Content:

- Calendar of economic events.

- Coronavirus attacks with a renewed vigour.

- Statistics supported bulls, while IMF supported bears.

- What to expect from the reporting season in the US.

- Stephen Roach: “The dollar is going to fall very, very sharply”.

- Gold and bitcoin are dollar alternatives

- Raw material markets are at 100 year low. Interesting opportunity?

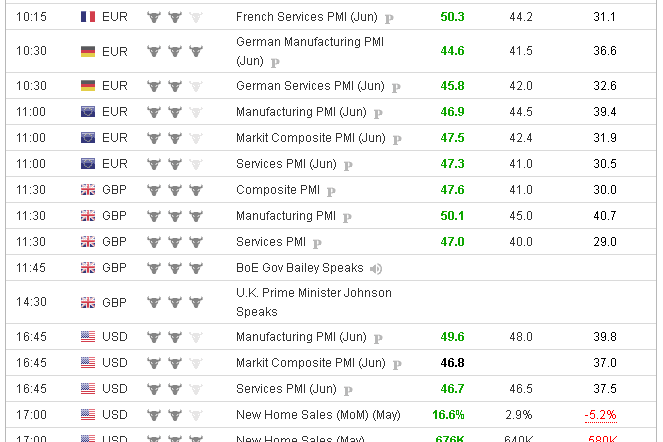

Calendar of economic events

| Time | Event | Impact |

| June 30, Tuesday

04:00 Moscow Time | China. Adjusted PMI (Purchasing Managers’ Index) in industry. | Oil, CNY, AUD, RUB. Previous value – 50.6, forecast – 51. |

| 17:00 Moscow Time | United States. CB (Conference Board) Consumer Sentiment Index. | USD, S&P 500. Previous value – 86.6, forecast – 90. |

| July 1, Wednesday | Russia. | Day off. No trading. |

| 15:15 Moscow Time | United States. Change of the employment level in the nonfarm sector from ADP (Automatic Data Processing Inc.) for June. | USD, S&P 500. Previous value – 2.760k, forecast – 3.500k |

| 21:00 Moscow Time | United States. Minutes of the US FRS Federal Open Market Committee (FOMC) meeting. | USD, S&P 500. |

| July 2, Thursday | United States. Change of the employment level in the nonfarm sector (Nonfarm Payrolls) for June. | USD, S&P 500. Previous value – 3.094k, forecast – 2.519k. |

| July 4, Friday | United States. Independence Day. | Day off. No trading. |

The ADP institute will publish the change in the US nonfarm private sector employment report on Wednesday and the official data from the Bureau of Economic Analysis (BEA) will be published on Thursday. It makes sense to avoid rolling margin positions overnight the day before.

Let’s also note that the Russian market will not work on Wednesday due to the national referendum and the American market will not work on Friday due to the main national holiday – Independence Day.

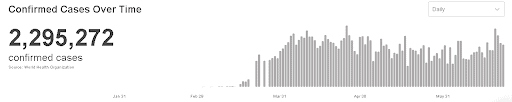

Coronavirus attacks with a renewed vigour

Coronavirus incidence statistics again took the first place in the business mass media headlines. The dangerous disease once again confirmed its craftiness and unpredictability. It is already evident that the infection seasonality is minimal and hopes to take the breather in summer are not fulfilled. Thus, the incidence in the US is again close to record-breaking – 20 to 36 thousand every day. Total death rate from the beginning of the epidemic reached 122 thousand people.

The quarantine easing doesn’t result in restoration of regular life against this background. People are just afraid of public places, which exerts influence on business. Thus, a wave of retail bankruptcies brews up in the US – restaurants and other service sphere businesses close en masse.

The most difficult situation is in Brazil, where daily incidence is more than 40 thousand and more than one thousand people die every day.

