- How does the head and shoulders pattern look on a chart?

- What does it mean?

- How to trade?

- Advantages and disadvantages

- How can you use the head and shoulders pattern to improve your trading?

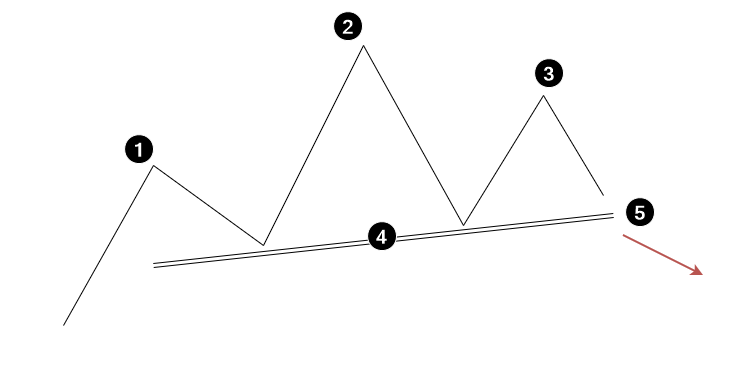

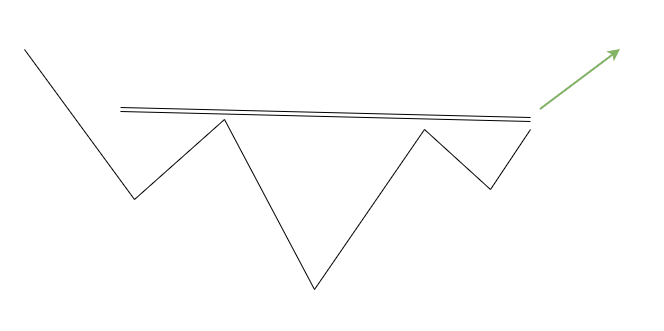

How does the head and shoulders pattern look on a chart?

The name “Head and Shoulders” (SHS) represents a visual pattern of three peaks on the chart.

What does the head and shoulders pattern mean? Examples on a chart.

