As a rule, agreements are executed outside the exchange, that is why they do not have standard options. More often, they are used for insurance against sharp price changes or for a real future delivery of some assets at a set price. It could be any asset – commodities, securities, currency, etc.

Apart from hedging and delivery, traders use forwards for speculative trading on the price difference.

- A participant, who agrees to buy an asset in future, takes a long position.

- A participant, who agrees to sell an asset in future, takes a short position.

History of emergence

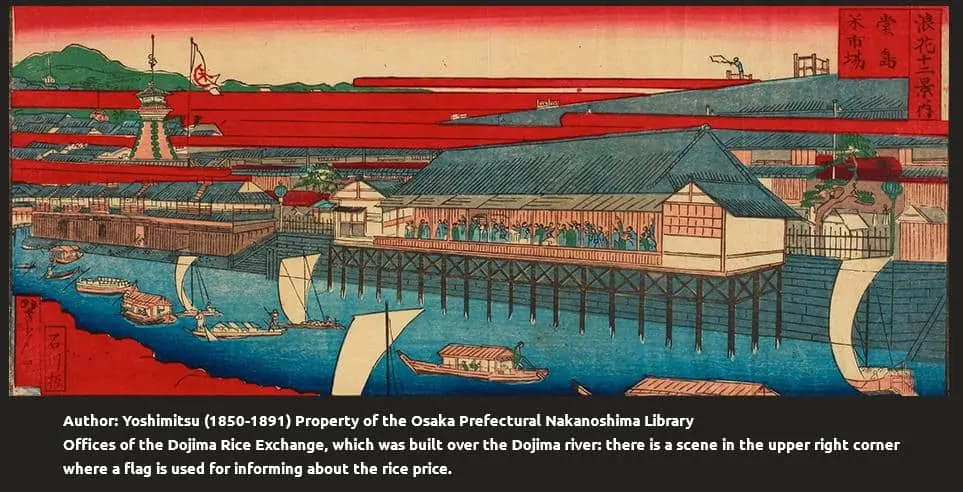

It is believed that the first forward contracts emerged in Japan on the rice exchange in 1730.

Such agreements started to be executed in America only in 1851 on the Chicago Exchange. They had to do with delivery of corn and grain crops.

Forward trades were very risky. Buyers refused to pay if the corn prices fell during the contract validity and farmers stayed without money. Authorities viewed such trades negatively since they considered them speculative, while judges viewed them as bets or gambling.

Content of a forward contract:

- a period of time for which it is executed;

- a future delivery price;

- quantity.

Forwards do not have a standard form, that is why the parties of a contract could add any condition.

When partners execute an agreement, the asset delivery price usually coincides with the forward contract price. The difference between the forward and spot prices is called premium or discount. If contracts are executed at different times, their prices may differ.

Example.

- On November 1, a trader bought a forward for delivery of 2 thousand pairs of rubber boots on March 1 of the next year at the price of RUB 250. The forward price of rubber boots was RUB 250 when he signed the contract.

- On December 1, a trader bought another forward for delivery of 2 thousand pairs of rubber boots on March 1 of the next year at the price of RUB 300.

Thus, the forward price of rubber boots under the second contract increased. However, it didn’t change under the first contract and is RUB 250.

Principles of assessment of forward and futures contracts are very similar. Initially, only the underlying asset has some value while the contract itself is of no value. However, if a trader resells it further, there will be a difference between the delivery price and the amount for which the trader would wish to or can sell it. Thus, the asset forward price and the forward contract price would be different.

In order to calculate at what price a forward contract is executed, you should know:

- the spot (current) price of the underlying asset. This price is constantly changing depending on the market situation;

- the risk-free rate. In order to motivate a trader to buy a forward contract, it is necessary to take into account the alternative reward, which he could have received if he would have invested the money in something else. For example, the deposit rate in major and reliable banks could be used as the risk-free rate;

- the period of validity of the forward.

Example. An investor wants to have Gazprom stock in his investment portfolio in 6 months. He can buy stock right now and keep it on his account or buy a forward contract for the stock delivery in half a year. For him to buy a forward contract, a theoretical forward price should take into account the following:

- the current Gazprom stock price – RUB 245;

- the risk-free rate – 6%;

- the period of validity of the forward contract – half a year.

