Does success as a trader depend on understanding psychology?

Many intraday traders think that the idea of trading lies in trading indicators, stock screeners and economic reports data. They rarely think about other important trading factors. Operation of the human brain stays unnoticeable in the majority of cases until we pay focused attention to it. You will learn from this article what role the trading psychology plays in the process of making trading decisions and how the clear mind and positive thinking influence the process of information processing.

In this article:

- About trading psychology.

- Psychology of fear and greed.

- How trading psychology can help you?

- How to keep positive thinking?

About trading psychology

Practically any trading aspect could be considered as a result of psychological processes. Traders that patiently wait for an ideal opportunity to execute a trade keep the psychological aspect of trading under control. The same cannot be said for beginners who still need to find a psychological balance in the process of waiting for profitable trading signals.

At first sight, such a simple task as a buy or sell of a security requires the brain to take into account information received with the help of advanced instruments of the market volume analysis of the ATAS platform, price action (price action is the analysis of the behaviour of the price and patterns, which it formed) and also to conduct quick calculations of the size of risk or capital, allocated for a trade, and to post a stop loss or take profit. When you start thinking through what volume of information your brain should take into account during trading, you will notice sooner or later that a clear mind and good mental health are key factors of your long-term success. Besides, it is applicable not only to traders or investors but also to any professional activity.

Let’s consider the sporting activity which is often considered as a very close to the intraday trading sphere of activity. When athletes train they master not only their physical skills. They also pay significant attention to the training of their mental health or psychology.. Perhaps it will sound banal, but the fight is won in the head first. The same is true about traders. For example, if you have a bad day but still decide to trade, there is a high probability of making a loss since your brain is somewhere else.

The trading psychology concept is not new and there is a huge amount of studies on how to get ready for successful trading. The trading psychology is a very important aspect of trading in the financial markets, since the market reflects the collective psychological behaviour of all its participants. Let’s consider an example of the growing bullish market. Investors buy on rally because they are in the bullish mood. Such behaviour could be caused by objective reasons or their greed.

On the other hand, there are many cases when good market news resulted in sells. Such moments send a signal about pessimistic forecasts of investors and, despite whatever good news, the market growth looks of little promise to them. Consequently, a trader, who trades in the market which reflects the collective psychology of all its participants, needs not only to understand the market behaviour, but also to train his mind in order to improve control.

Thus, the trading psychology has two important functions. First, the market by itself is a reflection of the psychology and mood of investors. Second, the psychology of one trader plays a very important role in identification of further prospects of the market.

Psychology of fear and greed

When we speak about the trading psychology, two words often come to our mind: fear and greed.

Fear arises in the stock market when investors are reluctant to take risks and look for a shelter in the low-income assets in order to preserve their capital. There is a simple explanation for it. Investors are too scared at such moments to invest into the stock market since they forecast that losses, most probably, would exceed the expected profit from investments.

Greed in the stock market, in its turn, is a desire of investors to get a high profit taking a high risk. It is explained by the optimistic mood of investors with respect to the prospects of the economy or stock market and that is why they are inclined to take a higher risk.

The same emotions exert a strong influence also on retail traders. You should admit that it is difficult to bring yourself to increase your market position when you feel fear. However, it is much easier to increase your market position after you have executed a number of profitable trades.

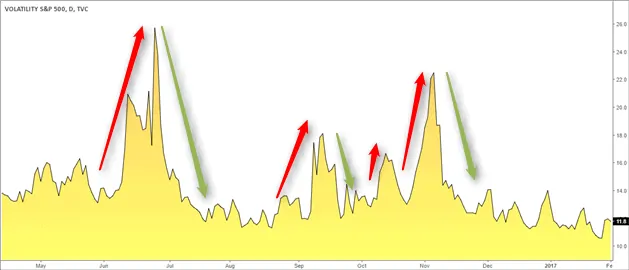

It is neither more nor less than the influence of fear and greed at the personal level, while the stock market cycles at a larger scale, shown below, are a reflection of the behaviour of the whole investment community. The falls of the stock market are nothing else as psychological cycles in action caused by the investors’ behaviour in the result of some negative market news.

In the majority of cases, when the stock market falls, you will see interventions of central banks or governments in order to support it. Usually, central banks threaten to decrease interest rates or to flow more money into the economy. Such statement interventions can largely calm down investors, which facilitates gradual restoration of the stock market despite the fact that the announced measures may not be realized in practice in the future.

