The topic of our today’s article is Binance Coin (BNB).

We already wrote about Bitcoin, Ethereum and Litecoin. In contrast with them, BNB is a coin issued by the largest cryptocurrency exchange. What are specific features of BNB?

These and other issues are described in this article in simple words:

- what Binance is;

- interesting facts about the Binance developer;

- what Binance Coin is;

- how Binance Coin is used;

- what Binance Smart Chain is;

- pros and cons of Binance Coin;

- about Binance problems with regulatory authorities;

- does it make sense to buy BNB;

- how to buy Binance Coin;

- where to learn about the Binance Coin capitalization;

- where to find the Binance Coin exchange rate in real time;

- BNB/USD exchange rate forecasts.

What is Binance?

Binance is an exchange for trading cryptocurrencies which was founded by Changpeng Zhao (Zhào Zhǎngpéng in Chinese) born in 1977 in Jiangsu, China.

Interesting facts about the Binance founder

Changpeng Zhao (commonly known as ‘CZ’; the Twitter account: @cz_binance) was born to a family of teachers. His father was criticized for bourgeois views and his family moved to Canada in 1989. Changpeng sold hamburgers in McDonalds and had a side job at a fuel station.

Changpeng got interested in programming when he was 16 and later he entered McGill University and, being a third-year student, got an internship in a Japanese company, which specialised in trading. He took interest in online trading and decided to stay in this industry forever.

His friends, including the BTC China CEO Bobby Lee, recommended Changpeng in 2013 to convert 10% of his capital into Bitcoins. According to Changpeng, he bought some Bitcoins just as a matter of interest.

However, later on he studied the issue more thoroughly and sold his house in Changhai to buy more Bitcoins. Changpeng left his job the same year to join the Blockchain.info project team.

In 2018, Changpeng was included in the Forbes list of the richest persons in the cryptocurrency industry with a fortune of USD 1.1-2 billion. He acknowledges that his whole capital is invested in cryptocurrencies. Changpeng recognizes shortcomings in owning real estate and automobiles.

He has one tattoo on his body – the Binance exchange logo.

Founding the Binance exchange

The cryptocurrency market boomed in 2017. Many web-sites, connected with cryptocurrencies, couldn’t bear the load. Moreover, they didn’t have an adequate support service.

Changpeng had experience in programming an order matching system for high-speed strategies on the Tokyo stock exchange and Bloomberg’s Tradebook. Changpeng launched the Binance exchange in order to increase cryptocurrency buying speed, introduce low commission fees and create a user-friendly interface with a mobile version and a customer support service. It took place in summer 2017 when he was 40 years old.

Binance soon became the leading exchange on the wave of the 2017 cryptocurrency boom.

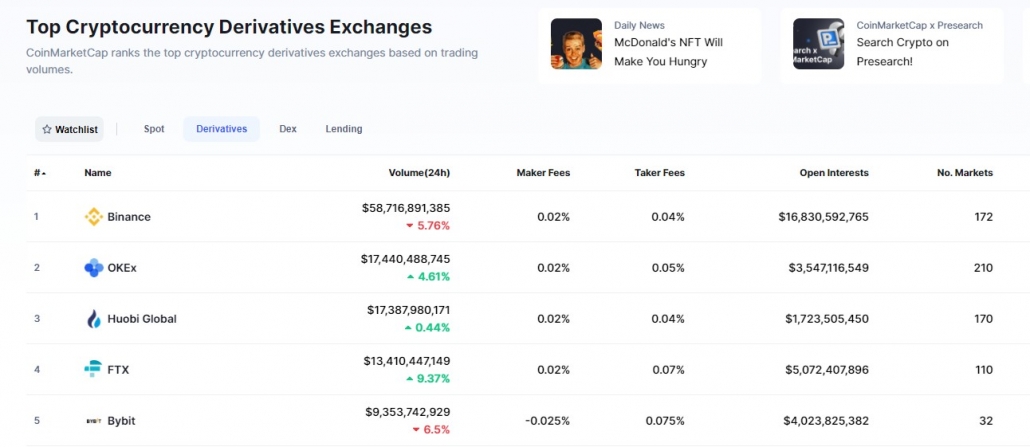

According to Coinmarketcap, the Binance exchange (at the moment of writing the article) is the largest one in the world. Only the spot market accounts for half a hundred billion dollar cryptocurrency assets traded during one day!

What is a Binance Coin?

Binance started to issue its own Binance Coin (BNB) on November 17, 2017. In fact, it was a token working under the ERC-20 protocol in the Ethereum blockchain network.

- 10% of the offering was for business angels;

- 40% of the offering was for the team of founders;

- 50% of the offering was for everyone interested.

How is a Binance Coin used?

