What Is Trading?

Trading refers to the process of buying and selling financial assets on an exchange to generate profit.One of the most important factors in achieving long-term success in trading is the consistency of your decision-making.

In other words, your trades must be systematic, based on sound reasoning, and offer a competitive edge. Without these elements, trading is not much different from gambling, which may bring short-term profits if luck and the current market trend are in your favor.

Martin Schwartz (trader and author of the book Pit Bull: Lessons from Wall Street’s Champion Day Trader) said: “A well-defined strategy is the foundation for any successful trader. Without a strategy, you cannot consistently make the right decisions.”

Thus, a beginner trader is faced with the need to choose a type of trading strategy.

What Are the Types of Trading?

Types of trading refer to the approach or style a trader uses when buying and selling assets in financial markets. Each type comes with its own characteristics, which are based on:- the time frame and frequency of trades;

- the methods used to analyze the market to make decisions;

- the level of risk and the strategy chosen by the trader.

Traders select their trading style based on their preferences, experience, time availability, and goals.

Types of Cryptocurrency Trading

Apart from specific activities like mining, different types of crypto trading strategies are almost identical to those used in traditional markets. This is because all exchanges follow the same basic principles: supply and demand, cause-and-effect relationships, and market trends.However, when choosing a strategy for cryptocurrency trading, it is important to consider the high volatility of these assets and the 24/7 operation of the market. This demands a unique approach to risk management and constant monitoring.

What Are the Most Common Types of Trading ?

According to general consensus, the most common types of trading strategies include:- Day trading

- Swing trading

- Position trading

- Scalping

- Algorithmic trading

- Buy and hold strategy

Day Trading

Day trading (intraday trading) envisages, as it follows from the name, execution of dozens of trades during one day on the basis of the technical analysis and complex chart systems. The traders of this trading type are called intraday or simply day traders.

The goal of an intraday trader is to make a living by trading stocks and futures, receiving a small profit from multiple trades and strictly limiting losses from unfortunate decisions.

The biggest attraction of the day trading is a potential for an impressive profit. However, not every trader is capable of realizing that potential. A day trader should possess such qualities as decisiveness, discipline and fervour. They are a must for achieving success on a roller-coaster ride during the day.

The US Securities and Exchange Commission (SEC) notes that the day traders, as a rule, bear financial losses during the first months of trading and many of them never acquire the status of profit-making traders.

Although the SEC, trading courses and common sense warn that day traders should put at risk only that money which they can afford to lose, the reality is such that they make huge losses using the borrowed funds or using margin trades or due to ‘borrowing’ from the family budget or other sources. These losses may not only destroy the day trading career, but also result in personal problems.

Advantages of intraday trading:

- A day trader works alone during the day independent of the whims of their bosses. They may have a flexible schedule of work, take a rest as required and work in their own rhythm, unlike a hired worker.

- Availability of a certain degree in a certain university is mandatory only for a job interview for many job positions in the field of finance. Day trading, on the contrary, does not require expensive higher education. You can find many free educational materials on the Internet, however, of doubtful quality.

- All positions should be closed by the end of the day and not a single position should be left overnight if it is intraday trading. A trader can have a sound sleep at night since there is no risk whatever.

- You can gain experience during a short period of intraday trading. Intraday traders usually execute 10 trades every day. It is less than scalpers, but, in fact, a trader gains knowledge and develops their mastery every day.

Although this type of trading is the most attractive one, the majority of people who trade exchange instruments on the intraday basis cannot make money. Insufficient training and discipline, as a rule, result in their failure.

Nevertheless, it could become a profitable enterprise for those who are ready to do homework, develop own trading plan and strictly stick to it.

Disadvantages:

- Full-time occupation. To become an intraday trader, you need to retire from your day job and forget about your regular monthly salary. From this moment, a day trader becomes completely dependent on their own mastery and efforts to make a profit, pay the bills and have a decent life. Trading under the pressure of responsibility is not a favourable factor.

