However, we traditionally start with the calendar of economic events for the next week.

Content:

- Calendar of economic events.

- Fighting COVID-19 and social unrest in the US.

- Stock markets set new records.

- RUB becomes stronger following oil. Is it time to buy dollars?

- ECB saves Europe: EUR growth is powerful.

- Chart of the week: gold futures.

Calendar of economic events

| Date | Event | Impact |

| Tuesday, June 9

17:00 Moscow Time | Publication of the Job Openings and Labor Turnover Survey (JOLTS) (April). | USD. S&P 500. |

| Wednesday, June 10

15:30 Moscow Time | Consumer Price Index (CPI) (May). | USD. S&P 500. Forecast – minus 0.1%, previous – minus 0.4%. |

| 13:00 Moscow Time | OPEC meeting. | Oil. |

| 21:00 Moscow Time | Decision about the US FRS interest rate, press conference of the FRS Chairman Jerome Powell. | All markets. |

| Thursday, June 10

15:30 Moscow Time | The US Producer Price Index (PPI) (May). | USD. Expected – 0.1%, previous indicator – minus 1.3%. |

| 19:00 Moscow Time | Report of the United States Department of Agriculture. | All types of agricultural goods. |

| Friday, June 11

13:00 Moscow Time | Meeting of finance ministers of the EU countries. | EUR. |

| 17:00 Moscow Time | University of Michigan United States Consumer Sentiment (June). | USD. S&P 500. Expectations – 75 points, previous indicator – 72.3. |

| Tuesday, June 9

17:00 Moscow Time | Publication of the Job Openings and Labor Turnover Survey (JOLTS) (April). | USD. S&P 500. |

| Wednesday, June 10

15:30 Moscow Time | Consumer Price Index (CPI) (May). | USD. S&P 500. Forecast – minus 0.1%, previous – minus 0.4%. |

| 13:00 Moscow Time | OPEC meeting. | Oil. |

| 21:00 Moscow Time | Decision about the US FRS interest rate, press conference of the FRS Chairman Jerome Powell. | All markets. |

| Thursday, June 10

15:30 Moscow Time | The US Producer Price Index (PPI) (May). | USD. Expected – 0.1%, previous indicator – minus 1.3%. |

| 19:00 Moscow Time | Report of the United States Department of Agriculture. | All types of agricultural goods. |

| Friday, June 11

13:00 Moscow Time | Meeting of finance ministers of the EU countries. | EUR. |

| 17:00 Moscow Time | University of Michigan United States Consumer Sentiment (June). | USD. S&P 500. Expectations – 75 points, previous indicator – 72.3. |

| Tuesday, June 9

17:00 Moscow Time | Wednesday, June 10

15:30 Moscow Time | 21:00 Moscow Time | Thursday, June 10

15:30 Moscow Time | Friday, June 11

13:00 Moscow Time |

| Publication of the Job Openings and Labor Turnover Survey (JOLTS) (April). | Consumer Price Index (CPI) (May). | Decision about the US FRS interest rate, press conference of the FRS Chairman Jerome Powell. | The US Producer Price Index (PPI) (May). | Meeting of finance ministers of the EU countries. |

| USD. S&P 500. | USD. S&P 500. Forecast – minus 0.1%, previous – minus 0.4%. | All markets. | USD. Expected – 0.1%, previous indicator – minus 1.3%. | EUR. |

| 13:00 Moscow Time | 19:00 Moscow Time | 17:00 Moscow Time | ||

| OPEC meeting. | Report of the United States Department of Agriculture. | University of Michigan United States Consumer Sentiment (June). | ||

| Oil. | All types of agricultural goods. | USD. S&P 500. Expectations – 75 points, previous indicator – 72.3. |

Tuesday, June 9. Publication of the Job Openings and Labor Turnover Survey (JOLTS), which traditionally shows the business economic health. Impact on markets would be limited since it will contain data for the crisis in April.

