HOW TO BECOME A TRADER FROM SCRATCH?

The trader profession is extremely attractive and more and more people want to become traders. This is not surprising since professional traders make good money and are masters of their time.

- What a trader is and what it means

- What a trader does

- How to become a trader

- How to study to become a trader

In this unusual article we would present you an interview with a professional trader from Europe. He would give you practical advice how to become a trader and avoid mistakes on the basis of his own personal experience.

But, first of all, let us find out (if someone does not know yet) – what a trader is.

Trader – what is it? Trader means a merchant. And, although trading has a broad sense, most often, they mean an exchange trader when they say “a trader”.

Traders buy and sell securities – shares, futures, commodities, currencies, bonds, etc. – on the exchanges. An exchange is a place of work of a trader. But, in reality, traders work at home or in a private office, connecting to the exchange via Internet.

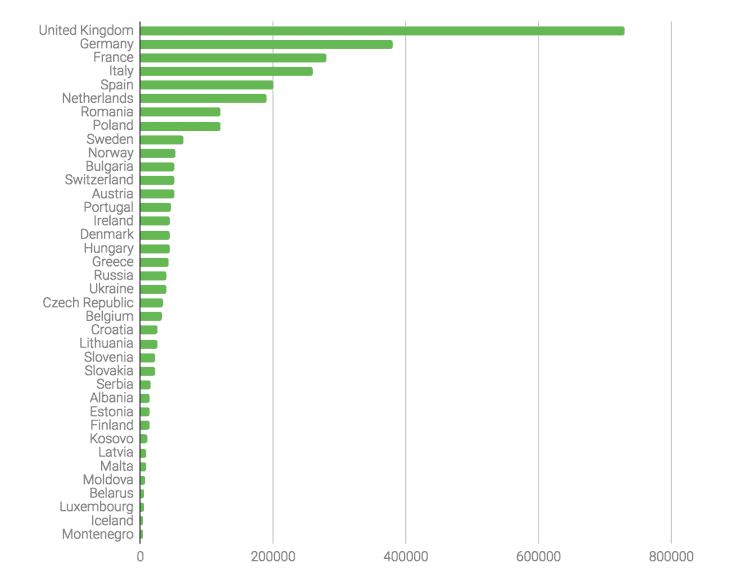

Due to development of online trading on the exchange, the number of traders in the world grows fast. According to brokernotes.co, there are more than 3 million traders in Europe and their number doubled during 2017-2018. But it does not mean that they all make profit on the exchange.

A beginner trader, most probably, will lose money. While a professional trader will make profit more often than suffer losses. A professional trader uses his knowledge and experience to analyze the market and, based on his conclusions, buys undervalued stock at the low. And when the stock goes up, he sells it at the high.

The goal of a trader is to make profit. On the one hand, the trader profession is based on a pure speculation and could cause disapproval. On the other hand, traders deliver benefit through filling the financial system with liquidity, stabilizing it, satisfying incoming supply and demand and financing production.

DO YOU WANT TO TEST YOURSELF AND BECOME A TRADER?

Let us meet a professional trader in order to learn:

- how he started to trade on the exchange

- what mistakes he did

- what his advice would be to beginners who want to become traders from scratch but still do not know how.

.

Hello everybody. My name is Michael Burgstaller. I am 35 and I live in Austria. My country is located in the middle of the European Union. My specialty is Marketing and Graphic Design, however, trading takes most of my time since 2009.

I cannot say that my life before trading and after trading is different. Before trading, I spent a lot of time in front of a computer monitor designing different things. Now I devote my time to studies and analysis. I like both of these occupations.

Michael, how did you become a trader?

I think my story is rather trivial. All financial markets and instruments are very interesting that is why I decided to try something personally.

