OI Analyzer is a custom-made indicator, which sorts out the Open Interest and shows what buyers and sellers do. The indicator idea belongs to Denis Sotnikov. Our channel has a webinar with Denis about the indicator capabilities.

The indicator will be useful for:

- intraday traders;

- position traders for the search of the entry point with minimum risks in the course of the position accumulation by major players.

Specific features of the OI Analyzer indicator

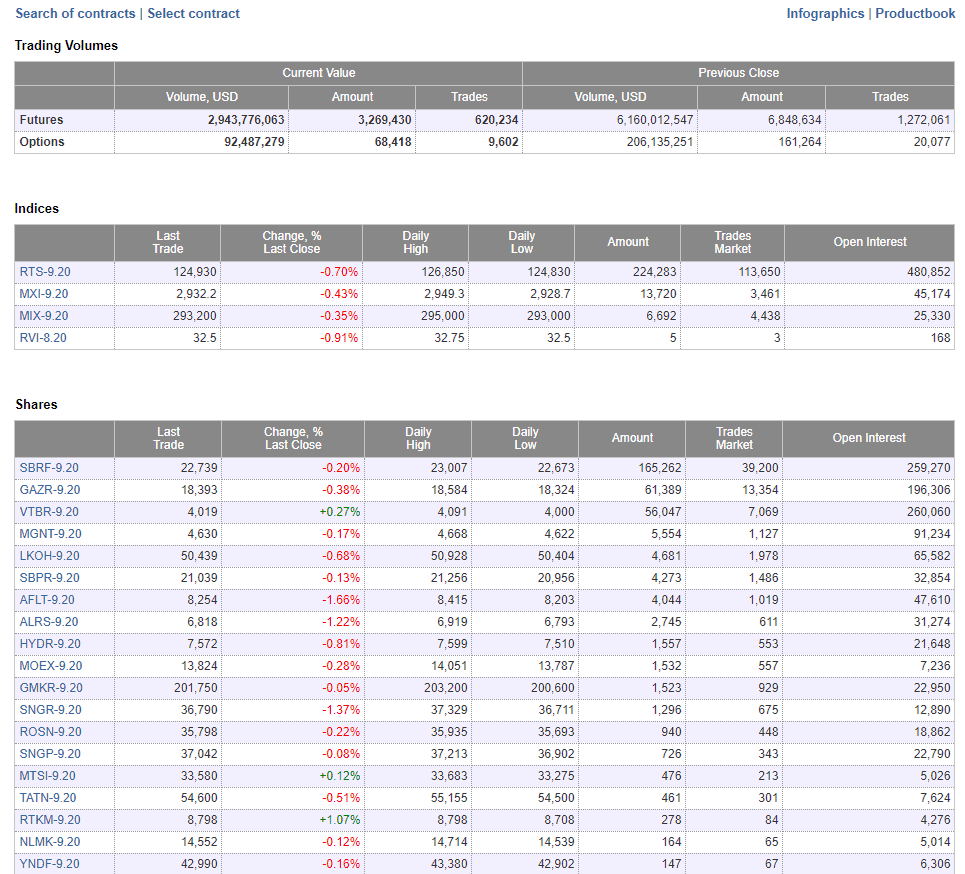

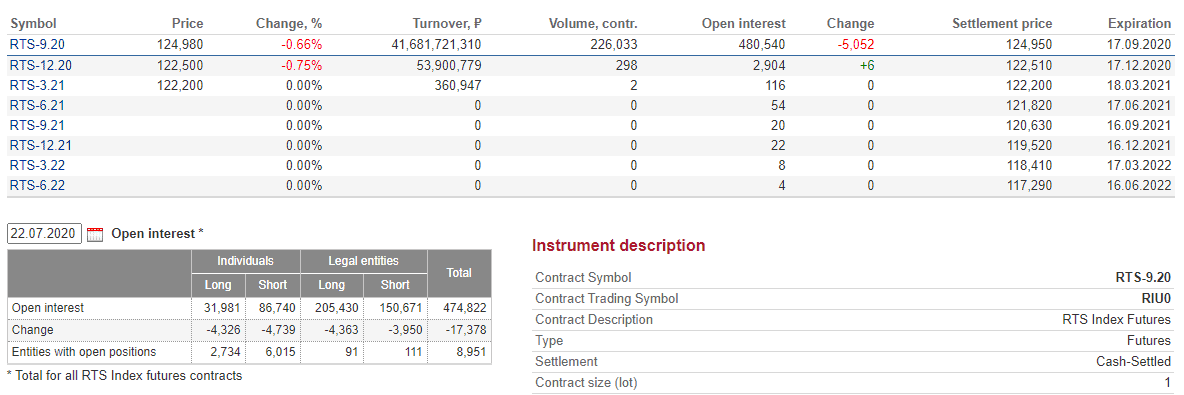

OI Analyzer lays out the Open Interest (OI) data, that is why it works only in forward markets – on futures and options contracts.Only the Moscow Exchange shows the Open Interest in real time. Selection of futures contracts is much smaller here than on CME. See Picture 1.

OI shows what number of contracts are opened in a futures.