Wednesday, June 10. A meeting of the ministers of oil producing countries in the OPEC-plus format is planned. They will discuss oil-cut extensions, which allowed market stabilization. If negotiations are not successful, it might lead to a sharp retracement of oil futures. Negotiations might start even earlier.

The main event of the week is expected at 21:00 (Moscow Time). The US FRS will announce its decision on the key interest rate. Perhaps, it would continue to stay at the level of 0.25%. The Federal Open Market Committee (FOMC) accompanying statement and FRS Chair Gerome Powell press conference are more interesting. These two events will show how the financial authorities assess the current economic situation in the US and what the prospects of the economic recovery and rates of the Quantitative Easing (QE) program development are. The central banks’ money and hopes for the fast economic recovery drive the markets now. FRS is the main emission center in the world, that is why the influence of its actions on the value of all assets is huge. Splashes of volatility are possible.

Thursday, June 11. An important day for traders who trade wheat, soybean and other agricultural futures. The US Department of Agriculture would present an analytical report with an assessment of the global demand and supply prospects on basic products. Splashes of volatility are possible. You should follow the risk management rules and close margin positions in agricultural futures on the eve of the publication.

Friday, June 12. Meeting of finance ministers of the EU countries. They will discuss a situation in the regional economy and crisis fighting methods. The economic budget support measures may be specified. High EUR volatility is possible.

Fighting COVID-19 and civil unrest in the US

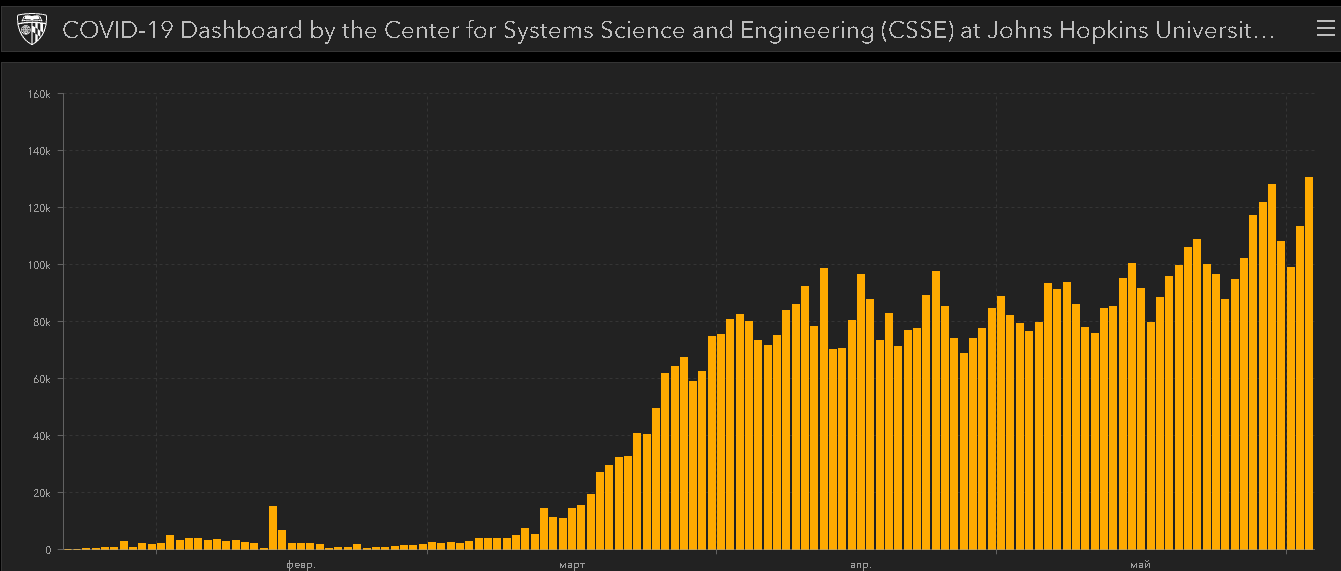

The COVID-19 epidemic development rates are still high. A new incidence anti-record was registered on Wednesday, June 3 – 131 thousand. According to the Johns Hopkins University data, the epidemic, as of June 4, took the lives of 386 thousand people.

