Major market crashes: from the dotcom bubble to the pandemic

It’s the end of just the second decade of the 21st century, but experienced investors already witnessed at least three big crashes of the stock market on the global scale and a countless number of local crises.

The century started with the dotcom bubble crash. The global financial crisis took place less than a decade after it in 2008. While writing this article we observe an equally great event. Coronavirus pandemic resulted in an unprecedented (by speed) crash of stock exchanges and, perhaps, the biggest global economic crisis of the past decades.

In this article, we will analyze the reasons of each of the three big exchange crashes of the modern time, what were the consequences and, most important, what to do in the epoch of exchange crashes. Good knowledge of the market history will be a useful aid in order:

- not to repeat mistakes of foregoers;

- to save the capitals (and, which is very important, nerves) during the 2020 crisis;

- to develop an action plan against the background of the market panic.

So, strap yourself in and let’s take a dramatic and exciting journey into the history of the market crashes of the 21st century.

Dotcom bubble: how irrational exuberance led to fast ascent and descent of Internet companies

An exchange crash is always a huge risk but also a huge opportunity. Hundreds of thousands of investors lose their capitals. Only the most foresighted and lucky ones make huge money.

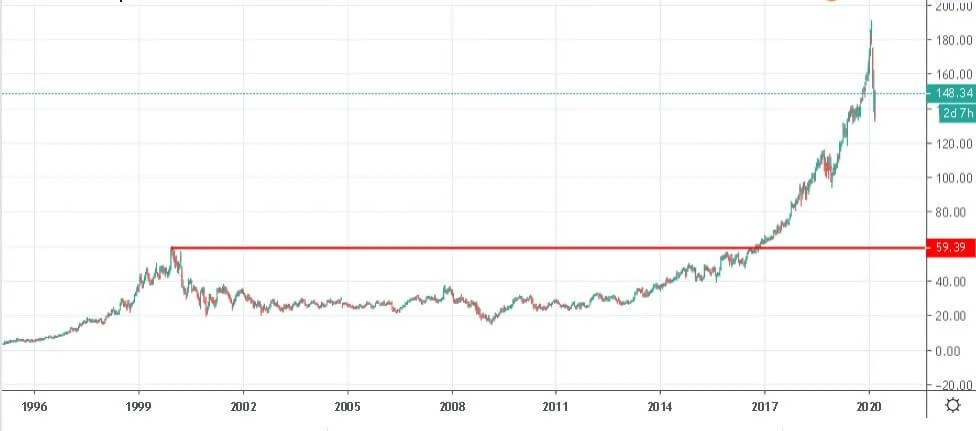

Here’s a simple example. Microsoft stock managed to renew the high of the year 1999 only 17 years after the dotcom bubble crash – in 2016. The company developed and increased income all those years but expectations were so high at the maximum level of the 2000s (the red line in the picture below) that it required nearly two decades to justify them.

However, not all the companies were as successful as the Bill Gates creation, since major ruins were regular at the beginning of the century. It is useful to know what was the reason for the development of that bubble and how it burst in order not to become an ‘eternal investor’.

The ‘dotcom bubble’ phrase has been used by finance historians to name the fast ascent of values of Internet companies in the second half of 1990s. It is accepted to believe that, chronologically, events developed from 1995 to 2002.

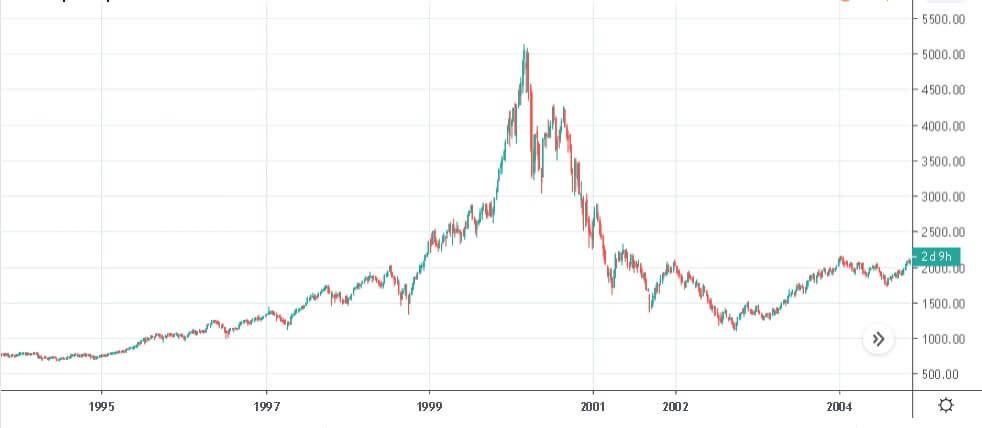

March 10, 2000, was the culminating point of growth of the exchange bubble when the Nasdaq Composite index of the US technological companies reached 5,132.52 points. The general capitalization of the technological sector doubled for the previous year and it increased more than 7 times (!) for the 5 years of the bubble growth – from 1995 until 2000.

