Types of Exit Strategies

Developing an exit strategy depends on financial goals, the trading system used, experience, the trader’s individual preferences, and other factors. The following types of exit strategies are available to traders and investors:- Diversification. Allocating capital among various assets (and/or trading systems) aims to reduce risk since negative changes in one area can be offset by positive changes in another.

- Position sizing management helps control risk by limiting the size of each position according to the overall trading capital. For example, a trader with a $10,000 capital may open each position with a volume of $500.

- Using options and futures. These derivative instruments (including hedging) can be used for more advanced exit strategies. For instance, to protect a long position in futures, a trader may decide to purchase a put option, which insures against potential price declines.

- Psychological preparation. To minimize the risk of making impulsive decisions, traders are encouraged to develop detailed trading plans, learn to manage emotions, extend timeframes (allowing more time for analysis), use clearer indicators, and practice trading in a simulator.

However, the most obvious and common way to protect your capital is by setting stop-loss and take-profit orders:

- stop-loss is an order to close a position automatically when the price reaches a specific level, preventing further losses.

- take-profit is an order that closes a position when the price reaches a predetermined profit level. The execution of the take-profit order cancels the stop-loss order: the higher the probability of the take-profit order being triggered, the lower the probability of the protective stop-loss order being triggered.

These tools are called Long (planning to buy positions) and Short (planning to sell positions) and can be found in the drawing objects menu (1). They can also be placed on the left panel (2) for quick access.

- visually demonstrate the risk-reward ratio based on the levels at which the trader plans to set SL and TP;

- calculate the position size based on the specified percentage of allowable risk.

