About Microsoft company

Microsoft Corporation is one of the world’s largest technology companies, which sells personal computing devices, cloud services, software and other products.

History of Microsoft creation

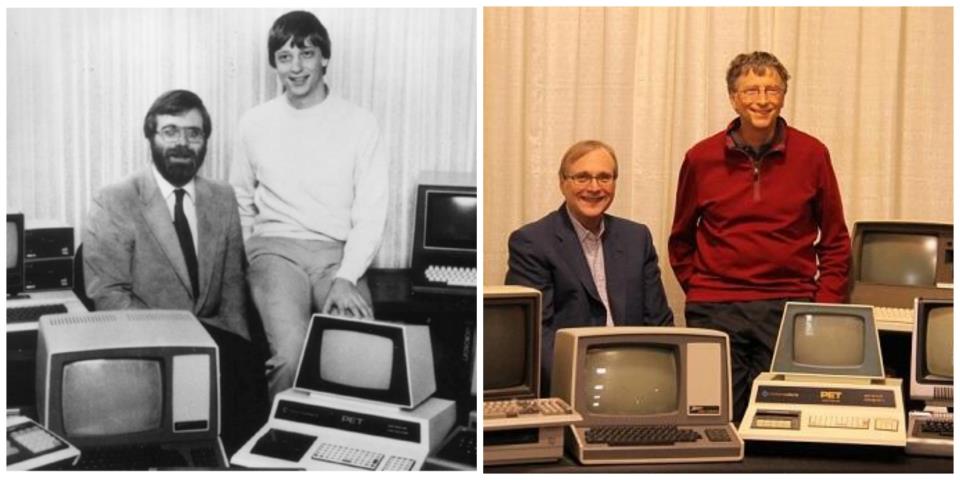

Eighth-grader Bill Gates and tenth-grader Paul Allen got acquainted during programming classes in the elite private Lakeside school in Seattle at the end of the 1960s. They got interested in testing the first computers. In the 1970s, Allen already worked as a programmer in Boston and Gates studied at Harvard University. Gates started his study in the College of Law at the University but then changed his professional development and passed some of the most advanced training courses in computers and mathematics, which were offered at Harvard. Gates made a life-changing phone call from his hostel room to the company that manufactured the first personal computer named Altair 8800. Gates proposed to develop software for the system. The firm agreed and paid him USD 3,000 plus fee earnings. In the end, as a result of common work, Allen and Gates became co-founders of Microsoft on April 4, 1975, in a garage in Albuquerque, New Mexico. It is believed that Paul proposed to name the company ‘Micro-Soft’ – which derives from ‘microprocessor’ and ‘software’. The hyphen soon disappeared from the name.

Microsoft Initial Public Offering (IPO)

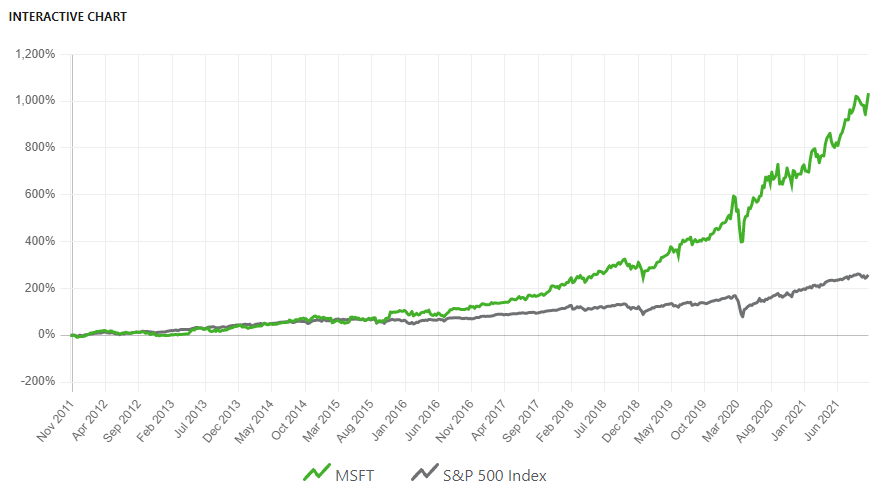

The Microsoft company had its IPO on March 13, 1986. The initial price was USD 21 per share. The market capitalization after the IPO was less than USD 700 million. By today’s standards, it would make Microsoft a company with small capitalization. There were nine MSFT stock splits in the course of many years. It means that a typical 2:1 split brought stockholders two ‘new’ shares for every old ‘one’ they had held. After that, the stock price is corrected proportionally, so that the investment value stays the same as it was before splitting. If you bought only one Microsoft share during the IPO at USD 21, you would have 288 shares today after all the splits. If we take quotation at USD 300, the value of all shares would have cost USD 86,400. Approximately, it means the revenue of about 25% a year or the total revenue of nearly 211,000% excluding dividends. Microsoft demonstrated phenomenal growth. Its success was based on developing relations with Intel and IBM. Microsoft developed its own software in the 1970s, which operated properly with the Intel 8086 processor. In 1980, Microsoft executed a deal for delivery of an operating system (known as DOS) for the new IBM PC.Complete historical MSFT stock chart

If we look at the historical MSFT stock chart, we can specify 3 periods.