- Day traders have to compete with robots, hedge funds and many market professionals who spend millions for receiving trading advantages. An intraday trader often has the only choice in such an environment – to increase their competitiveness using advanced software for analyzing and trading.

- Similarly to scalping, day trading is stressful due to a necessity to monitor several screens searching for opportunities and then to act quickly in order to use them. This has to be done day after day and a need for such a high degree of concentration and efforts may often result in burnout.

- High dependence on commissions. For example, an active intraday trader with a USD 20,000 deposit who works with e-mini S&P contracts may well accumulate a total commission in the amount of USD 5,000-10,000 by the end of the year.

- Insufficient training and discipline, as a rule, could result in losses. Day trading could be unforgiving. Nevertheless, the day trading could be a profitable enterprise for those who are ready to develop both themselves and a trading plan and strictly stick to it.

Different Types of Day Trading Strategies

Day traders need a diverse set of trading strategies that can be adapted to the current market conditions, whether the market is in a strong trend, a weak trend, or moving sideways.

Generally, these strategies fall into the following categories:

Breakout Strategy. This strategy is based on opening positions when the price breaks through a key support or resistance level. The assumption is that the price will continue moving in the direction of the breakout.

You can find a detailed discussion of this strategy in the article: 4 Ideas on How to Trade Breakouts

Reversal Strategy. In this approach, traders look for signals that indicate a trend reversal, allowing them to enter the market against the current price movement.

Valuable tips on trading reversals can be found in the following articles:

- 5 simple and working reversal patterns

- How not to miss a Trend Reversal?

- How to Set Reversal Charts for Finding the Market Reversal?

False Breakout Strategy. This strategy involves opening positions after the price temporarily breaks through a level but then reverses. This signals a false breakout and a return to the original price levels.

A detailed discussion can be found in the following articles:

- False breakout trading strategy using Market Profile

- False breakout: reasons, attributes and strategy

- Bull Trap in Trading.

Swing Trading

Swing trading is based on the analysis of fluctuations in stocks, commodities and currencies, which last for several days. A trade of a swing trader may take up to several months. Unlike an intraday trader, a swing trader would hardly allocate their whole working time to trading.

Anybody who has ideas and investment capital could try swing trading. Due to a longer time-frame (1 hour, 4 hours, 1 day, etc.), a swing trader does not have to stick to the computer monitor the whole day long. They even can completely concentrate on another type of activity.

Advantages:

- Keeping an open position during several days or weeks could result in a higher profit than trading the same security several times a day.

- Since swing trading is rarely a full-time occupation, the probability of over-fatigue due to stress is much lower. There is time available for doing something else and keeping the nerves and energy in a healthy state.

- Swing trading may be carried out with the use of a regular computer or smartphone with the installed broker’s terminal. There are no high requirements to the connection speed and advanced technological solutions.

- Swing traders usually have a permanent job or another source of income, using which they may compensate or decrease trading losses.

Disadvantages:

- As well as any other trading style, swing trading may result in significant losses. Since swing traders keep their positions longer than intraday traders, they also take risks to make bigger losses. Especially the risk of losses increases due to holding the overnight position.

- Swing traders rarely enter at better prices. They check the chart 1-2 times a day and are satisfied with what the market offers at the moment of the position opening.

- A longer period of waiting for a signal to enter a position. If scalpers receive signals with the frequency of meowing of an annoying cat, swingers may wait for a setup day after day.

Is Swing Trading Good for Beginners?

Different types of trading can be suitable for beginners, as everyone has their own preferences. However, swing trading is often considered an optimal choice for novice traders:

- Swing trading does not require constant market monitoring. Beginners can analyze the market in the morning and evening, making this style more flexible and suitable for those who have a full-time job or other commitments.

- Swing trading does not involve making frequent high-risk decisions, unlike scalping or day trading, which are known to be emotionally intense forms of trading. The moderate psychological pressure helps beginners avoid emotional mistakes and allows them to focus more on making well-reasoned trades.