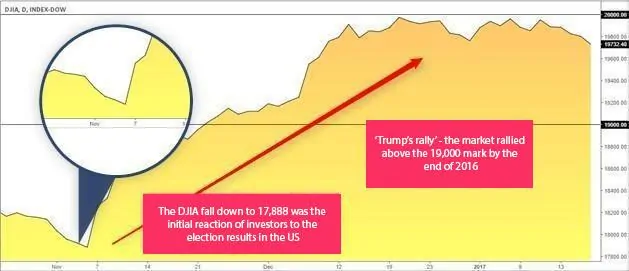

In order to demonstrate the market sentiment (sentiment is a dominating mood of the market participants), we recommend you to look at the DJIA (Dow Jones Industrial Average) chart. We are interested in November 2016 when Donald Trump was elected the 45th President of the US. The DJIA sharply fell on the day when the election results were announced, since investors didn’t clearly understand what impact the Trump’s protectionist policy, declared during the pre-election campaign, would have on the economy. However, the same day, Trump calmed down investors and soon shifted his attention to the plans of the fiscal stimulus and taxation reform.

The President’s statement was sufficient to fundamentally influence the investors’ sentiment and add fuel to the market rally which brought the market to new historical highs.

You can see in the linear chart above how the psychological factor facilitated the market ‘Trump’s rally’. No doubt, apart from the Trump’s statement interventions, the stock market received some feeding from the Federal Reserve System (FRS), which was in the hawkish mood in its economic forecast and stayed in the cycle of increasing the base interest rate.

Another classical example of the influence of the psychological factor on financial markets is irrational exuberance – this term was introduced by Alan Greenspan. He was the Chair of the FRS for 18.5 years (1987-2006) and he used this term to describe the market euphoria of the 1990s in the early days of the dot-com bubble (the dot-com bubble is a financial bubble which existed from 1995 until 2001). Some experts think that Alan Greenspan used this term to describe overvaluation of the stock market.

How trading psychology can help you?

Intraday traders can use advantages of the trading psychology, if they develop their discipline and leave emotions outside the market, not only for making profit, but also for reducing risks, especially on those days when trading doesn’t go along.

The most common reason of losing money is averaging of a loss-making position. It is rather simple to describe such situations in theory, but it is rather difficult to detect them at the moments of real trading. Confidence of a trader in the correctness of his own market analysis and, consequently, assurance that the market is about to change its current direction and that it will go towards him are one of the reasons why it is difficult for traders to close loss-making positions.

At the same time, insufficient knowledge of the trading psychology or even its absence may cause an even bigger fear of a trader which would result in an early closure of profit-making trades. And although the market knowledge is undoubtedly very important in trading, namely emotions, in the majority of cases, lead to such ill-considered decisions.

How to keep positive thinking?

Trading may become a boring and even dull activity for intraday traders who open and close trades day after day, especially if they specialize in one market only. For example, you can always find quite a lot of successful intraday traders who trade only E-mini S&P 500 futures (ticker: ES).

Paradoxical as it may sound, but a break in trading can become the first step to maintain the positing thinking in trading. It means that you shouldn’t monitor the charts for some time to get rid of any preconceived ideas about the traded market. A fresh eye and periodical breaks will not only help you to dissolve dullness of intraday trading but also to find new trading opportunities or even detect risks you haven’t noticed before.

It goes without saying that it is necessary to put time into physical exercises or even to find a hobby, which is not connected with financial markets and trading, in order to maintain the positive thinking. Sometimes, traders think that they have rest, although they read books about financial markets or watch videos of the same type. A hobby, which is connected with physical activity in one way or another, will become an excellent way of training the body and spirit and also will help to get rid of the stress.

Traders should also take into account such an aspect as the own environment. Some unpleasant personal situation or a serious loss during trading negatively influences their psychological state. That is why they often say that traders (especially if their only income comes from trading) should know either how to control emotions or how to abstain from trading until overcoming psychological difficulties.

Remember that any person can become a trader but only less than 20% of people that made such a decision continue to stay in this business. According to the statistics, more than 80% of novices completely lose their trading capital and this is the reality. Trading might seem an easy profession, especially when the profit flows directly into your hands. However, the professional aptitude is tested in reality when everything goes wrong or when the trading capital was seriously damaged. Quite often, only those who managed to restore psychologically after failures and continued to trade, drawing conclusions from the made mistakes, will be able to reach the end and achieve the desired results.

If you haven’t yet thought about the importance of trading psychology, find time and have a look at your trading results. In the majority of cases, the answers to why you closed profitable trades early or increased the loss-making trades, or even made big losses, lie in your thinking at those moments when you did it.