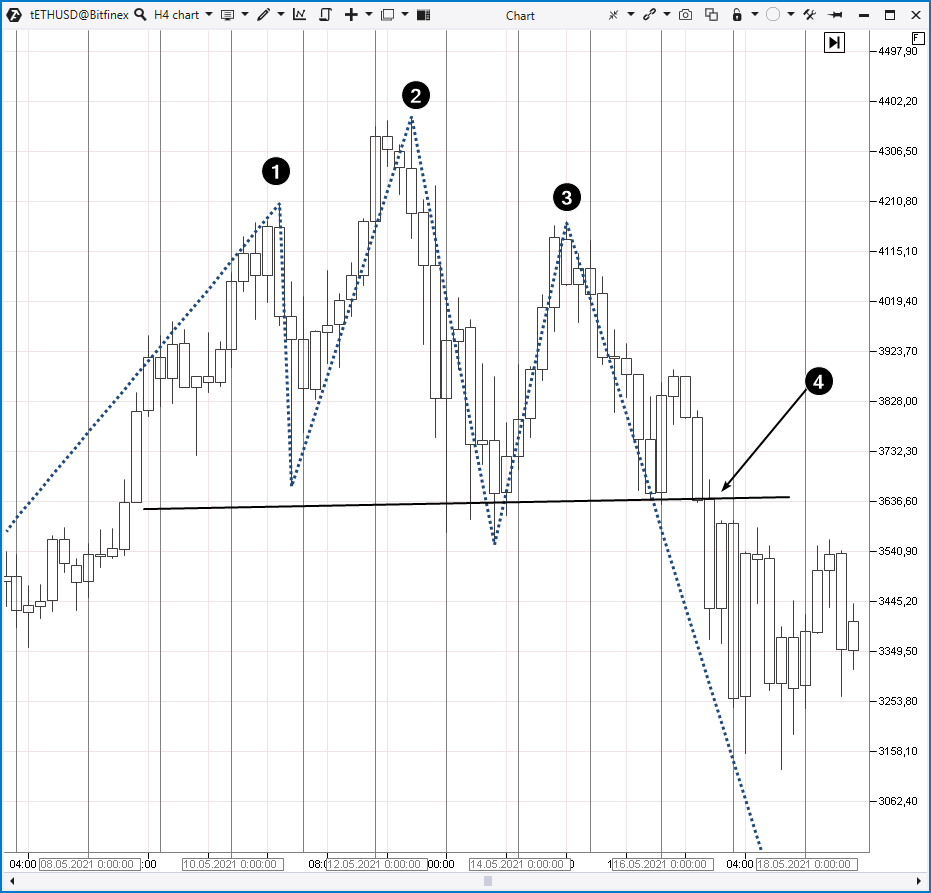

Let’s have a look at an example with a real Ethereum price chart, the data was taken from the Bitfinex exchange, timeframe = 4 hours. The ZigZag Pro indicator is added to the chart. This is a useful indicator from the ATAS platform, it automatically splits price data into a sequence of upward and downward waves. The indicator has sensitivity settings and can display statistics for each wave (volume, time, delta and other information).

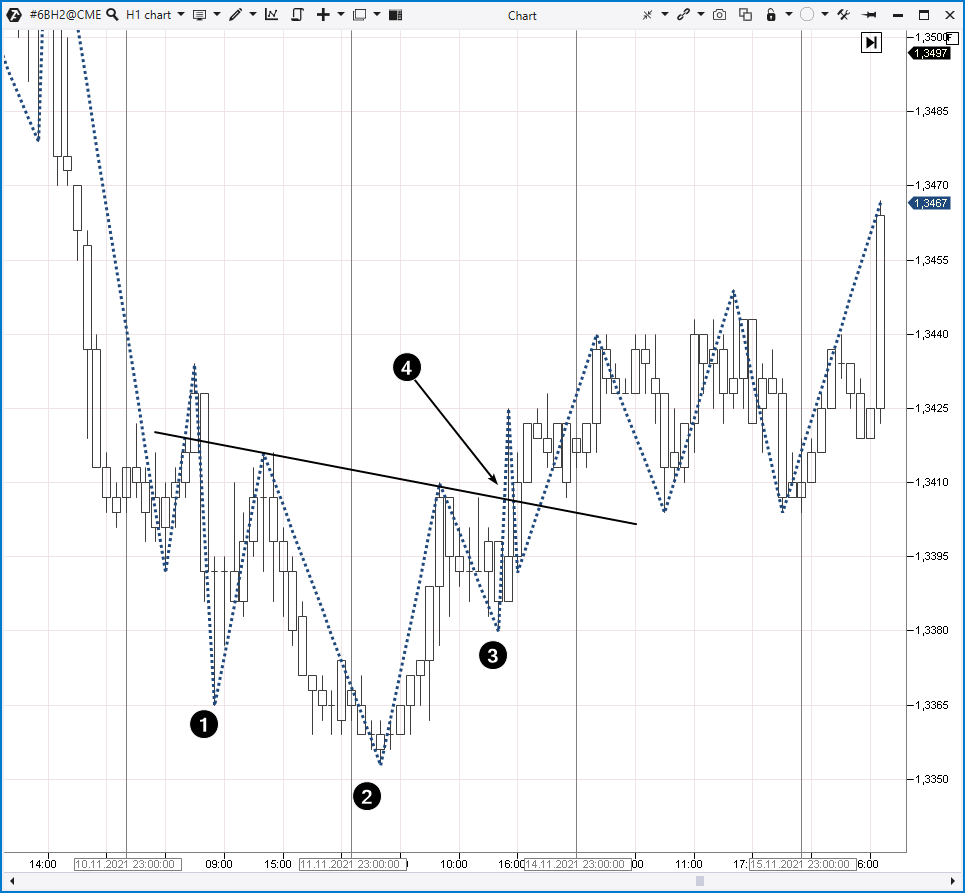

- open a short position;

- set a protective stop loss above top number 3;

- set a take profit on the target level, which is laid down from the neckline at a distance equal to the difference between the top number 2 and the neck level. In this example, Target = 69.42-(69.78-69.42) = 69.06.