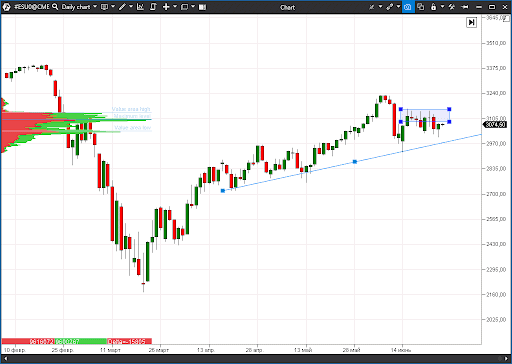

The main world stock indices lost 2-4% on this background. S&P 500 lost 2.59% while banks are again the drawdown leaders. However, the bulls bought out about a half of losses on Thursday under the ‘fall upon – it’s cheap!’ slogan. The S&P 500 index futures closed at the 3,083 point level. The volume accumulation area should be passed at the 3,100-3,150 point level for further growth.

Statistics supported bulls while IMF supported bears

Despite the complex situation, the business mood, on an average, improves. Thus, the preliminary PMI business activity indices were published on Tuesday.

One more positive weekly piece of news – the Chinese measures on stimulation of the economy may exceed all other leading countries. The Celestial Empire government published details of the program on easy-term loans and social provision in the amount of USD 4.2 trillion. It is a strong long-term positive development for raw material markets and Chinese stocks.

