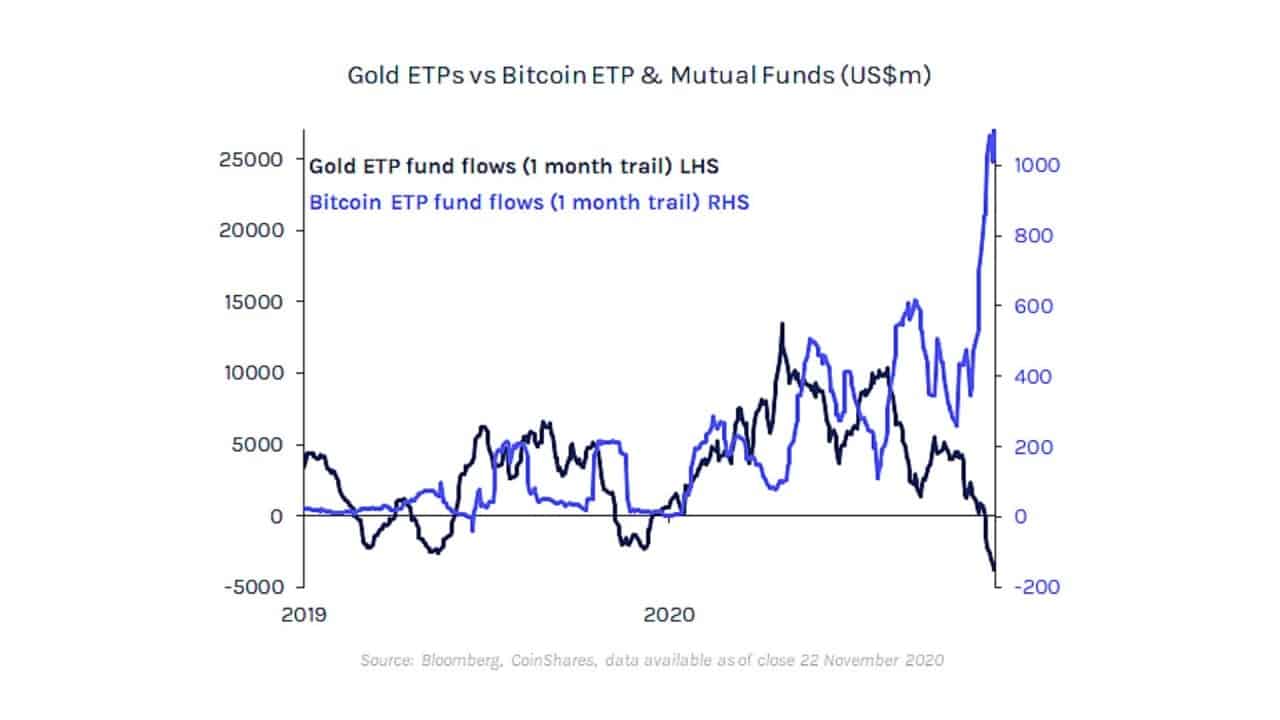

Thus, a trend for the inflow of institutional investors’ money in bitcoin funds was gaining momentum during the whole 2020. Up to USD 500 million of fresh capital entered the funds at the end of December 2020, which is a record-breaking indicator.

