What is Ethereum and what is Ether?

In everyday usage, Ether and Ethereum are synonyms, although they are not exactly the same.

Ethereum is a complex decentralized platform of applications based on the blockchain technology. In simple words, Ethereum is a big database with a publicly available source code. The official web-site of the platform is ethereum.org.

Ether (ticker: ETH) is a token directly connected with Ethereum. In particular, operators (miners) that support the network operation receive Ether as remuneration. Ether is often called ‘cryptocurrency’, although it is more correct to call it ‘token’, which gives the right to use services provided in the Ethereum platform.

You can find basic information about Ethereum and Ether in this article:

Ethereum history and reasons of its emergence

In order to tell you about the history of Ethereum emergence, we will start from more famous and earlier developed Bitcoin.

Bitcoin (developed in 2009) was the first popular application of the blockchain technology. In fact, blockchain is a registry (database), copies of which are stored by all network participants.

Bitcoin was revolutionary. It was the first currency, which was built on the blockchain and which introduced the term ‘cryptocurrency’. The ‘crypto’ prefix refers to the use of cryptographic encryption methods, which guarantee integrity of the blockchain registry.

As Bitcoin became more and more popular, people started to think about wider (apart from cryptocurrency) possibilities of applications for the blockchain technology.

A Bitcoin Magazine co-founder Vitalik Buterin published a technical document in 2013, in which he offered a new and more functional realisation of the blockchain technology. In the document, the author described smart contracts, which are automatic unchangeable ‘if-then’ statements that allow development of decentralized applications (dApps).

Vitalik (actually, Vitaly Dmitrievich, a son of a programmer, who moved from Russia to Canada) called his project ‘Ethereum’. He wanted to unite dApps, development of which was carried out at that time, but they were incompatible.

A Swiss non-profit organisation called Ethereum Foundation, which became the Ethereum developer, was established after the emergence of public interest.

Ether was offered to the public in 2014. Anyone could buy 2,000 Ethers for 1 Bitcoin. Thus, the organisation co-founders – Gavin Wood, Jeffrey Wilcke, Charles Hoskinson, Mihai Alisie, Anthony Di Iorio and Amir Chetrit – carried out initial sales of tokens in order to collect USD 18 million for financing Ethereum development.

Later, Vitalik announced that Ethereum would be a non-profit organisation with the goal to support and develop the network, after which some co-founders left.

In 2016, the Ethereum organisation was transformed into the DAO democratic group, which voted for the development direction. The organisation doesn’t need the Director General. Instead, proposals should have a majority of ‘yes’ votes for changes to be adopted.

Ether grew from USD 8 to USD 700 in 2017 and dApps applications became world-famous. One of them is CryptoKitties, in which one can grow virtual kittens. There were 100 thousand users of this game as of 2020.

The so-called London Hard Fork took place in 2021. It is an important network update, which made network commissions more predictable and limited the Ether supply, making it more resistant to inflation.

How the Ethereum network works

Bitcoin and Ether are based on the blockchain. Both BTC and ETH emerge as a result of mining – conducting computer operations which are needed for supporting the blockchain network operation. Every block in the Ethereum network has a unique 64-digit code and stores so-called ‘transactions’ – facts about network interactions.

Miners check a block before writing it in the publicly available Ethereum network. The Proof of Work (PoW) principle is used in mining. Besides, resource-intensive lengthy calculations, results of which can be easily checked, are carried out. That is why the network works fast and it is practically impossible to hack it.

However, the Ethereum developers plan to use the alternative principle, called Proof of Stake (PoS), which requires less energy, makes mining more affordable and provides more possibilities for scaling. Switch to Proof of Stake will mark emergence of Ethereum 2.0, but it is not clear (at the moment of writing this article) when it will take place (they say in 2022).

How Ethers are mined

Anyone can take part in the network operation. To do it, one installs an Ethereum network node on a computer or another computing device. After that, this person becomes a node operator.

An operator (miner) receives remuneration in Ethers for the use of his node, required for the network operation. However, where do ETH for paying miners come from?

They come from a commission fee, which is taken for every transaction in the Ethereum network. The fee is called ‘gas fee’ and it is paid by a user who initiates a transaction. This fee is paid to a miner who checks the transaction.

In fact, the gas fee is required to:

- stimulate people to support the network;

- avoid unwanted transactions.

