The investor search guide.

To become a millionaire from ground zero is a dream of many. The only thing is that the exchange is not the place where the money is given away. However, you can learn to derive profits using small amounts of money, in order to look for investors later, increase your capital and execute your dream.

You can use a general plan with 3 steps for achieving success:

- Learn to trade profitably.

For example, develop a trading system in ATAS using exchange volume analysis.

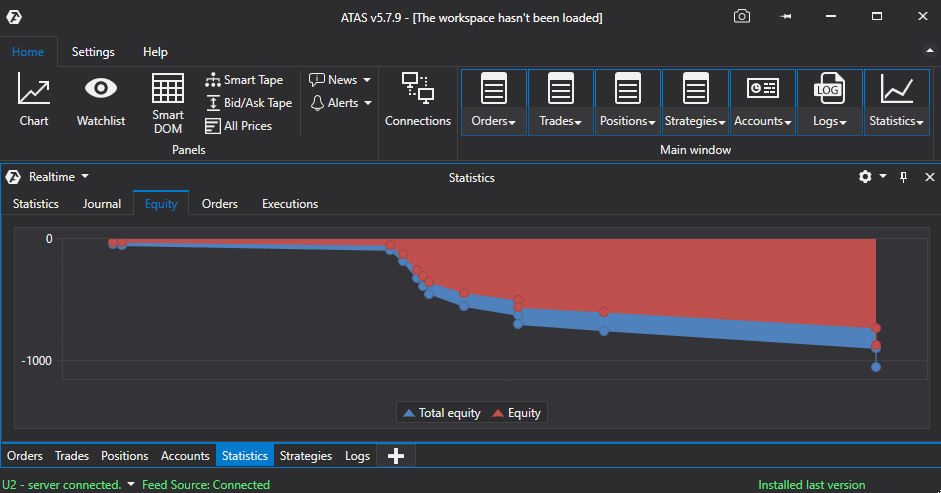

First, test your system on the ATAS Sim demo account and then start trading on the real account. You do not need a big start-up capital in order to trade one contract during a day. The main thing is to prove profitability during a long period of time. For example, 1 year. - Draw up a presentation for investors. It should include official brokerage statements, independent monitoring data and the growth curve from the ATAS platform (see example in the picture below).

- Take the investor’s capital under management. Increase the position size several-fold in order to start making real money.

In other words, use the available small capital to demonstrate your abilities and then scale up at the investor’s expense.

Why it is important for a private trader to target the investor’s capital

An average yield of many hedge funds around the world is about 10-15% annual. Using professional instruments of the ATAS platform, you can find profitable trades efficiently in order to reach the level of 15% annual and surpass it.

However, if your capital is USD 1,000 only, you will make as much as USD 150 a year. This is definitely insufficient for a living. What capital should you have in order to make a living from trading?

Let’s assume you need USD 2,000 a month for a living. Consequently, you need USD 24,000 just for a living. Plus you need some additional money for saving or investing in reliable securities. Thus, our goal is USD 30,000 a year.

If USD 30,000 is 15%, then 100% is USD 200,000. Quite tough …

There are not so many traders who are ready to start trading with the capital of USD 200,000.

Thus, the idea of looking for an investor becomes of vital importance.

How much money to ask from an investor

Usually, the investor takes the major part. He takes 70-80% of the profit, while 20-30% go to the trader. This proportion may vary but, as a rule, the bigger the investment capital, the smaller percentage of profit the trader would get.

Let’s calculate now. You want to make USD 30,000 a year. If your trader’s share is 20%, you need to show the profit of USD 150,000 a year. It means that, if your yield is 15%, you need USD 1 million under management.

How to get 1 million under management

You need to draw up a serious investment proposal. It should contain:

- A complete brokerage statement about trades.

