- what oil futures is

- why the oil futures market is so attractive among traders

- pros and cons of oil futures trading

- how to start trading oil futures

- and in conclusion – a harmful advice – how to lose money trading oil on the forward market

WORLD PRODUCTION OF OIL

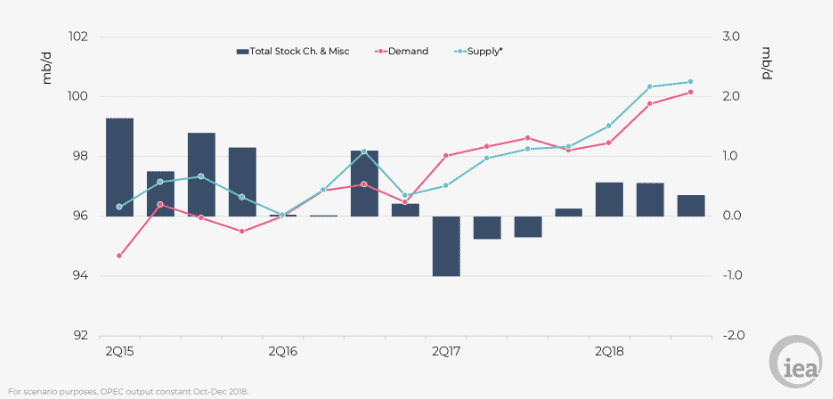

According to recent information from the International Energy Agency, the world volume of oil production exceeded 100 million barrels per day. If we take USD 70 for one barrel, a commodity value of USD 7 billion is extracted from the Earth interior every 24 hours. But what is interesting …

Why the oil futures market is attractive for traders

- Minimum spread and maximum liquidity. Practically, at any moment of time, there is an army of sellers in the market, who would be ready to sell you an oil futures one cent higher than the current price. The same is true for an army of buyers at one cent lower than the current price.

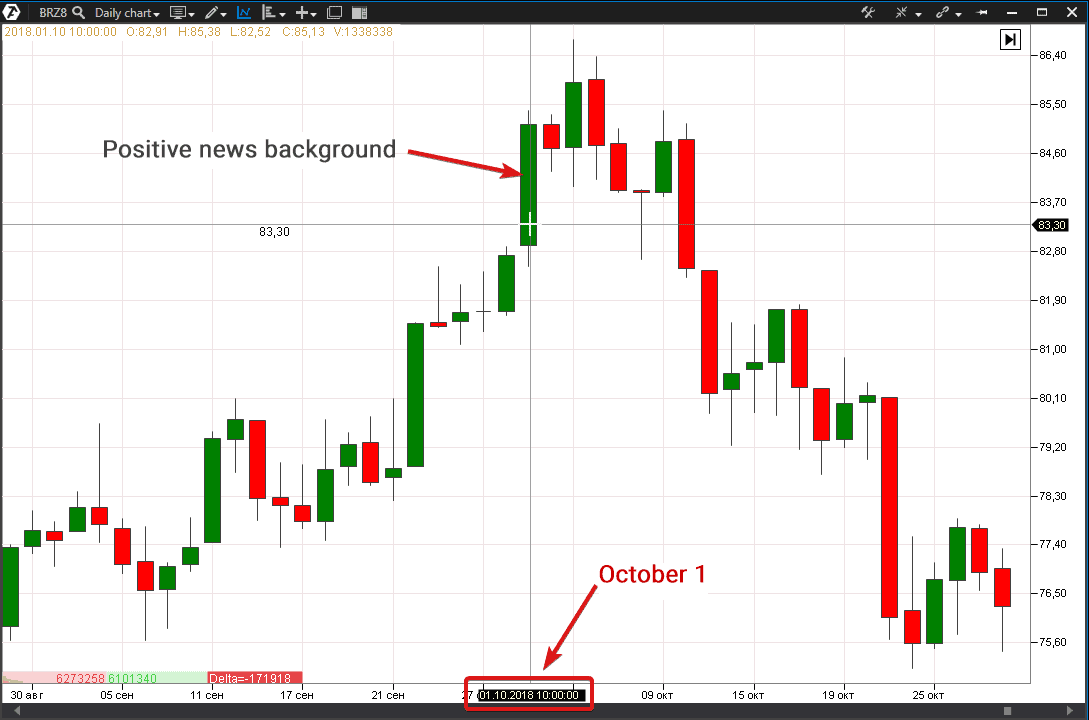

- High volatility. During less than 3 months, starting from the middle of August 2018, an oil futures went up in price by 20% and then went down by 20%. Add wide day fluctuations to this whipsaw. Isn’t it a volatility any trader dreams about?

