What is portfolio diversification?

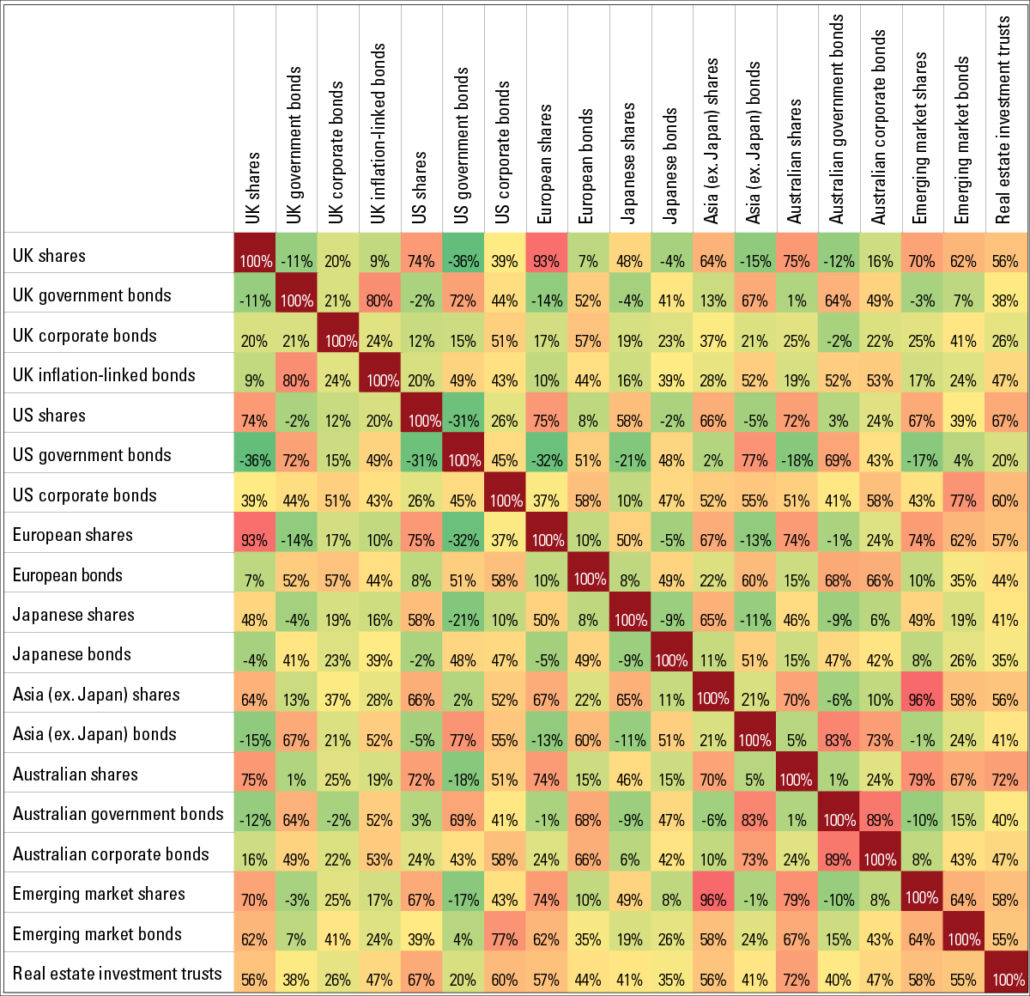

In simple words, diversification is distribution of the portfolio parts between various assets with the goal to reduce risks. In a very simple form, diversification can be: Buying several company stocks in smaller volumes instead of a big package of one company stock. Buying a portfolio of several cryptocurrencies instead of buying Bitcoin only. This model is also called naive diversification. Naive diversification cannot be considered an efficient method of risk management, since many assets move in sync. For example, when Bitcoin falls, a majority of other cryptocurrencies follow it. Experienced investors resort to diversification across assets with different correlation. They do it because the diversification goal is not only to “put eggs in various baskets”, but also to preserve the average expected portfolio yield at an acceptable level. What does it mean – assets with different correlation? Correlation is a statistical dependence between the price movement of various assets. If a correlation is 100%, it means that asset prices move with linear dependence. If it is negative, asset prices move in opposite directions. Below is an example of a correlation matrix of assets in different countries, which was developed by the Vanguard investment company in 2020.