The whole world learnt about Jobs and Gates

It was a romantic time! Mass media made headlines about arrival of the new era in the economy and stories of a breakneck growth of IT-specialists, which started to work in their garages and became the richest men of their time with the rocket speed. The foundations of the capital and glory of such business pioneers as Bill Gates, Steve Jobs and Jeff Bezos were laid namely in those years.

Companies massively moved their business processes to the Internet. Simply adding the ‘.com’ (dotcom) to the name could increase the stock value by dozens of percent. Revolutionary new types of activity started to develop on the Internet. The world learnt about the first Internet shops (Amazon), Internet auctions (eBay) and electronic payment systems (PayPal).

Media hype and nearly fairytale stories about housewives who bought stock and became rich did their work. The bubble grew to a colossal size and its crash in 2000-2002 resulted in hundreds of bankrupt companies and millions of disillusioned investors. The fall of the market capitalization by USD 5 trillion was the largest in history at that moment!

Irrational nature of the Internet boom

Talented modern scholars wrote many studies describing reasons of the bubble origination and crash. The most famous of them was Robert Shiller who became the Noble prize winner for economics in 2013. The economist devoted a significant part of his excellent bestseller Irrational Exuberance to the boom in the stock market at the end of the 1990s.

Robert J. Shiller not only masterfully performed ‘trepanation’ of the bubble, but also thoroughly justified that not only and not so much pure economics was in the base of the price ascent as much as an unreasonable and irrational behaviour of people – irrational exuberance. For the first time ever millions of regular Americans, who had a very vague idea of what investments are, flooded the stock market.

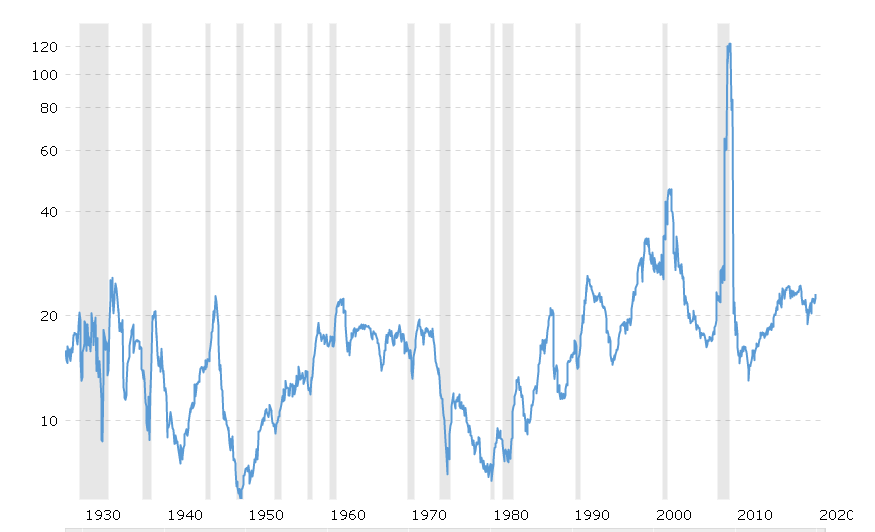

Investors ceased to soberly assess financial indicators of companies. For example, the most important multiplier in the fundamental analysis (Price to Earnings ratio – p/e), which shows the current company stock value in relation to its profit, reached, at that moment, astronomical 46 for the wide US stock index (S&P 500). Given that, historically, it reached 25 very rarely.

This indicator ‘flew’ above 150 for the Nasdaq index stocks. It means that every dollar made by an Internet company accounted for 150 dollars of its value. Investors implemented all possible positive scenarios in the firm value.

Robert Shiller published the first edition of his study before the bubble burst. He travelled a lot around the United States during the book promotion campaign meeting many people, including professional investors. The economist was shocked that even professional investors, who realised what was going on, yielded to the hysteria. Moreover, their behaviour didn’t differ from the behaviour of regular housewives who ‘poured’ the whole family budgets into stocks. The economist talked with one investment fund manager who confessed that he was absolutely aware of the risk level and unnaturalness of the situation but had to recommend stocks to his customers since they themselves insisted on it.