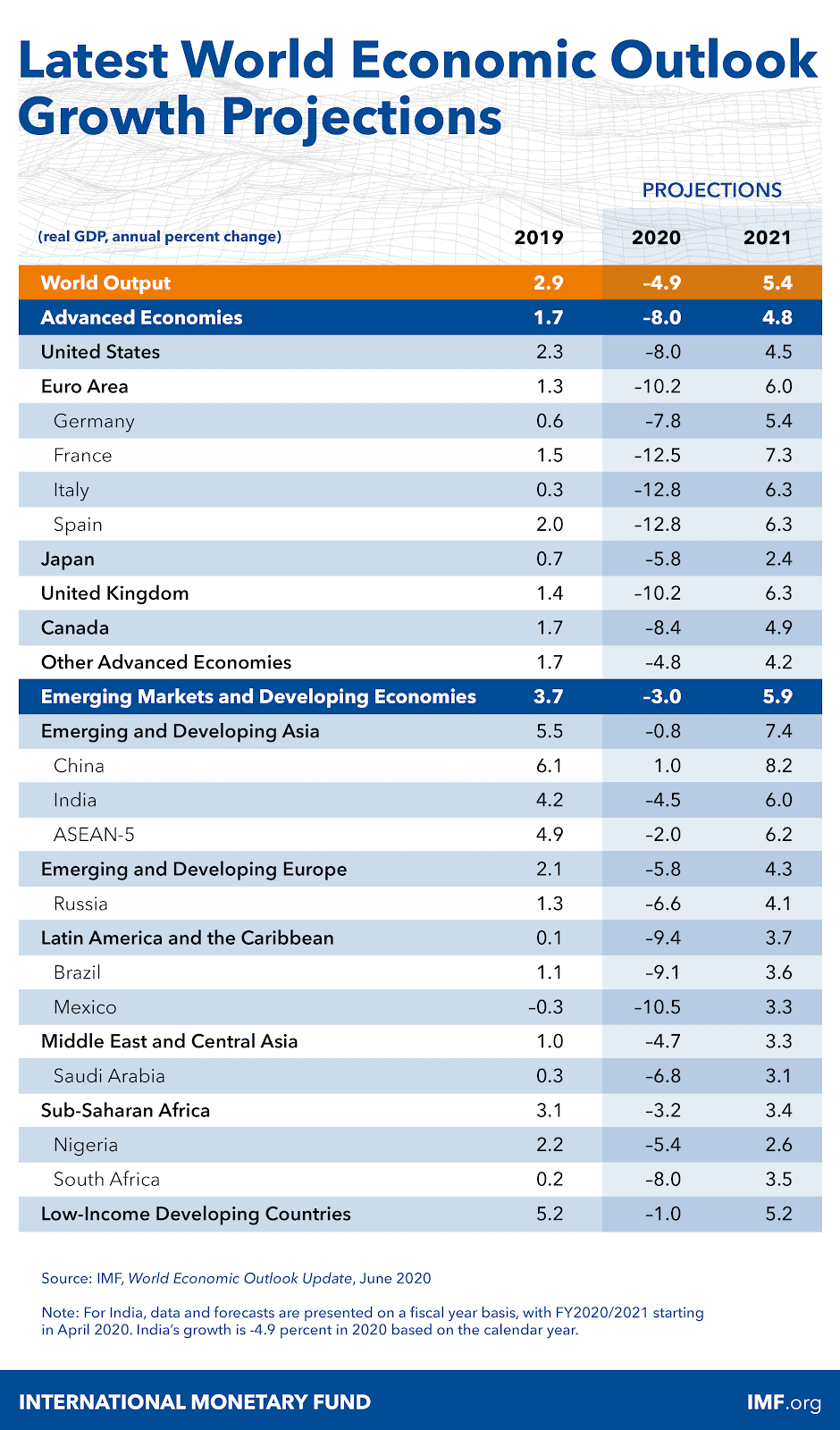

Meanwhile, the IMF put a big fly into the overall enthusiasm ointment. Analysts reviewed expectations in the world economy. Thus, if the previous forecast (published in April) spoke about 3% fall, now the forecasted fall is 4.9%. It could be the biggest fall since World War II. The world economy may grow by 5.4% in 2021.

As regards the key world risks, experts marked intensification of confrontation between the US and China before the presidential election, social unrest and oil market volatility.

It is fair to say that IMF forecasts are often inaccurate. Even the best world economists do not know the future. The Fund recognises it and assumes that adjustments of forecasts are quite possible after taking into account effective economic data.

What to expect from the reporting season in the US

Meanwhile, the investor focus moves from the macroeconomic statistics to the reporting season for the second quarter of 2020. We may quite probably observe a volatile flat before it starts.

A sharp fall of corporation profits due to corona-crisis is already included into market expectations for the second quarter. Company forecasts for the 3rd and 4th quarters would be of much bigger interest. It is because the stocks grow exceptionally on hopes that the situation would improve very fast. If it turns out that business is optimistic, it will support recovery of stocks, while deterioration of expectations on revenues and profits is capable of reversing the uptrend.

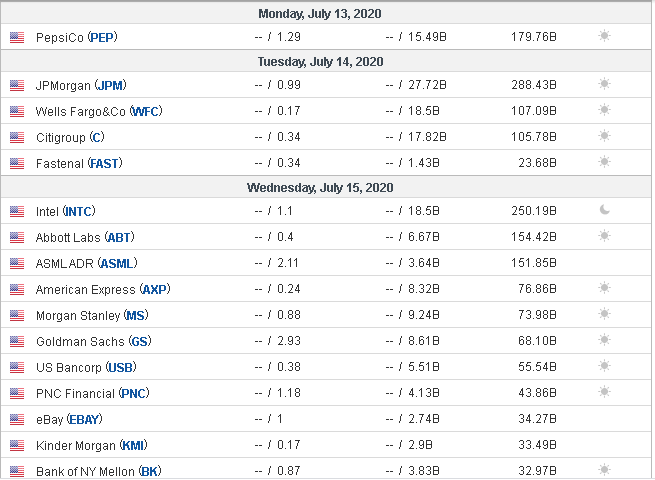

The active stage of the season in the US starts on July 13.The first quarterly results will be presented to investors by PepsiCo and largest banks. Microsoft will report on July 16, Facebook on July 22 and Amazon and Google on July 23. The hottest period will end on July 28 after the publication of the report of the most expensive company in the world as of today – Apple.