- Relatively low cost of the market entry (depending on the exchange).

- Information background is not boring. The oil futures price is pushed both ways by the news from all over the world every day. We will speak about a fundamental analysis of oil futures a bit later.

- High status. “What are you doing for living? – Trading oil. – Wow!”

Types of oil futures

Oil futures could be divided by different criteria

- by oil brand

- by expiration term

- by type – deliverable and non-deliverable. For example, they trade non-deliverable Brent oil futures (code – BR**) on the Moscow Exchange. And they trade oil products futures with delivery by railroad on the Saint-Petersburg Exchange.

- by the contract currency. The vast majority of oil futures is quoted in USD. But a milestone event took place in March 2018 against a backdrop of economic conflict between the USA and China. Oil futures trading in CNY was started, for the first time, on the Shanghai International Energy Exchange.

Let us consider such features as oil brand and expiration term in more detail.

First of all, differences between various oil futures are due to the fact that the oil could be different (by the way, despite the fact that oil is called “black gold”, its color spectrum could be from black to yellow).

There are two most popular marker brands of oil:

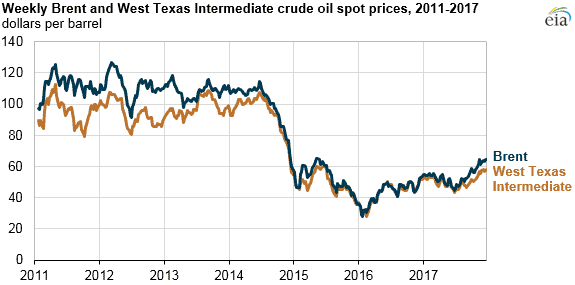

- Brent North Sea Crude (better known as Brent Crude and named after a deposit in the North Sea).

- West Texas Intermediate (better known as WTI). Another name is Light Sweet Crude Oil.

Brent refers to the oil that is produced on the North Sea deposits. The Brent oil price is a benchmark for African, European and Middle East oils. The Brent pricing mechanism imposes the cost of about two thirds of the world volume of oil production. Sulphur content in Brent is 0.37%.

WTI is a basic brand for the North America. WTI sulphur content is about 0.24%. WTI is the best crude oil brand for production of petrol, while Brent is the best for production of diesel. WTI price is a bit lower than the Brent one.

Asian countries, when assessing own crude oil, use, as a rule, a mix from Brent and WTI prices, however, a difference between them is not big and the correlation, practically, tends to 100%, as you can see in the picture below.