Consequences of the dotcom bubble

We can specify a number of important negative consequences of the exchange boom on the line of the millenia:

- The stock market lost USD 5 trillion of capitalization, hundreds of ‘dotcoms’ and thousands of professional market participants went bankrupt. Millions of people in the United States and other parts of the world (stocks grew exponentially at that time in the majority regions of the world) lost their money;

- It took 15 years for Nasdaq Composite Index to reach the high of the year 2000;

- Despite the crash of quotations, the public interest and big investments resulted in formation and strengthening of the Internet industry;

- The legendary Big Four of the richest US companies – Apple, Microsoft, Amazon and Google – received a big growth impulse in those years;

- Development of technologies and massive interest of the world audience led to emergence of such a type of activity as a private trader. Any person needed just a computer and Internet connection in order to trade securities.

As it became clear nearly 2 decades after the dotcom crash, every generation ‘needs its bubble’. A young reader can remember the not so far 2017-2018 years and the ICO/cryptocurrency bubble. Do you remember how thousands of projects with doubtful ideas and goals ascended on the wave of hype (and then crashed)? Only the most high quality projects, which gave real value to people, survived after the cryptocurrency market crash. Something similar took place at the end of the 1990s and beginning of the 2000s.

General cryptocurrency market capitalization from 2017 until our days:

Global financial crisis of 2008-2009

As Professor Shiller rightly stated, not only regular citizens but also professionals are subject to the overall ‘mental blackouts’ during new cycles of irrational exuberance. Greed and precipitance of the largest investment banks of the world led to the great crisis of 2008-2009.

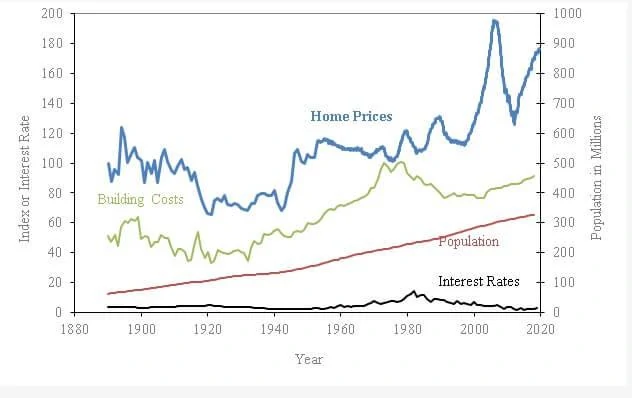

Shiller notes in his works that the US housing market has never been inclined to form bubbles during its whole history. The historic yield of investments hasn’t moved above 0.5-2% annual, which is lower than the yield of the stock market, since the end of the 19th century.

However, the situation sharply changed from the end of the 1990s until the beginning of the crash in 2006. First of all, the psychology of people changed. They became inclined to speculate in the housing market – they bought houses with the aim to resell them. Shiller proves that the price growth had no purely economic explanation using the chart, which also reflects the cost of building (green line), historic interest rates (black) and dynamics of growth of the US population (red).

The mortgage boom gripped Americans

Americans started to take out mortgages by the middle of the noughties even if they couldn’t afford it. Since the underlying asset prices increased, many people hoped to resell the bought assets at higher prices after some time.

The banks turned the blind eye to the price ‘inflation’. Requirements to the borrowers became less and less strict. Moreover, new derivative financial instruments were created on the basis of the loans. These derivatives, despite the risks, received the highest loan rating and the top bank portfolios contained huge quantities of these derivatives.

It was getting tough already in 2006, when the real estate prices started to decrease, which led to the growth of the mortgage payment delays. The share of soured loans jumped from the traditional level of 8% to 20%. The avalanche of non-payments only increased during 2007 and 2008 and the value of securities fell, which resulted in a sharp liquidity crisis in the US banking system.

The crash of Lehman Brothers was a trigger for the crisis beginning

Bankruptcy of the largest investment conglomerate Lehman Brothers and a number of major mortgage organizations in the US in September 2008 was the peak of the mortgage crisis and beginning of the global financial crisis. The panic increased in the stock markets of the world and the global economy showed negative development for the first time after the Second World War.