Meanwhile, one more non-market event with a high explosion potential took place in the US. Killing of the black American George Floyd by policemen became a catalyst of an unprecedented upheaval in US history.

Waves of violence and demolition swept major American cities, including Washington, during the weekend. Protesters robbed stores and set police vehicles on fire. The National Guards and security services managed to hold back the protesters from taking over the White House at cost of dozens of wounded officers. It reached the point where the ‘fearless’ American leader Donald Trump had to hide in the underground bunker.

The situation started to calm down a bit by the middle of the previous week, however, new outbreaks of violence are quite possible during the weekend. What’s about the stock market? Traders are so sure in the brighter future that even didn’t notice the unrest. Maybe, they should have done it.

Stock markets set new records

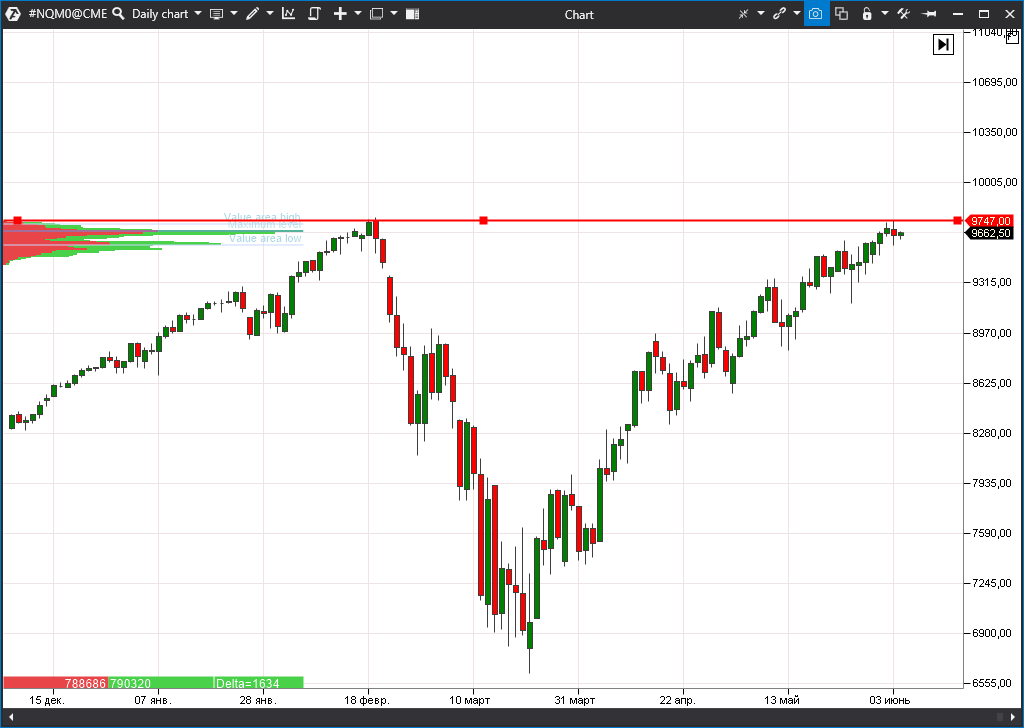

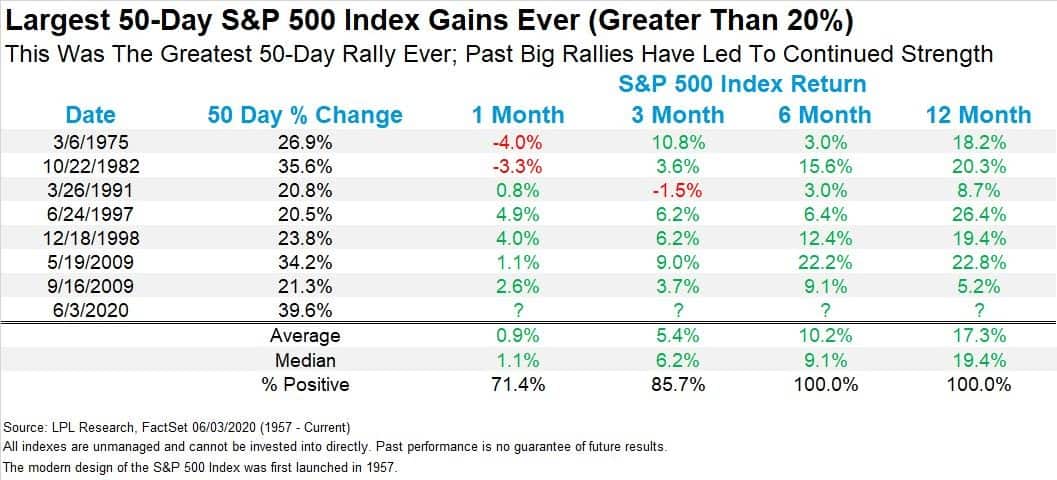