Binance Coin is used as a utility token for the Binance exchange and it provides users with a possibility to pay for transactions and trading fees at a lower rate. Other ways of using BNB:- for paying for goods and services through a wide spectrum of DApps applications, for example, games based on the Binance blockchain;

- for charity;

- for making passive income;

- for receiving additional discounts;

- for traditional purchases, for example, for booking air tickets and hotel rooms, for buying virtual gifts, electronic gift cards, etc.

What is Binance Smart Chain?

Binance announced its new Binance Smart Chain platform in September 2020 and launched it in April 2021. The aim is to provide an alternative to Ethereum and other leading DeFi platforms. According to the developers’ opinion, the Ethereum network, in the course of time, exceeded the limits of what its infrastructure could cope with. It resulted in slowing down transactions and increasing fees. Necessity of the emergence of platforms with smart contracts, such as Binance Smart Chain, confirmed its fast growth. Soon after its launch in April 2021, the BSC platform performed more than 1.4 million transactions per second. The main difference between Binance Smart Chain and Ethereum lies in different methods of consensus formation in the network. Since the network is decentralized, it means that changes can be introduced in it only after reaching a common agreement (consensus) of its all participants. This is how blockchain network security is provided and how network participants can check transaction authenticity. Besides, there can be different methods of consensus establishment:- At present, Ethereum applies the Proof-of-Work (PoW) method, which presents an original consensus mechanism used in the Bitcoin network. It is also known that Ethereum plans to use Proof-of-Stake.

- Binance Smart Chain applies the Proof-of-Authority (PoA) method.

Pros and cons of a Binance Coin

Advantages:- It is the official utility token of the largest cryptocurrency exchange which continues to actively develop.

- The coin value is supported by a long list of its applications, for example, for reducing trading fees.

- Speed. Transactions with BNB are performed practically instantly – up to 1.4 million of operations are performed in the network every second.

- The fact that the exchange ‘burns’ tokens can be considered a Binance Coin advantage. Binance uses 20% of its profit every 3 months in order to buy and delete (‘burn’) the bought BNB forever. For example, 1,099,888 tokens were burnt on April 15, 2021. What is it done for? The aim is to increase BNB value in the course of time.

- Not much time has passed since the emergence of BNB to consider it a stable asset. The BNB/USD exchange rate is very volatile, although for active speculators it is not a con but a pro.

- Dependence on the Binance exchange. Any problem with the exchange, for example, data leakage or security breach, can crash the BNB/USD exchange rate.

- Regulatory risks.

Problems with regulatory authorities

Initially, the Binance exchange was based in China but was forced to change the place of registration since regulatory tightening of the cryptocurrency industry by the state authorities posed risks to the exchange. Relations with regulatory authorities is a big difficulty in the Binance operation.

Changpeng said in his interview to Bloomberg in April 2021 that: “perhaps, Binance has more exchange licenses than any other exchange in the world”. Even the Binance US legal entity was established in order to meet the US legislative rules. Binance US successively gets licenses in every state.

Nevertheless, regulation of cryptocurrencies and cryptocurrency exchanges is a serious obstacle on the way of the exchange development and it often has faced claims from authorities.

The United States Department of Justice and Internal Revenue Service launched an investigation in May 2021 with respect to Binance Holdings Ltd concerning involvement in criminal activity including money laundering and revenue offence.

The Financial Service Agency (FSA) of Japan warned Binance on June 25, 2021, that it worked in the country without permission. The next day, the Financial Conduct Authority (FCA) of Great Britain prohibited activity of the local Binance Markets Limited subdivision.

Immediately after that, regulatory authorities of three countries (Cayman Islands, Thailand and Singapore) announced inspection of the Binance activity.

Being under pressure from German and US regulatory authorities, the Binance exchange announced in July 2021 that it will stop trading tokenized stocks since they violated the securities legislation.

Does it make sense to buy BNB?

