What Skills Should Futures Traders Have?

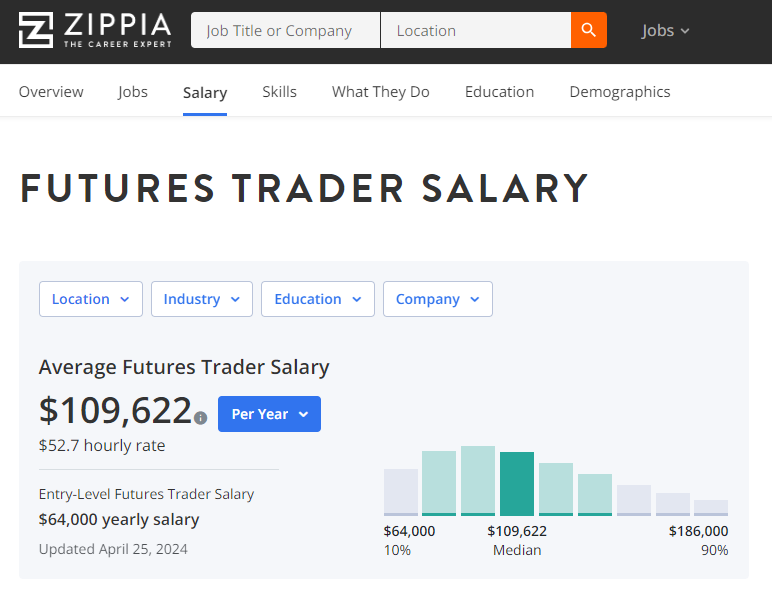

The salary of an employed futures trader typically averages around $50 per hour. This data can be found on specialized resources, such as in the screenshot below. While employed traders are unlikely to earn more than $200,000 per year, independent traders have no income ceiling.

- Analytical skills

- Emotional control

- Patience

- Organization

- Risk management

- Learning agility

Analytical skills

If you did not know, the word “analysis” comes from the Greek word “ἀνάλυσις” and is made up of two parts: the prefix “ἀνά-” (ana-), meaning “back” or “up,” and the root “-λύσις” (-lysis), which translates to “loosen” or “release.” Thus, the original meaning of the word is related to the process of breaking down a whole into parts for a deep understanding of its structure and functioning. The trading and analytical platform ATAS is a great example of it as it can turn ordinary candlestick charts into more detailed cluster charts (or footprints):

- identifying supply-demand balances and imbalances;

- spotting potential market reversal points based on support and resistance levels;

- confirming existing trends.

