Read in this article:

- What the Spread Tape is.

- Where to take it from and how to set up.

- How to use the Spread Tape.

- What the difference between the Spread Tape and Smart Tape is.

What is the Spread Tape?

Spread Tape is a special Time and Sales Tape, which shows Bid and Ask trades separately. The Spread Tape got a new name in the latest ATAS version – the Bid/Ask Tape.

If you’ve got questions after reading the previous paragraph, here’re some links, which will help you to understand what we speak about:

- what Ask, Bid and Spread are;

- about order matching on the exchange;

- what the Smart Tape is.

We want to briefly remind you that:

- Ask is the best supply price;

- Bid is the best demand price;

- Spread is the distance between the Bid and Ask. The Spread includes those price levels, which are between the best demand price and the best supply price.

The Spread value will be different depending on the instrument liquidity. For example, there could be no free price levels between the best demand price and best supply price in the event of high market liquidity. In such a case, the Spread value will be equal to 0 (this is typical for the oil futures). However, the Spread value could be several percent in the event of low liquidity of a financial asset.

What the Bid/Ask Tape shows

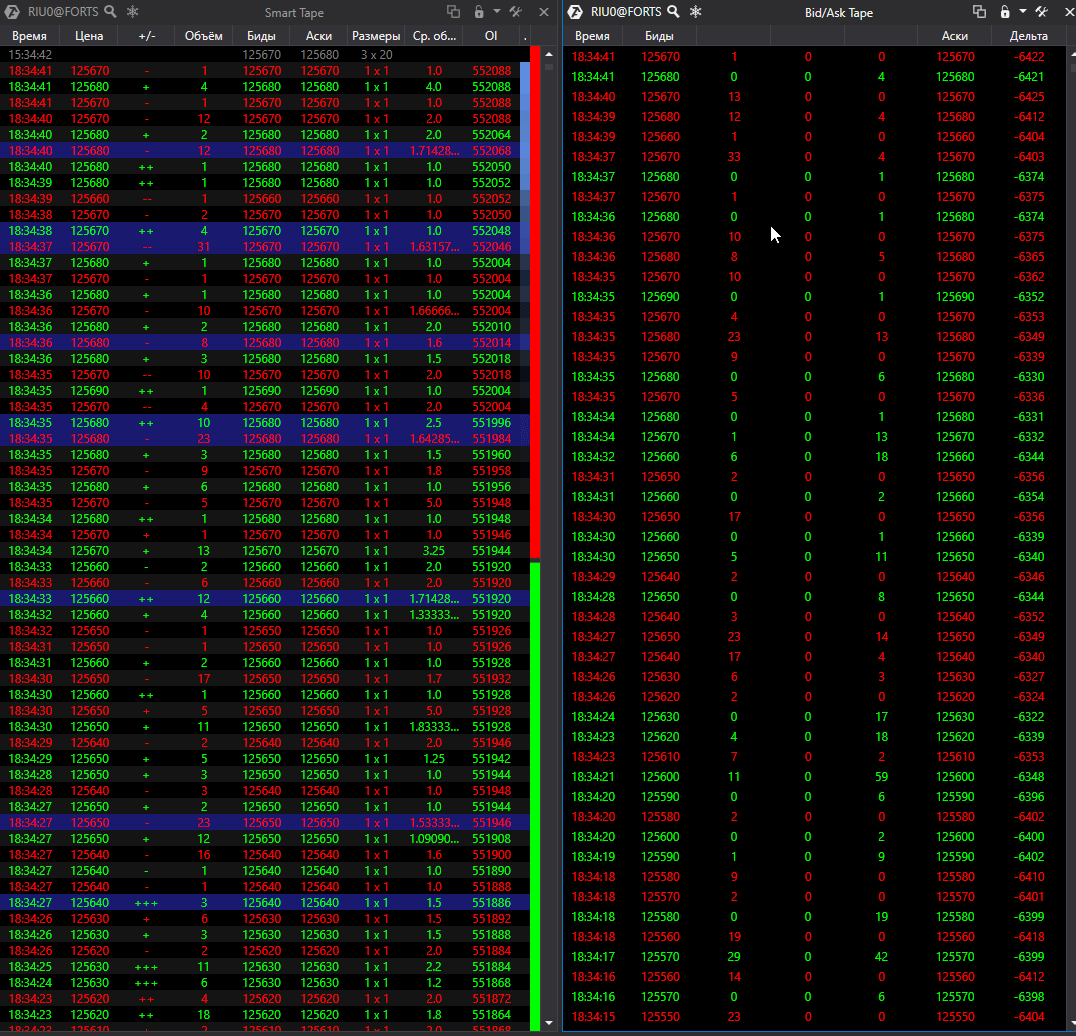

The Bid/Ask Tape shows the Bid and Ask volumes at each price level. Unlike the standard Smart Tape, where we see the general traded volume at each price level per unit of time, the Bid/Ask Tape splits this volume into two values – Bid volume and Ask volume.How to open the Bid/Ask Tape