Stephen Roach: “The dollar is going to fall very, very sharply”

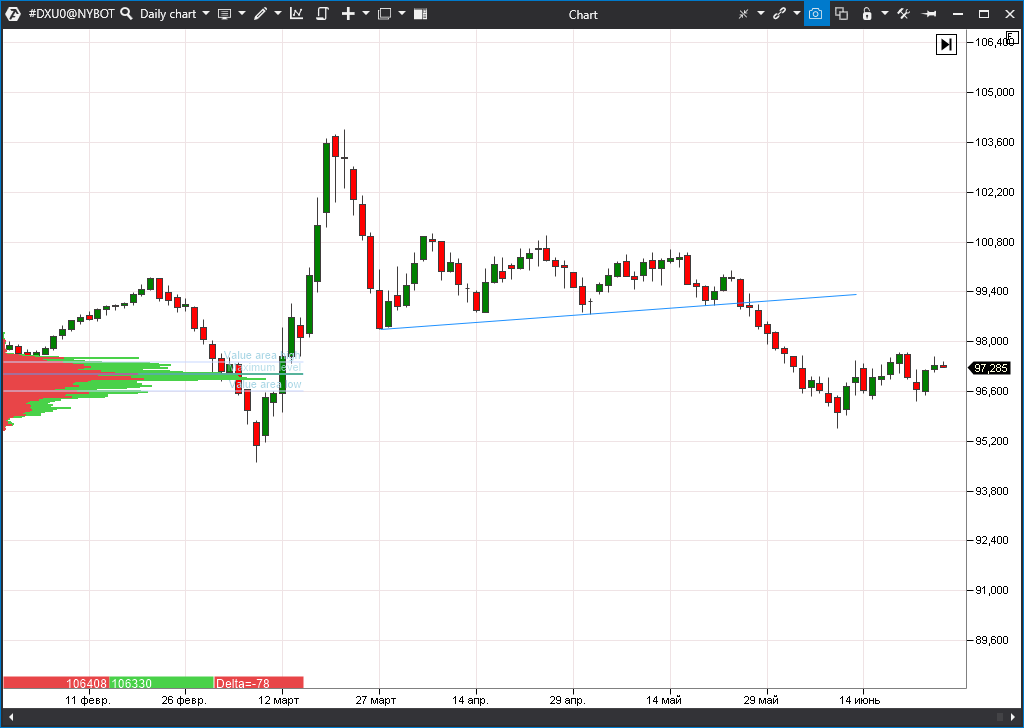

More and more often the world mass media speak about a possible devaluation of the US dollar. Thus, the former Chairman of the Board of Morgan Stanley Asia and one of the world experts of the Forex market Stephen Roach predicted the crash of the American currency.

“The US economy suffered from the macroeconomic disbalance for a long time, namely from a very low level of internal savings and chronic deficit of the current account. The dollar is going to fall very, very sharply”, – stated Roach in the CNBC interview. He believes that the fall may reach 35% with respect to other currencies.

However, the majority of experts didn’t support Roach’s dramatic point of view. The dollar is still the most popular risk avoidance instrument, which is very topical in times of a global crisis. A whole row of unfavourable events is required in order to undermine confidence in it.

Anyways, it makes sense to monitor the US trading balance. If statistics deteriorates, then the expert forecast would get a serious justification.