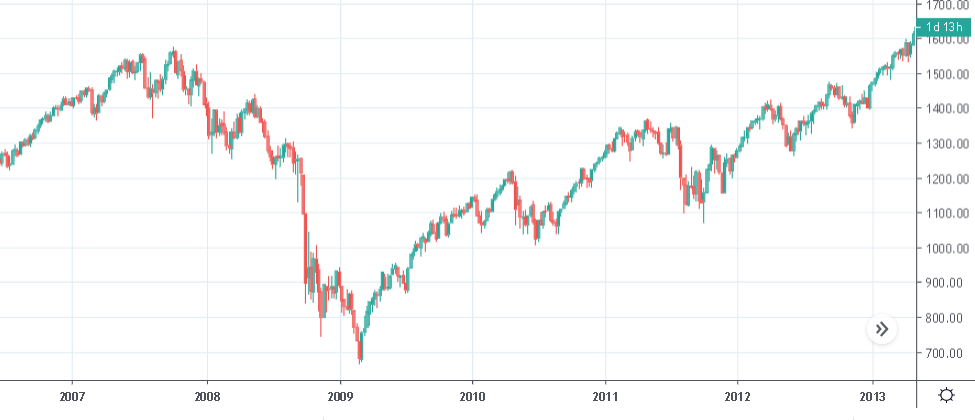

The S&P 500 stock index fell from 1560 points in the autumn of 2007 to 666 points in March 2009. Stocks completely restored their value only in 2013 and moved to new highs.

Rescue of the global financial system cost taxpayers all over the world trillions of dollars. Central banks reacted to the crisis by reducing interest rates (sometimes to negative values) and printing money. The emission was carried out under the banners of the ‘qualitative easing’ program, which envisaged a massive flooding of the market with cheap liquidity.

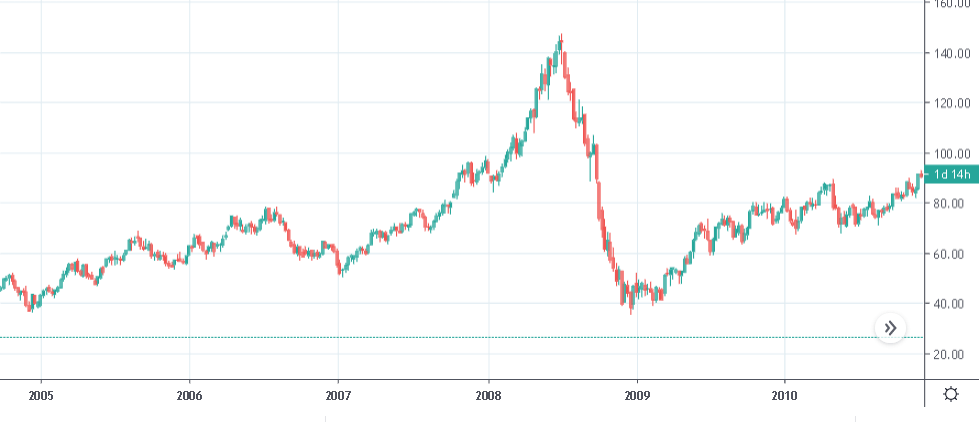

The 2009 crisis had a direct impact on Russia. The crash of the oil market (the Brent oil price fell from USD 145 to USD 36 per barrel – see the picture below) and other raw materials, which are crucial for the budget, resulted in the GDP fall by 7.8%. The crash of the Russian stock market was the largest one after the 1998 default.

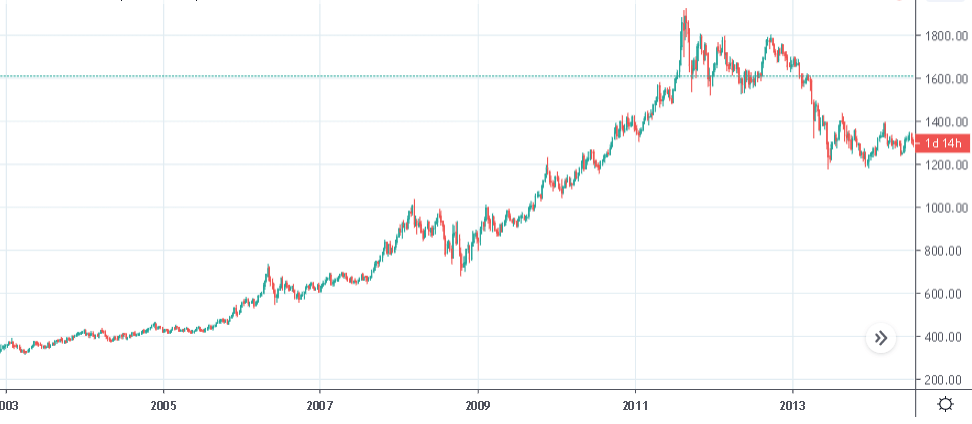

The stock markets started to recover after inflows from the central banks, however, investors still preferred to hold a part of their funds in such protective assets as gold for a long time. The yellow metal value increased more than 3 times during the crisis years.

