What parallel channels are

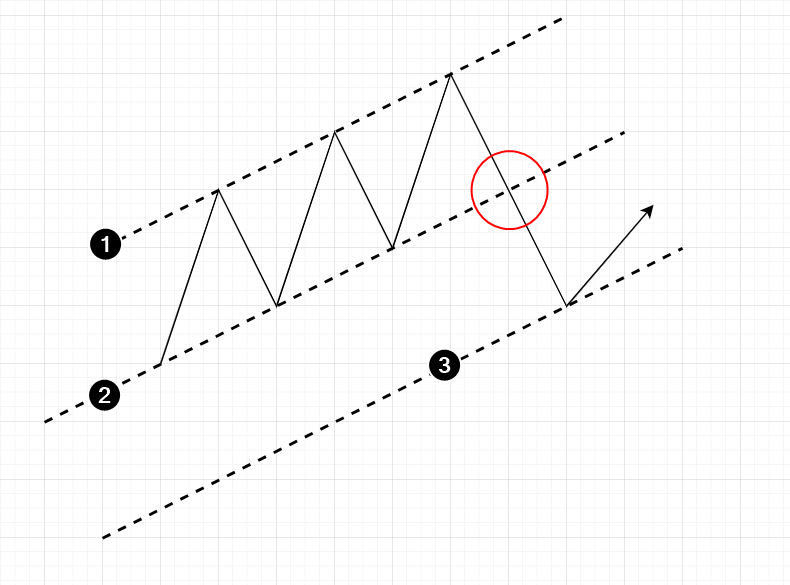

A parallel channel is a technical analysis pattern in which the price forms a trend channel (1-2) and then breaks through one of the boundaries to find the next boundary (marked with a red circle in the diagram below). This provides a condition for creating a parallel channel.

Example 2

The same SPX index, but on a larger scale. Another candidate for “trade of the year” or even more.

Example 3

During 2018-2022, the NFLX stock price formed a trend channel (1-2). But then the price plunged down amid the news of a decline in the number of subscribers.

Example 4

At the end of 2021, the investors’ agenda was formed considering strict restrictions due to the coronavirus in China. They led to a decrease in demand. The statistics also made it clear that some of the world’s largest economies were heading towards a recession. Oil futures fell sharply in price.

A false breakout in August makes it more difficult to draw the main channel. Other than that, the main channel (1-2) shows up quite clearly. The parallel channel line (3) provides a major reference point for finding a long entry point.

Example 5

A similar situation occurred in the market of another energy asset during the same period.

However, the rebound from the parallel channel line did not form as actively on the natural gas futures chart as it did on the oil futures chart.

Example 6

Now let’s have a look at a bearish pattern from the cryptocurrency market. After declining from a historical peak in November 2021, the early spring of 2022 gave bulls hope.

Advantages and disadvantages

Like many other technical analysis patterns, the parallel channel has its advantages and disadvantages.Advantages

- it is easily formed;

- you can enter a position at the beginning of a trend impulse;

- examples are found in all markets, time frames;

- reference points for calculating target and a stop-loss.

Disadvantages

- the price does not always break through the trend channel in order to test the parallel channel line;

- there is no guarantee that the trend will resume;

- a setup for a rebound from the parallel channel line may mean countertrend trading, which carries additional risks;

- subjectivity in the drawing of initial channel lines.

How to improve parallel channel trading with ATAS

Try to use the following trading plan as a basis:

- arrow 1 —significant bearish progress, even though the price has closed in the middle.

- arrow 2 — bearish progress has decreased. The pressure of the sellers is strong, but the price has slightly decreased in response.

- arrow 3 — progress is insignificant, moreover, the pressure is decreasing significantly.

Euro futures example

The price action on the left side of the chart (the evening of the previous day and the morning of the next day) provided information for drawing the main channel (1-2).

- thickening of the profile in the lower part: the “dam” of limit buys keeps the flow of market sells;

- over time, the flow of market sells becomes exhausted (1);

- a change in delta shows that buyers have become more active (2). The price responds in a cheerful way and skyrockets.

Example from the cryptocurrency market

The 1-hour chart shows the price action for the BNB token futures market (the data was taken from the Binance exchange). It is easy to draw the main channel line (2). Despite the characteristic “pivots” that abound in such crypto futures and bring some chaos due to false breakouts, support from the channel line is clearly visible. After examining the chart, you can draw a line (1)– a line between1 и 2. The price should react to touching the lines (shown by arrows) as often as possible.

Tips for beginner traders

If you are looking for a long position, pay attention to bullish parallel channels. The opposite is true for entering short positions — focus more on drawing descending channels. Follow the rules of capital management and control risks. Practice on history to build parallel channels more professionally. Use ATAS instruments to confirm the market reaction to the parallel channel line. If the number of interactions is high, it indicates the line’s validity. Use ATAS instruments to confirm the market reaction to the parallel channel line.Conclusions

To start parallel channel trading, you can use the following algorithm:- Draw the main channel.

- Draw a parallel line.

- Wait for the breakout of the main channel and the test of the parallel channel line.

- Examine the readings of the ATAS indicators to make sure that the line of the parallel channel gives reason to enter a position.

- Enter the position and control the risks. The price rebound from the line 3 at the panic low and a spike in positive delta (4) confirm the activation of buyers.

- It is free. Moreover, you will be able to continue using the program even after the 14-day trial period is over, but only for cryptocurrency trading. Moreover, you will be able to continue using the program even after the 14-day trial period is over, but only for cryptocurrency trading.

- The platform allows you to download tick history from the futures, stock and crypto markets, therefore, you can be sure that parallel channels give you an advantage.

- Market Replay (a simulator for a trader) is built into the ATAS platform,so you will have the opportunity to practice trading without risking real capital.

- 4. The platform offers many benefits for traders who want to combine bounce trading with easy-to-use cluster charts anduseful indicators.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.