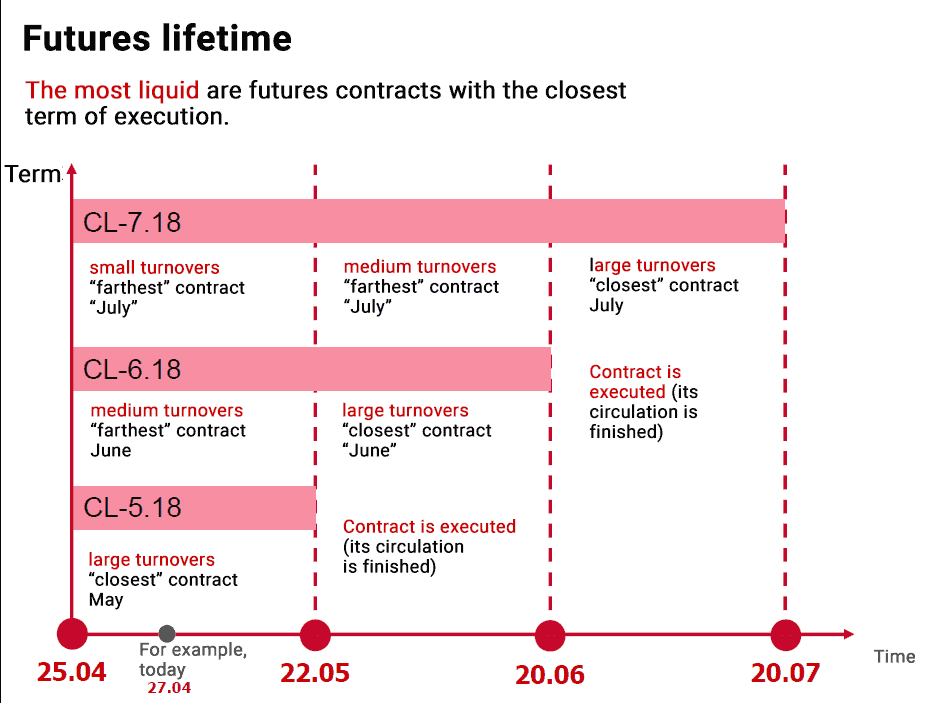

While expiration date of such instruments as Gazprom or Sberbank stock futures takes place once in a quarter, expiration in the oil futures market takes place every month.

Where an oil futures is traded

Main exchange platforms where oil futures are traded:- New York Mercantile Exchange (NYMEX), which is a subdivision of the Chicago Mercantile Echange (CME). Volume of trading Light Sweet Crude Oil (CL) futures was more than 310 million contracts in 2017 (+12% to the year 2016 indicator).

- Intercontinental Exchange ICE.

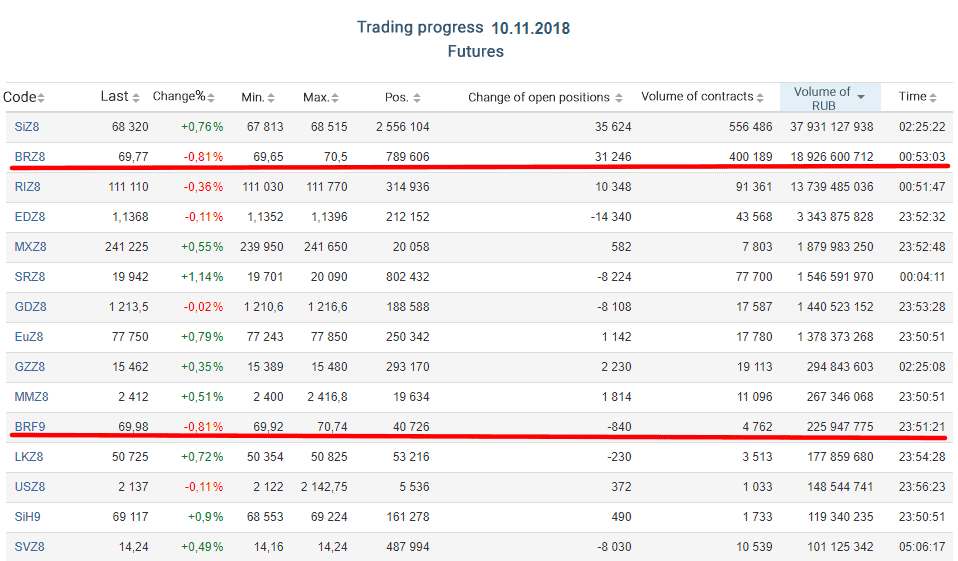

- Moscow Exchange (MOEX). Both Brent oil and Crude Sweet WTI (starting from the spring of 2018) futures are traded in the forward market. But, as it was already mentioned above, Brent is much more popular.

HOW TO START TRADING OIL FUTURES

The mechanism is simple and is not different from entering into other instruments trading:- To choose an exchange and a broker.

- To make a contract with the broker.

- Install software. Usually, a broker provides the required software, but this software often lacks useful “tricks”. That is why professionals install additionally some specialized trading and analytical platforms in order to increase efficiency and convenience.

- Put money on the account.

- Start trading, following the trading system regulations (for example, oil futures trading with the use of footprints).

A size of a guarantee collateral could become a key factor when choosing an exchange, which you should enter to start the oil futures trading. In order to perform trading operations with one oil futures contract on the Moscow Exchange, a trader needs to have 10-12% of the cost of a lot consisting of 10 contracts, which is about USD 80, on his broker’s account. And in order to trade E-mini Crude Light on NYMEX, a trader needs to have USD 500 on this account for intraday operations. In case a trader wants to postpone the position “overnight”, this could cost by far more than an intraday guarantee collateral. Please note that the mentioned tariffs are just an example. Contact your broker and check exchange specifications for more accurate information. Clarify all existing exchange, bank and broker’s commission payments.