Emotional control

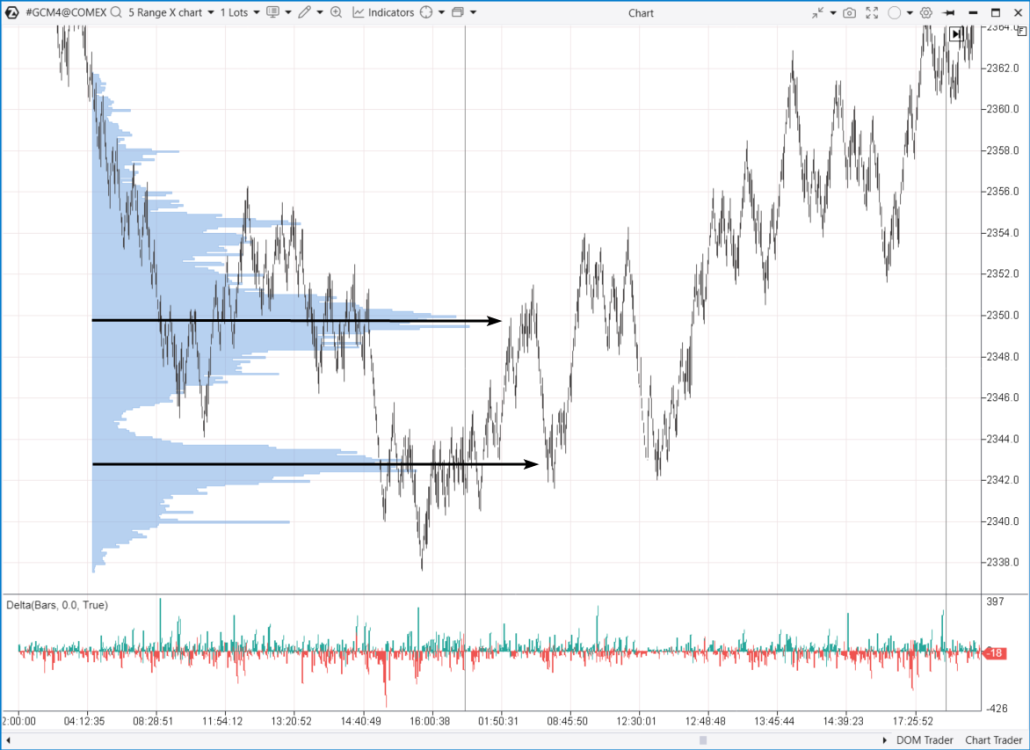

Emotional control is an extremely important skill for futures traders because emotional decisions can lead to unpredictable and often undesirable outcomes in the market. Control of impulsive decisions. The futures market is highly volatile, and prices can change sharply in short periods of time. Emotions such as greed or fear can prompt traders to make spontaneous decisions, such as closing a position too early due to fear of losses or too late hoping for further price growth. Ultimately, emotions can lead to deteriorating performance, even resulting in consecutive losses that can lead to the loss of the account. Maintaining discipline. Effective trading requires strict adherence to a trading plan and strategy. Emotions can interfere with this, causing traders to deviate from proven methodologies and make decisions based on momentary market fluctuations, which raises risk levels and lowers the chances of consistent profits. Let’s briefly explain the basics using the example of the crude oil futures market (below is a range chart with the Delta indicator):

Patience

Patience is a crucial skill for futures traders because it allows them to:- Wait for optimal market conditions. Successful traders know when it is best to actively trade and when it is better to wait and observe, preserving their resources and capital for more confident and profitable opportunities.

- Avoid frequent and small trades that can lead to overtrading. Patience enables traders to focus on quality rather than quantity aspects of trading.

- a significant volume level forming on the profile (a balanced state);

- the price breaking out of this level (a disruption of balance);

- the price returning to this level (known as a level test).