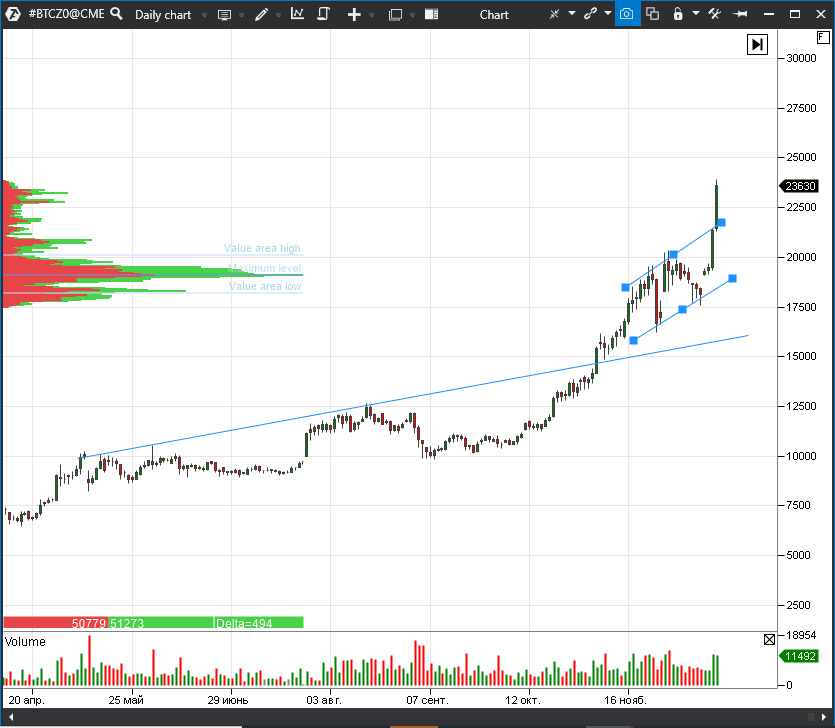

The bitcoin futures (BTCZ0) price renewed its historic high of December 17, 2017, on hype. It’s interesting that the new record also took place on December 17 but in 2020. The crypto needed all these years for the financial infrastructure development and adaptation in the sphere of traditional financial assets.

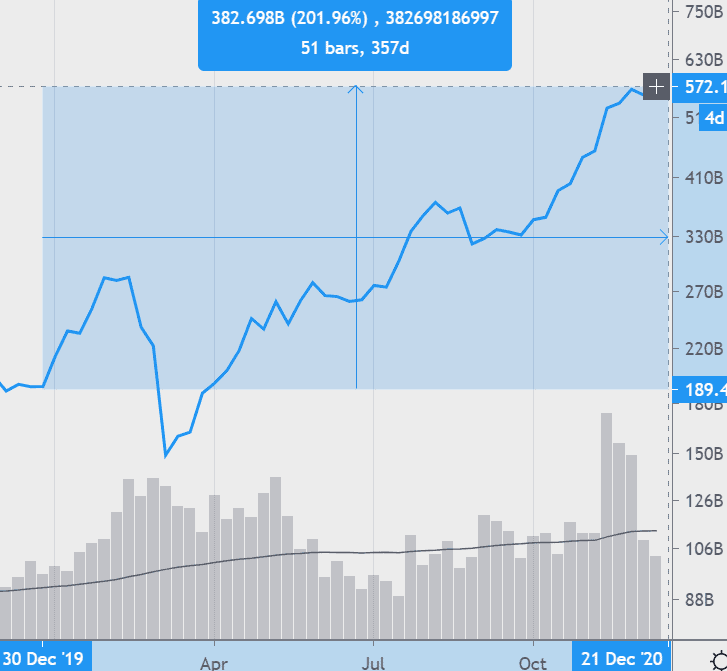

All this resulted in the growth of the cryptocurrency market capitalization from USD 190 billion at the beginning of 2020 to USD 570 billion at the end of 2020.

What happened to bitcoin in 2020

It goes without saying that bitcoin is the King among cryptocurrencies (about 60% by capitalization) and its dynamics would influence the whole cryptocurrency market.Let’s have a look at the CME bitcoin futures in order to assess the bitcoin chart development in 2020.

A breathtaking rally started after active interference of authorities, launch of printing presses and inflow of liquidity into the financial system. The bitcoin futures raised in price up to USD 20,375 in December 2020 or by 383% of the year low. It is a huge growth and only very few financial assets could show such a progress in 9 months. The market bitcoin capitalization reached USD 337 billion, which exceeded the previous record of USD 328 billion in December 2017.

Why bitcoin has the growth potential

Support of institutional investors and major companies is one of the main reasons of the cryptocurrency market and bitcoin growth.According to the JPMorgan report as of October 2020, bitcoin had a big growth potential, since it competed with gold as an alternative store of value:

“Even a slight displacement of gold as an alternative currency would mean a double or triple growth of the bitcoin price in the long-term perspective”.

The Galaxy Digital Director General and investor billionaire Mike Novogratz believes that the bitcoin boom in 2020 is caused by institutional support and investors, who wish to insure their capitals against devaluation of the traditional fiat money.

The Square payment system also decided to store some of its cash in bitcoins. The company bought 4,709 bitcoins, which cost about USD 50 million. This amount constitutes nearly 1% of the total Square assets as of the end of the second quarter 2020.