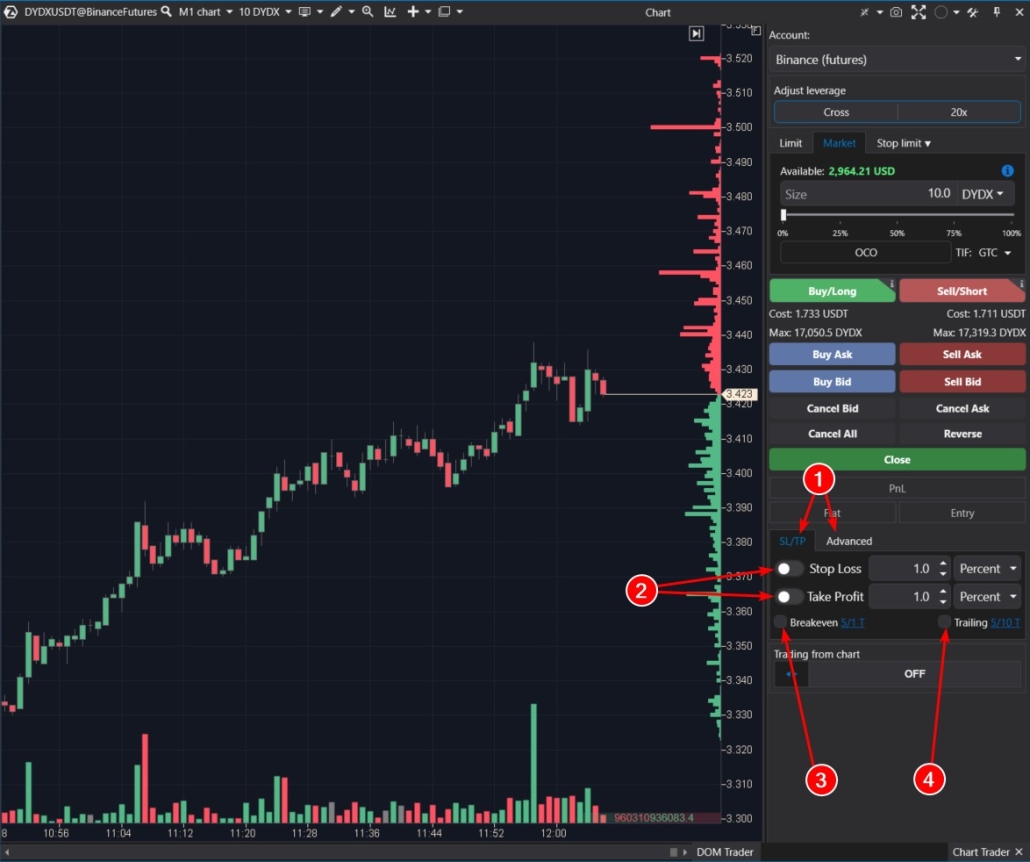

More details about the Long and Short tools can be found on the respective page in the Knowledge Base. Now, let’s focus on the exit strategies block located on the Chart Trader panel (to access it, press ‘T’).

Capabilities of the ATAS Exit Strategies Block

The ATAS platform is constantly evolving. In its current configuration, users have access to a user-friendly and functional exit strategies block:

- the SL/TP tab has functionality for working with stop-loss and take-profit orders;

- the Advanced tab provides options for setting take-profit and stop-loss orders not for the entire position, but for its parts, offering more flexibility in capital management.

- settings (2) for placing fixed stop-loss and/or take-profit orders;

- settings (3) for transitioning a position to breakeven;

- settings (4) for a trailing stop-loss.

Fixed SL and/or TP Strategy

This is the easiest strategy where a trader has well-defined rules (logic) for placing stop-loss and take-profit orders. For instance, if a trader has opened a long position on BTC/USD, they can set fixed values for SL and TP using either:

- Pros: visual, convenient, simple.

- Cons: there is a risk of making a human error: accidentally placing an order at the wrong level or not doing it quickly enough. Or forgetting about it.

- activate the Stop-Loss slider;

- in the settings, specify the distance = 0.1% (you can set it in percentages, ticks, or currency – rounding in calculations is acceptable);

- click Apply to use the settings;

- open a position.

- you can set stop-loss and take-profit orders automatically;

- you can configure setting stop-loss and take-profit orders using values in percentages, ticks, or currency;

- you can adjust the balance between stop and take;

- you can configure stop-loss and take-profit orders independently. For instance, a strict stop will be automatically set to a predefined risk value for a trade, while a take-profit can be manually adjusted based on market conditions.

- High market volatility or setting stops and takes too close may result in them triggering immediately after being set.

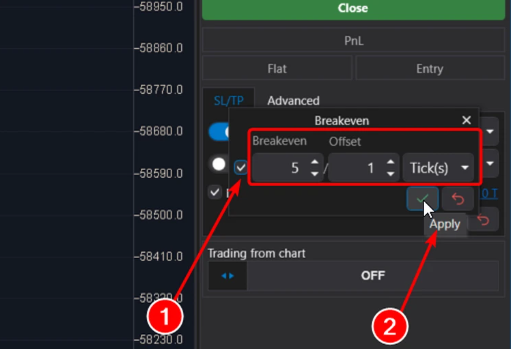

Breakeven Strategy

This exit strategy involves activating an option to move the stop-loss to the position’s opening level if the price moves a specified distance in the desired direction. The implementation of this strategy is expected to make the deposit growth curve smoother. On the other hand, it can be disappointing if the price hits the breakeven point and then continues to move in the initially predicted direction. Simply put, here is how it works:

Example. ES market, E-mini S&P-500 futures.

- Pros of breakeven: it reduces psychological pressure on the trader, partially protects capital, helps smooth out the growth curve.

- Cons: it may lead to prematurely closing trades that could have potentially been profitable.

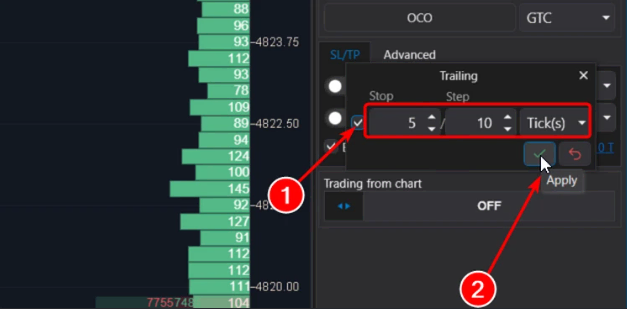

Trailing Stop Strategy

This exit strategy is based on a stop-loss that automatically follows the position:- if a long position is opened, the stop-loss is progressively raised as the price increases;

- if a short position is opened, the stop-loss is progressively lowered as the price decreases.