WHAT INFLUENCES THE OIL FUTURES PRICE

The oil futures market is very complex from the point of view of fundamental analysis due to its global nature and importance for the modern economy. The reason is that the oil price is sensitive to a huge number of political, economic and other factors. Let us list the basic drivers of the oil futures price in grief:- Industrial production demand. At the time of writing this article, the biggest oil consumer is the USA. However, if the Chinese economy develops at the same rate, China will become the biggest importer of black gold in 2020.

- OPEC (Organization of the Petroleum Exporting Countries). Decisions of this organization, which was created in order to control oil production quotas, and also news from other oil producing countries, which are not OPEC members, cause significant oil price fluctuations.

- Geopolitical conflicts and wars. As an example are sanctions against Iran.

- Statistical data publication. Dynamics of reserves and reports of oil producing companies.

- Currency market fluctuations. Increase of the USD index exerts pressure on the oil futures price.

- Emergencies, such as windstorms, earthquakes and industrial accidents.

- Other fundamental factors and also rumors, forecasts of analysts and expert articles in business media.

By the way, have you paid attention to the fact that bursts of optimism in the news often coincide with the market peaks, which are followed by a significant price decrease? Below is a fresh example:

- CNBC: OPEC ‘powerless to prevent’ oil prices jumping toward $100 a barrel this year;

- Fortune: The price is at a 4-year maximum and may go even higher as investors observe inability of OPEC to replace the falling export of Iran oil.

However, something went wrong. And, from the 86.38 peak on October 5, the oil futures on the Moscow Exchange went down to the 82.65 minimum on October 8. And, after an unsuccessful attempt to rally on October 9, the oil futures price slid down.

However, there is one more way to “burn” your trading account in no time. We will tell you a story.

