All about free and paid trader trading signals

If you have to do something with trading on MICEX or any other exchange, you have come across the trading signal services one way or another. Different messengers and social networks are full of groups and chats, where signals of successful traders are published. Most probably, you received invitations to join them.

How does it happen? Usually, people you don’t know and who have an avatar with a pretty blond offer you friendship and to join their group where you, at last, would receive really successful trading signals.

Some signals are paid, some signals are free. Some signals are provided on behalf of successful traders, some – anonymously.

Why on earth should you trust anyone and conduct your trading on the basis of somebody else’s recommendations? How does the trader signal business is built and is it possible to make money on it? Let’s try to find the answer in this article.

Read in this article:

- Trading signals – are they legitimate or not?

- How are trading signals formed?

- Who stands behind trading signals?

- Is there a difference between expensive and free signals?

- Should we trust free signals?

- How to launch the service of your own trading signals using the ATAS platform?

Trading signals – are they legitimate or not?

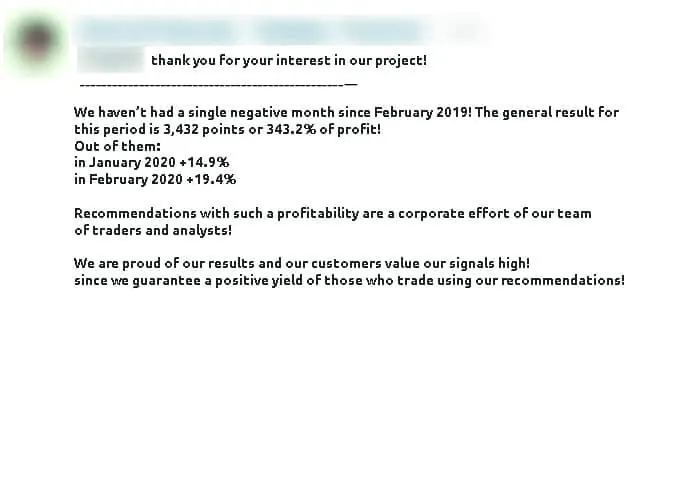

While preparing the current publication, we selected several attractive (in our opinion) services, which ‘fall short of’ trading signals, and were surprised that as soon as the resource owners learnt that their trading signals would be thoroughly analyzed and checked on historic data, negotiations came to an end. At the same time, the news feeds, which show high profitability, continue to be renewed in open groups.

Here arises a justified question – why successful owners of such resources avoid publicising results of analysis of their trading signals? Guess by yourself.

As a result, we didn’t manage to get a demonstration access to any of the paid groups with trading signals in the process of preparation of the publication.

Perhaps, the current market situation, when many markets crashed, revealed weak sides of such services, when there is nothing behind the promises of high income.

How trading signals are formed?

The author of this publication worked, some time ago, in an organisation, which, apart from its main financial activity, sold paid subscriptions to the channel with trading signals for the cryptocurrency market. Since it was an officially registered organisation and had the top manager and deputies and a staff of employees, analysts and traders – it is possible to say that it had a good experience. Which, however, lasted short – the reason was a sharp rollback of cryptocurrencies with the further stagnation of the whole market.

The author’s experience allows telling a story how a trading signal originates and how it passes through all stages of testing before it is published.

The process starts when fundamental analysts collect information about prospects of growth or fall of one or another financial instrument.

It should be mentioned that they collect this information on the Internet and this information is available to anybody and it is not clear who published it and for what purpose. Monitoring the work of such analysts, the author was shocked with the quality of the information, which is submitted further to the technical analysis department. Not only does nobody check the collected information, it often has a character of a ‘bait’.

Having received such information, the technical analysis department gives its estimate of the prospects of growth or fall of the instrument. As you know, technical analysis is assessment of the chart with the use of such instruments as:

- various chart patterns, where candles draw ‘heads and shoulders’, ‘flags and pennants’ and, actually, they draw everything;

- technical analysis indicators, such as RSI, MACD, BBands, moving averages, etc.

The process of technical analysis of an instrument rarely lasted longer than 15 minutes. Having completed the technical analysis, a specialist formed specific recommendations on the price of opening and closing a trade using protective strategies: stop losses, price trailing, dividing a position into parts, etc.

More expensive signals usually should give specific prices – where to open a trade and where to post take and stop.

At the final stage, the signal was passed to the manager, who was responsible for running the messenger or social group channel, which publishes the signal.

It looks like this:

All fine and dandy but some of the signals would inevitably bring losses and efficiency of work by trading signals could be equal to the ‘heads or tails’ principle.

Nevertheless, the buy trading signals will be very good in the growing markets. However, if a market falls, the majority of buy recommendations will turn out to be wrong.

Who is behind trading signals?

Having studied the trading signal selling service from inside, the author could predict the organization’s bankruptcy with confidence due to the fact that the cryptocurrency market couldn’t grow all the time. Some customers paid the life-long subscription and went out of the picture. Some of the customers didn’t return the funds invested in crypto-assets, freezing them till better times.

Several years have passed since then and the cryptocurrency market still hasn’t restored its indicators. Despite the fact that the company staff enlisted about 50 persons and had a well-established vertical system of management and control, the market didn’t leave them a chance for survival.

In the majority of cases, a small staff is behind the trading signals or even a single trader (nobody knows whether this trader is successful or not) moderates his channel and not all people find time to check it.

What is important for us now is the motivation, which drives those people. For example, if anyone can accurately predict the market, why should he share his findings and knowledge with anyone else? He can achieve, all by himself, a bigger success with less efforts than from selling trading signals.