I started on ZuluTrade and also worked with some European CFD brokers. I made big money and I lost big money at the same time …

I realized very fast that it was really difficult to trade without the information the professionals have, that is why I became interested in the futures markets in 2012. Since then I never came back to CFD trading again …

Let us step aside to make some things clear:

- what CFD is

- why Michael, a professional trader, does not recommend to work with CFD and started to trade futures contracts

- why the futures markets have information, which professionals possess

What CFD is, advantages and disadvantages

CFD is a Contract For Difference of prices. It is a financial instrument, which allows making profit from the underlying asset price change without owning this asset. The underlying assets are stock, currencies, etc.

CFD trading is like betting. If a trader believes that the Apple stock would go up, he buys CFD AAPL and makes profit if AAPL go up.

Main CFD advantages

- high leverage and, as a consequence, a low cost of market entrance. If one wants to buy 1 Google share, he needs to pay its real cost (this is more than USD one thousand), however, one needs to have 2% to 20% of the share cost (depending on a broker) on his account in order to buy CFD GOOG.

- global coverage. There are CFD on currencies, cryptocurrencies, stocks of companies from various countries, indices, oil, gold and other underlying assets. After connecting to a CFD broker, you can start trading from one platform in different markets immediately.

CFD disadvantages

- higher risk which is connected with a high leverage

- high spreadsbetween ask and bid (what ask, bid and spread are)

- despite the fact that CFD products are provided by reputable brokers, the market of contracts for difference of prices is poorly regulated.

Also, one of CFD disadvantages is deficiency valuable information in this market. We do not mean the information background, such as news, rumors and forecasts.

WHY THE FUTURES MARKETS HAVE INFORMATION POSSESSED BY PROFESSIONAL TRADERS

The forward market provides more information about the processes of buying and selling, which provides better possibilities for analysis and making decisions regarding the quality of supply and demand and search for support and resistance levels. Analysis with the help of professional instruments cannot be compared with very simple strategies the beginner traders use.

In order to demonstrate what information we speak about, let us look at 2 charts.

