Calendar of economic statistics

Sell-outs in the world markets: for how long

TikTok left Microsoft and intended IPO

Elon Musk “charged” with the storage battery optimism

| Date, time (GMT +3:00) | Event | Impact. Forecast |

| Tuesday, September 29

17:00 | United States. CB Consumer Confidence Index in September. | USD. S&P 500. Forecast – 90, previous value – 84.8. |

| Wednesday, September 30

4:00 | China. Industrial PMI in September. | CNY. AUD. OIL. Forecast – 51.2, previous value – 51.0. |

| 11:55 | Germany. Unemployment level in September. | EUR. DAX. Previous value – 9K. |

| 12:00 | Eurozone. Level of consumer prices in September. | EUR. Forecast – 0.2%, previous value -0.2%. |

| Thursday, October 1

10:55 | Germany. Industrial PMI in September. | EUR. DAX. Previous value – 56.6. |

| 11:30 | Great Britain. Industrial PMI in September. | GBP. FTSE. Previous value – 54.3. |

| 17:00 | United States. Industrial PMI in September from ISM. | USD. S&P 500. Forecast – 56, previous value – 56. |

| Friday, October 2

15:30 | United States. Number of created working places in the non-agricultural sector (Nonfarm Payrolls) in September. | USD. S&P 500. Forecast – 913K, previous value – 1.027K. |

| Tuesday, September 29

17:00 |

| United States. CB Consumer Confidence Index in September. |

| USD. S&P 500. Forecast – 90, previous value – 84.8. |

| Wednesday, September 30

4:00 |

| China. Industrial PMI in September. |

| CNY. AUD. OIL. Forecast – 51.2, previous value – 51.0. |

| 11:55 |

| Germany. Unemployment level in September. |

| EUR. DAX. Previous value – 9K. |

| 12:00 |

| Eurozone. Level of consumer prices in September. |

| EUR. Forecast – 0.2%, previous value -0.2%. |

| Thursday, October 1

10:55 |

| Germany. Industrial PMI in September. |

| EUR. DAX. Previous value – 56.6. |

| 11:30 |

| Great Britain. Industrial PMI in September. |

| GBP. FTSE. Previous value – 54.3. |

| 17:00 |

| United States. Industrial PMI in September from ISM. |

| USD. S&P 500. Forecast – 56, previous value – 56. |

| Friday, October 2

15:30 |

| United States. Number of created working places in the non-agricultural sector (Nonfarm Payrolls) in September. |