However, statistics shows that a trader lives in the market from one to three years. We assume that sooner or later a trader would lose his capital and become an analyst in order to recover the lost money through selling trading signals. The analyst’s life is longer and depends on the way he presents his signals rather than on their quality.

Is there a difference between expensive and cheap trading signals?

The cost of switching to the trading signal service could be both zero and equal to an average monthly salary.

For example, channels in the VIP format could take for subscription from USD 2-3 thousand a month, but the quality of their signals could have no difference with the free ones.

Analyzing his former experience of work in one of such companies, the author himself watched how the customers paid life-long and VIP subscriptions in the amount of RUB 150,000. However, in fact, the same signals were published both for VIP and regular channels. We can say, drawing a conclusion, that there was no difference between expensive and cheap subscriptions.

Do you know that the majority of trading signals are taken from the already existing trading platforms?

For example, a technical analyst studies areas of market interest, which anyone, who has a trading platform for volume analysis in his possession, can identify. For example, the Cluster Search indicator in the ATAS platform shows areas with high volumes.

Analyzing his former experience of work in one of such companies, the author himself watched how the customers paid life-long and VIP subscriptions in the amount of RUB 150,000. However, in fact, the same signals were published both for VIP and regular channels. We can say, drawing a conclusion, that there was no difference between expensive and cheap subscriptions.

Do you know that the majority of trading signals are taken from the already existing trading platforms?

For example, a technical analyst studies areas of market interest, which anyone, who has a trading platform for volume analysis in his possession, can identify. For example, the Cluster Search indicator in the ATAS platform shows areas with high volumes.

It is obvious that if such a cluster appears in the chart, someone is very interested in buying or selling at these prices, which means that the second passage through this area could well cause the appearance of support or resistance.

An analyst offers this price level as a trading recommendation for buying or selling and calculates approximate stop and take.

Thus, the majority of trading signals do not represent any value, since the signal author possesses the same information the other people possess.

In view of this, we want to underline that it is a personal decision of anyone whether to buy trading signals or not. If you decide to buy, it would be reasonable not to create excessive pressure on your pocket through subscribing to trading signals.

Some signal systems are automated and robots publish them. Such automation allows reducing overhead expenses for paying the employees.

We managed to analyze one of such signal systems.

Signals, which are published in the channel, in fact, point to the areas where there were big accumulations in adjacent markets. For example, if a trader tracks quotations of the RTS index futures, the information he receives is formed on the basis of:

- visual perception of the chart;

- futures volume analysis;

- open interest analysis.

However, if we analyze the structure of exchange instruments, we acquire understanding of the hierarchy of dependence of the instruments from each other. Stocks and bonds are on top in this structure, since they accumulate most of the capital, then currency pairs go and then futures and options.

Understanding of what instruments contain the maximum risk would be useful. For example, the holder of a stock or bond has no obligation to sell them in the event of a crash in the market (if they were bought without the use of borrowed funds). If the stock is bought for the holder’s own money, the risk in this case is equal to zero, since the security may recover its value in the long run, especially if it is a stock of a well-established company.

The forward market is different. All positions there have the margin character, which means that the risk here is directly proportional to the asset movement against the trader.

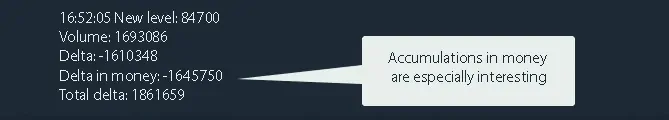

Accumulations from the options market of the RTS index futures are published in the channel, which we have analyzed.

As soon as the price forms the volume, established by the developer, the bot sends a signal about what volume of risky obligations are accumulated at this level. After publication of the signal, we register the volume and delta values in the chart and draw the level, which, further on, exerts influence on the price during the second passage of this area.

In fact, such a signal is not a trading recommendation, it just provides the trader with additional information about the state of the market and accumulated risk positions.

By the way, we recommend you to read our articles about options for better understanding of interaction of the options market and futures market.

How to launch the service of your own trading signals in the ATAS platform

Today, anyone of you can have some useful market information. The ATAS platform has in its arsenal a service for development of user indicators, which could be:

- both passive (that is, only to focus attention on important areas),

- and active, which have the character of trading recommendations.

Let’s check an example of one of such user indicators, which draws green and red levels in the chart.

These levels could be assessed as the levels of support and resistance.

This author’s indicator reflects option levels, at which the maximum risk accumulated during the day. It works only for three instruments from the Moscow Exchange: Si, Ri and Br futures.

If you have such an indicator in your possession, you can launch the trading signal service by yourself.

In order to organize this service independently, you would need the knowledge of the C# programming language and platform’s API (Application Programming Interface), and if you do not have time to study the programming language or platform’s API, you can contact the developers, the list of whom is available here: https://atas.net/atas-indicator/

If you are interested in studying the platform’s API, we recommend you to visit the Knowledge Base section of the web-site: https://support.atas.net/ru/knowledge-bases/46-api

The platform service allows granting access to the developed indicators to any ATAS user and setting the terms of use of the indicator or signal service. Signals could be provided both in the form of the chart elements and in the form of messages in a special window of the platform. Apart from the visual notification, the indicator or signal service may have a sound notification of the user for the purpose of entering a trade or exiting from it. If desired, the signal could also be sent to any available messenger.

Summary

We would like to note in the end that the majority of services with trading signals will not give you any guarantee of making a profit, while really working strategies, as a rule, are not publicized and quite often are connected with the market insider information. You can find a lot of confirmations in real life that various trading signals, in fact, are just one of the ways to make money on easy marks.

In order to make money in the markets, you need an advantage. Read our blog and watch videos on our channel. ATAS will help you to have a real understanding of the market and then you will find trading signals in your head.