The trade takes place at the moment of meeting the market and limit orders. That is, a buyer and a seller are required for opening one contract. When a seller and buyer open new contracts, OI increases. When a seller and buyers close old contracts, OI decreases. If there are old and new contracts in a trade, the Open Interest doesn’t change.

| Short positions | Long positions | Open Interest |

| +3,000 new | +3,000 new | +3000 |

| –3000 | –3000 | –3000 |

| +3,000 new | -3,000 closing previous ones | didn’t change |

| -3,000 closing previous ones | +3,000 new | didn’t change |

We see general actions of buyers and sellers in the standard Open Interest. However, what exactly do sellers do and what do buyers do? We can only guess.

At any moment of time, buyers and sellers can:

- open new positions;

- close old positions.

It is important information, because it helps to assess interest and aggression of one of the sides.

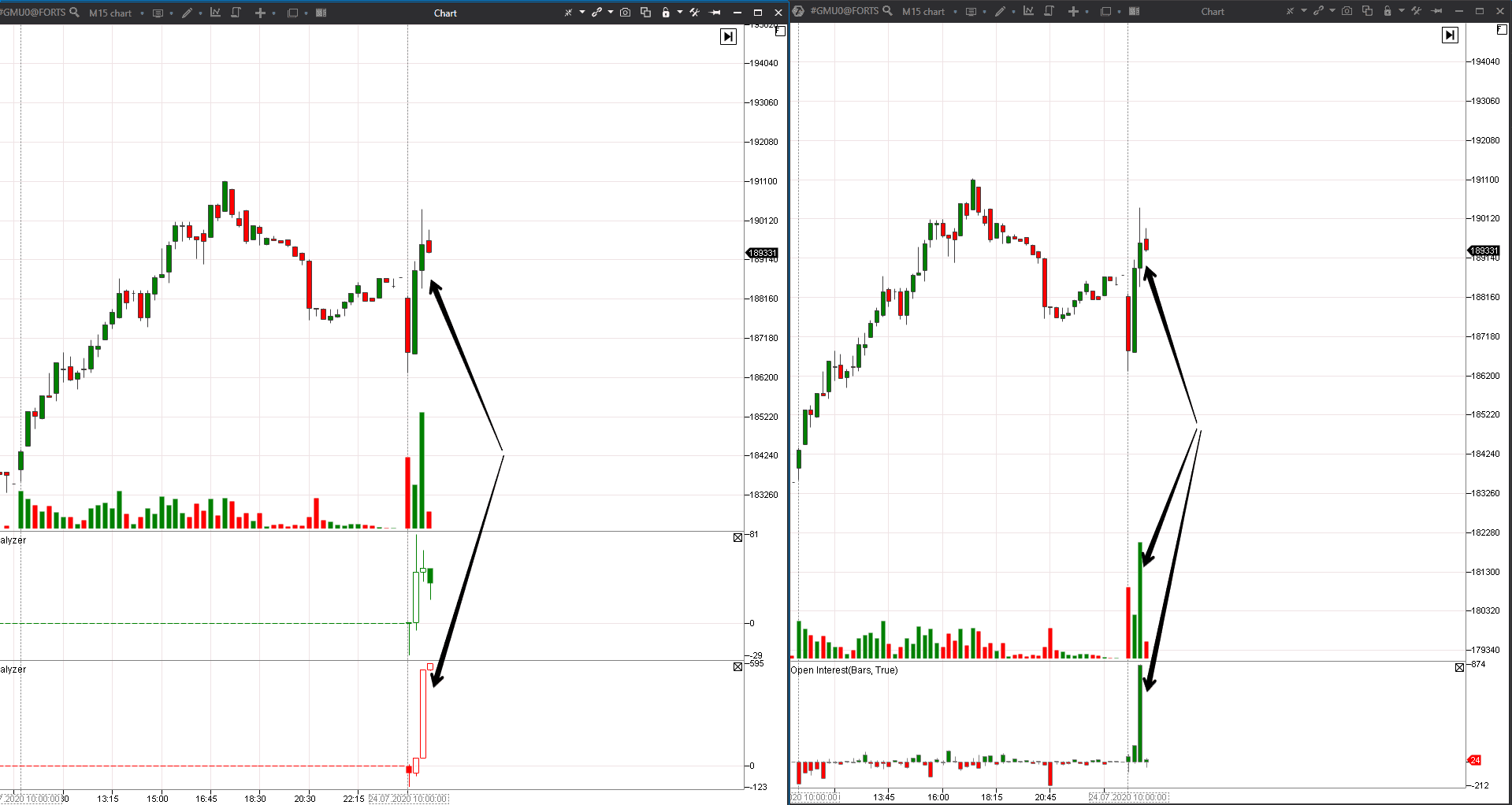

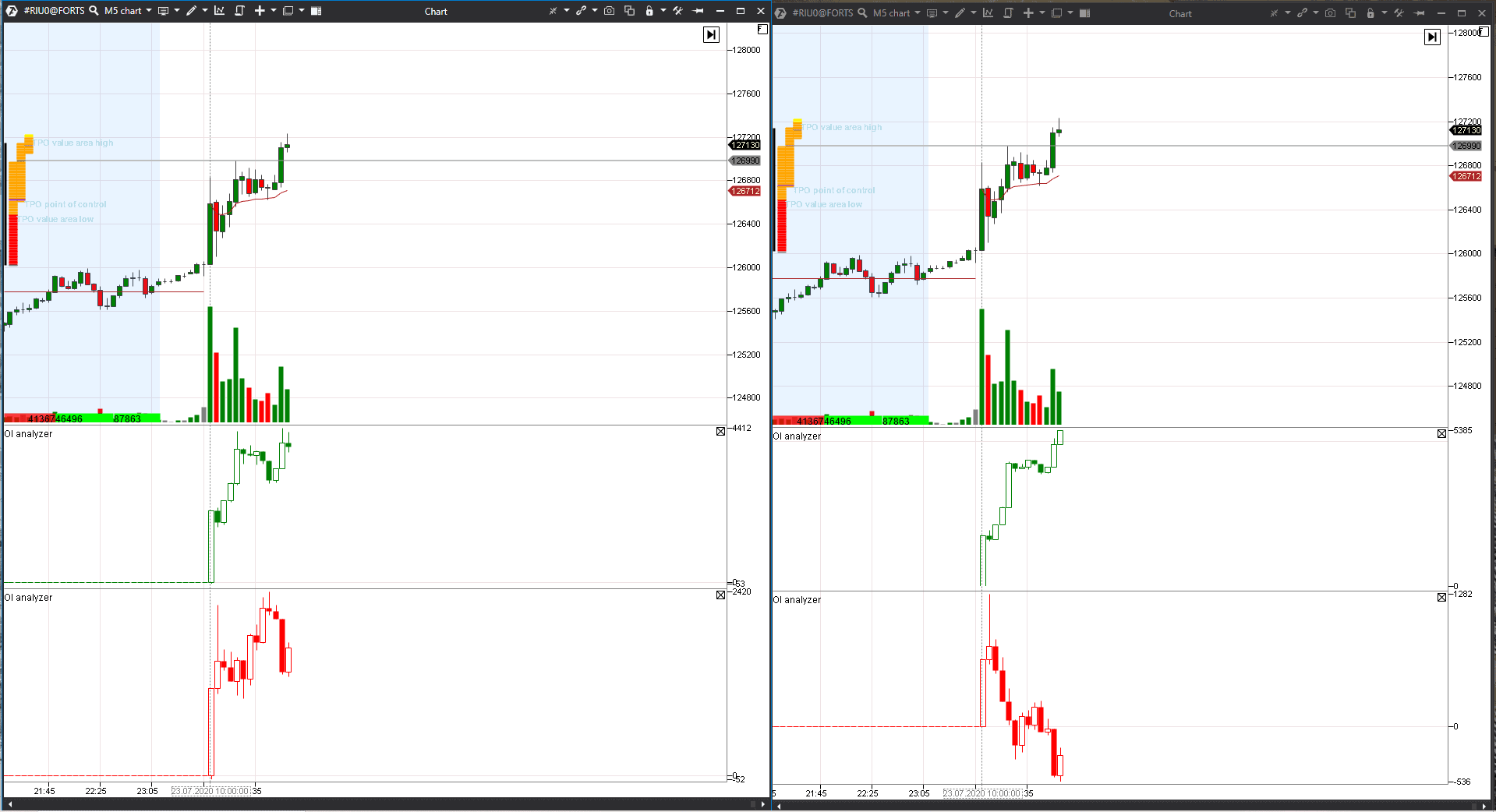

Let’s consider an example in the 5-minute PAO GMK stock futures (GMU0) chart. We have OI only in the left chart and two OI Analyzer indicators in the right chart. See Picture 3.

OI Analyzer shows what traders, working with market orders, do. For example, if a trader sends a market buy order, the OI Analyzer of buyers will grow. See Picture 4.

- separately for buyers;

- separately for sellers.

Setting up the OI Analyzer indicator

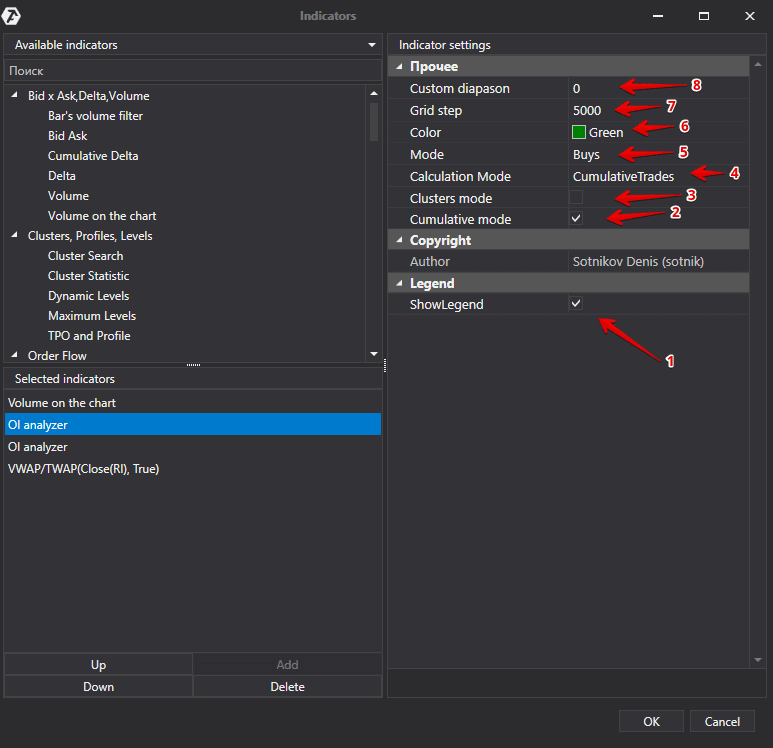

Let’s see how to set up the indicator. See Picture 6.

