What is the DAX index?

The DAX (Deutscher AktienIndex) is a German stock index. Its calculation is based on the value of shares of the largest companies in Germany (“blue chips”) which are traded on the Frankfurt Stock Exchange. Let’s trace the key dates in the history of the DAX index. December 31, 1987. The start of the DAX index. Initial value = 1000, it was based on the value of 30 shares of the largest companies in Germany. January 1, 2006. The DAX index is calculated every second thanks to Xetra technology 2021. The base for calculating the index was increased from 30 to 40 companies. November 15, 2021. The historical (at the time of writing this article) maximum has been set. The record value of the index is = 16,290.What companies are included in the DAX index?

The DAX index is calculated by Qontigo which is part of the Deutsche Börse Group. The selection of index components is based on the market capitalization of the publicly traded shares. The index composition is reviewed quarterly. On the special index page https://qontigo.com/products/dax-en/ you can find out:- about the calculation methodology;

- companies of which sectors form the index;

- what shares have the most weight.

How to profit from DAX fluctuations

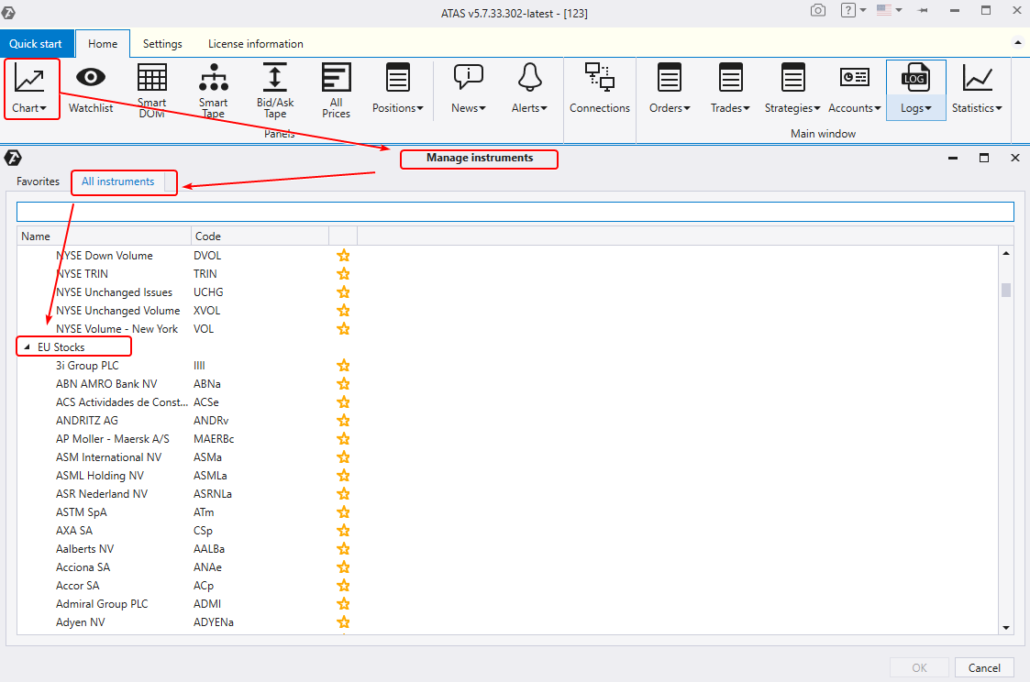

Download the ATAS platform for free, install and run it. Then open the Chart, in the Instrument Manager window select the EU Stocks section on the All Instruments tab. You will definitely find here all the stocks that are included in the DAX index.

How to start trading DAX index

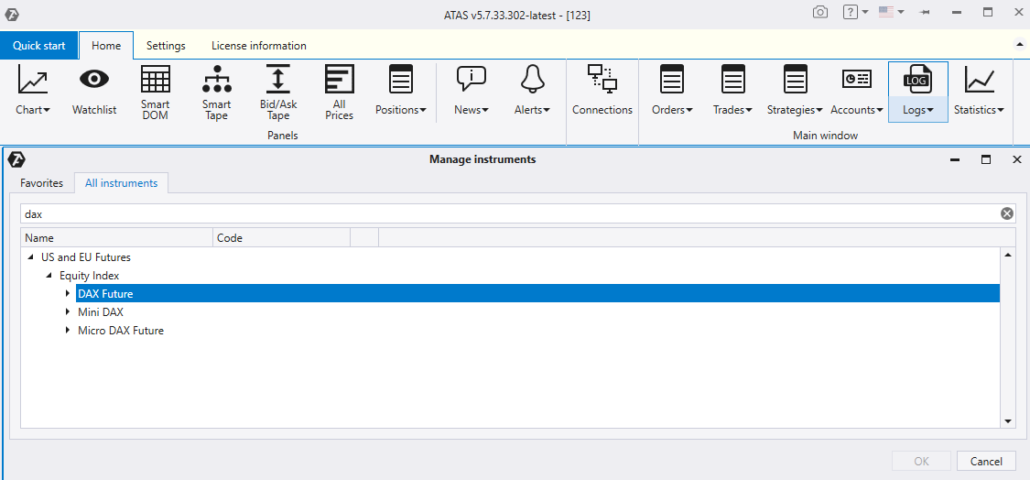

Here is a step-by-step guide to help you take advantage of price changes for DAX index futures.- Download ATAS. The platform offers many benefits for futures traders. Learn how to apply easy-to-use cluster charts and useful indicators of the ATAS platform.

- Open a demo account built into the ATAS program and connect quotes. Try trading without risking real capital at first.

- If your demo account is growing, learn the terms and conditions of the stockbroker that provides access to trading DAX index futures. Please read the specifications of the contracts carefully. Make a trading plan. Treat trading like a business, not a game of chance.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.