- activate the function by checking the box (1);

- adjust the Stop and Step parameters;

- click Apply (2) to use the settings.

Stage 1. We open a long position at 4821 with a stop loss set at 10 ticks (automatically placed at 4818.50, as the tick size on this market is 0.25 points).

Stage 2. As the price moved up by 5 ticks, the stop loss was adjusted by 3 ticks – specifically to the 4819.25 level (note that after the first triggering of the trailing stop, the stop loss value changed – instead of being 10 ticks, the stop loss is now indicated as a specific price level of 4819.25).

Stage 3. The price continues to rise. The second automatic adjustment of the stop loss occurs. Instead of the initial risk of 10 ticks, the risk is now reduced to 4 ticks.

During this process, the trailing function moved the stop-loss over a considerable distance. However, the activation of bearish sentiment led to the closing of the long position:

- Pros of trailing: it automatically follows the price, protecting profits; it operates in real-time mode and closes the position when the market trend changes.

- Cons: it may be triggered during a correction if it follows the price too closely; it may lead to significant missed profits.

Partial Position Closing

Let’s explore the functionality located on the Advanced tab. Here, you can configure partial position closing. This feature can be useful in many cases:- for instance, a trader opens a long position;

- sets a fixed stop-loss at a level where the price convincingly proves the fallacy of their reasoning;

- and for take-profit, the trader has 2 levels – let’s call them ‘TP1 – conservative’ (closer) and ‘TP2 – optimistic’ (farther, higher).

- closing of 50% of the position at the TP1 level,

- and the remaining 50% at the TP2 level.

- First, you need to specify that the volume of the opened position (1) will be equal to two contracts.

- Then, in the Advanced block, you need to add a layer by clicking on the plus sign. Then the first layer will be responsible for closing half of the position at TP1, and the second one for closing at TP2.

- Make sure that all settings are correct and click on the confirming green checkmark.

- Pros of Advanced protective layers: automation + maximum flexibility, allowing gradual position reduction depending on where the price is heading.

- Cons: high risk of human error – especially if the position is split into a large number of parts.

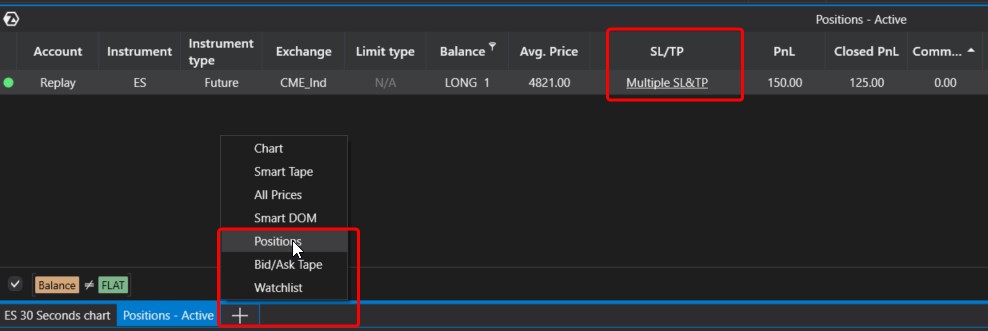

By the way, to help users track open positions in different markets, ATAS has a Positions window. To open it, click on the corresponding button in the main menu or select the Positions option by clicking on the plus sign at the bottom as shown in the screenshot.

In the Positions window, there is a special column for managing SL and TP levels. Check out how easy it will be to use.