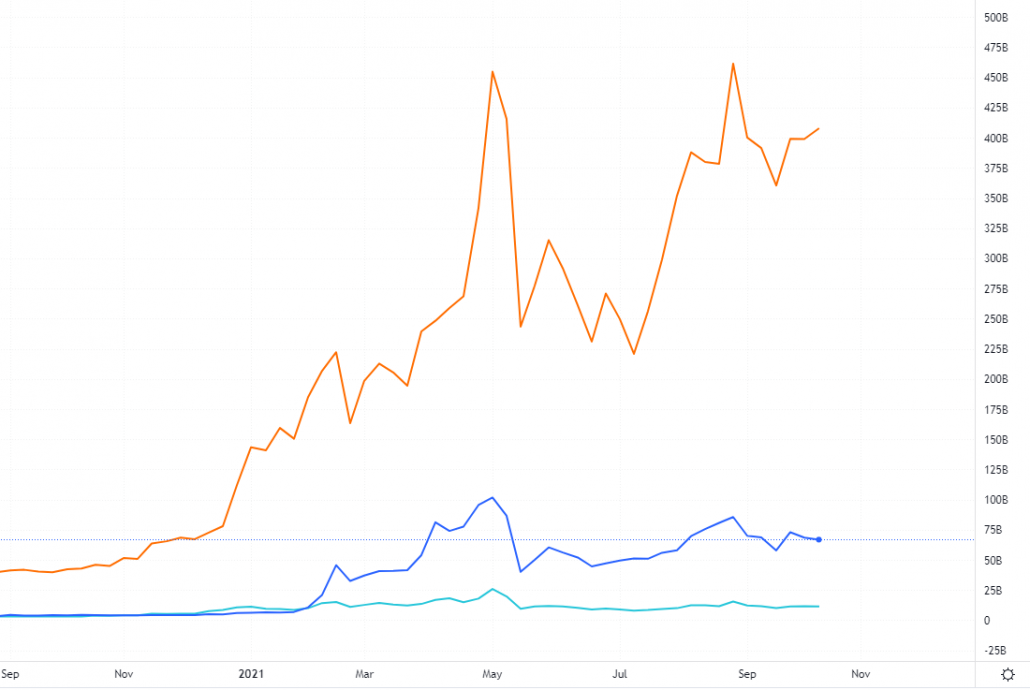

One BNB cost USD 15 in the fall of 2019 and USD 450 in the fall of 2021. About +3,000% in 2 years! The chart with a logarithmic scale shows the impressive BNB/USD progress.

Note that the acceptable volume of operations can be limited by the user account type. Exchange customers increase their status and limits for conducting operations by passing a verification.

Visit the https://www.binance.com/en/buy-BNB page to get more detailed instructions on buying a Binance Coin.

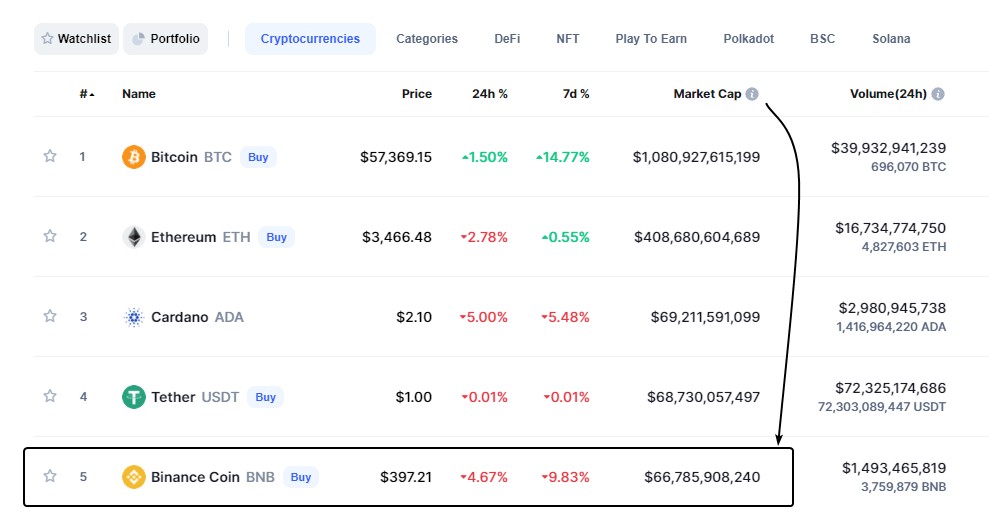

Where to learn about the BNB capitalization?

We recommend that you use the coinmarketcap.com web-site to see the current Binance Coin capitalization value (total value of all coins). The name stands for Coin Market Capitalization (it tracks capitalization and other data for 6 thousand cryptocurrencies). You can find more useful resources on the cryptocurrency subject in this article.