The past week is interesting due to setting new records in the US stock market. Thus, the technology company index – Nasdaq 100 – tests historic highs, having added already 43% from the March 23 low.

We would also note the opinion of the legendary hedge fund manager Ray Dalio. He is sure that a huge economic paradigm shift takes place in the world right now. Changes are marked with a sharp growth of inequality between rich and poor countries, social tension, unprecedented emissions of central banks and a new round of scientific and technical progress. The investor is sure that sitting in cash in such times is a bad idea. He recommends forming a diversified portfolio, which should include stocks, bonds and gold.

RUB becomes stronger following oil. Is it time to buy dollars?

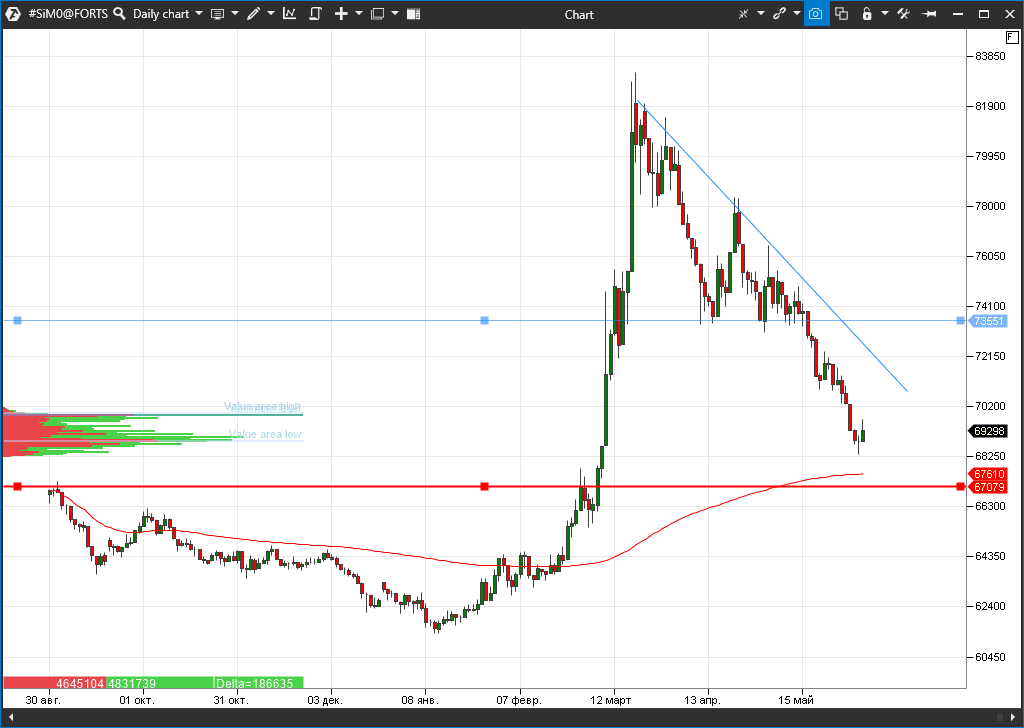

We noted in our last but one review, that the USD/RUB (SiM0) pair would perhaps test the 200 MA level and autumn highs, which are in the 67-67.3 area. The oil price growth and global world optimism helped the futures to closely approach the target – the local USD low was at the 68.19 level. There are good chances to reach the target.