MSFT stock dividends

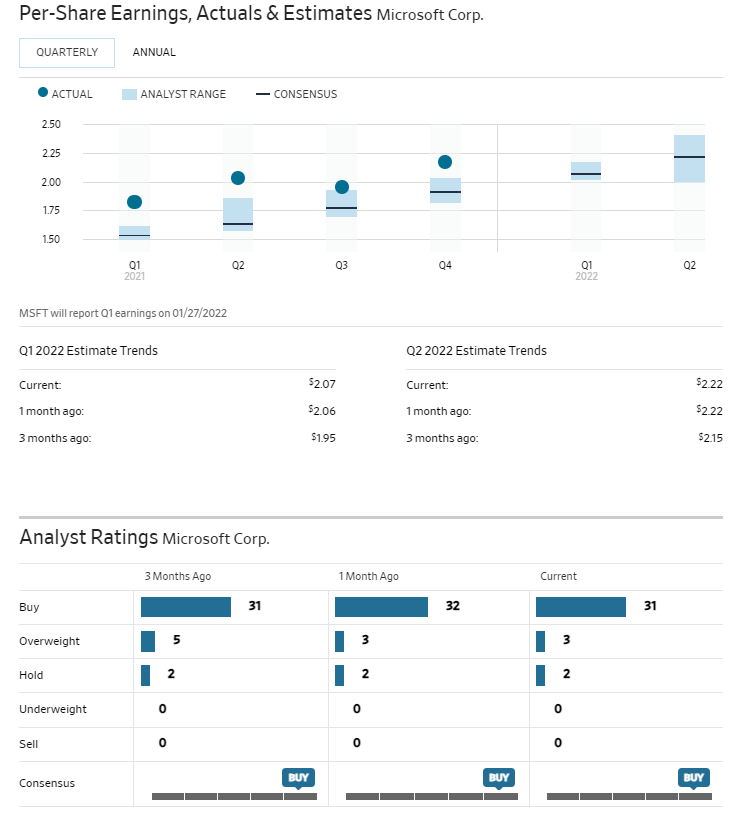

Microsoft paid its first quarterly dividends in 2004. Microsoft announced on September 14, 2021, that the Board of Directors approved an increase of quarterly dividends by 11% bringing them up to USD 0.62 per share. Microsoft also approved a new stock buyback program which allowed it to spend up to USD 60 billion. The buyback program doesn’t have its date of expiry and can be terminated at any time. If you want to learn the current size of dividends and other data about MSFT stock, you can use various sources of financial information. For example, Wall Street Journal – namely, the Microsoft page: https://www.wsj.com/market-data/quotes/MSFT.

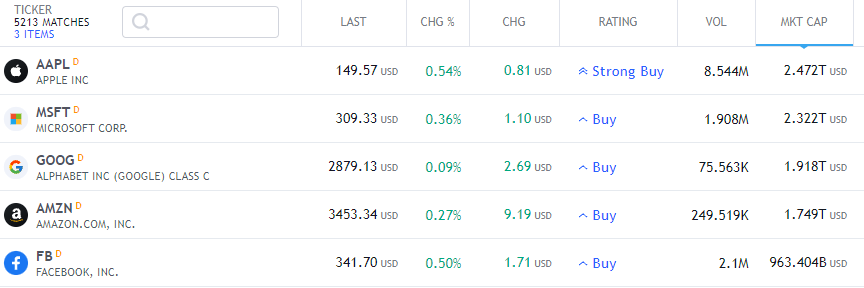

- P/E Ratio (TTM) = 38.27.

- EPS Ratio (TTM) = USD 8.06.

- MSFT market capitalization = USD 2.31 trillion.

- MSFT stock in circulation = 7.51 billion.