Conclusions from the 2008-2009 crisis

A number of fundamental analysts believe that the world hasn’t yet overcome the consequences of the crisis, which took place more than a decade ago. They specify both purely economic and purely sociopolitical long-term negative consequences of the crisis:

- Growth of the debt load in the world economy. The level of the debt in relation to the global GDP still continues to grow.

- Slowing down of the rates of global economic growth and international trade.

- Growth of inequality between rich and poor.

- Rise of the populist political movements and the policy of economic protectionism.

A lot was written and shot about the crisis of 2008. The author of the present article would draw special attention to The Big Short movie, which is based on real events. The story explains the reasons for the burst of the mortgage loan bubble, perhaps, most accurately. It’s interesting that the most foresighted traders managed to make a fortune on short positions. There are always those who know how to make money on the market crashes!

Coronavirus pandemic and stock market crash in 2020

Our article about the history of exchange crashes is especially topical under the conditions, which we witness nowadays. The COVID-19 pandemic led to slowing down of the global economy and crash of stock indices all over the world.

A number of experts warned about the coming recession as early as in summer 2019.

- First, the cyclic nature of the global economy, where downcycles occur approximately once a decade, suggested the coming recession.

- Second, the economies of China and Germany significantly slowed down a year ago due to the protectionist policy of Donald Trump and trade wars, initiated by him.

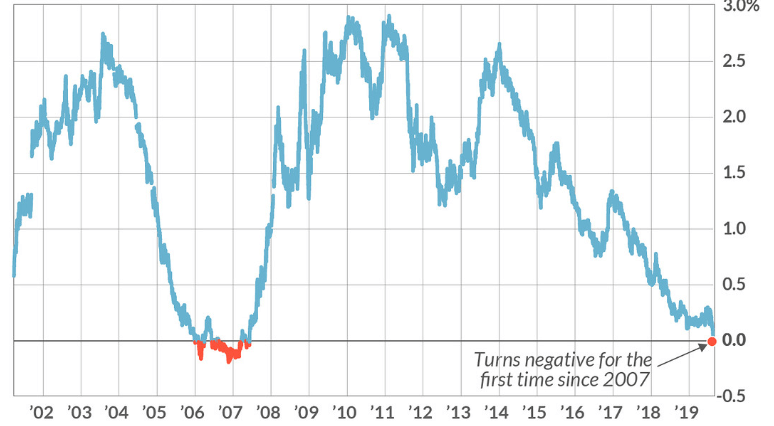

- Third, some economic indicators showed a growth of global risks. In particular, the gold price jumped and the US Treasuries yield curve showed inversion – short-term notes became more profitable than the long-term ones. This indicator predicted recession earlier with a surprising accuracy.

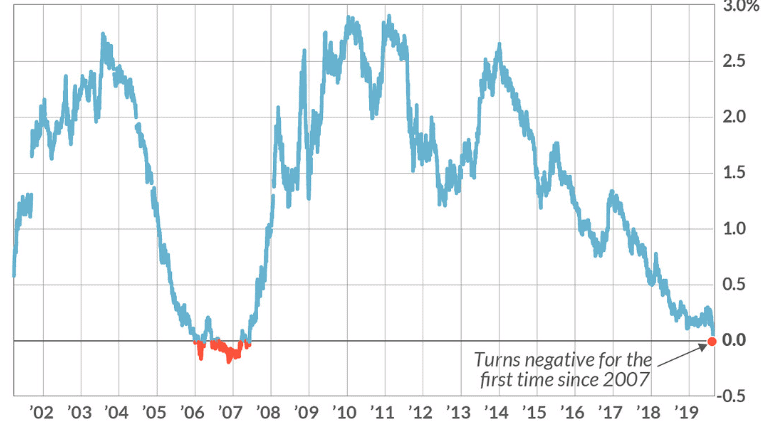

The chart below: the yield curve inversion was observed for the first time since 2007

Nevertheless, nobody couldn’t even assume that the 2020 crisis would have this nature and would be so strong.