Theoretical forward price = 245 * (1+10%*6/12) = RUB 257.25

Such an approach to the price calculation is called arbitrage-free. As soon as the forward price becomes different from the theoretical one, arbitrageurs get a possibility to make money on the difference.

If dividends are paid during the period of validity of the Gazprom stock contract, they should be deducted, since dividends are an additional income, which the stockholder would have received but the forward holder will not receive. A more complex calculation is used for assessing forward contracts with income.

Let’s assume that the spot price of a security is RUB 245, the risk-free rate is 6% and the dividends of RUB 14 per share will be paid in half a year. In order to find the six-month forward price of the stock, we should use the following formula:

F = 245 * (1 + 0.06 * 6/12) – 14 = RUB 238.35

Dividends, in our calculation, are paid at the end of the period of validity of the contract. If the dividends would have been paid at another point of time, the calculation would have been even more complex. The buyer could have reinvested the received dividends and make an even bigger income.

It is necessary to take into account the storage cost for physical commodities, for example, gold or silver, when calculating the forward price. In this case, the storage expenses should be considered as a negative income of the commodity owner. For example, gold should be stored in the bank security box and a monthly fee should be paid for it.

As we already wrote above, the value of the contract itself may change if the market situation changes. For example, when the parties executed a six-month forward, the spot price was RUB 200 and the risk-free rate was 10%. The delivery price of this contract was:

F = 200 * (1 + 0.1 * 6/12) = RUB 210

Let’s assume that the spot price of the stock increased to RUB 230 in 3 months – then the price of the forward should also change, because this trade would become unprofitable at least for one party of this trade. In such a case:

Contract price = spot price of the stock at the moment of selling the contract – delivery price, discounted at the moment of selling

This value could be positive or negative, since the spot price may either increase or decrease. The negative price means that it would be necessary to make an additional payment in order to get rid of obligations.

Differences of a forward contract from the futures one

What is the difference between futures and forwards?

- Forwards usually do not circulate on the exchange;

- they are not subject to intermediate calculations. Unrealized profit or loss are accumulated during the whole period of the contract validity;

- they are not standardized, which means that they have significance only for the parties, specified in the contract.

Types of forward contracts

There are two main types of forward contracts – delivery and settlement.

If the parties want to get the underlying asset in the future, they execute a delivery contract. Asset delivery doesn’t take place under settlement forwards and the parties know about it from the beginning. Thus, trades with settlement forward contracts are speculative or hedge (what hedging is). One of the parties receives profit while the other receives loss in the money form.

Forward currency contracts are used, more often, for hedging currency risks of an enterprise. They belong to settlement trades. When such a contract is executed, an enterprise undertakes to sell or buy a foreign currency at an exchange rate, specified in the contract, after a certain period of time in the future. If the forward currency rate exceeds the current one, it means that one currency is quoted with a premium and the other one with a discount. Since a contract is an agreement between the parties, there is always a risk that it won’t be executed.

Example of a forward contract. A Russian manufacturer of metal structures acquired equipment from an American supplier for USD 1.5 million. The manufacturer will pay for the equipment by installments during 1.5 years. Installments should be paid every six months in equal parts. The exchange rate at the moment of delivery was RUB 65 per USD 1, which means that the cost of the equipment was USD 1,500,000 * 65 = RUB 97,500,000.

In order to hedge the currency risks, the company executed 3 forwards for buying USD – in half a year, in a year and in a year and a half at the current price of RUB 65.

| Payment | Payment amount, USD thousand | Exchange rate, RUB | Amount by the exchange rate, RUB thousand | Exchange rate under the forward contract, RUB | Amount under the forward contract, RUB thousand |

| 1st payment | 500 | 70 | 35,000 | 65 | 32,500 |

| 2nd payment | 500 | 72 | 36,000 | 65 | 32,500 |

| 3rd payment | 500 | 75 | 37,500 | 65 | 32,500 |

| Total | 1,500 | 108,500 | 97,500 |

So, the enterprise saved RUB 11,000,000 due to hedging. However, the situation could have been the opposite if the USD to RUB exchange rate would have decreased.

A security forward contract is an example of a delivery agreement. They were popular in Russia in the 18th-19th centuries and were called ‘difference trades’.

The risk of a forward contract lies in its nonexecution by one of the parties, that is why the banks always check the solvency of a party when executing such trades and ask for a pledge. In such cases, the parties simultaneously sign two contracts – forward contract and pledge agreement.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.