Organization

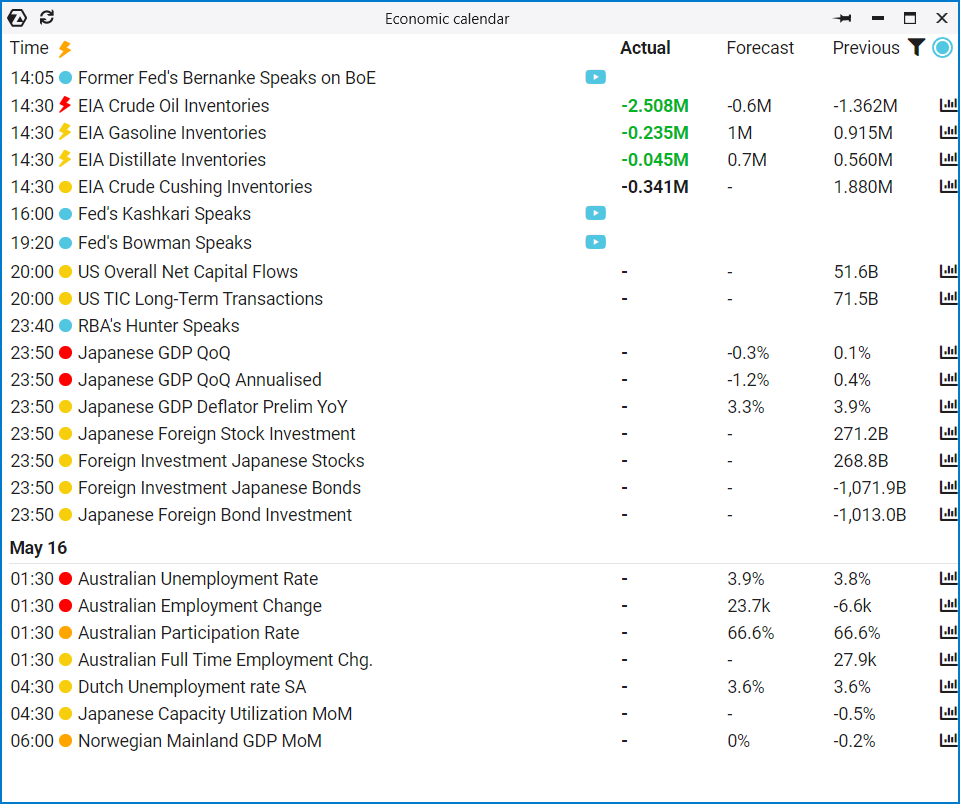

Trading futures requires precision and systematic effort to achieve long-term success, making organizational skills crucial for good results. By analyzing your trading statistics, you can assess the effectiveness of your strategies, learn from your mistakes, and reinforce successful methods. This continuous improvement and optimization are essential for effective trading operations. Keeping your chart annotations up-to-date with drawing objects is also crucial. This helps you cover more markets and quickly analyze changes. Clearly marked support and resistance levels, trend lines, and other technical indicators allow you to visually assess market dynamics and react more efficiently. Staying aware of the time when economic news is released is another important aspect of being organized. This allows traders to avoid entering the market during periods of high volatility or, conversely, to capitalize on these moments by making trades based on the market’s anticipated reaction to the news.

Risk management

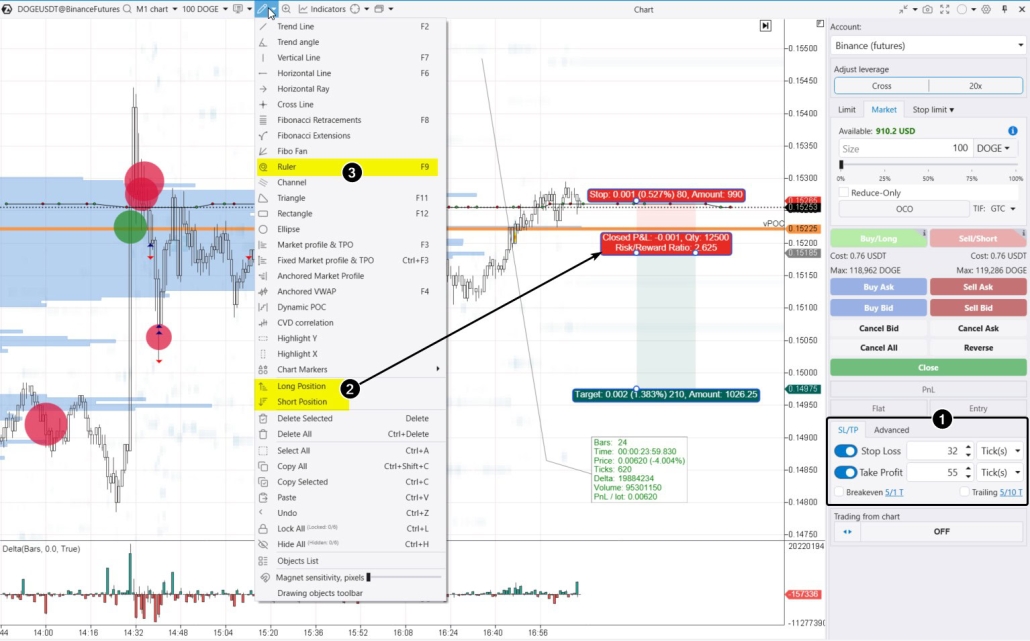

Among trading maxims, there is a concise and crucial idea about risk control: It does not matter how many winning or losing trades you have. What matters is how much you lose on a losing trade and how much you make on a winning one. The skill of risk management is essential for the sustainability of futures trading in the long term. A stop-loss order helps limit losses to an acceptable, predetermined level, which is vital in the highly volatile futures market. This prevents emotional decisions to hold onto a losing position in the hope of a market reversal. Alongside using stop-loss orders, planning the profit-to-loss ratio allows traders to set clear goals for each trade. It helps determine how much potential profit should exceed possible losses to ensure overall profitability.