Pros and Cons of Exit Strategies

What are the pros and cons of the discussed capital protection measures related to setting stop-losses, trailing stops, breakeven levels, and take-profits? Pros:- Protection. The main advantage is that exit strategies prevent the worst-case scenario from occurring.

- Systematic approach. They help better manage and control the trading process, optimizing SL and TP levels.

- Psychological impact. Stop-loss orders help maintain composure, knowing that capital is protected in adverse situations.

- Exit strategies tend to limit profit potential. If a stop-loss is triggered too early (e.g., due to volatility spikes), the trader may miss out on the intended part of the trend.

- Subjectivity. Determining levels for setting stop-loss orders involves additional analysis and decision-making, which can be prone to errors.

- Psychological pressure. Frequent stop-loss triggers can lead to disappointment and a decrease in confidence, sometimes causing traders to refrain from setting stop-losses altogether.

FAQ

Can a trailing stop and breakeven be used simultaneously? Technically, it is possible. ATAS will systematically execute commands embedded in both functions as conditions are met. However, it is not entirely logical, so we may recommend choosing one or the other. Otherwise, there is a possibility that with certain settings, these functions may conflict and disrupt the system’s consistency. When using both a trailing stop and breakeven simultaneously, it is important to have a clear understanding of why this is done and how the system will operate under different price behavior scenarios. Is it necessary to set stop-loss orders? A position can be opened without a stop-loss. Technically, when a position is opened, it does not have a stop-loss. Setting a protective order is not mandatory, but highly advisable, as it will prevent critical scenarios where capital may be either completely destroyed or irreversibly reduced. What are mental stop-losses? This is for experienced traders. They closely monitor the market while keeping in mind the levels of mental stop-losses. When these levels are reached, traders conduct an analysis considering new data and decide what to do next: either manually close (reduce/increase) the position, continue holding, or choose another option. This adds flexibility, eliminates the risk of stop-loss being triggered by a volatility spike, but leaves open the scenario with catastrophic consequences. Use mental stops only when fully aware of everything you are doing. What are mathematical stop-losses? In simple terms, this is when a trader sets a stop-loss not based on an extreme point, a level of significant volume, or any other element of the chart, but by using a formula. A simple example is a stop-loss set at 0.1% of the asset’s price from the entry point. Can stop-loss and take-profit orders be saved when restarting ATAS? Yes, since the beginning of 2024, SL/TP orders can be saved after restarting the platform.How to Apply Exit Strategies

Properly applying stop-losses and take-profits can make a significant difference in trading outcomes. Some say that in trading, it is not just about where you enter, but also where you exit – and that is precisely what is determined when using SL and TP. To start, it is important to assess your risk tolerance, your strategy’s characteristics, and the current market conditions. Trading is not a one-size-fits-all method, so every trader needs to find their own approach that aligns with their style, knowledge, and preferences. To quickly learn how to fully use the exit strategies available in the ATAS platform, and to assess how they affect your performance, launch the ATAS Market Replay. It is an integrated simulator for traders. Analyzing statistics for the Replay account will help you find an acceptable balance between risk and potential profit without losing capital. Gain valuable experience in setting stop-losses and take-profits as if trading were happening in real time.Conclusions

When it comes to risk management, it is generally advised not to stake more than 2% of your total deposit on any single trade. However, a balance between risk and potential reward should ideally range from 1:2 to 1:3 or even higher. To effectively control risks and secure profits, ATAS offers exit strategies. These are tailored to provide users with flexibility, convenience, and help them maintain control over their portfolios, avoiding emotional decisions that could result in substantial losses. Download ATAS, professional software for working with exchange volumes. It is free. During the trial period, you will get full access to the platform’s tools to experiment with horizontal and other volumes. Moreover, you can continue using the program for free even after the 14-day trial period is over, whether it is for cryptocurrency trading and/or learning, conducting market analysis. Do not miss the next article on our blog. Subscribe to our YouTube channel, follow us on Facebook, Instagram, Telegram, or X, where we publish the latest ATAS news.Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.