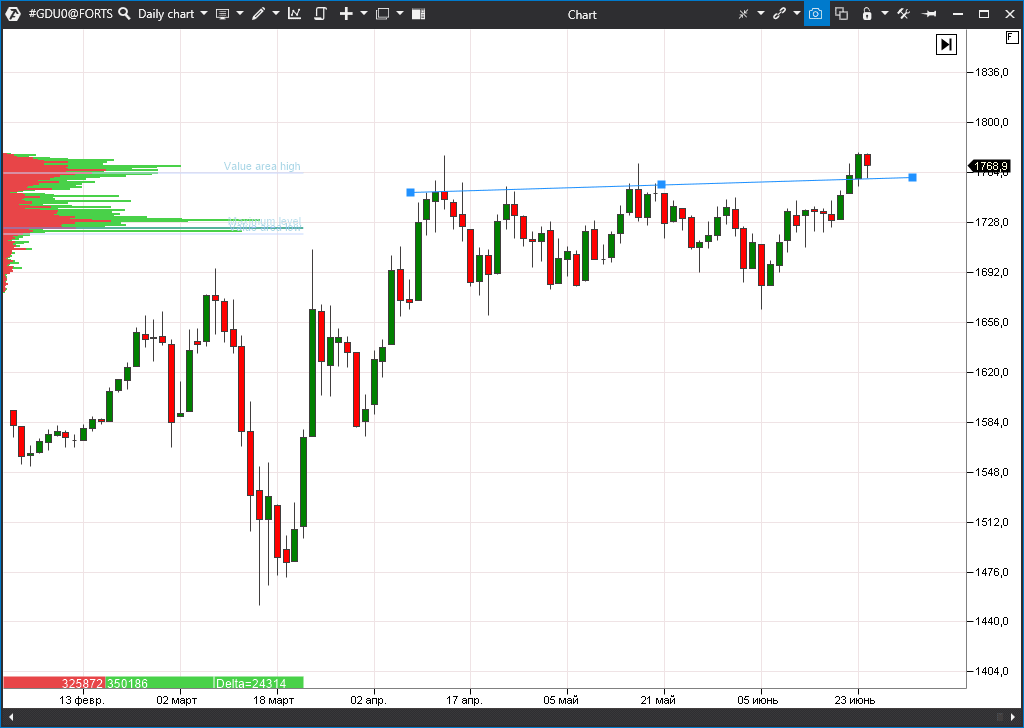

Gold and bitcoin are dollar alternatives

Those investors who believe in the dollar crash should pay attention to the most prospective alternative assets. In particular, it is gold, which, historically, feels itself well in times of crises. The gold price has been in the uptrend since November 2018 and there are no fundamental reasons yet for a reversal. Large-scale emissions of dollar, euro and other key currencies create a stable demand for protection against the world economy risks.

Bulls managed to break the resistance level near USD 1,750 per ounce at the beginning of the week, which opens movement to the area of historic highs (USD 1,920 per ounce) already in the current year.

