We will consider the following topics in the article:

- Gold during the 2008-2009 crisis.

- The gold growth during the coronavirus pandemic.

- Hedging risks: gold as an alternative currency.

- Other protective assets: US Treasuries, Yen, Franc, etc.

- Bitcoin as a new alternative currency – ‘digital gold’.

The coronavirus pandemic became a classical ‘Black Swan’ (the term is from a book by Nassim Taleb) for the world financial markets in the very beginning of 2020. The chain reaction initiated a cascade crash of assets in March. Investors are frightened by the developing economic crisis and look for ‘safe harbours’, where they can wait till dangerous months are over and hedge their risks in the stock market.

One of the most promising variants is gold, for which a number of experts predict a significant growth and reaching new historic highs. Let’s see why the yellow metal is so attractive in the current conditions and what other alternatives are available in the financial markets.

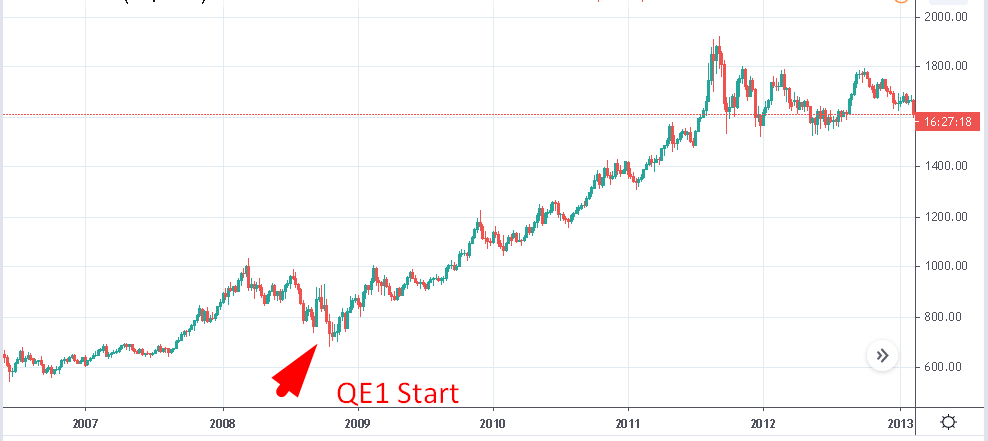

Gold during the 2008-2009 crisis

Civilizations come and go, while gold continues to be the universal measure of value in the digital and robotized 21st century. Even after the withdrawal from the gold standard (when USD had been strictly fixed to gold) in 1971, the yellow metal didn’t lose its significance as one of the base reserve instruments.The example of the 2008-2009 crisis is illustrative. Gold started its ascent to new historic highs as early as in 2007, when the signs of the bubble exhaustion in the American mortgage market started to manifest themselves.

The gold price experienced a strongest retracement in the midst of the liquidity crisis in the fall of 2008, but it completely recovered in 2009 and reached new historic highs. Experts connect the growth renewal with the launch of the US FRS program of Quantitative Easing.

A retracement started as early as at the end of 2012, when it became absolutely clear that the world economy embarked on a path of sustainable recovery and the US FRS would get ready for tightening the monetary policy.