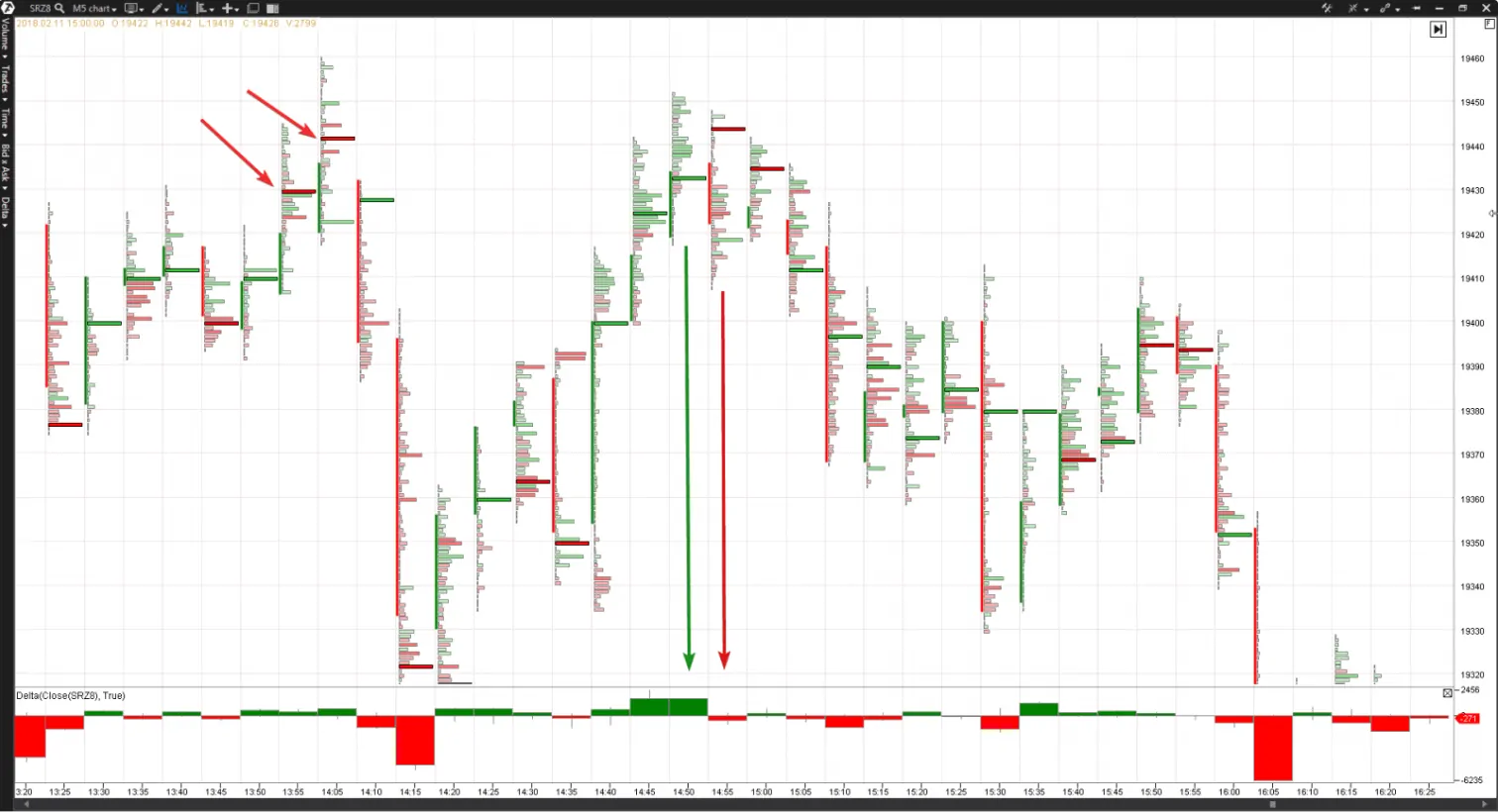

- The first one shows the process of trading futures contracts on the SBER stock; it is the cluster type of a chart.

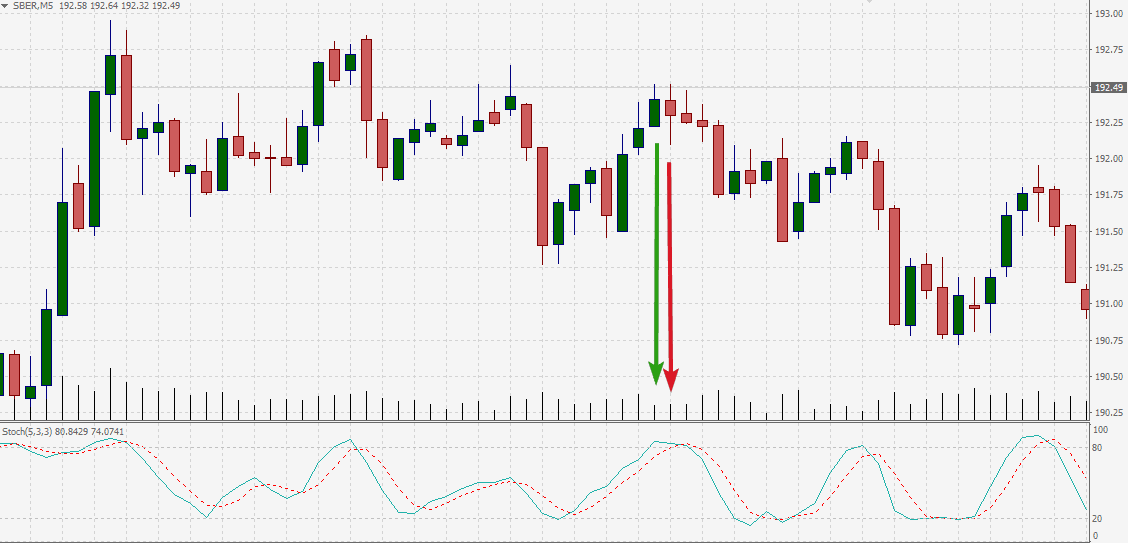

- The second one shows CFD on Sberbank stock; it is the standard candle type of a chart.