- Legend is the visibility of the indicator name.

- Cumulative mode shows accumulated trades for the whole trading session. If we uncheck this item, the chart will be presented in the bar chart form.

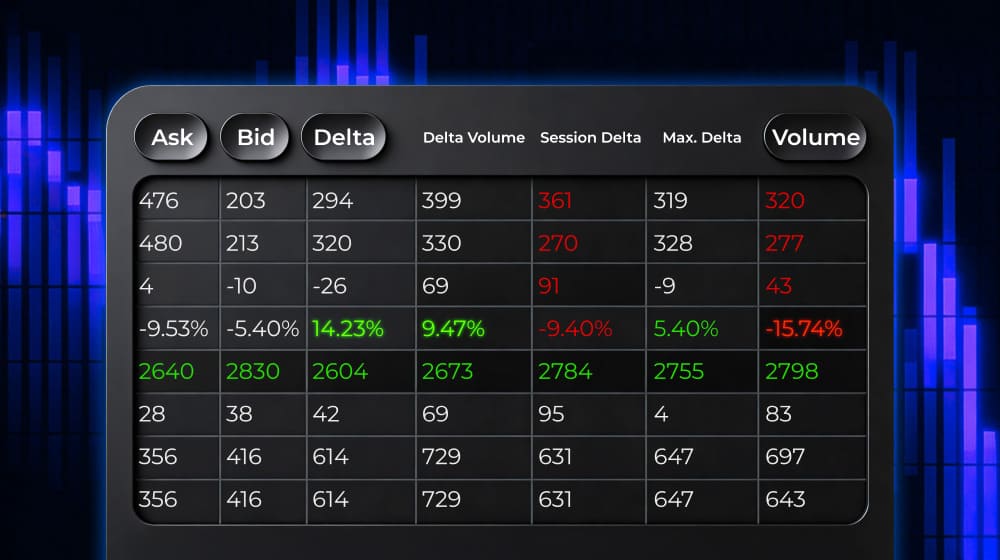

- Clusters mode works only for cluster charts (Footprints). OI Analyzer, in this mode, is shown in the digital form in the chart.

- Calculation mode. You can select SeparatedTrades or CumulativeTrades.

What is the difference between the SeparatedTrades and CumulativeTrades? Let’s discuss it in detail. Denis applies CumulativeTrades. This mode shows only actions of those traders who work with market orders. That is, if there is a new sell of 1,000 contracts in the tape, the OI Analyzer will increase by 1,000.