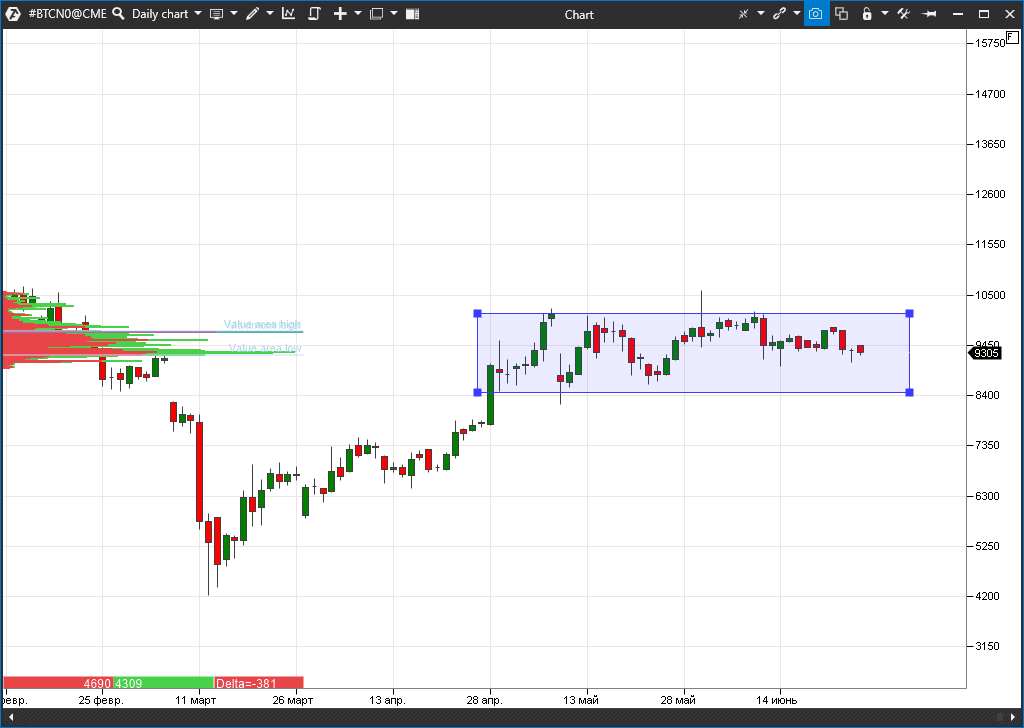

One more prospective alternative for classical currencies is Bitcoin. The value of the main cryptocurrency got stuck in a flat after a weeks-long growth.

Raw material markets are at 100 year low. Interesting opportunity?

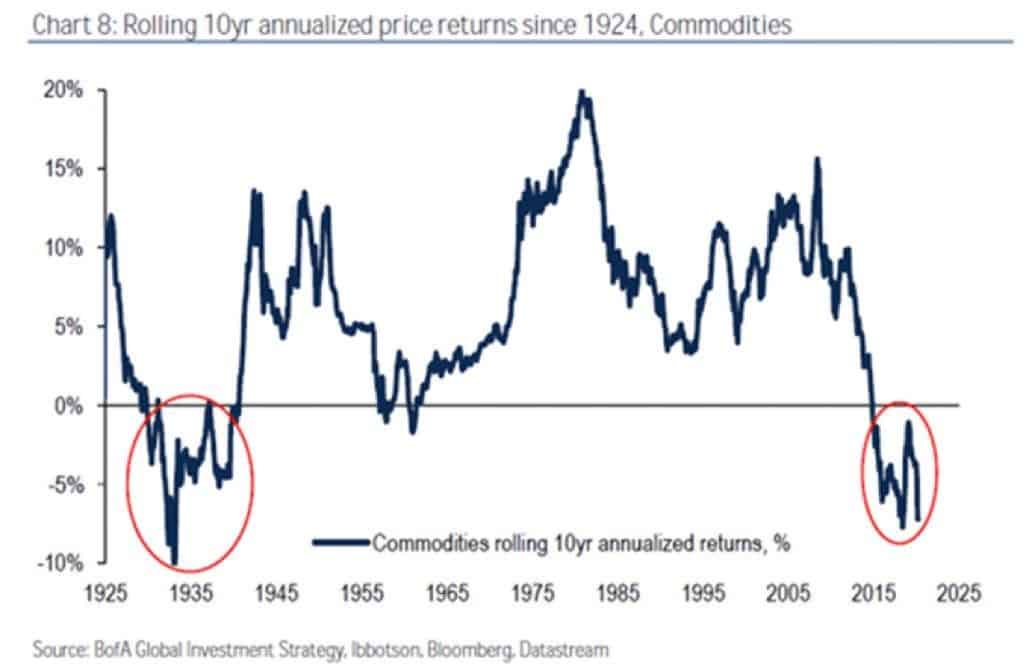

An interesting chart was prepared by the Bank of America economists. The trailing 10-year revenue of the commodity market is nearly at 100-year lows – from the times of the Great Depression of the 1930s. Due to the fact that the instrument revenues usually tend to mean values on big time periods, it opens rather good prospects for the recovery growth.

However, investors should also remember about significant raw material volatility. Buying commodity ETF (Exchange Traded Funds) is reasonable within the formation of a long-term investment portfolio, while new retracement waves are possible in the short-term perspective.