Timeframes are 5 minutes. The charts cover a short period of time of the process of trading one and the same underlying asset on November 2, 2018.

Take heed of the massive clusters highlighted red at around 14:00. Perhaps, this determination of sellers was the reason of the subsequent price decrease at 14:10-14:15. This makes it more interesting to keep track of the dynamics of buying and selling during 14:45-14-55, when the price went back to the same level.

Let us look at it. The Delta indicator (what Delta is) shows a significant predominance of buying. However, the price growth shows regress. How to interpret this situation as a trader? Assess it from the point of view of the Law of Effort vs Results, about which Richard Wyckoff wrote as early as in 1931. If there is a background of active buying (Effort), but the price “refuses” to grow (Result), it speaks about the bearish mood in the market at the level of the previous peak. It means that, at this moment, there are chances that this resistance level will not be broken. Consequently, a decrease is anticipated. The red Delta indicator marks the beginning of this decrease. This is a reaction of professional sellers to the fact of weakness of bulls.

Note that we read this story solely from the cluster chart. Many professional traders, such as Michael, use it. Can one read this useful for making a trading decision information from the candle chart? Obviously – not.

By the way, the Stoch indicator with standard settings just started to form a signal for selling, while professionals were selling the market actively already. The beginner (and, usually, loser) traders work, most often, with such simple indicators as Stoch in order to enter a market position.

Michael confirms this.

My first mistake in this sphere was that I believed in simplicity of this business – just buy breaks and sell rallies.

I started to study markets and their structures. And I started to use ATAS sometime in 2011-2012. It was the period when I went deep into futures, volumes and order from techniques.

I can state that I tried practically EVERY product in this sphere and saw it for myself that there is no other software for traders, which would provide such a freedom of action and offered so many opportunities.

Another strong point of my decision is a personal support and a possibility to develop own instruments with the help of ATAS API.

In my work I mainly use my own developments and, of course, such basic instruments as Cluster Search and various market profiles.

There is one good way to compare my trading with ATAS and without it: put a plastic bag on your head and say what the weather is like outside. The same is judging the futures market without ATAS. The platform provides me with additional information, based on which I apply a completely different trading approach – it helps me to make a correct decision – when to enter the market or when to exit the market.

ATAS is good various trading styles. The platform provides you with such an arsenal of instruments that you can develop any types of strategies.

Can I recommend ATAS to my friends? Yes, I do it for a long time. As I already said, this is the best trading solution for me.

Well, we came to conclusion that on the way from a beginner to professional trader one needs to:

- trade on professional markets. For a trader this means to connect to regulated official exchanges, which provide full data about volumes of purchases and sales with up to one transaction accuracy.

- to use professional software for analysis and trading.

But there is a question: how much time will it take to cover this path? Let us listen to what a professional trader says.

It is difficult to say how much time you need to start positive trading. I think it all depends on a person. Not only on person’s ability to study technical things, but also on a psychological type of a person.

What I can state with 100% guarantee: the trading is not a thing you can study in two weeks … Technical part is the simplest one, while the most complex one is psychology. Speaking honestly, during my first 4 years of trading I always tried to beat the market, now I trade together with the market.

I would give three advice to every beginner trader who wants to approach the professional level:

- study how the futures markets work and don’t waste your time on CFD

- do your own research

- do not trust everyone who gives you advice – 90% of trading trainers are cheaters.

Summary from the professional trader interview

- do not think that trading is a piece of cake. The “buy when the price goes up” rule does not work;

- choose professional platformsfor trading on official exchanges;

- devote more time to the trading psychology

- use professional softwarefor analyzing and trading.