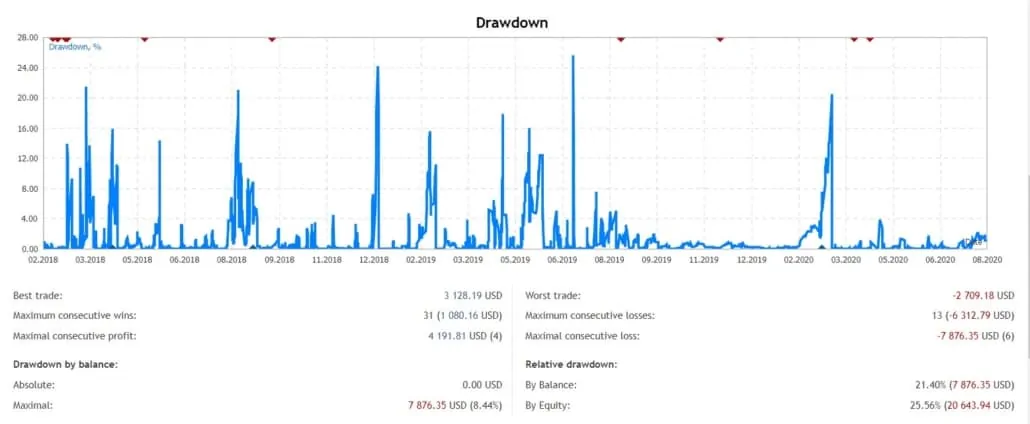

Of course, such a statement should be based on the real account, opened with a reputable broker. - Information about risks and maximum drawdown. Risk assessment is very important since a major investor wants, first of all, to preserve his money and only then to make more.

So, what risk can an investor take? Everybody has his preferences. However, if the drawdown is more than 20%, it significantly lowers the chances.

3. Income Statement. An extremely high yield may frighten experienced investors, since it is directly connected with high risks. The yield of 10-20% annual in USD with low risks is considered to be good. However, if the risks of the trading system are high, the profit should also be high.

- Reward:risk ratio. Investing in trading is considered to be a risky enterprise compared to investing in stocks or bonds. Consequently, the investor’s expectations will be higher here. A good reward:risk ratio would be 3:1. For example, the yield of 15% annual with the maximum risk of 5% would be acceptable. The ratio of 2:1 could also be acceptable, but not for all investors. The annual yield of 20% with 10% risk is quite a working variant.

Where to find an investor

Do you have a statement with a good yield and risk? Start looking for an investor. You can move simultaneously in several directions:

- Specialised services. Connect your account to the public trader account monitoring service. A big number of potential investors visit web-sites of such services. They study main account indicators to make a choice. Investors may send personal messages to traders in order to agree on individual conditions.

- Active search for institutional investors. These are investment funds, hedge funds and specialised bank departments. Draw up a presentation of your trading strategy with a statement and links to account monitoring services and send it to all companies, which might be interested in it. Make cold calls. One trader said that every 100 contacts helped him to find 1 investor.

- Social networks. The best network for this purpose is the community of professional contacts LinkedIn. Establish links in financial circles and offer your services on capital management. Create a YouTube channel, devoted to your trading.

- Regional links. Visit financial activities in your city and establish links.

Attraction of sufficient capital under management is not an easy process, but if you conduct it as systematically as you conduct trading, the results will not be long in coming.

How to build relations with an investor

Cooperation of an investor and trader is a long-term project and only in this case it may bring a substantial result to both of them.

As a rule, an investor puts at risk only a small amount of money at the initial stage of the collaboration. If everything goes well, the investor would increase the capital to its complete volume.

If the trader exaggerated his statement or didn’t disclose his weaknesses, all hidden pitfalls will come to surface after some time. And then the investor would leave the project and the trader would destroy his reputation.

Under conditions when both sides are interested in receiving a stable benefit, the most correct trader’s policy would be HONESTY.

That is why it is better to discuss all possible nuances at the very beginning and execute an agreement, which would contain:

- Maximum allowable risk and actions in the event of reaching it.

- Possible force majeure circumstance.

- Accounting period.

- Trader’s commission and payment conditions.

- Rights and liabilities.

If investors are attracted through specialised services, the investor-trader interaction is regulated by the service itself. However, honesty in describing the trading system and risks would always stay an important factor for investors.

Conclusions

It is not easy to find investors. It is connected with the fact that there is a high level of distrust in investment proposals. Another nuance is regulation and control on the part of governmental organisations. Conditions of the trader-investor collaboration may be different in different states.

However, if a trader really has a valuable product, which is capable of bringing stable results for investors, there will be no problem with the capital attraction. It requires to:

- build a trading system with the yield of 15% annual or higher and with 5% risk. The desirable reward:risk ratio is 3:1;

- draw up a presentation with a statement from a reputable broker;

- provide investment resource monitoring records;

- look actively for new investors rather than wait for investors to find you;

- build relations with investors honestly, on the basis of a written agreement.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.