Portfolio diversification: markets and general principles

Investors can diversify both a portfolio composed of assets of one type (efficiency is lower) and of various ones. Let’s briefly discuss general principles of work. Diversification between assets of various types It assumes a portfolio of a wide circle of assets with different correlation. It is used mostly by professionals. To calculate efficient diversification, managers apply price data arrays and understanding of the common economic regularities. If a portfolio has been diversified correctly, a price decrease of one asset type will be, at an average, compensated by increase of another. As a rule, investors widely use the following asset types for diversification: – stocks of companies from different sectors and also index and industry ETFs; – government bonds, municipal and corporate debt obligations; – currencies and cash instruments; – precious metals; – primary materials – mainly in the form of futures and commodity ETFs; – cryptocurrencies; – real estate and its derivatives. Stock portfolio diversification In a very simple form, diversification of a stock portfolio assumes buying securities of companies from different sectors with a low correlation between them. According to various assessments, the optimum number of stocks in a portfolio (for better diversification) is from 15 to 30. Why is correlation between stocks different? It’s very simple. For example, it is profitable for streaming companies when people travel less and spend more time at home (like it was during the coronavirus epidemic), while such a situation is disastrous for travel companies. Oil price increase is definitely good for oil companies, while it is very bad for profitability of airline companies, since the fuel price forms the bulk of their expenditures. You can achieve diversification if you include the best companies from every sector in your portfolio. Some investors prefer to invest outright in the index, which reflects the average value of growth and fall of all industries. Judging by the performance of S&P 500 company stocks from July 15 until August 15, 2021, you can see that various companies had various dynamics, although, on average, the market grew. This happens quite often.

The Holy Grail – Ray Dalio’s diversification principles

As it has already been mentioned above, that diversification has the biggest positive effect, which envisages portfolio risk reduction with preservation of yield. Ray Dalio is a founder and longstanding CEO of the biggest and most successful hedge fund of the world – Bridgewater Associates. He is one of the ideologists and popularizers of this strategy, which helped him to recover after the fall in the second half of the 1980s and prosper during the following decades. Dalio calls diversification the Holy Grail of investing. In brief, his model looks as follows:- You should have 15-20 assets with a different correlation in your portfolio for achieving diversification. In doing so, you can reduce risks sharply without endangering your yield.

- You should avoid big concentrations of assets of one type (for example, stocks or bonds) since a correlation within one type is 60% or even more.

- You should regularly reconsider your portfolio composition since correlations change over time under the influence of various macroeconomic factors and the state of liquidity in the world.

Example of portfolio diversification from Ray Dalio

Also, Dalio offered a diversification formula, which, in principle, should work properly in any situation – whether it is a crisis, high inflation or, on the contrary, deflation. The investor called this model the All Weather Portfolio. The formula of this portfolio looked as follows:- 40% – long-term bonds;

- 30% – stocks;

- 15% – middle-term bonds;

- 7.5% – gold;

- 7.5% – primary materials.

Portfolio diversification in 2021

The year 2021 finds the world under intensive recovery after the 2020 corona crisis. This stage is characterized with very fast rates of economic growth – the world GDP growth is expected at the level of 6%, which is one of the best markers in history. All this takes place in the background of unprecedented measures of inflating the leading country economies with liquidity, high inflation rates and very low yield of debt instruments. According to economists’ forecasts, this stage will last, at least, until the end of 2022, after which the GDP growth rates will come back to average markers and the markets, most probably, will retrace. Under such conditions, it makes sense to keep the main part of your portfolio in stocks, also not forgetting about primary materials and gold. However, if there are serious signs of the US Federal Reserve interest rate growth, investors, probably, will have to change the strategy quite fast, reducing the share of stocks and primary materials. We also want to add at the end that even a novice trader can master portfolio diversification skills at the basic level. In case you want to become a professional investor, of course, you cannot do it without a deep dive into special literature. The portfolio theory is quite an in-depth science, which requires perfect understanding of macro-economy and ability to work with statistics.Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.