Earlier in 2020, one of the biggest asset management companies in the world – Fidelity Investments with assets in the amount of USD 3.3 trillion, presented its first mutual fund, connected with the bitcoin price.

These examples show that bitcoin and cryptocurrencies in general start to receive more and more support from institutional investors and, consequently, have the growth potential.

Bitcoin price forecasts for the year 2021

It is a rare case when analysts are so unanimous in their bitcoin price forecasts. And although the target values of forecasted bitcoin prices are different, all of them are optimistic in their attitudes towards the BTC/USD prospects in 2021.Tom Lee, a Managing Partner of Fundstrat Global Advisors, supported the opinion that bitcoin would replace gold as the means of hedging against inflation and store of value. Lee said in his interview to Yahoo Finance:

“Bitcoin is killing it – it just crashes all other hedges and asset categories, but I believe that the year 2021 may become the year of fireworks for bitcoin … the best is, most probably, ahead”.

BTC/USD forecast No. 1: USD 65,000 from Mike Novogratz

The investor billionaire expects that the bitcoin price would increase up to USD 65,000. Then, 2021 will become a good year for buyers. Mike believes that bitcoin:

- will reach the level of USD 20,000,

- then it may fall again to the level of USD 16,000,

- but it will grow to the level higher than USD 60,000 by the end of 2021 due to its ‘network effect’ with the attraction of new buyers and reduction of bitcoin supply.

Let’s get a rough estimate of how it would look like in the CME bitcoin futures chart from the trading and analytical ATAS platform:

“People buy bitcoins because the general number of coins cannot exceed 21 million. People believe that this is a store of value. It is a social structure and you cannot change it”, – said Novogratz.

BTC/USD forecast No. 2: USD 100,000 from the S2F founder

According to the founder of the popular bitcoin forecasting model Stock-to-Flow (S2F), which uses the PlanB name in Twitter, the baseline cryptocurrency will reach the level of USD 100,000 by December 2021.

The S2F model calculates the expected bitcoin price in 2021 with consideration of reduction of its supply and growth of demand. Since the bitcoin mining benefit reduces twice every four years, supply gradually goes down. Taking into account that the world inflation spreads, it theoretically may increase demand on bitcoins and cause a sharp splash of the bitcoin price.

The bitcoin price fluctuated at the level of USD 640 during the second halving in July 2016. Seventeen months later, the bitcoin price reached the record-breaking level of USD 20,000. If the situation repeats, the bitcoin price could reach USD 100,000-288,000 by December 2021.

BTC/USD forecast No. 3: USD 170,000 from a Bloomberg strategic analyst

Mike McGlone, an analyst from Bloomberg, shared one more optimistic opinion with respect to the bitcoin prices in 2021. He believes that the cryptocurrency hasn’t yet completed its upward impulse and he sets the level of USD 170,000 as the target BTC price for the year 2022.

“If you look at the past results, which potentially may point to the future, a zero could be added to the price in a year or two. Bitcoin completed 2019 at the level of USD 7,000 and now it is traded above USD 17,000, having added the figure of one in the beginning of the price value; perhaps, it might add zero in the end of the price value, which would be USD 170,000”, – said McGlone.

BTC/USD forecast No. 4: USD 318,000 from a Citibank analyst

However, the most optimistic opinion was expressed by Tom Fitzpatrick, a Citibank analyst. He believes that bitcoin would skyrocket in 2021 reaching the target of USD 318,000.

Why is the Citibank Senior Analyst so optimistic?

He explains his forecast with the bitcoin historical chart development. Remembering about the bitcoin price exponential growth in 2010 and 2011, Fitzpatrick expects that the similar movement would gain momentum in 2021.

He also mentions that the FRS interference and nearly zero interest rates, introduced for minimization of the coronavirus pandemic impact, caused the inflation surge. That is why people consider cryptocurrencies as hedging against currency devaluation and a safe asset.

Best cryptocurrencies for investing in the year 2021

What other cryptocurrencies have a growth potential in 2021?King of DeFi: Ethereum

Ethereum has the second largest capitalization after Bitcoin. The Ethereum capitalization was about USD 70 billion in December 2020. Ethereum started the year from the level of USD 125 and grew up to USD 600, which was 380% of growth.