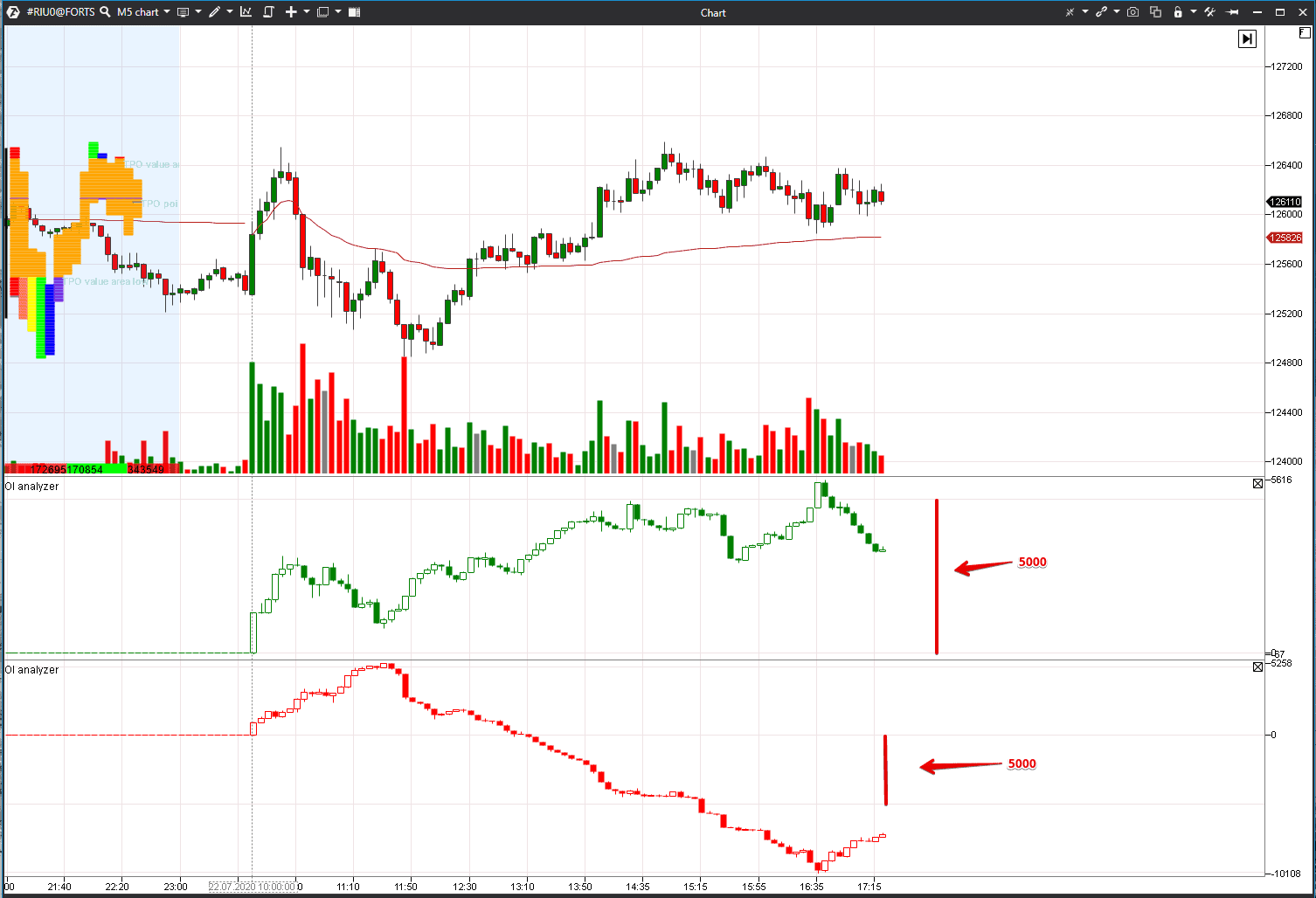

The SeparatedTrades mode for OI calculation takes into account market and limit orders and also information about what number of trades there were by bids and asks. That is why, if a trader sent 1,000 new market orders, the number in the chart may differ from 1,000 in this mode. The CumulativeTrades mode is to the right in the chart while the SeparatedTrades mode is to the left. See Picture 7.

- Mode allows setting OI for buyers and sellers – OI Analyzer buy and OI Analyzer sell.

- Color could be any for any indicator.