- https://www.barrons.com/market-data/stocks/msft

- https://www.marketwatch.com/investing/stock/msft

- https://www.microsoft.com/en-us/investor

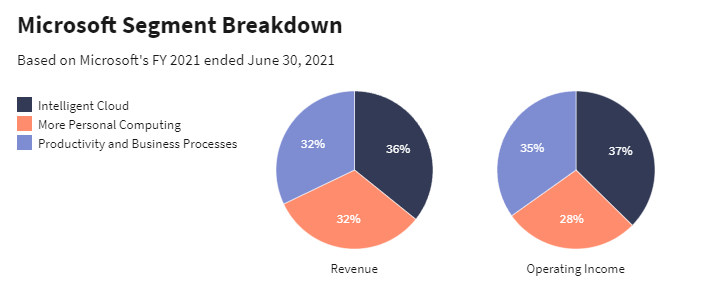

How Microsoft makes money

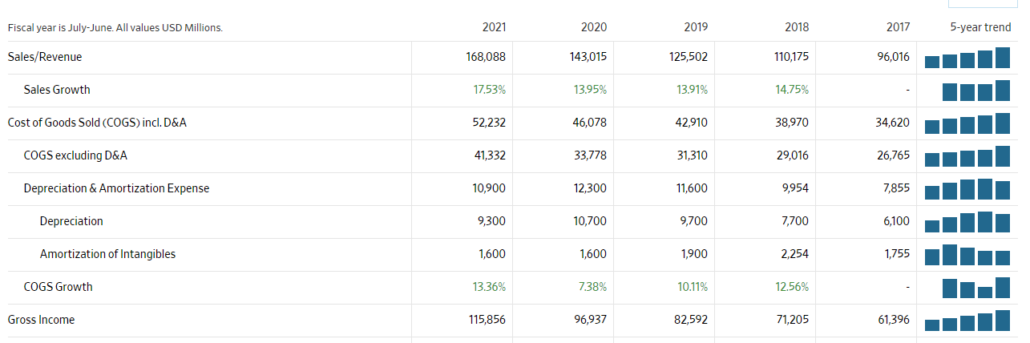

Microsoft noted in its reports that COVID-19 pandemic influenced its business operations and financial results in the 2021 financial year:- Net profit increased by 38.4% up to USD 61,300 million.

- Annual revenue increased by 17.5% up to USD 168.1 billion.

- Operating income increased during one year by 32.0% up to USD 69.9 billion.

- Intelligent Cloud.

- More Personal Computing.

- Productivity and Business Processes.

Growth strategy

Satya Nadella replaced Steve Ballmer on February 4, 2014, becoming the third Microsoft Director General.

- The Windows operating system and Office software continued to bring a lot of money but more and more users kept old versions instead of buying updates.

- The Azure cloud platform was much smaller than Amazon Web Services and new Office 365 cloud services faced a strong competition on behalf of Google Alphabet.

- Microsoft Windows Phone lost the mobile market to iPhone from Apple and Android devices from Google and the company undertook the final effort to save the product by buying a Nokia mobile phone subdivision.

- The Xbox One console emerged at the end of 2013 and also gave way to PS4 from Sony in the gaming market.

