- What derivatives are. Plain and simple.

- First derivatives in the world.

- Properties of derivative instruments.

- Types of financial derivatives.

- Participants of the derivative market.

- An example of making money in the derivative instrument market.

What financial derivatives are

The word ‘derivative’ originates from the French word ‘dérivatif’ or Latin ‘dērīvātus’. It is connected with the verb ‘to derive’, which means ‘to produce’, ‘to inherit’, ‘to extract’ or ‘to establish the origin’. Let’s see the derivative idea through an example. Let’s assume that the XYZ company stock is traded on the exchange at USD 100. We also assume that traders John and Jack agreed that John will sell 100 XYZ stocks to Jack at USD 101 in one month and they documented their agreement. So, this agreement is a derivative. In this example:- XYZ stock is an underlying asset;

- the agreement of buying/selling 100 stocks in one month is a derivative instrument or financial derivative.

History of derivatives

Financial derivatives have been known since long ago. It is believed that the first derivatives in history were agreements, executed in ancient Mesopotamia in the 18th century BC during the reign of the Babylonian king Hammurabi, who developed a set of rules, in which such agreements were also mentioned. Also, the risk sharing agreements, which were executed by Babylonian merchants of those times who transported goods by trains of camels, can also be considered derivatives. According to those agreements, merchants received premiums in the event of a successful delivery of goods. Later, derivatives were mentioned by the Ancient Greek philosopher Aristotle, who lived in the 4th century BC. Then they were used on the Osaka (Japan) commodity exchange when trading rice crops in 1710. In the course of time, trading through derivatives only increased. According to the World Federation of Exchanges (WFE) data, reflected in the 2019 WFE IOMA Report on Derivative Financial Instruments, 32 billion contracts with derivative financial instruments were executed in the world in 2019.

Derivative properties

The financial derivative properties are:- Maturity. As a rule, the transfer of rights on an underlying asset takes place not at the moment of executing a contract but after some time. You can find more details on this subject in our article about expiry.

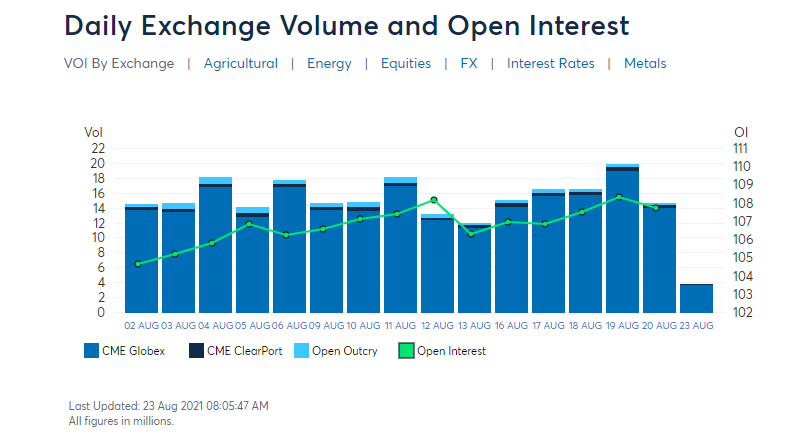

- Speculative nature. Many derivatives are volatile and traded with the use of margin leverage nearly 24 hours during working days with low commission fees, that is why they are actively used by algo-traders, speculators and scalpers for intraday operations. The speculative derivative market nature is intensified by the fact that it is not necessary for participants to perform delivery of an underlying asset. This ‘inflates’ the derivative market volume to irrational values, when the underlying asset volume is much less than the volume of the market of their derivative instruments.

- Ability to reduce risks. Holding underlying assets in possession, investors can include derivative instruments of these underlying assets in their portfolios in order to reduce the overall risk. You can find more details about derivatives and risk management in our article about hedging risks.

Types of financial derivatives

There are four most common types of derivative instruments:| Difference | Futures | Forward |

| Where it is traded | On a centralized exchange | Often – on over-the-counter platforms |

| Terms of agreement | Standardized by an exchange | Often – individual |

| Liquidity | High | Low |

| Price | Public | Not always public |

| Marginality | Yes | No |

| Settlement | Can be sold to any other participant of trades | Settlement is performed only with the counteragent |

Participants of the derivative instrument market

The popular derivative market is open and free. Pension funds can execute trades with private scalpers here. If you trade, for example, the popular S&P 500 index E-mini futures, you do not know who your counterparty is – it can be a trader from Goldman Sachs or a robot, which was developed in Singapore. Motives of the participants come down to a benefit either due to risk reduction or due to making profit by the effect of price difference. Let’s consider 3 common groups of derivative traders:

Conclusions

A derivative (or a derivative financial instrument) is not a specific asset by itself. Instead, its value is determined by the value of the underlying asset, from which the derivative originates. Derivative examples are futures, options, swaps and forwards. Their underlying assets are stocks, stock indices, primary materials, bonds, real estate and many other objects, which have value. Derivatives are used both for risk management and for making a speculative profit. In order to try deriving benefit from the price fluctuation, download the professional ATAS platform free of charge. It provides rich opportunities for trading financial derivatives all over the world.Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.