The raw material demand stays low, which restricts the further market recovery potential. The situation is even more difficult due to the fact that OPEC-plus countries have very many contradictions, which may well ruin continuation of agreements on oil production cutting.

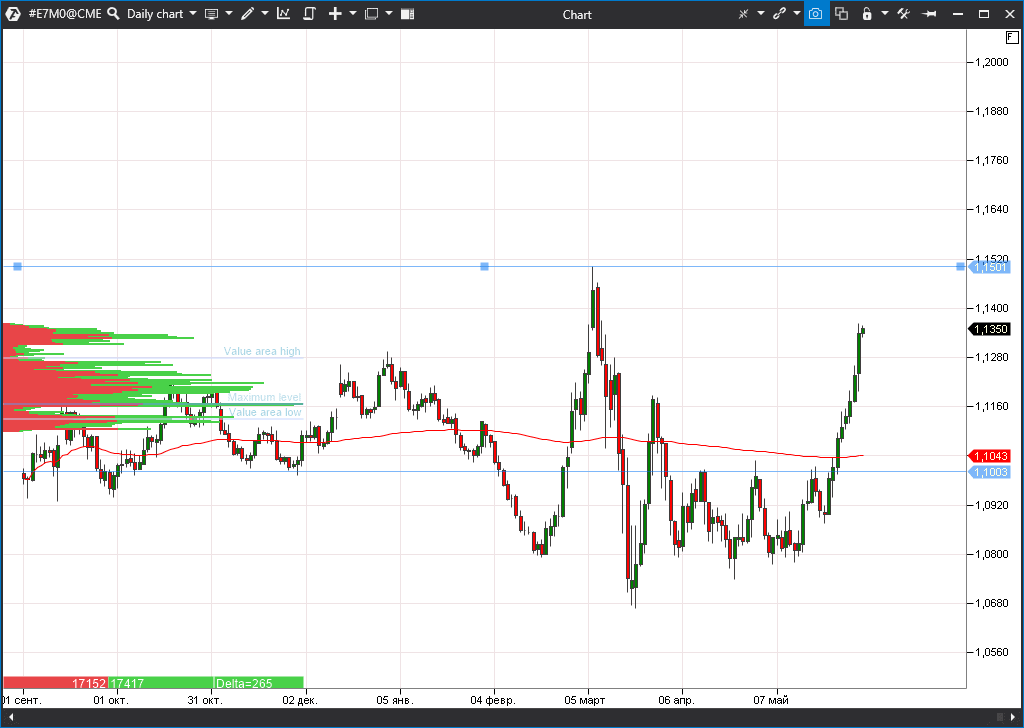

ECB saves Europe: EUR growth is powerful

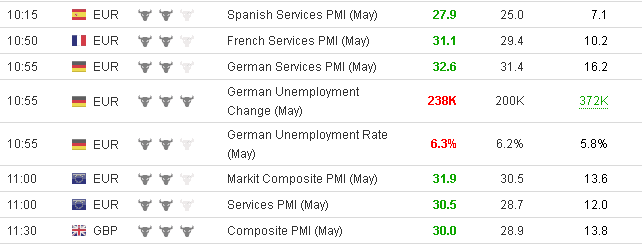

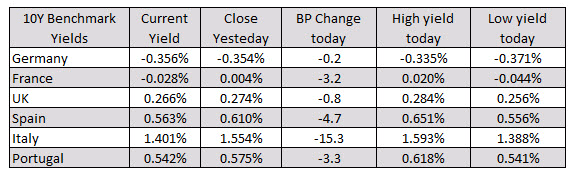

A number of economic data were published in Europe, which do not inspire optimism. Purchasing Managers Index (PMI), an important leading indicator of business activity, showed an unpleasant situation in the real economy sector for bulls. Recovery goes on very slowly in the key countries from Germany and France to Italy and Spain. PMI in industry and service sphere is still much lower than 50 points, which testifies to a longer recovery period than optimists expect.