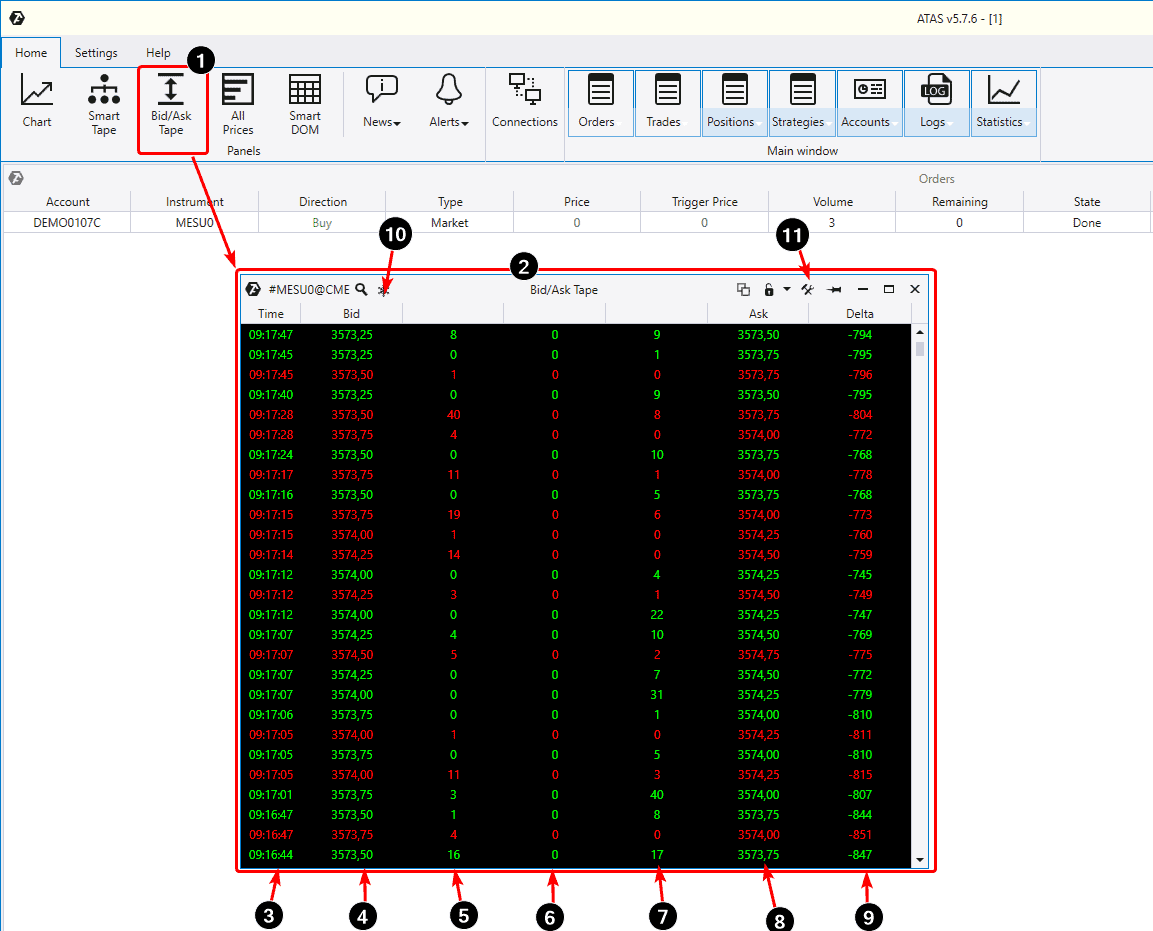

The picture below explains how to open the Bid/Ask Tape, what it shows and how to set it up.

- Press Bid/Ask Tape in the main ATAS window.

- Select the instrument and you will see the Bid/Ask Tape. It has the form of columns. Every row is a separate trade.

- The left column shows the trade time execution with up-to-the-second accuracy.

- Then goes the column, which shows the price where the Bid was during the trade execution.