In this context, we strongly recommend the book of an American trader and financial philosopher Nassim Taleb ‘The Black Swan: The Impact of the Highly Improbable’. The author convincingly proves that any large scale crisis is always a black swan – an event, which nobody expects but which radically changes the existing order of things. Today, we observe a classical black swan!

What we know as of the end of March 2020:

- A strict quarantine was announced in the US, EU and a number of other countries. It led to a massive stoppage of production and slowing down of economic activity. The RF government also joined the quarantine practice.

- The S&P 500 stock index already lost about 40% from the year high (3303). The dollar index of the Russian RTS stocks ‘collapsed’ two times after the oil price crash to the low from 2003.

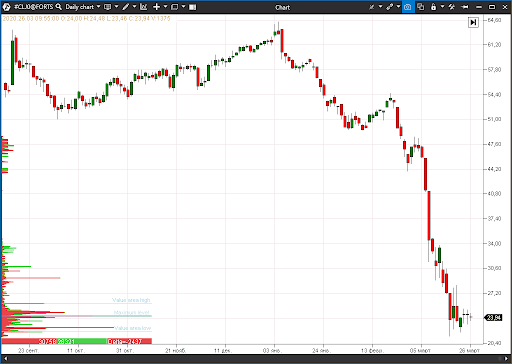

The picture below: the Brent oil barrel price fell from USD 63 to USD 24.

- The US FRS decreased the key interest rate to zero and announced an unlimited program of quantitative easing. The country government agreed on an unprecedented (by scale) program of financial assistance to citizens and businesses in the amount of USD 2 trillion. Similar measures are undertaken by the EU, Great Britain, Japan and other countries of the world.

As of today, hardly anyone has an accurate forecast of development of the situation since the pandemic is still far from the end. However, all brain centers of the world agree that the 2020 crisis could be of the same scale as the 2009 crisis.

Here are some forecasts of the situation development:

- IMF, OECD and major banks predict the fall of the world GDP by 1.5% instead of the growth by 3%. In this case, the scales of the exchange crashes could be compared only with the year 2009.

- According to the JPMorgan Chase and Goldman Sachs forecasts, the US economy may fall by 20-30% in the second quarter of 2020 and unemployment may grow from 3.5 to 12-13%. One of the FRS managers, James Bullard, doesn’t rule out that unemployment may reach 30% and GDP may fall by an unbelievable 50%! Similar consequences might be observed in other developed countries.

- The crisis in the developing countries (including Russia) would be deeper due to a massive outflow of capital, which is approaching today USD 100 billion.

One of the favourable forecasts is that many experts say that epidemic crises usually have a V-shape nature. It means that a sharp fall of the economy would probably be followed by a similarly sharp recovery. However, we remember that coronavirus is a black swan and forecasts often fail in such situations. The real situation could be both better and worse. It will largely depend on how fast the world would develop an efficient algorithm of fighting the infection.

How to behave during the crisis. Simple advice

Nobody can predict for sure when to start buying stocks in 2020. We can give 4 simple advice, based on the experience of millions of traders, what a regular investor should do when the market crashes and, which is more important, what he shouldn’t do under any circumstance. At least, these advice will help you not to repeat somebody else’s mistakes:

- Do not try to guess the bottom. This is especially true if you are not a long-term investor but a trader. What seems cheap to you now may become even cheaper. The example of the oil prices this year testifies to it.

- Do not use leverages and do not rollover big positions overnight during the periods of splashes of volatility. The higher the leverage, the higher your risk to lose everything is. The majority of investors lose because they do not observe the risk management rules.

- Start investment buys only for a part of the portfolio and only after receiving clear signals that the world goes out of the crisis. The leading indicators of economic activity PMI and employment level are the most important ones.

- Do not submerge into news. There is a lot of information noise today, which could confuse even an experienced investor. You’d better not concentrate on the news tape but track the cluster charts and important economic statistics.

Today, investors have a possibility to get an invaluable experience, which would help to make more money in the future. The first-priority task during the exchange crash of the year 2020 is to preserve the capital. If you manage to do it, you will not lose your chance to make money.

In conclusion, we will add that a major fall of the stock market is always a landmark in the history of finance. Books are written and movies are shot about great crises and the best economists of the world undertake huge efforts to study their reasons and consequences. Nevertheless, there is no efficient remedy to fight the market crash (and it will hardly be developed in the future). It means that the 2020 crisis is far from being the last one in history. It’s too early to unstrap!

We wish you good health and lucky trades!