Spain went even further than all its neighbours. Spain plans to introduce universal basic income, being one of the first in the world. This is when a state gives money to the poor only because they exist. It would be from EUR 465 per person to EUR 1,015 per family. Some experts believe that, taking into account the growing inequality and social tension, the majority of the world developed countries would come to the universal basic income policy.

Of course, all these social carrots should be sponsored by the ECB printing press. On Thursday, June 4, European bankers agreed to increase the Pandemic Emergency Purchase Programme (PEPP) by EUR 600 billion up to EUR 1.35 trillion. Emergency measures were taken in response to deterioration of economic forecasts. They expect in the Central Bank that the regional economy would fall in 2020 by the record-breaking -8.7%.

After the ECB announced its decision, the yield of Italian 10-Year Notes fell to the several years’ low. Similar German and French securities fell into the negative area even more. It means that investors should pay the most powerful eurozone states, so that they borrow money from them. The situation is absurd at first sight. However, this is reality in the situation of excessive money and insufficient supply of instruments for its safe investing.

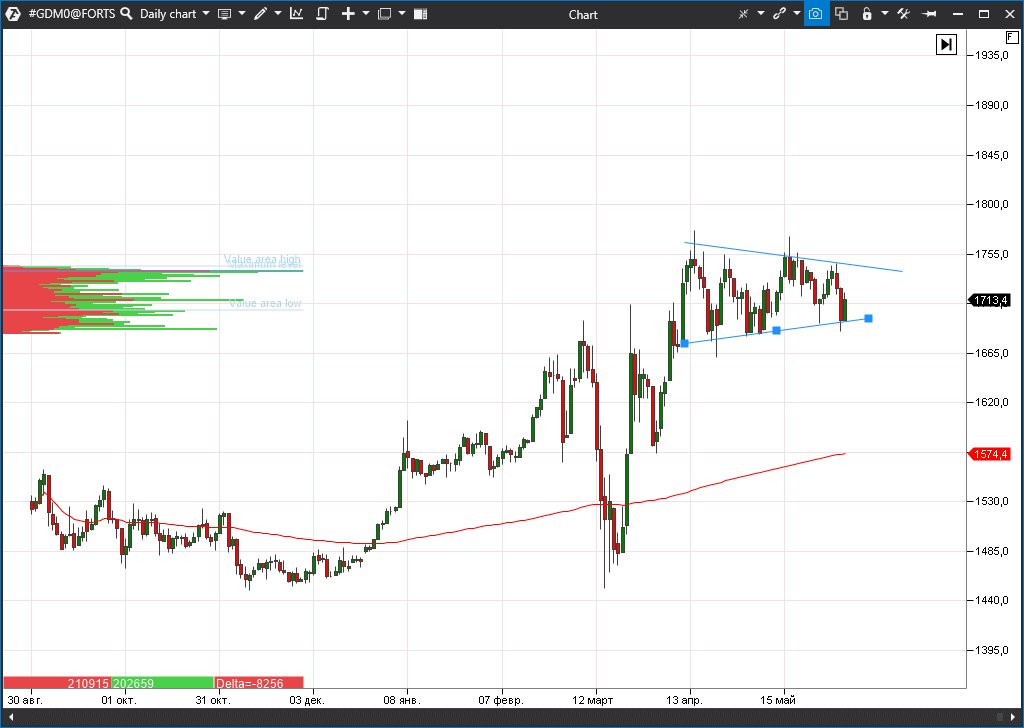

Chart of the day: gold futures

High global risks, unprecedented emission programs of the leading central banks and weak dollar create good fundamental grounds for the gold price growth. The gold futures (GDM0) chart shows formation, which tells us about high probability of the trend continuation. It is necessary to monitor the triangle breakout and consolidation above the 1740-1760 resistance area.