- It also offers the opportunity to consider a broader range of information that may influence the outcome of a trade. This could include technical analysis, fundamental analysis, and other methods.

For more details on how to get started with swing trading, check out the article: What Is Swing Trading and What Strategies to Use?

Position Trading

Position traders hold positions from several months to several years (however, there are no strict time-frames here; some Internet sources state that position trading is holding positions during several days).

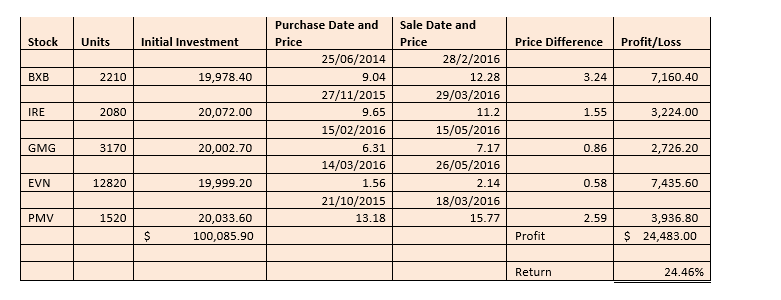

Below is an example of a successful position portfolio.

An investor bought stock for a middle term (period of holding is about 1.5 years) and received a ‘spin-off’ in the amount of 24.46%.

Positiontrading is the most characteristic for stock, since such dynamic instruments as currencies and oil could be very volatile in the middle-term perspective.

Advantages of position trading:

- It preserves emotions which are connected with trading. It always keeps your point of view clear and helps to look at the company’s perspectives of growth and resilience of its business model from different points of view.

- High-technology terminals are not required. An example of a successful position trader is described in the classical literature. They bought stock over the phone using information from a newspaper which arrived with a several days delay.

- Commissions do not exert a decisive impact on the final result.

- A trader has a lot of free time.

- There are wide possibilities for the market selection. While long-term investors prefer stable companies from the top-100, position investors may have unknown but promising stocks in their portfolio.

Disadvantages:

- A trader needs to have knowledge and skills to conduct a fundamental analysis.

- A trader needs to assess a large number of stocks, sectors and industries in order to select the best ones for buying.

- Holding a position for several months does not fit traders who used to act energetically.

Algorithmic (or Automated) Trading

Algorithmic trading is a form of trading where positions are opened and closed not by a person, but by a trading program (bot or automated advisor) that operates based on a set algorithm.Creating a bot for algorithmic trading involves several key steps, starting with the development of an idea:

Step 1: Hypothesis. At this stage, you formulate an idea about a market pattern. For instance, you might hypothesize that when a resistance level is broken, the price typically continues to rise.

The hypothesis could be stated as: “If the price of an asset breaks the resistance level by 2%, in 80% of cases, the price continues to increase by 5% over the next week.”

Step 2: Formalization. Here, you translate the hypothesis into clear, actionable rules that can be programmed. This includes defining the conditions for entering and exiting trades, as well as risk management criteria and other parameters of the strategy. All steps must be mathematically clear and easily understandable for the bot.

Step 3: Backtesting on historical data. This step helps you see how the bot would have performed under real market conditions in the past, providing insights into its potential effectiveness in the future.

The goals of backtesting include:

- Assessing the strategy’s profitability.

- Identifying weaknesses.

- Evaluating risks (such as maximum drawdown and volatility).

Step 4: Optimization. This stage involves finding the best parameter values (such as adjusting entry and exit levels) to boost profitability and minimize risks. It is crucial to avoid excessive optimization, as overfitting the trading strategy to past data can make it ineffective in real market conditions.

Once you have successfully backtested and optimized the strategy, the next step is to test it in real time on a demo account. This enables you to see how the bot performs under current market conditions without risking any real money.