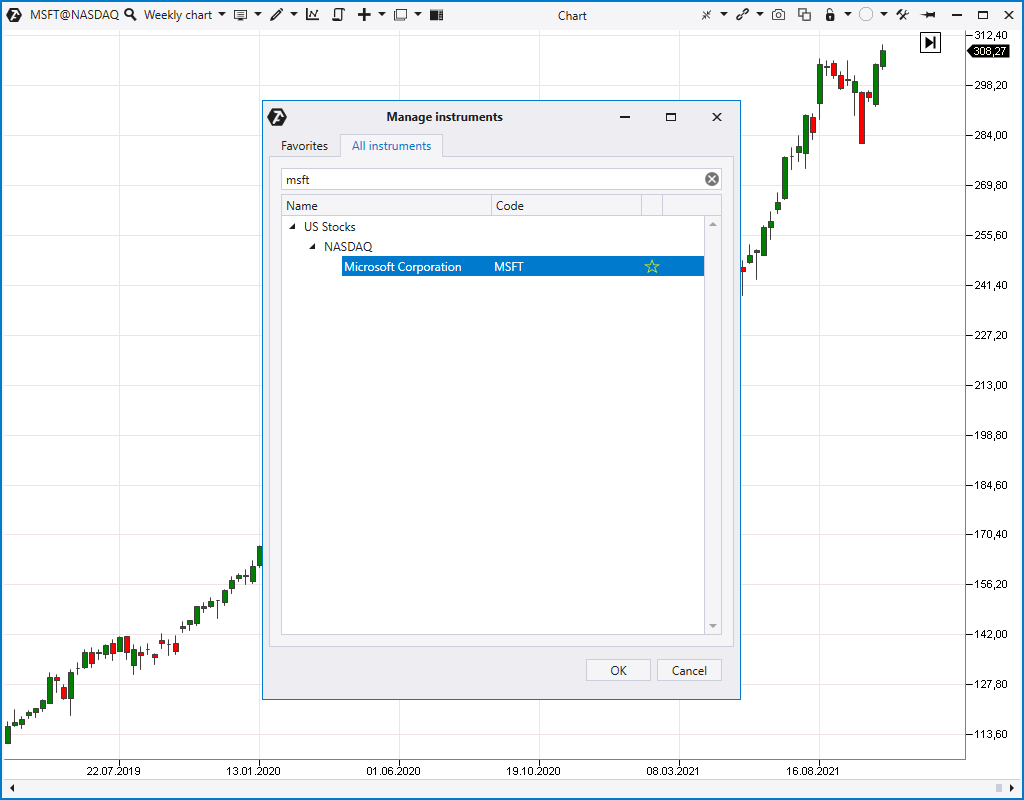

How to see quotations

In order to see the MSFT stock chart and the most recent quotation on your computer screen, make the following 3 steps:

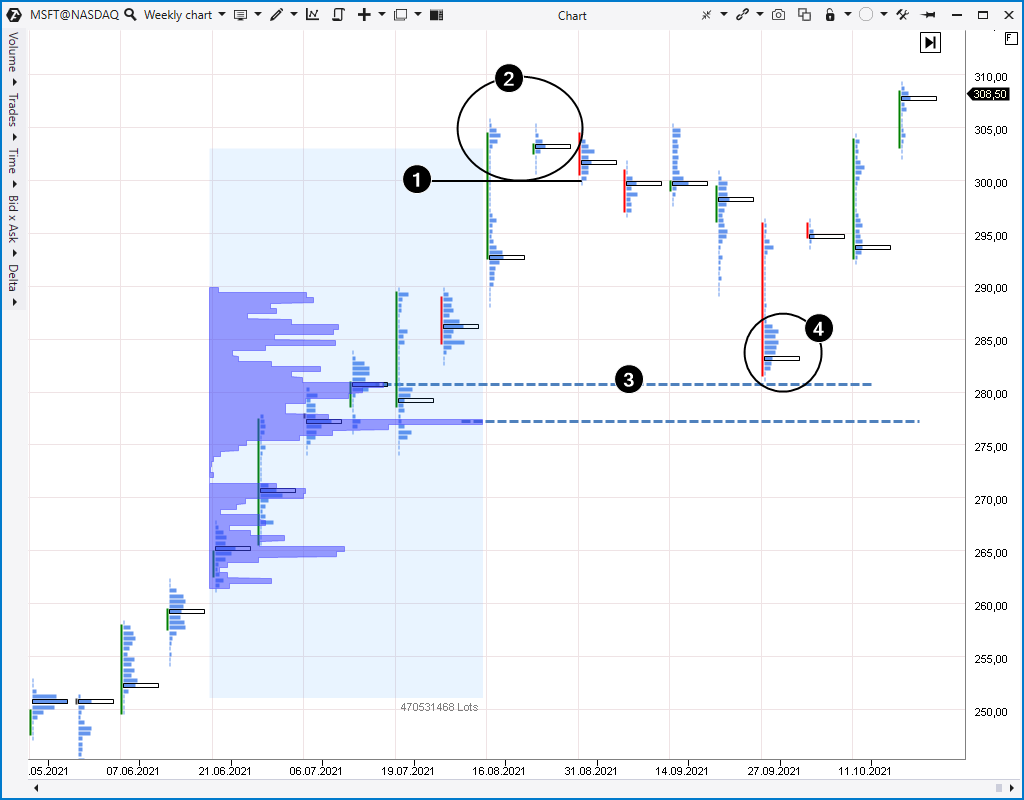

How to analyse the MSFT stock chart

Use cluster charts to select the best point of entry into the market. They help to understand real trading processes, which take place in the MSFT stock market, better.

How to start trading MSFT stock

In order to start trading Microsoft stock on Nasdaq, you will need:- Start-up capital. If 1 share price is USD 300, a couple of hundred will be enough to start trading the stock using leverage provided by your broker. We recommend that you use your demo account in order to get some experience without putting your capital at risk before you start trading with real money.

- Brokerage account. How to select a broker.

- A professional trading terminal for receiving advantage due to a fast execution of trades and situation analysis. Download ATAS free of charge – this platform has a lot of advantages.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.