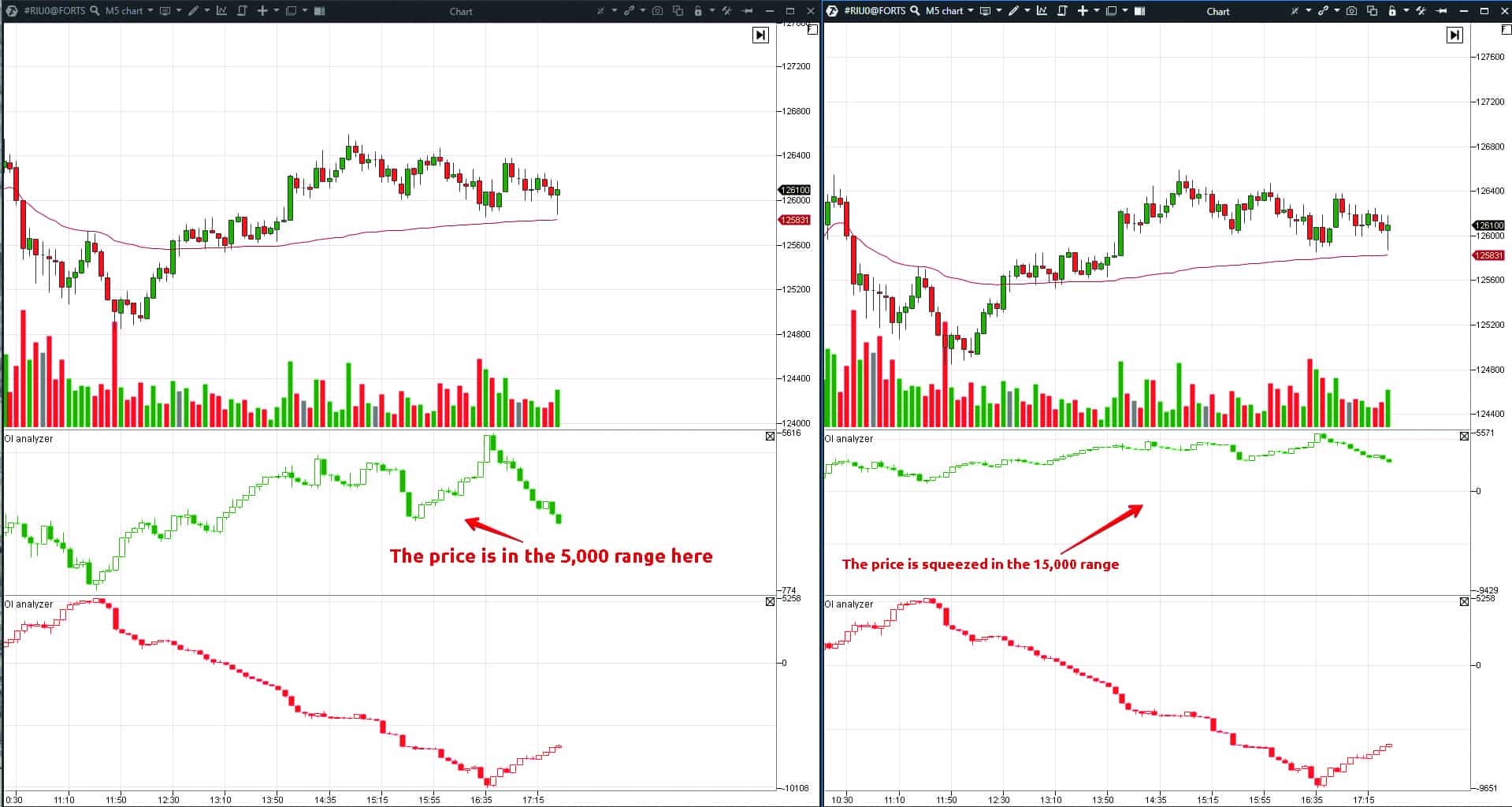

7. Grid step improves visualization. It is better to apply different grid step settings for every contract and identify them based on experience. For example, we set the grid step of 5,000 contracts for the RTS index futures. The upper green chart is seated in one division, which means that around 5,000 contracts were traded here. The bottom red chart consists of three divisions, which means that around 15,000 contracts were traded here. See Picture 8.

Examples of use of the OI Analyzer indicator

The OI Analyzer indicator works on liquid instruments. The author trades with the help of the indicator on the RTS index futures (RI) and sometimes on the USD/RUB futures (SI).