If the demo account consistently grows without significant drawdowns, you can consider launching it on a live account. However, it is important to keep monitoring its performance and adjust as needed in response to any major changes in the market.

Advantages of algorithmic trading:

- Speed and accuracy. Algorithms execute trades instantly based on predefined rules, eliminating human error.

- Emotion-free trading. Bots are not influenced by fear or greed.

- Coverage. Algorithmic trading allows for simultaneous trading of multiple positions across different markets.

- Predictable results. For accurate backtesting, it is best to use tick data and account for potential slippage.

Disadvantages of algorithmic trading:

- Technical challenges. Launching a bot can be technically complex, starting with the coding process.

- Risk of failures. Issues like connection drops or system crashes can lead to unexpected losses.

- Overfitting. Excessive optimization on historical data may not perform well in real market conditions.

- Ineffectiveness during extreme volatility. Algorithms may struggle with sudden market events.

- High Competition. Simple strategies (like moving average crossovers) may not yield results.

The ATAS platform enables users to implement algorithmic trading strategies. For more details, see the article: How to Program a Profitable Strategy.

Scalping

This trading type already fits human beings. Trades in scalping last for several seconds and, sometimes, for several minutes.

Scalpers (traders that do scalping) adhere to the ‘grain by grain and the hen fills her belly’ principle.

It is highly unlikely that scalpers would be satisfied with the fact that they spend days to sell automobile spare parts or type texts in a small office room. Deep-rooted scalpers prefer to gently fight with the market and other professionals day by day.

Their strategy lies in a big number of small trades. As a result, a day should be closed with a positive result. Scalpers catch small impulses caused by different factors. If you like extreme situations, then scalping fits you. Splashes of adrenaline from fast trading are an important factor in your decision to make a living by scalping.

As a rule, the working space of a scalper (a real example is in the picture below) is inhabited by the Smart Tape modules, different variations of the Smart DOM and cluster charts with the time-frames from 1 second to 3-5 minutes.

Scalping is interesting for beginner traders due to the fact that a frequent execution of trades helps to:

- quickly work out experience;

- intensively study the market mechanics and chart patterns;

- train the trader’s psychology.

Advantages:

- you do not need to have a big start-up deposit – USD 100-200 is enough for 1 contract scalping on the Moscow Exchange;

- a multiple circulation of the working capital provides a potential for increasing the deposit;

- a comparatively simple development of a trading plan, since the scalping formations are not considered to be complex;

- there are many trading signals during a day even in one market;

- there is no risk of an overnight trade.

Disadvantages:

- an exhausting style of trading. It is not easy to sit in front of the computer and focus on the course of the trades in order to catch a successful moment of entering a trade. Also, each trade requires attention for monitoring it. That is why scalpers trade during a selected period, for example, 1-2 hours after opening a session;

- focusing on short periods, you may miss the influence of longer time-frames;

- high expenditures caused by frequent trades. The trading profit is often comparable with the commissions paid. That is why the percentage of successful trades should be significant in the scalping strategies;

- high hardware and connection speed requirements;

- it becomes more difficult to work with scalping as you get older.

We recommend you to read the following materials if you want to learn more about practical scalping techniques:

Buy and Hold

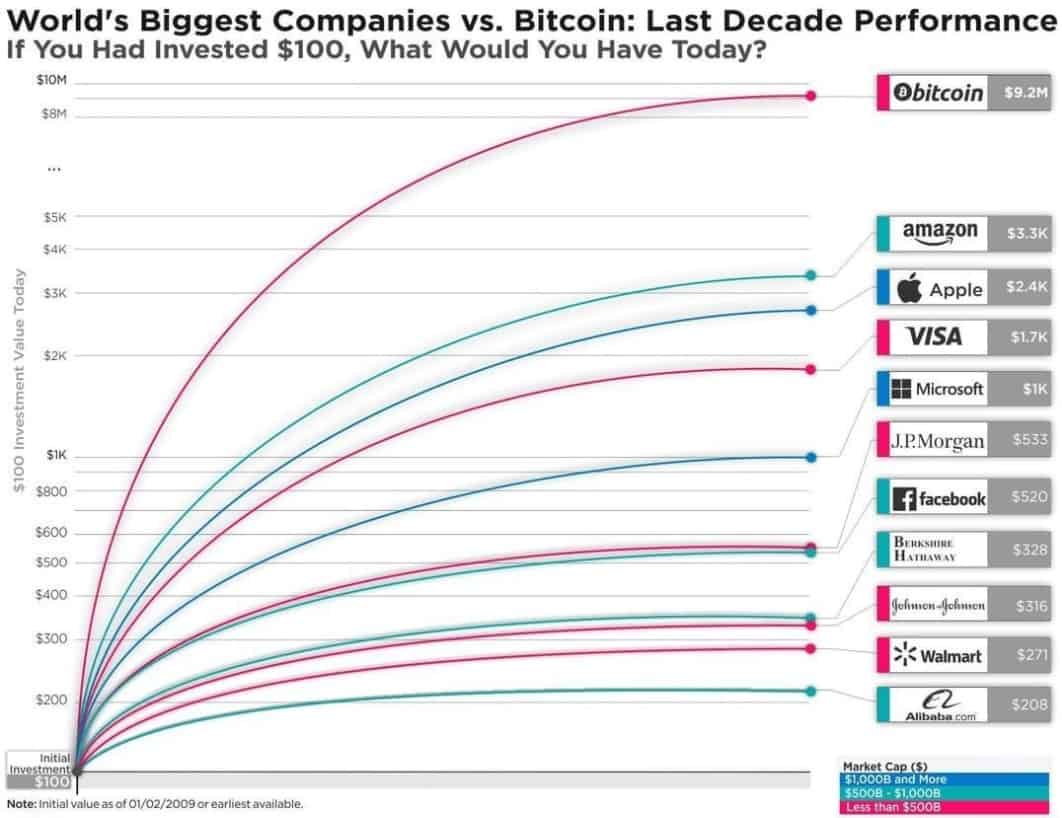

When people speak about long-term investing they, first of all, mean the stock market and buying the company stock. However, the picture below shows that the most successful investment (where the period of holding is the past 10 years) is bitcoin (how to make money on cryptocurrencies).

The main cryptocurrency exceeded all top stocks by several orders of magnitude.

‘Buy and hold’ fits the logic of a long-term investor the best. There is a funny joke on this subject:

A girl comes to her father, a rich investor, and asks to give her money:

- Papa, give me 100 dollars. I want to go with my friends to the shop and then to the nightclub.

- Sorry, my darling. All my money is in stocks.

- And when will you sell the stocks?

- Never.

Pros of long-term investing:

- Less distresses: there is no need to monitor the stock market all the time.

- Time saving: you can devote the time, saved from constant market monitoring, to other fruitful types of activity – those that are connected with the exchange and those that are far from it.

- Less efforts: you do not need to study various trading strategies or platforms, since you will not be an active intraday trader.

- If you do not take into account specific features of a specific country, but look at the situation in general, long-term trading helps to save on taxes. It could be that the long-term capital growth would be taxed in the amount of 5-15% while short-term traders may pay about 20-30% of taxes.

- Receiving dividends. Your capital grows not only due to the increase of the stock value but also due to the dividends paid by the company to stockholders.

Cons of long-term trading:

- Investments: long-term trading, as it follows from the name, requires you to have free capital. And it should be free for many years to come. You should be ready for a situation when a part of your capital is blocked in one stock and you will not be able to use it for making a profit on short-term speculations.

- Deep knowledge. Long-term trading requires an advanced understanding of the assets you invest in. You cannot just make decisions on the basis of certain news, advice or rumors. It is also not sufficient to rely only on charts or signals of indicators for buying or selling. You should be a specialist in the fundamental analysis of both an individual company and the global economy.