What the difference between Bitcoin and Ether is

Bitcoin and Ether are often mentioned with the same meanings, but they are not the same. ETH is mostly used as a means of interaction with the network, while Bitcoin is used as a means of money transfer and value protection (‘digital gold’), although Ether can also do it.

| Bitcoin | Ethereum |

| Cryptocurrency with limited functionality. | Platform with expanding functionality. |

| Network is designed for Bitcoins only. | Other tokens, ERC-20 protocol compatible, can take part in the network. |

| It is used as a storage of valuables and means of payment for commodities and services. | It is a platform, in which you can develop your own applications (games, DeFi, NFT, etc.) with the help of smart contracts. |

| Maximum number of coins is 21 million. | Maximum number of Ethers is unlimited. ETH 117 million had been mined by the end of the summer 2021. |

Ethereum is inspired by Bitcoin, but it is a bit different. While Bitcoin is a currency, ETH is more like a utility token, that is why its supply is unlimited.

What smart contracts are and their advantages and disadvantages

They are more like computer programs than contracts in the conventional sense. Smart contracts allow people to develop and launch their own decentralized applications (dApps).

Imagine that a dApp is a web-site interface, and a smart contract is its server side. Smart contracts are stored in the Ethereum blockchain and they can execute themselves independently under certain conditions.

A dApp cannot be removed after a user added it to the network, because the network cannot be edited and controlled by one participant. It can be a shortcoming for those who want to use Ethereum.

On the other hand, smart contracts allow users to gain anonymity and fight with government censorship and dependence on third parties (banks, intermediaries, etc.). It can be an advantage.

Does it make sense to buy Ether?

Ether is the Ethereum network cryptocurrency and it is ‘the fuel that feeds the network’. Anyone can:

- invest in the Ethereum network through buying Ether on a cryptocurrency exchange for long-term holding;

- buy and sell Ethers that were acquired from speculative operations.

One Ether cost less than one Dollar in 2015 and it was traded for USD 4,000 in 2021.

Ethereum success attracted institutional players:

- ETH futures started to trade on the CME in February 2021.

- The European Investment Bank sold bonds in April 2021, which were issued on the Ethereum platform, for the amount of more than EUR 100 million. The transaction was accompanied by Goldman Sachs, Banco Santander and Societe Generale banks.

- Investment service providers issue ETF (what ETF is) on the basis of Ether.

A big demand on ETH produced a boom in NFT – non-fungible tokens that are used for selling artworks and other unique works. Artists, for example, make millions of dollars by adding their paintings to the blockchain with the help of NFT, because this format:

- contains proof of ownership;

- serves as a safe form of storage.

However, despite positive news and the fact that ETH/USD exchange rate shows impressive growth on the historical data, it doesn’t mean that you need to invest all your money in Ether immediately.

First of all, past efficiency doesn’t guarantee continuation of the trend in the future.

Second, the Ethereum network has swiftly developing competitors – PolkaDot, Cardano and others.

Where to learn about the Ether capitalization

If you want to see the current Ether capitalization value (total value of all Ethers), we recommend using the coinmarketcap.com web-site. The web-site name stands for Coin Market Capitalization and it monitors capitalization and other data for 6 thousand cryptocurrencies. You can find more useful resources on the cryptocurrency subject in this article.

We want to note that Bitcoin holds the first stable position in capitalization, while ETH holds the second stable one. However, it will be incorrect to state that Ethereum is the Bitcoin chaser, as it often happens when their capitalizations are compared.

The current Ether exchange rate

If you want to receive the current value of Bitcoin, Ether and other digital assets directly from cryptocurrency exchanges, you can download the professional ATAS platform.

The ATAS platform is free for working with cryptocurrencies, it is directly connected to cryptocurrency exchanges and allows you not only to receive quotations in real time, but also to analyse the market with the help of cluster charts and conduct ETH/USD buying / selling operations in other markets.

Ethereum prospects. Pros and cons

Many people believe that Ethereum is the next Internet level. While centralized platforms, such as Apple App Store, represent Web 2.0, Web 3.0 can be built on a decentralized network, managed by users. Such a network as Ethereum is.

Absence of censorship will be one of the principles. For example, if you write a negative comment against someone, Facebook can delete it. Moreover, it can punish you. As regards the Ethereum based social network platform, this can happen only if the community votes for it. Thus, users with different points of view can discuss what they think is appropriate and the community decides what should be pronounced and what shouldn’t. Malicious users will need to have control over 51% of nodes, which is impossible.

The following things will govern in this ecosystem:

- Decentralized applications (dApps), which emerged approximately in 2019.

- Decentralized finances (DeFi), which turnover amounts to billions of dollars and in which banks cannot block up what they believe to be a ‘suspicious transaction’. There are applications in which users can sell valuables, received while playing a game. And social network users can reward others for creative posts or correct forecasts.