Gold growth during the coronavirus pandemic

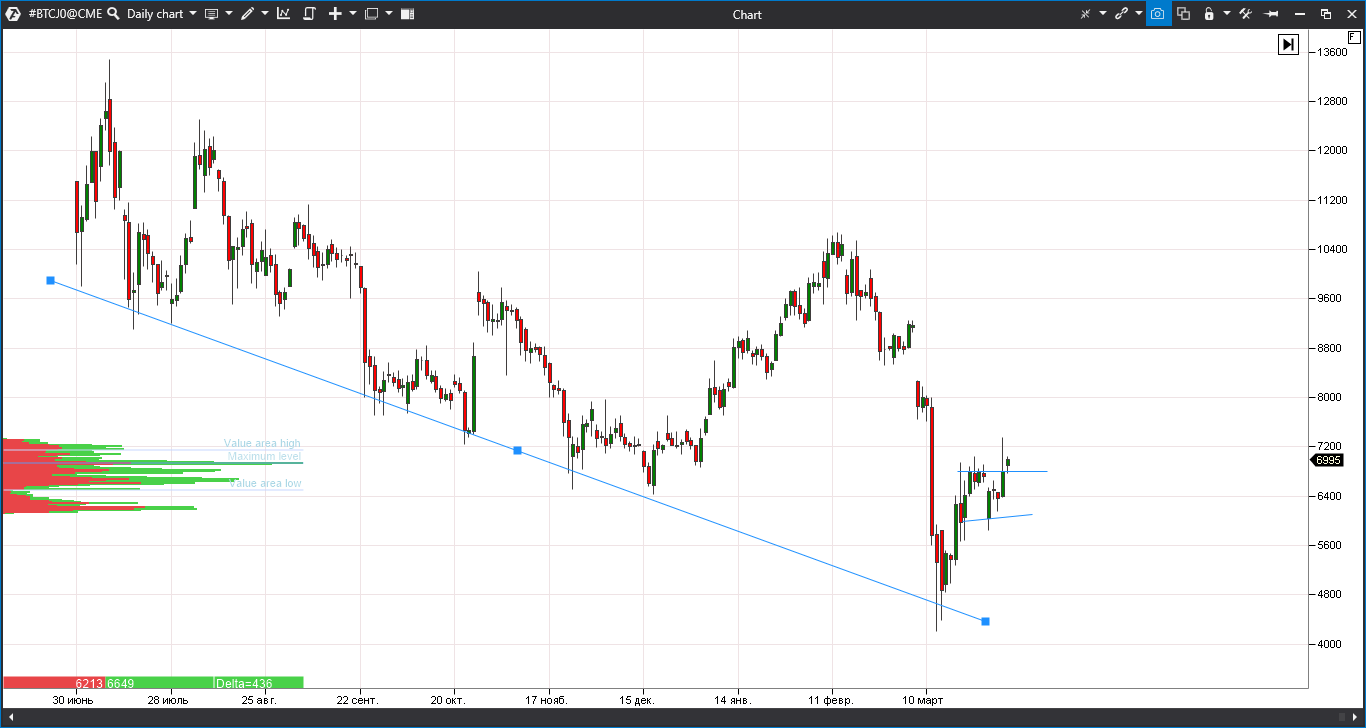

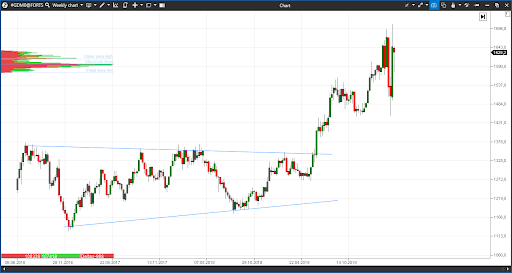

A bit more than a decade has passed and the 2020 crisis is in full roar. However, the story with a popular protective asset is very similar. The gold futures price moved out of the flat, in which it stayed since 2013, as early as in July 2019 – on the eve of the crisis. Only a few experts pointed to a probability of the cyclic recession of the world economy at that time.Gold strongly retraced during the intensive selling out of assets from the end of February until the third part of March. The main reason was a deficit of liquidity, as it was in 2008. Many players with margin positions were forced to sell practically everything in order ‘not to get into the margin calls’. Institutional investors, who are obliged by rules to observe a certain risk norm and correlation of assets in their portfolios, found themselves in a similar situation. The price crash made them get rid even of protective assets.