The Ethereum open code blockchain network always served as a preferable network for decentralized applications (dApps). Apart from its own cryptocurrency – Ether (ETH), the platform supports other crypto-platforms, for example, Uniswap (UNI), Maker (MKR) and Aave (AAVE), which are active in the sector of Decentralized Finance (DeFi).

DeFi is believed to be one of the fast-growing tendencies in the cryptocurrency area, which may transform insurance, lending and saving programs, making them independent of banks and other centralized financial institutions.

The fastest growing sector in the world of cryptography in 2020 – DeFi – reached new heights. The total number of assets, blocked in the DeFi ecosystem, exceeded USD 13 billion (it was less than USD 3 billion in 2019). An explosive inflow of the market participants and capital into DeFi facilitated the strong Ethereum position as the leading altcoin, since it dominated in the sector, the share of which was 96% of the total transaction volume.

Ripple: a new payment ecosystem

Ripple was created as an alternative financial payment system with the goal to transform and simplify trans-border payments, making them 100% safe, nearly free of charge and instantaneous.

- Banco Santander (SAN),

- American Express (AXP),

- JP Morgan (JPM),

- HSBC Holdings (HSBA).

The largest Indian bank – HDFC Bank Limited (HDB) – and the second largest US bank – Bank of America (BAC) – are among the recent followers of RippleNet.

If we look into the year 2021, what are the main factors, which could make you think about Ripple as about one of the best cryptocurrencies for investing?

According to the OMFIF (Official Monetary and Financial Institutions Forum) report, Ripple, with its Distributed Ledger Technology (DLT), may ‘position itself as the SWIFT alternative’, solving five basic problems: safety, speed, traceability, cost, transparency and risk management.

Ripple prospects seem to be brighter than ever due to:

- the growing support from the side of the European Commission;

- the plans of development of a new legal framework, which would allow the use of DLT and crypto-assets in the financial sector.

Litecoin: fast and affordable

The market capitalization of LTC is USD 5,792 billion. Litecoin may boast that it:

- could be mined faster than other coins;

- offers a high reward to miners – LTC 25 per block.

LiteBringer is the first decentralized role playing fantasy game on the basis of Litecoin. Every player’s move is a transaction and the game launch brought benefit to the whole chain of blocks. The number of Litecoin transactions sharply increased after the game launch and exceeded 130,000.

The higher efficiency could serve as a positive price driver, since the CoinSwitch analysts forecast the target price for Litecoin at the level of USD 600 in 2021.

Some analysts also believe that the Litecoin price would grow in the coming years after halving. According to the optimistic LTC cryptocurrency forecast from Cryptoground.com, Litecoin would be traded at the level of USD 88 at the beginning of 2021 and would grow up to USD 347 by the end of 2024.

TRON: transformation of the altcoin market

The peer-to-peer TRON network was initially launched in the Ethereum network and was targeted at a revolution in the entertainment industry and democratization of the content development. The team has a big number of well-known partners, including:

- Samsung,

- oBike (bicycle rental company),

- Baidu (Chinese search system),

- Baofeng (the so-called ‘Chinese Netflix’).

Growth of a number of decentralized applications could make a big contribution into the TRON ascending movement, since the crypto-platform is considered to be one of the most powerful in this market. The volume of dApp TRON transactions even exceeded Ethereum in 2020.

The platform launched the TRON 4.0 Great Voltage protocol upgrade in summer 2020. The 4.0 upgrade introduced confidentiality functions in smart-cards, which provides a new reason for optimism in respect of the TRX cryptocurrency forecast in 2021.

Conclusions

Blockchain technology exerts more and more influence on human civilization. It soon may reach the level of technologies that changed the world – Internet, computer-aided teaching and electricity. Major companies and investment funds will use cryptocurrencies more and more often in their businesses. The thing is when rather than if.What to expect from the crypto-industry in 2021?

- Since wide spreading of cryptocurrencies and crypto-payments is just the question of time, the year 2021 promises to become an excellent period for the whole cryptocurrency market.

- Although different lists of the best cryptocurrencies may differ, all of them could provide good trading opportunities.

- Only the time will show whose forecast was better. Nevertheless, experts, as it seems, are unanimous in forecasting bright prospects for the cryptocurrency market for the next 12 months.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.