- Decentralized exchanges (DEX), on which cryptocurrencies, NTF and other assets are traded and investments at interest are made.

A big progress will be achieved after switching to Proof of Stake. It should be accompanied by a solution to the overload problem, which occurs during peak hours when there are many check conduct demands in the network. At such moments, miners take those ‘applications’, which have bigger fees (‘gas fees’), that, sometimes, makes network services too expensive.

Other Ethereum shortcomings:

- Scaling problems, which result from the fact that, due to the PoW consensus algorithm, interaction is limited by the time of the block check and gas fee.

- It is difficult for novices.

7 factors that influence the ETH price

Why does the Ether price change?

There are many Ether price influence factors. In total, they constitute demand and supply forces. As soon as one outweighs the other one, the price changes. That is why the ETH price falls or grows from time to time.

Let’s specify 7 factors (the list is non-exhaustive) as of the fall of 2021, each of which can significantly influence the ETH price.

- Ethereum 2.0 deployment rate. If problems arise, the price will fall.

- Burning rate. The higher the burning rate, the faster the ETH deflation develops. In its turn, this rises the ETH price compared to USD.

- Fiat currency inflation – citizens and governments may prefer ETH to their local currencies due to potential hyperinflation of the fiat currencies.

- Governmental decrees and introduction of central banks’ own cryptocurrencies (CBDC – Central Bank Digital Currency).

- Economic / global conditions, including overcoming Covid pandemic.

- Changes in the Ethereum Foundation.

- Other altcoins – competitors that seize the DeFi environment.

ETH/USD exchange rate forecasts

Analysts of the Standard Chartered Bank published a forecast in September 2021 with the target price from USD 26,000 to USD 35,000 per Ether. The bank expects that Ethereum capitalization will exceed the Bitcoin one in the end.

Forbes wrote that major investors prefer Ether due to a continuing interest in non-fungible tokens (NFT) and expectations that Ethereum-based decentralized financing (DeFi) will compete with traditional finances.

Other predictions are less optimistic. According to Nikolaos Panigirtzoglou, a JPMorgan cryptocurrency strategist, the fair Ether value is about USD 1,500, judging by the network activity indicators. In the expert’s view, the Ethereum network is less attractive due to the current Ether price and growing competition on the part of such blockchains as Solana and Cardano.

The ETH/USD exchange rate fluctuated around USD 3,000 at the moment of writing this article in September 2021. And the range from USD 1,500 (-50%) to USD 35,000 (+1,100%) is obviously too big.

This reflects such a shortcoming of Ether (as an investment asset) as its volatility.

That is why it is important for a regular investor to develop his own opinion with respect to the dynamically changing market. The trading and analytical ATAS platform (download it free of charge) with direct connections to cryptocurrency exchanges will help you in it. The platform allows building cluster charts, which visually display behaviour of buyers and sellers.