Advantages and disadvantages of the head and shoulders pattern

Advantages:- Easy to understand.

- This pattern can point at levels for setting stop losses and take profits.

- It works in any markets, timeframes.

- According to various studies, this pattern gives quite accurate reversal signals.

- It can be subjective. The pattern is difficult to identify because the market consists of many local tops and lows, and ideal patterns rarely appear. Sometimes the head and shoulders become visible when the reversal has already taken place.

- Not all reversals fit into the shape of the head and shoulders pattern. If the right shoulder slightly exceeds the top of the head (for example, forming an Upthrust), the pattern will look wrong, but the market will not stop showing signs of weakness. To learn how to recognize market reversals, we recommend the article on Accumulations and Distributions.

How can you use the head and shoulders pattern to improve your trading?

Tip Number 1. Try using non-standard chart types. For example, Range XV chart below. The numbers 1, 2, 3 show the head and shoulders pattern. Ranges can make it visually easier for you to evaluate local highs and lows.

How to trade the head and shoulders pattern better using the ZigZag indicator?

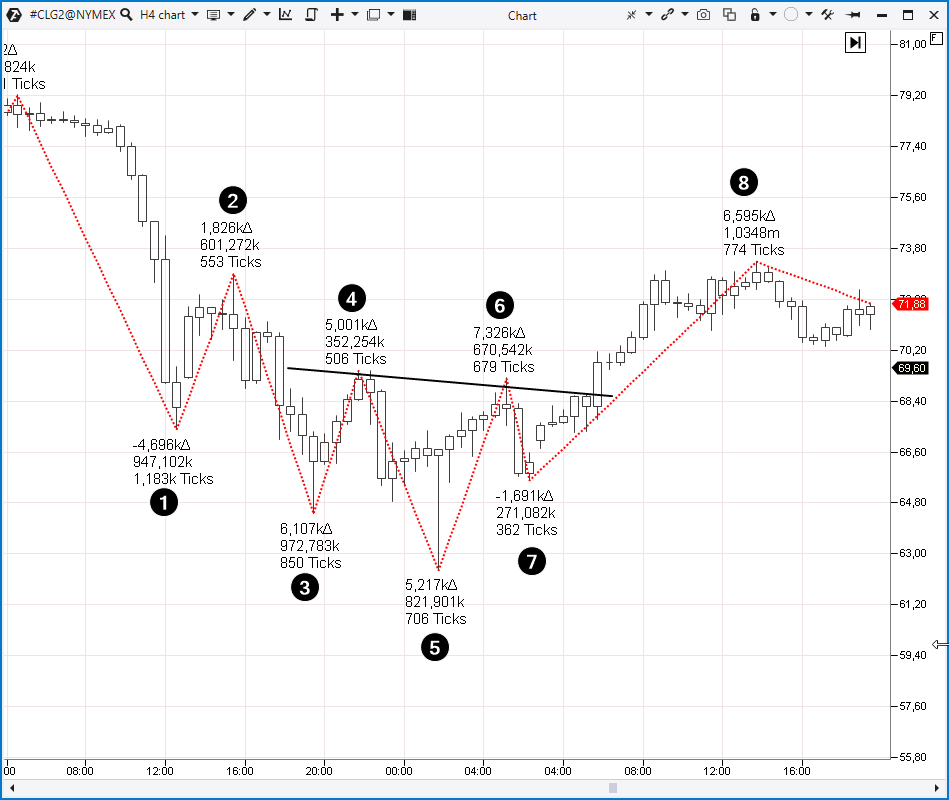

The picture below shows the oil futures chart, 4-hour timeframe. The data was taken from the NYMEX exchange (part of the CME Group). The numbers indicate the local peaks and troughs which are found by the ZigZag Pro indicator. The indicator splits price data into a sequence of upward and downward waves. The indicator also shows statistics for each wave. How can it help?