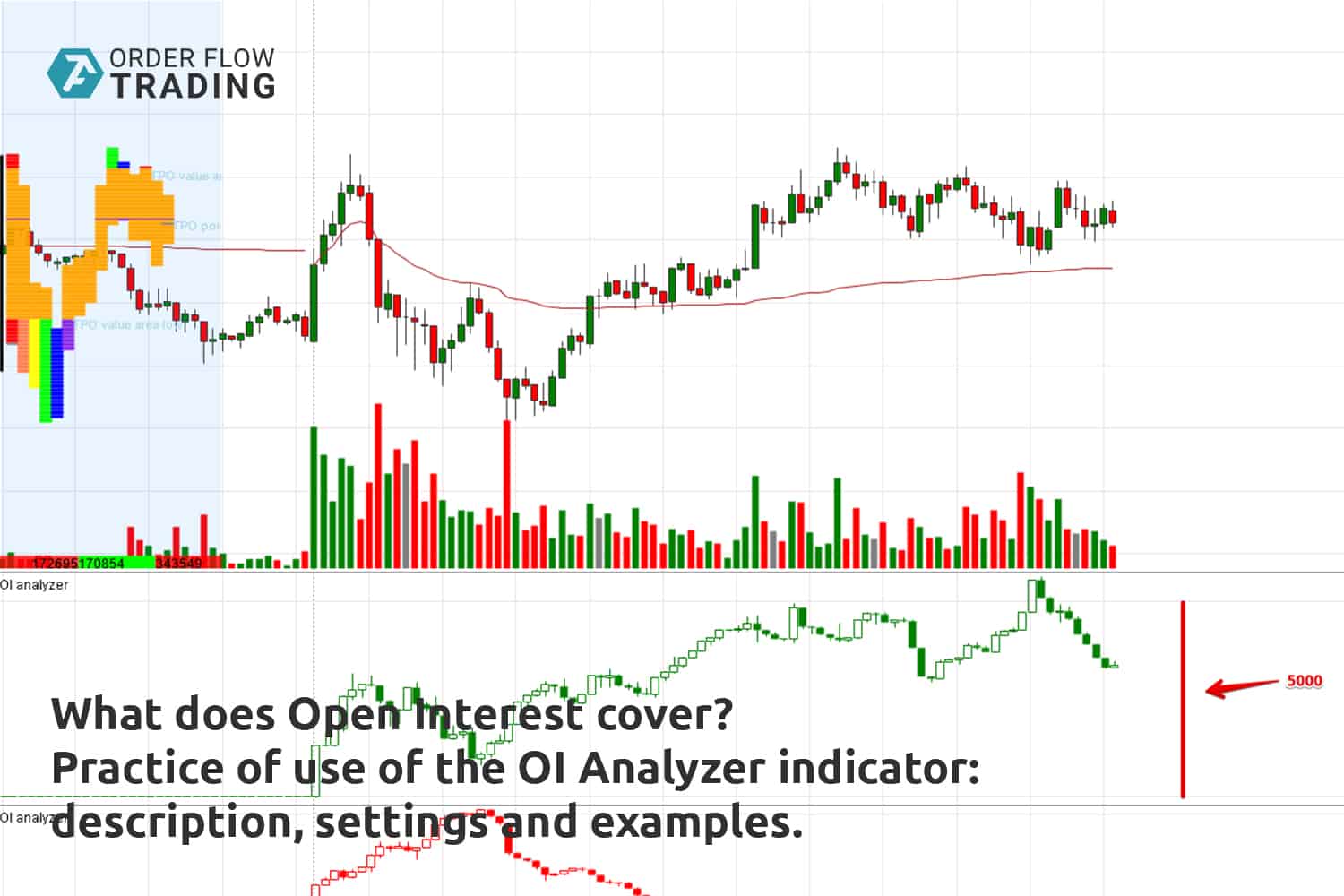

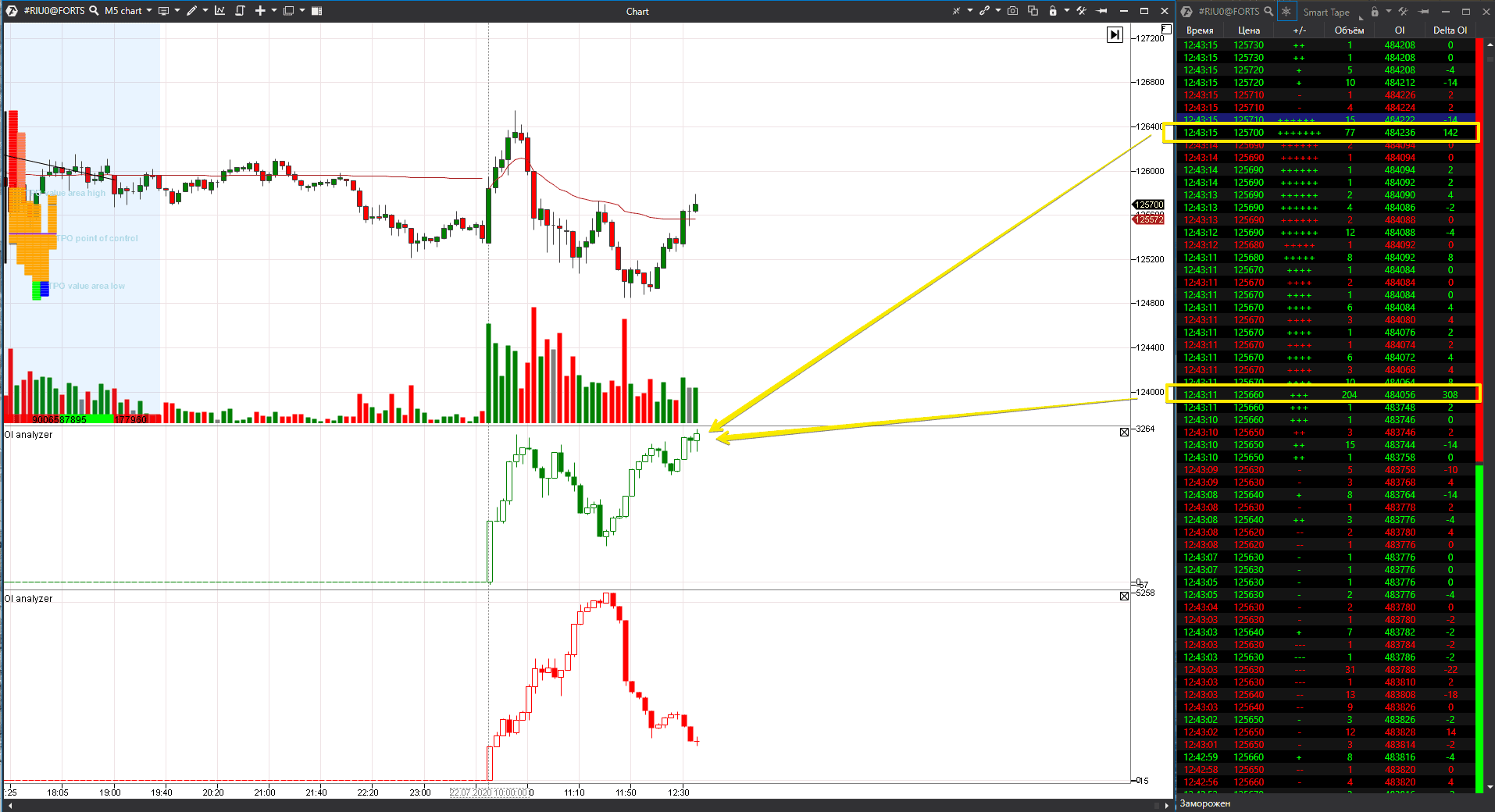

Let’s consider an example in the 5-minute RTS index futures (RIU0) chart. We added to the chart two OI Analyzer indicators, fixed TPO and Profile and VWAP indicator.

We will identify the main trend and priority direction of trades by VWAP:

- If the price steadily stays above and the indicator looks up, it’s time to buy.

- If the price steadily stays below and the indicator looks down, it’s time to sell.

However, it is not a constant trading recommendation.

We will assess the general trading session development and take into account a bigger time-frame by the fixed Profile, since the Profile is built by 30 minutes. See Picture 10.

Now, let’s take heed of the OI Analyzer:

- First, there are both market buys and market sells in the market. However, the price grows, which means that buyers are stronger.

- Then the market buys stop while market sells continue. But the price continues to grow since the market sells bump into limit buys. Limit buy orders move higher and higher. The price grows at the expense of limit buys!

Approximately 20,000 short positions were opened during the trading session – we see it from 4 divisions of the red chart grid. The grid step in our charts is 5,000 contracts. These positions are already loss-making. If the price goes up, the traders, most probably, would close them with buys and the price would move even higher.