- Long-term trading requires patience. The inability to stay calm would create problems for an investor in the long-term perspective.

- Age restrictions. You should have some life horizon in order to use a profit from investing. In case you are 60, it is rather late to start your investing career for obvious reasons.

How to Get Started With Financial Trading

Different types of trading have their own unique features, but one common aspect is that no matter which trading style you choose, you should generally follow a similar sequence of steps:- Learn the basics. Start by reading trading blogs, books, and educational materials that cover various trading strategies, principles of trading, and other helpful information for beginners.

- Create a trading plan. Define your goals, outline your risk management strategy, and select an appropriate trading approach. Be sure to include clear rules for entering and exiting trades in your plan.

- Use a simulator (demo account). Practice with virtual funds to test your chosen strategy in real market conditions without risking any real money.

We recommend ATAS Market Replay — a simulator for futures, stocks, and cryptocurrency traders that offers speed adjustments, Level II support, footprint charts, and other professional features.

- Analyze your performance. Review your trading results on the simulator, identify your strengths and weaknesses, and assess whether the chosen trading strategy fits your style.

- Make adjustments. Based on your analysis, refine your trading plan to improve your effectiveness and minimize risks.

Discipline is a crucial element for achieving success in any type of trading.

What Is the Best Trading Strategy for a Beginner?

What are the best types of trading for beginners? There is no definitive answer to this question, as it ultimately depends on the trader’s preferences, goals, and resources.- Day trading. Beginners may consider this intensive style if they have shown successful and consistent capital growth on a demo account. It requires constant attention and quick reactions to market changes, making it suitable for those who can dedicate a lot of time to trading.

- Swing trading. This type of trading often proves to be the most optimal choice for beginners, as swing trading is a balanced approach that allows newcomers to learn from real market movements without the need for constant market monitoring.

- Position trading. This is a good option for those who do not want to trade actively every day but prefer a long-term strategy that incorporates fundamental analysis for selecting assets.

- Algorithmic trading. This type of trading is ideal for beginners who already have programming skills.

- Scalping. Beginners can choose this approach in their free time, as trades occur frequently, allowing for quick experience gain. However, it is important to note that scalping requires high concentration and fast decision-making.

- Long-term trading. Beginners aged 20 to 30 can gain the most from a long-term approach based on the principle of “buy and hold.” Investing in quality assets, such as stocks from the S&P 500, can provide steady capital growth over many years.

It is important to note that different types of trading do not exclude one another. For example, you can:

- run an automated trading robot on a VPS;

- actively engage in day trading;

- use the profits earned to purchase stocks from the S&P 500 that also offer high dividends.

Bottom Line

Algorithmic trading, scalping, day trading, swing trading, position trading, and long-term trading are all types of trading, each with its own set of advantages and disadvantages. No single type of trading is inherently better than the others.A common characteristic of the financial markets is high competition. Regardless of the trading style you choose, you should be prepared for hard work and not expect that it will lead to easy, quick, and substantial profits.

What you can realistically expect is that success will come from consistent effort, where achieving long-term results often hinges on having a trading edge. The ATAS platform can support you in this journey by offering professional tools for traders, including footprint charts, market profile indicators, the DOM Levels (Heatmap) indicator, and more.

Download ATAS. It is free. Once you install the platform, you will automatically get the free START plan, which includes cryptocurrency trading and basic features. You can use this plan for as long as you like before deciding to upgrade to a more advanced plan for additional ATAS tools. You can also activate the Free Trial at any time, giving you 14 days of full access to all the platform’s features. This trial allows you to explore the benefits of higher-tier plans and make a well-informed purchasing decision.

Do not miss the next article on our blog. Subscribe to our YouTube channel, follow us on Facebook, Instagram, Telegram or X, where we publish the latest ATAS news. Share life hacks and seek advice from other traders in the Telegram group @ATAS_Discussions.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.