"HARMFUL ADVICE". HOW TO LOSE A DEPOSIT TRADING OIL FUTURES

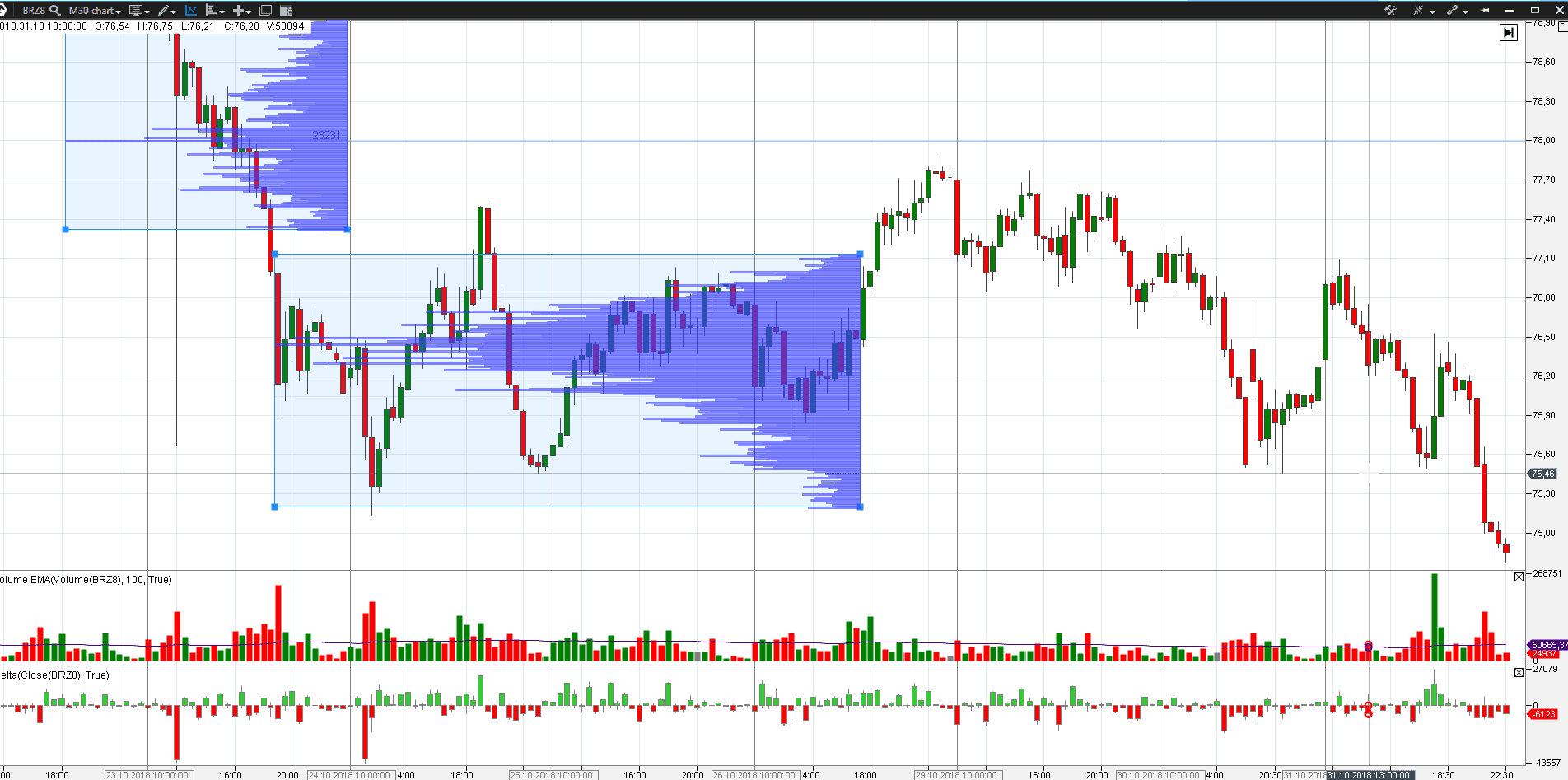

A story about trading against the trend. We will speak about the oil drop in October 2018, which we mentioned above already.Look at the chart, which shows dynamics of the oil futures price on the Moscow Exchange with the 30m timeframe.

- a volume indicator with the sliding average MA=100;

- a Delta indicator (what Delta is).

Now then. The oil futures went down from USD 80 to USD 76 on October 23. Take heed of the Market Profile readings. The indicator recorded a high volume at the USD 78 level during a steep fall of the price. It is a result of the fight of sellers and buyers. The latter were completely preoccupied and the contract price kept on decreasing. As a rule, a peak on the horizontal volume serves further as a resistance level. The price found support at the 75.50 level during the next three trading sessions from October 24 to October 26. “This is a double bottom and the oil futures will go up!” – this is how, most likely, the beginners in the cunning financial markets thought. The price was higher than USD 77 a barrel on October 27, inspiring optimism. “A new bullish trend has started!” They hurried to enter into longs with such bright thoughts, while the price was still not very far (as they thought) from the assumed bottom of 75.50.

But there are 2 facts, which professional oil futures traders do not miss:

- Resistance level 78, built on the Market Delta indicator readings, is not broken yet. Which gives grounds to assume that the downward trend could resume.

- Low trading volumes on October 27. The chart bars exceed the sliding average MA=100 few times only during the whole session. Why? Maybe, because buyers do not push. What if the major traders are not interested in higher prices? Maybe, they are just watching how the market would behave under the resistance of 78? Then we should see a wave of sales, which would confirm weakness of the demand.

This wave comes in the middle of the day on October 30. It is worthy of note that volumes grow, testifying to the deficit of buyers at USD 77 and higher. The wave of sales finds support again at the level of 75.50. “Well, now it will go up for sure!” Inexperienced buyers built up the quantity of longs on opening on October 31.

However, more experienced traders were aware of the actual market weakness under the resistance level of 78 and chose bearish behavior on the last day of October. They acted so along the trend, making decisions on the basis of demand and supply, which could be analyzed with the help of professional instruments of the ATAS platform. And what about the beginners? The price of oil futures reached USD 73 a barrel on November 1. Very few longs, opened at the support of 75.50, stayed alive until that moment. And those, who stayed alive, regretted.

Summary

- the oil futures are an extremely volatile and liquid market;

- the fundamental analysis is very complicated due to a big number of influence factors;

- the use of modern instruments allows oil futures market analyzing with high efficiency.

Download a free test version of ATAS right now and analyze the state of the oil futures market on the Moscow Exchange as early as in 10 minutes.