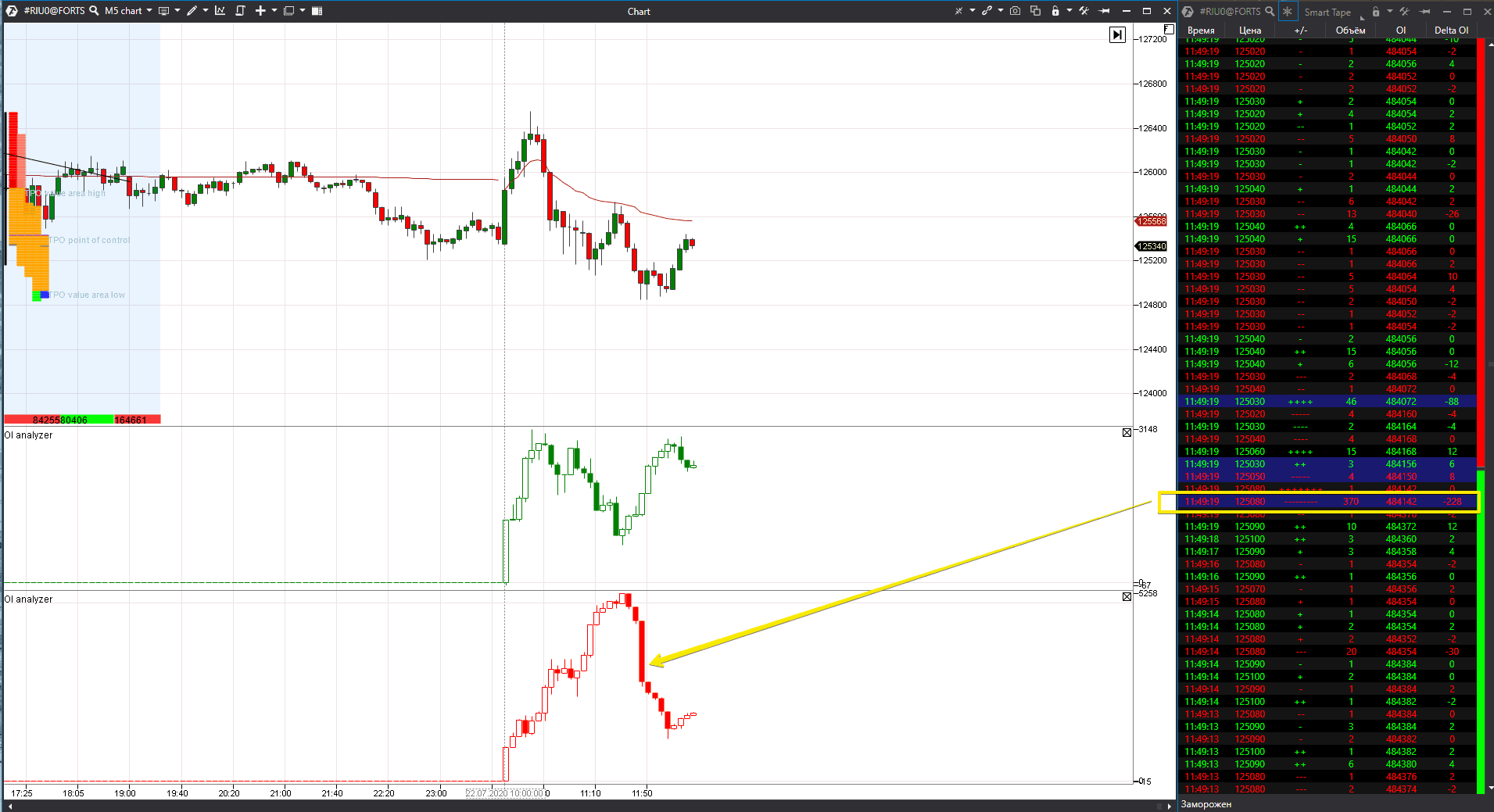

Let’s see what happened the next day. It looks like the next day starts from the stop activation, because the trading session opens above the previous day. That is why the price trades in a narrow range. See Picture 11.

Moreover, we may assume that there are serious limit sell orders in the market, because the price doesn’t grow on market buys. It means that the market buys bump into limit sells, which move lower and lower in the course of the session.

Conclusions

When the traders start their path to the market understanding, they analyse price and time charts. Then they add a new dimension – volume.Open Interest is one more separate dimension, which could (and should) be analysed when working in the exchange markets.

- Disadvantage of the Open Interest is in its limitation. It is available only on derivative instruments and only on the Moscow Exchange in real time.

Advantage of the Open Interest is in the fact that it could be divided into buys and sells. This operation is implementable due to the unique OI Analyzer indicator of the ATAS platform.

OI Analyzer is not a mechanical trading system, it is necessary to analyze and understand it. The indicator protects traders from unnecessary loss-making trades and shows false movements.

For example, you shouldn’t open sell trades if the buyers’ Open Interest starts to grow sharply. However, if OI decreases when the price increases, you can open counter-trades from significant levels.

The indicator doesn’t work on currency pairs. You shouldn’t also build your trading strategies exceptionally on the OI Analyzer signals when working with futures, which are traded in the American markets, for example, oil or gold. These contracts are traded on the Moscow Exchange with a significantly lower volume and they repeat movements on the leading American platforms.

Denis recommends to analyse the USD/RUB futures (SI) only at those moments when the volume in the futures is significantly bigger than the volume in the underlying asset, that is on the currency section.

Download the free 14-day demo version of ATAS, which has an unlimited functionality, if you haven’t yet tried the OI Analyzer.