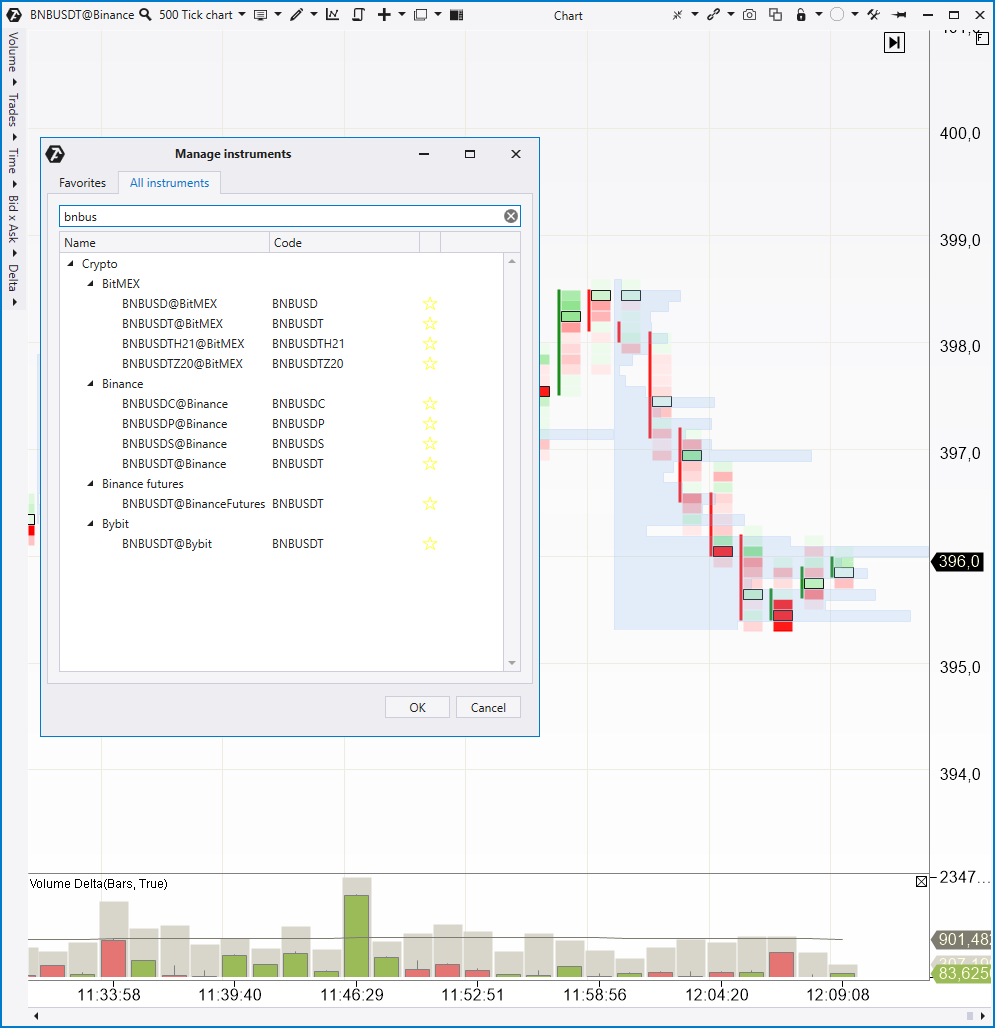

The current BNB exchange rate

In order to get real-time data about the current Bitcoin, Ethereum, BNB and other crypto asset prices directly from cryptocurrency exchanges, you can download the professional ATAS platform.

BNB exchange rate forecasts

There are many factors that influence the cryptocurrency value. In total, they represent demand and supply forces. The value changes as soon as one of the forces predominates. That is why Binance Coins grow or fall in price from time to time. Reputable investment banks do not provide expert forecasts and analytics with respect to the BNB price in the future. We will try to formulate our own opinion based on the data, which are provided by the trading and analytical ATAS platform with direct connections to cryptocurrency exchanges. The platform allows assessing buyer and seller behaviour with the help of clusters and form your own point of view about the most probable price movement in the future.

The price moves upward mainly ‘jumping’ from the trend line (1), which serves as a significant support. Decreasing to this level will give a reason to consider buying BNB.

Let’s imagine a variant of a trend line bearish breakout (1) and decrease to the level of USD 130 as an alternative and pessimistic scenario. Analysis of vertical volumes and market profile gives ground to assume that big amounts were invested in BNB at USD 50, USD 72 and USD 130 levels. USD 50 per coin seems to be an unlikely horizon, but we wouldn’t exclude USD 130 as unlikely taking into account cryptocurrency volatility in the times of panic.

Advice. If you want to develop cluster reading skills in cryptocurrency markets, read this article, in which we consider reasons for panic in the market on May 19 when BTC cost around USD 43 thousand at the day’s high and around USD 30 thousand at the day’s low.Conclusion

Let’s give a brief summary of the main Binance Coin facts:- Binance (BNB) is the world’s largest cryptocurrency exchange.

- The exchange launched the Binance Coin as an ERC-20 token on the Ethereum blockchain, which allowed exchange users to pay lower fees.

- The Binance Coin network was moved (in September 2020) to the Binance Smart Chain, which was developed as an Ethereum alternative since BSChain supports smart contracts that are necessary for creating a decentralized financial ecosystem (DeFi).

- All Binance Coin Smart coins have already been mined and the exchange spends a part of its income for buying and burning coins to support their value.

- Start-up capital. You will need USD 50 and even less to start with since trading small BNB fractions is affordable to all. Moreover, you can trade on your demo account without any risk to your real capital.

- Registration on a cryptocurrency exchange.

- Professional trading terminal for fast execution of trades and situation analysis. Download ATAS – this platform is free for trading cryptocurrencies and has a lot of advantages.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.