Gold as an alternative currency

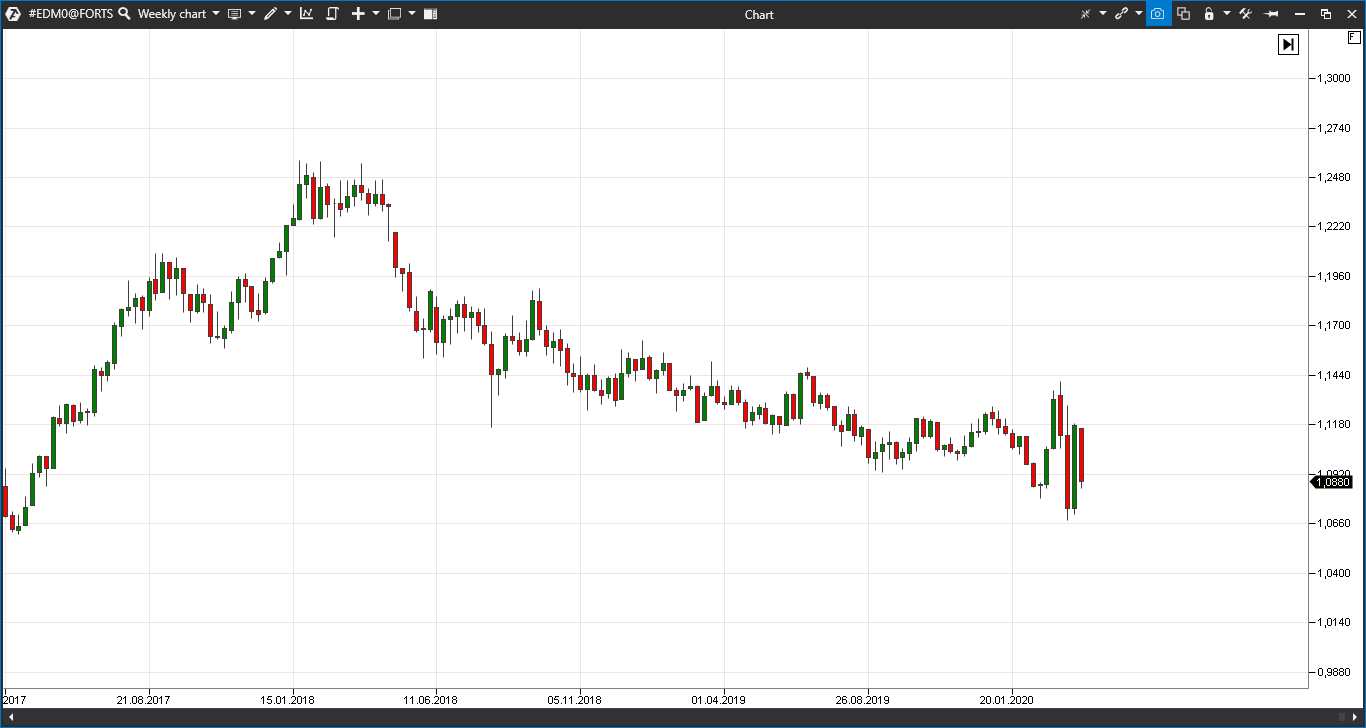

What happens to the country’s currency if the central bank of the country starts printing money? That’s right, the exchange rate is subject to strong pressure. Exchange rates are formed in accordance with the laws of demand and supply, as well as the prices on all the other assets. The higher the supply (emission) at the stationary level of demand, the lower the price is.So, what happens when all leading central banks of the world switch on the money printing presses synchronously? Approximately what we observe now in the international currency market (Forex) – ‘nervous somersaults’ of EUR/USD to and fro. A fluctuation amplitude, which is absolutely non-typical for this conservative pair, appeared in the weekly chart of Japanese candles.

Despite the growing volatility, the monetary gold, in fact, is the only international alternative currency, which is not subject to the supply shock. The demand on it increases both from the side of the central banks, which diversify their reserves, and from the side of investors.

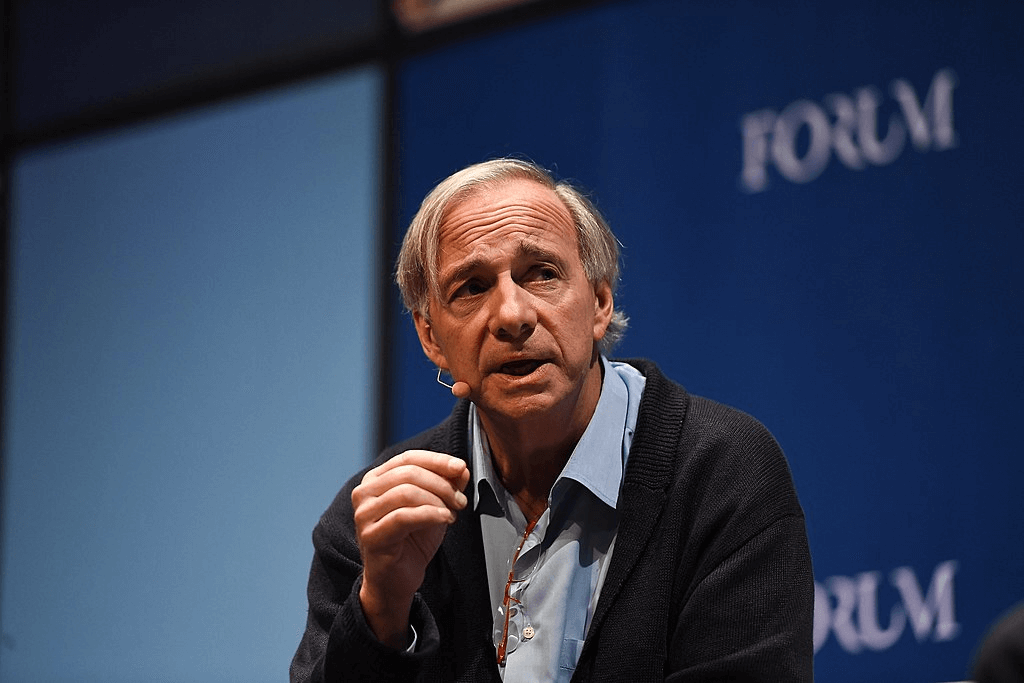

Many leading experts consider gold as the main reserve currency in the times of devaluation of USD and EUR. One of the most active promoters of the yellow metal is the legendary investor and founder of the Bridgewater Associates hedge fund Ray Dalio.