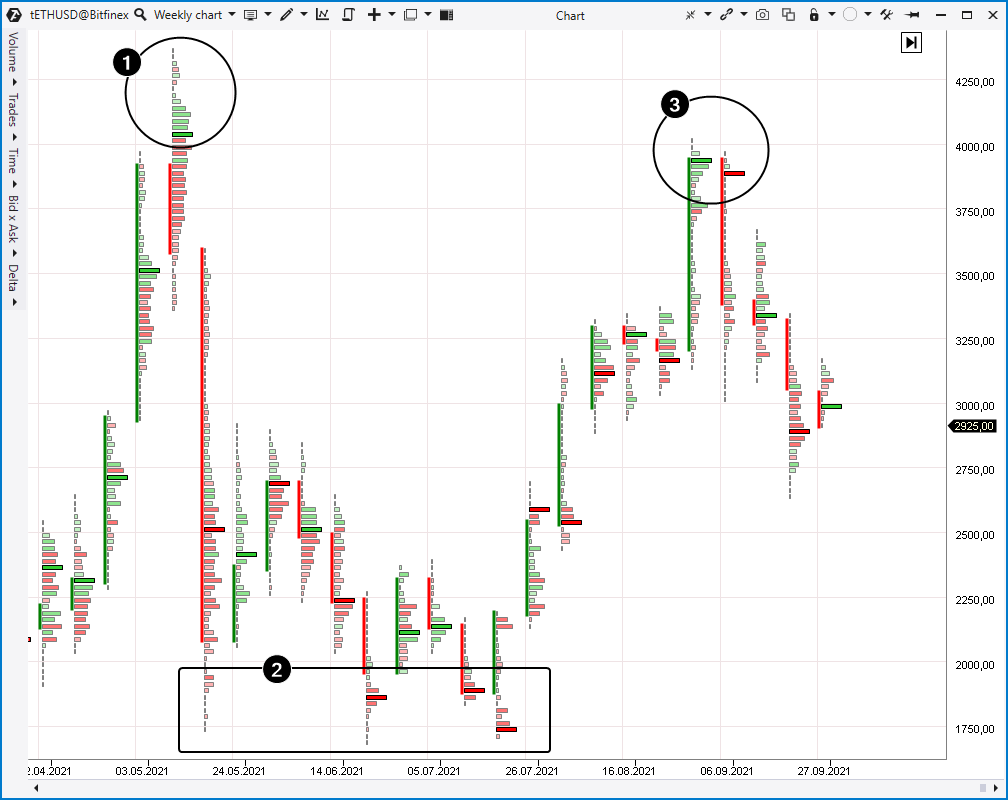

See an example below.

Number 1 marks the moment of a buying climax. Investors rushed to buy up the asset after crossing the psychological 4 thousand level. However, the higher the price increased, the more evidently the buyers’ pressure exhausted. The fact that the Market Profile becomes thinner clearly testifies to it. Clusters sent a warning that it was risky to buy. Sellers that emerged later pushed the price down, and their predominance is noticeable below 4k.

Number 2 marks an area where bright red clusters (actual market sells) can be seen when the price falls below the round level of 2000. Note that the price bounces up from them. It is a sign that a conventional ‘major player’ buys up panic sells under the psychological level. The clusters send a signal for entering into an investment long position in harmony with the major player’s intentions.

Number 3 marks the opposite situation. A big green cluster shows that the price doesn’t grow despite a high volume of market buys. It can be assumed that this is the level where the major player sells out his position with limit sell orders using the feverish demand and, in so doing, he doesn’t allow the price to move further up. Sell orders that emerged later (maybe from the same major player) sharply pushed the market down. Clusters allow reading these events from the chart and act correspondingly without delay.

Advice. Read this article, in which we discuss the reasons for the 1-day Bitcoin fall on May 19 when BTC 1 value was about USD 43 thousand at the high and about USD 30 thousand at the low.

Ethereum FAQ

We are approaching the end of the article about ETH, so we will formulate the most important questions and try to answer them. If, after this, you still have unanswered questions, ask them in the comments.

What is decentralization?

In simple words, decentralization is the absence of a master server. The Ethereum network is located on thousands of peer-to-peer nodes all over the world thanks to operators that participate in the network. This makes the system hack-tolerant. If one node goes down, this will not have critical consequences, because thousands of other nodes support the network.

What is decentralization?

In simple words, decentralization is the absence of a master server. The Ethereum network is located on thousands of peer-to-peer nodes all over the world thanks to operators that participate in the network. This makes the system hack-tolerant. If one node goes down, this will not have critical consequences, because thousands of other nodes support the network.

By the way, we need to warn you. Many fraudsters operate in the young cryptocurrency industry, that is why, trying to earn free Ethers, you can be involved in a ‘shady enterprise’. Be careful.

Where can you buy Ether?

You can buy it online on cryptocurrency exchanges, from brokers, in banks and currency exchange offices. More and more classical financial market participants ‘build bridges’ to the cryptocurrency environment.

Is it possible to buy a portion of Ether?

Yes, you can. ETH 1 can be expensive for a novice, but you can always buy its portion. For example, ETH 0.01.

How fast can you buy Ether?

It is not an instantaneous process. You will definitely have to wait, since blockchain transactions should be checked by node operators. You can learn details at a place where you plan to buy Ether.

How to buy Ether profitably?

You will need patience for this, financial market analysis knowledge and a bit of luck.

How to make money trading ETH/USD?

Pay attention to the cryptocurrency exchange futures for a speculative gain on the ETH/USD exchange rate changes. These futures will allow you to benefit ‘with leverage’ both on the price growth and fall. Moreover, these futures are traded with lower commission fees and are very liquid.

In order to start trading ETH/USD futures on cryptocurrency exchanges, you will need:

- A startup capital. USD 100 and even less will be enough to start with, since trading small portions of ETH is affordable for all. Moreover, you can trade on your demo account without any risk for your real capital.

- Registration on a cryptocurrency exchange.

- A professional trading terminal for a fast execution of trades and situation analysis. Download ATAS – this platform is free for trading cryptocurrencies and has a lot of advantages.

ATAS shows the buyer and seller activity in real time with the help of user-friendly cluster charts. Read our blog and subscribe to our YouTube channel to learn about useful indicators of the ATAS platform and various cryptocurrency trading strategies.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.