- Volume, which was traded by the Bid (market sells).

- Volume, which was traded between the Bid and Ask (inside the Spread).

- Volume, which was traded by the Ask (market buys).

- The price where the Ask was during the trade execution.

- Delta change (what Delta is).

- Here you can ‘freeze’ the Tape to view the details while the Tape is on pause.

- Visual Tape settings.

How to use the Bid/Ask Tape

In general, the Bid/Ask Tape helps to:- look for the interest in holding the levels;

- understand how strong one or the other side is.

It is an individual decision of any trader how to do it specifically. It depends on specific features of a personal trading style of any trader. However, there are some critical situations, which you can detect with the help of the Bid/Ask Tape. Let’s consider two situations and you will understand the idea.

- High Ask volumes.

- High Ask and Bid volumes.

Let’s consider examples from the RTS stock index futures market.

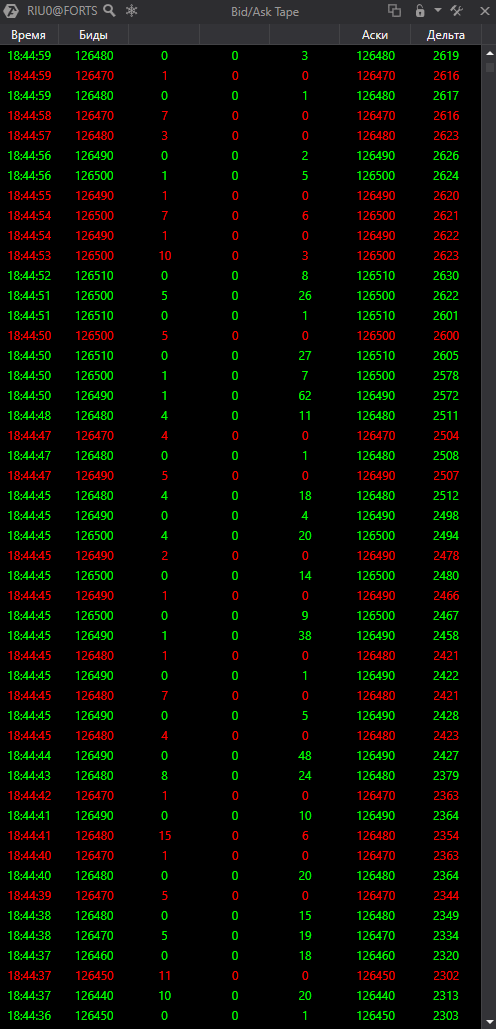

Situation 1. High Ask volumes

Let’s assume that you watch the Tape and see above average Ask volumes (5th column). See example in the picture below:

Situation 2. High Bid and Ask volumes

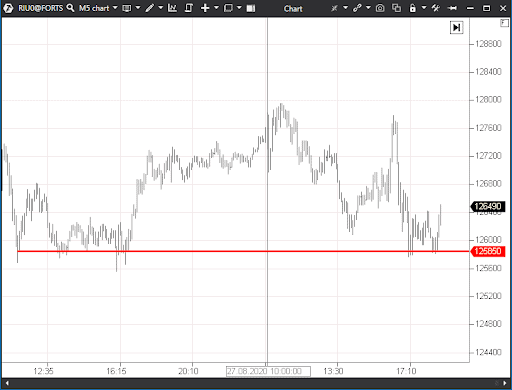

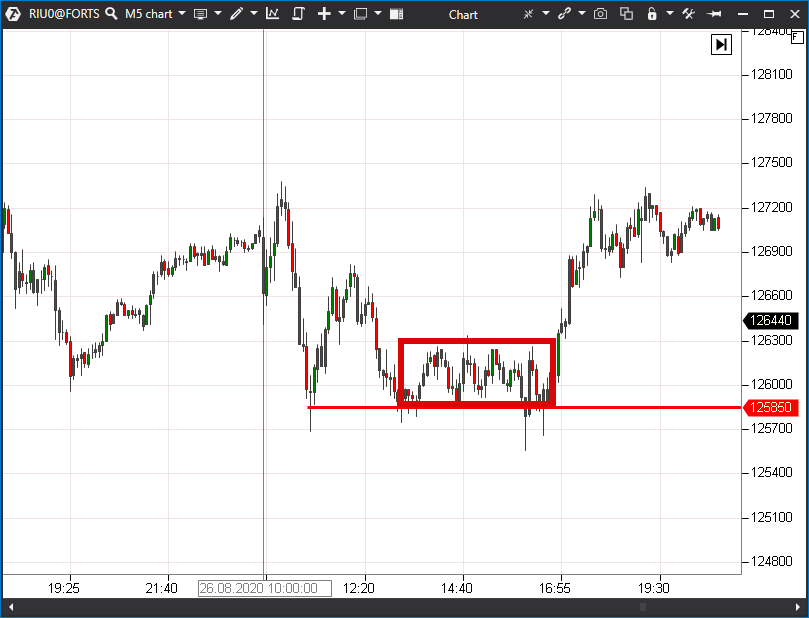

Let’s assume that you see higher than average volumes in the Bid/Ask Tape and they are approximately equal. Such a situation may arise in significant price sectors and often is accompanied with flat price behaviour. You may have a feeling that there is a fight for a significant price level when you observe the Tape in such sectors. In this case, you may notice false breakdowns of the support level with subsequent returns and backward retracement.

In our case, the price behaved as if trying to break the support level. It tested the level many times, conducted several false breakdowns and the general trend spoke in favour of moving down, but the level was inaccessible.

Watching the Bid/Ask Tape trades, you could have noticed a certain absurdity of the developing situation: first, the big Bid volumes reduced the price then similarly big Ask volumes brought it back. The nature of influencing the price by indirect signs told us that there was no focused impact on the support level with the aim to break it.

So, what has actually happened?

Perhaps, the following has happened. There are market makers and correlators (the market participants who align the futures and underlying asset quotations) on the RTS futures. Such players may hold the price within certain boundaries since they have significant money assets and special algorithms.It could be assumed that, in this situation, major market participants tried to convince traders in irreversibility of the further price reduction. However, the Bid/Ask Tape monitoring suggested that the situation couldn’t be interpreted unambiguously in favour of reduction. If you have such doubts, we recommend you to hold back from trading or reduce risks at the expense of the open position size.

Why it is important to use the Bid/Ask Tape

If you haven’t used the Bid/Ask Tape before, it would be difficult for you to understand from the start what takes place in the market. You might need additional time to study how one or another situation leads to certain consequences.

Using the Bid/Ask Tape is especially useful for scalping trades (what scalping is), since the duration of influence of some volumes could be very short.

We recommend you to use the Bid/Ask Tape together with the Volume, Delta and Open Interest indicators and also the classical technical analysis indicators and support and resistance levels.

For example, when the testing of the 50th line of the Simple Moving Average (SMA) sends a signal to buy or sell for other trading systems, we will see high Ask volumes in the Bid/Ask Tape. If the Bid volumes do not stick out at this moment, then, most probably, the trade, which was opened along with the big majority, would bring profit.

If the exchange broadcasts the Open Interest value (how MOEX does it), then it would be possible to understand, in a combination with the Bid/Ask Tape, whether new trades are opened or positions are registered.

It would also be useful to watch the Bid/Ask Tape when the price tests the support or resistance level, since the price may face counteraction when moving towards the level, and then the trades, directed against the main movement, should appear in the Bid/Ask Tape. Such a situation confirms that the level is protected by someone. Besides, the counteraction could be either active (with market orders) or passive (with limit orders). A high volume in the latter case could also be on the side of the main direction, but each such market order would be engulfed by a limit one, which are often posted as mini-icebergs. Such an iceberg will take the market order ‘hit’ and, as soon as the market order pressure ends, small market orders would be applied in the opposite direction to move the price a bit away from the significant level.

What is the difference between the Bid/Ask Tape and Smart Tape?

The Smart Tape shows the general traded volume at a price level, while the Bid/Ask Tape shows what the Bid volume and what the Ask volume were.Smart Tape includes filters, using which you can watch only big volumes. The Bid/Ask Tape doesn’t have such settings. Moreover, the Smart Tape allows analysing some additional data, such as:

- Open Interest value;

- average Volume;

- number of price levels engulfed by the Volume.

Conclusions

Let’s draw some conclusions from the above:

- The Bid/Ask Tape is a useful instrument. It can be used by scalpers or for assessing the market behaviour with a high degree of detail and for the search of the entry point.

- The Bid/Ask Tape shows places of special interest on the part of the system market participants.

- It helps to avoid traps, connected with false level breakdowns.

Try to add the Bid/Ask Tape to your working space. You will need to spend some time and effort studying it for being able to notice specific patterns. Conduct experiments on using the Bid/Ask Tape in a combination with other indicators available in the trading and analytical ATAS platform.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.