The Dalio’s Bridgewater Associates fund makes a forecast that the price would reach the psychologically important level of USD 2,000 per troy ounce and recommends to hold the asset. A number of major investment banks also have a bullish view on gold. For example, analysis of the American City Bank also mentioned USD 2,000 as the main middle-term goal.

It should be noted that many investment funds accumulate their positions in precious metals, which they use as the instruments of hedging risks in stocks. The monetary gold, perhaps, would be in great demand until investors shift the switch of their strategies from the ‘risk off’ position to the ‘risk on’ position. The beginning of cutting the central bank stimulating measures would be a probable trigger for the end of the uptrend.

How soon will it happen? As of today, there is no clear answer since nobody understands how long the current crisis would last.

Optimistic forecasts say that the recession would have a V-shape nature. It means that a sharp recovery would follow the sharp fall of the economy. Indeed, we already observed it in China, which already announced the end of the quarantine, at the beginning of April.

However, there are a lot of sceptics who point to the risk of the L-shape recession, when a protracted stagnation would follow the fall. There is a potential danger that monetary stimulation would not help in fighting the economic crisis, which would launch a series of bankruptcies in the corporate sector, overloaded by debts, of the leading countries of the world. In such a case, trading gold and investing into gold will be topical for many years.

Other protective assets: US Treasuries, Yen, Franc, etc.

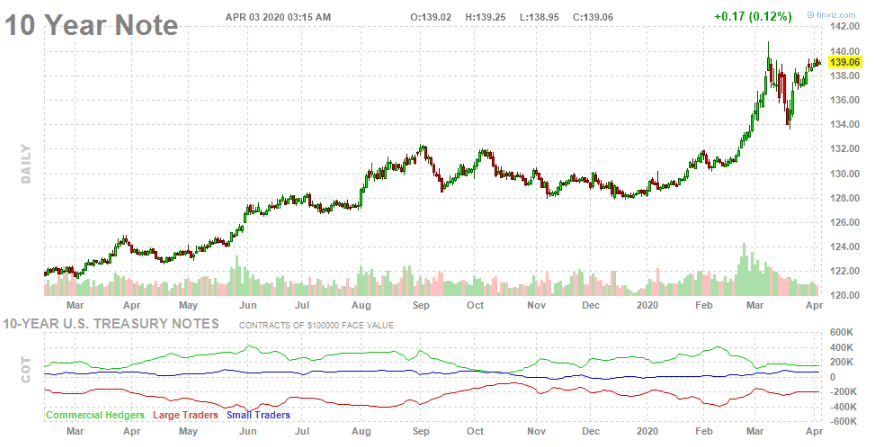

In general, investors have a bullish mood with respect to gold. However, the list of protective assets is not limited to precious metals only (the monetary silver, platinum and palladium are used for similar purposes).When we speak about protective assets, we need to mention bonds. First of all, we need to mention debt obligations of the American Government – US Treasuries. They are the main reserve of the majority of the world central banks and are in the portfolios of thousands of investment funds and private investors.

Even the most liquid securities – 10-Year Notes – showed the dynamics (similar to the gold one) in March this year. They reached the multiyear highs after a sharp retracement. It confirms the hypothesis that the sharp retracement of the precious metal price was caused by the deficit of liquidity rather than by fundamental economic reasons and shift of the demand and supply balance.