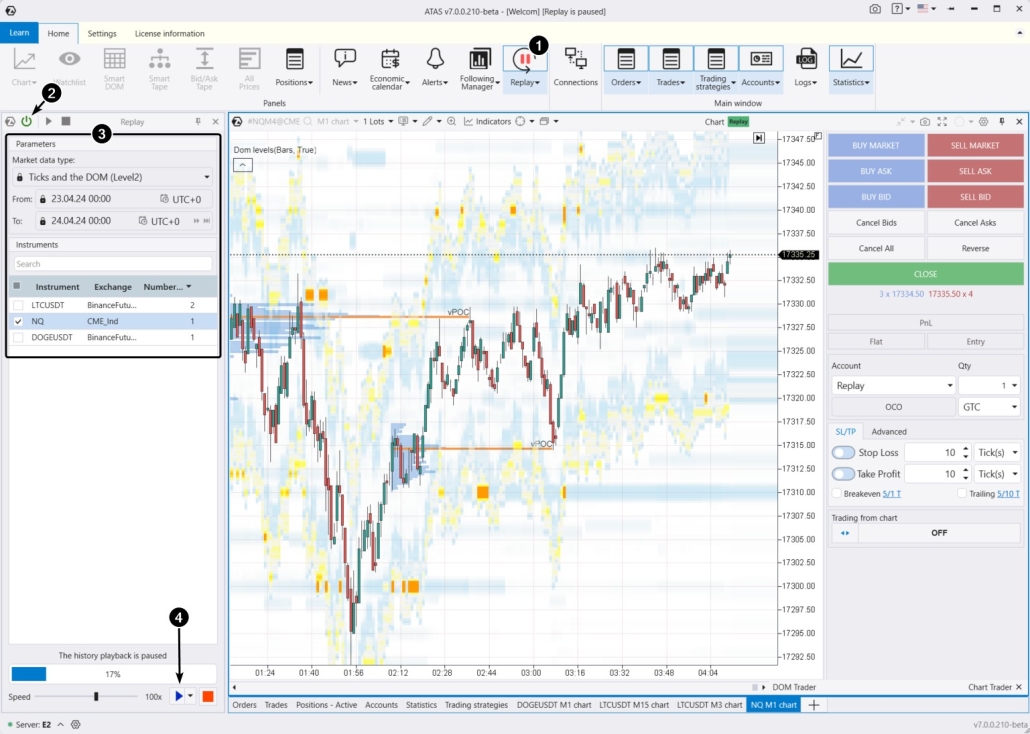

- adjust the playback speed, and pause;

- test your strategies, monitor signals from over 400 indicators;

- trade futures on the built-in demo account;

- use drawing objects, for example, mark support and resistance levels;

- use various chart types (e.g., non-standard Range XV);

- use exit strategies;

- analyze volumes in the Level II order book;

- and much more to master professional skills for futures trading.

Conclusions

While the initial requirements for beginners in the futures market are relatively small, success in trading is not solely determined by having starting capital, desire, and technical tools. Effective trading in the futures market requires not only the skills to analyze the market but also psychological resilience, the ability to manage risks and make thoughtful decisions in uncertain conditions. These qualities become crucial in the long run and can significantly influence the final trading outcomes. Are you starting futures trading from scratch? Developing practical skills will be aided by a solid foundation of theoretical knowledge:- Check out the Learn section in the main menu of the ATAS platform for educational materials.

- Explore ATAS tools like professional-grade cluster charts, the Smart DOM order book, Smart Tape, useful indicators, and more.

- Read helpful articles about trading strategies in the blog. Test your skills in the simulator or in real time on the built-in demo account without risking real funds.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.