How to trade the head and shoulders pattern better using cluster charts and profiles?

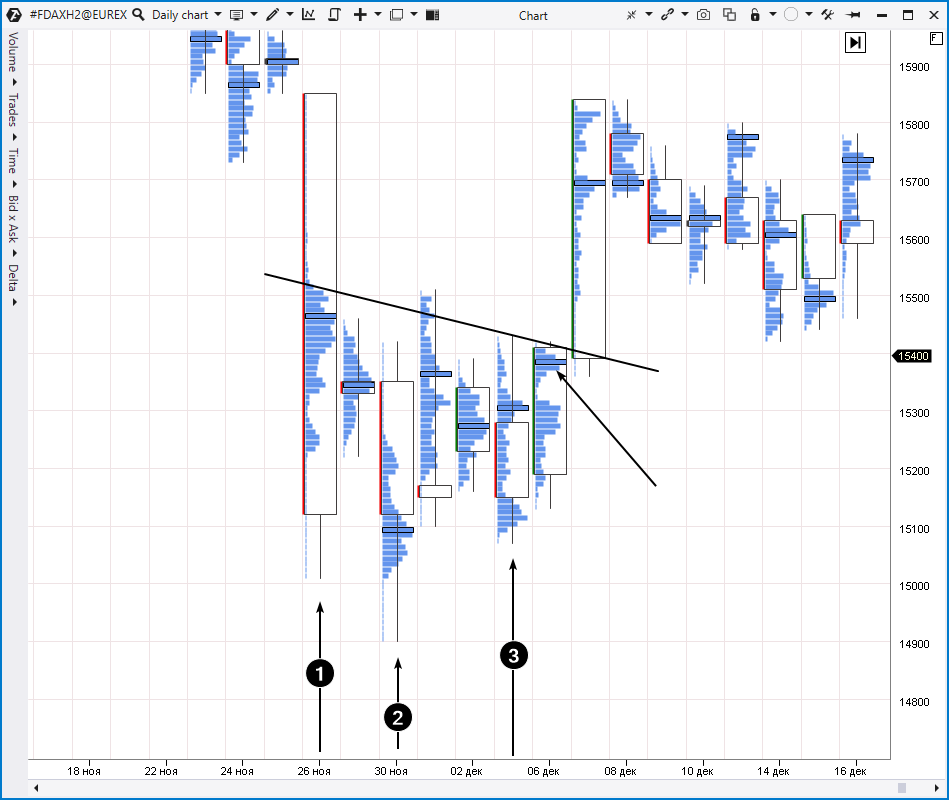

The picture below shows a futures chart for the DAX stock index, a daily timeframe. The data was taken from the EUREX exchange. The numbers 1-2-3 indicate the local troughs which form the head and shoulders pattern. The volume histogram clusters allow you to “look inside” the candles and help you understand what is going on.

How to start trading?

We hope that the examples with the head and shoulders chart pattern presented in the article will be useful for you. If you want to explore the pattern on the charts and see the benefits of volume analysis, download the ATAS platform.- You can register and download it for free. You do not need to give your bank card details. You can continue using the program even after the 14-day trial period.

- You will be able to analyze the head and shoulders pattern in the stock, futures and crypto markets.

- There is a demo account built into the ATAS platform, so you can practice trading without risking your real capital.

Conclusions

We hope that the examples with the head and shoulders chart pattern presented in the article will be useful for you. If you want to explore the pattern on the charts and see the benefits of volume analysis, download the ATAS platform.- You can register and download it for free. You do not need to give your bank card details. You can continue using the program even after the 14-day trial period.

- You will be able to analyze the head and shoulders pattern in the stock, futures and crypto markets.

- There is a demo account built into the ATAS platform, so you can practice trading without risking your real capital.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.