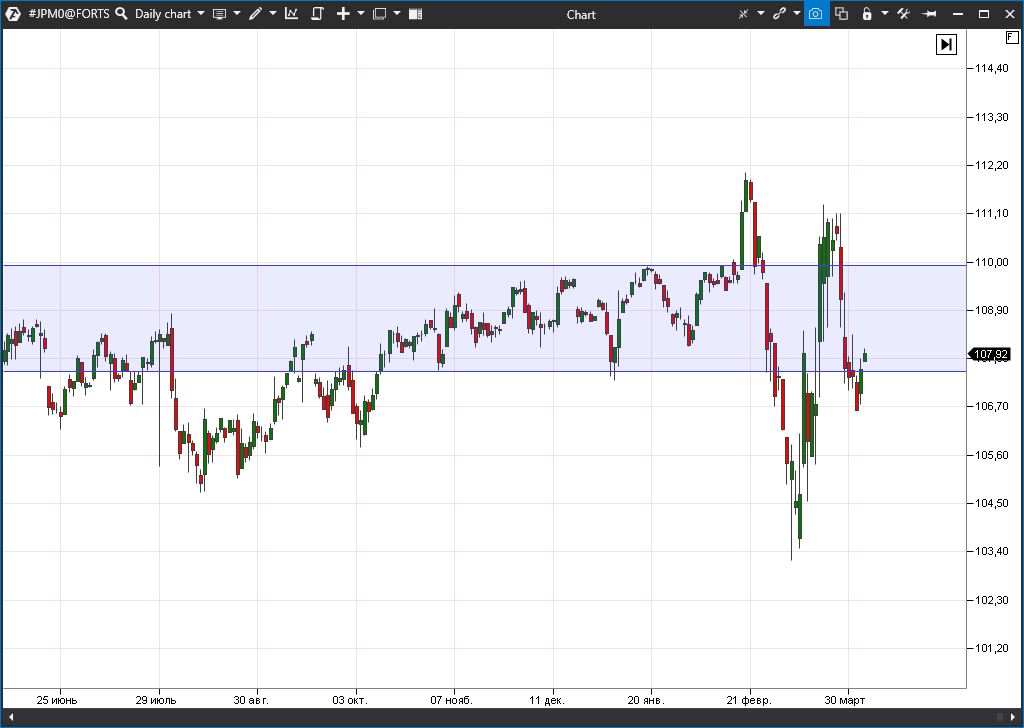

Also, if you speak about protective assets, you could often come across references about the Japanese Yen (JPY) and Swiss Franc (CHF). Earlier, investors often bought these currencies for hedging risks, since the economies of Japan and Switzerland possess high stability. However, the specific character of the current crisis tells us that these currencies do not have any advantage. Judging by quotations, investors expect that their central banks would initiate a policy, which would facilitate devaluation.

Thus, the USD/JPY pair, after several jumps of volatility on Forex, returned to the previous range, which had been before the COVID-19 pandemic started.

Is Bitcoin a digital gold or pure hype?

The Bitcoin is a prospective candidate to become a ‘partner’ of gold in the role of an alternative world currency in the times of switching on the printing presses. There was an important shift in understanding this digital currency by the investors from the classical financial markets in 2018-2019. If earlier the Bitcoin had been considered a purely speculative instrument and a game for geeks and a gimmick for simpletons, they speak about it today as about a promising alternative to the fiat money.So, what has happened during the recent years?

- First, the level of availability of the bitcoin derivatives has increased. Some classical exchanges, such as CME and Cboe, introduced futures and the leading investment companies of the Black Rock level continued development of infrastructure for storing digital assets.

- Second, people really started to accept Bitcoin as a certain alternative to the traditional currencies. Confidence in the fiat money goes down due to the currency wars and devaluation policy. The limited emission of the main cryptocurrency is an important advantage in this context.

- Third, Bitcoin really resembles gold a lot by its characteristics. Its resources are limited and there is no single center of its ‘production’ and there is no central bank, which would print more Bitcoins.

The cryptocurrency rate crashed during the crisis of liquidity during the first 20 days of March 2020, as well as it happened with bonds and gold. However, a rather intensive recovery started at the end of March. This asset deserves, at least, attentive monitoring.

- Thus, the Bitcoin market volume is estimated at USD 100-200 billion, which is very little for acquiring the status of a global asset. The stable growth would be difficult without the further development of derivatives and financial infrastructure.

- It is difficult to follow the risk parameters, when investing into Bitcoin, due to a very high volatility. It is an asset with a very high risk level in itself. Investment instruments will not lose 50% of their value during a couple of days, while it has already happened several times with bitcoin. The March crash is yet another confirmation of it.

- It is still a big problem that the main volumes of the cryptocurrency circulate on the unregulated cryptocurrency exchanges, which, on top of that, have serious problems with safety.

Thus, it’s too early to say that Bitcoin could be bought for the amount bigger than the one an investor is ready to put at risk. Let alone, it is unacceptable to use Bitcoin as a hedging instrument.

Summary

As we can see, the specific character of the current crisis shows that not all the protective assets are similarly suited for risk hedging. Perhaps, gold looks the most attractive one if we consider the relation of the potential of the growth/risk level and liquidity.However, Bitcoin also has a growth potential due to the increasing monetary expansion of the central banks, but a number of unsolved infrastructure problems still keep it among the candidates to be a ‘partner’ of the yellow metal.

Good luck investing!

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.