| USD. S&P 500. Forecast – 913K, previous value – 1.027K. |

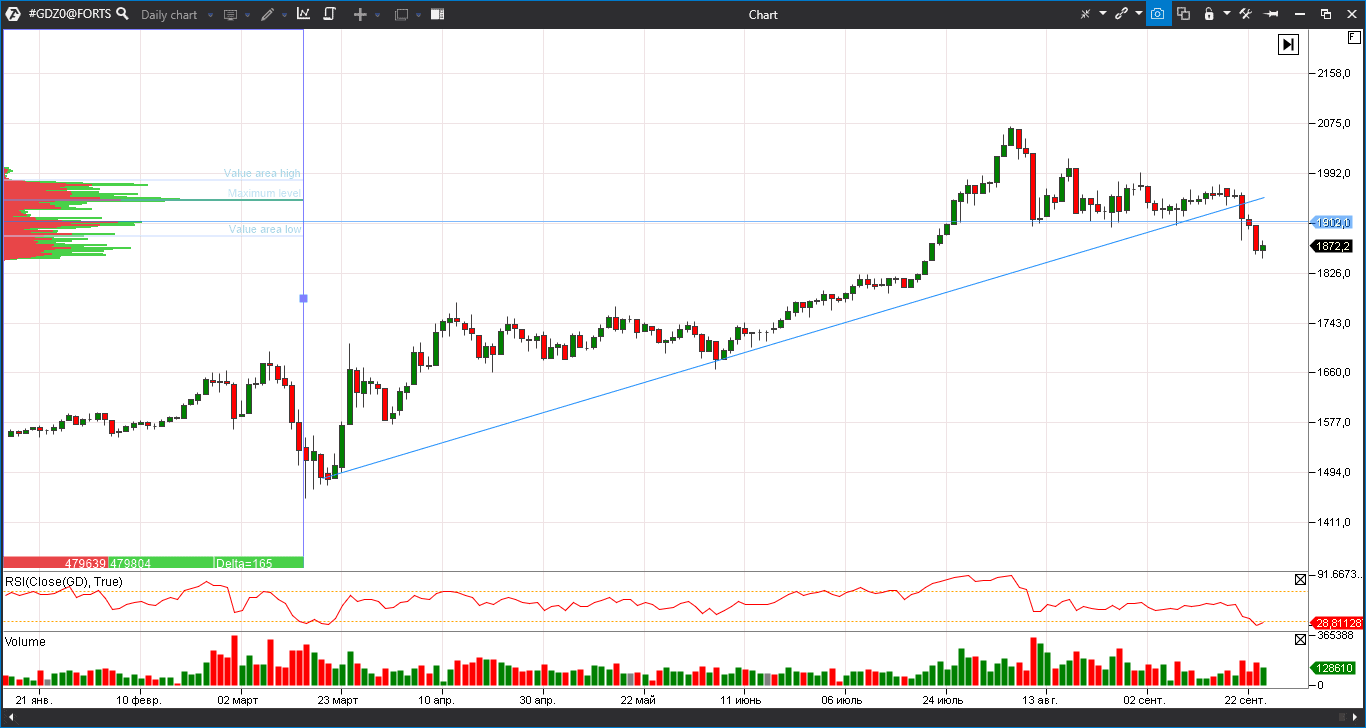

Sell-outs in the world markets: for how long

The main topic of the week is retracement continuation in the world markets. Besides, events of September 23 resembled March 2020 very much – investors got rid practically of all asset types. Especially of those, which managed to grow significantly from the beginning of the year.Thus, the fall in the technology sector, led by Apple and Google, continued, the euro was falling in the currency market and not a stone was left standing on silver in the precious metal market. The futures on the main ‘protective’ asset – gold – didn’t protect anyone from the retracement and also fell by more than 2% as well breaking the uptrend.

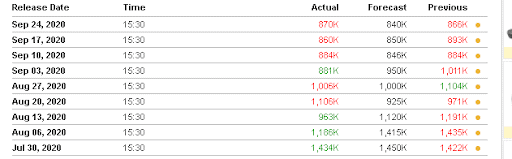

The unemployment news also does not look good – the number of jobless claims stopped to fall since the middle of August, which testifies to the fact that the US economy got stuck. On Thursday, this number turned out to be worse than the forecasted – 870 thousand claims against 840 thousand forecasted. Around 200-300 thousand claims a week had been filed before the crisis.

TikTok left Microsoft and intended IPO

Owners of the TikTok social network from the Chinese ByteDance holding intended an interesting game: how to sell its international subdivision profitably so that to make more money and not to lose control over it.We want to remind you that initially they didn’t plan to sell it if it were not for the rage of President Donald Trump. In the breaks between making posts on Twitter, Trump sailed into the social network as if for the Americans’ personal data ‘leak’ to the ‘enemies’ in the Chinese Government. The White House practically forces out the TikTok owners to find reliable owners in the United States under the threat of a complete business lock out.

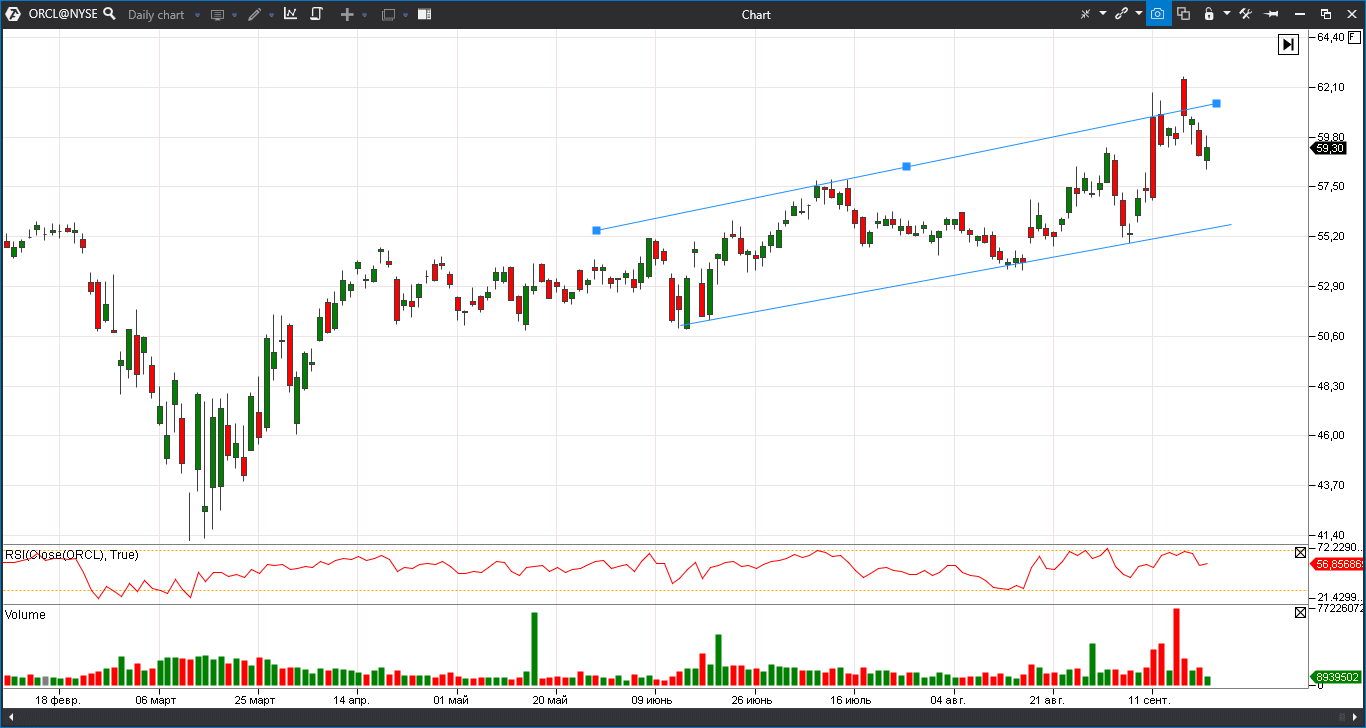

Elon Musk charged with the ‘battery’ optimism

Elon Musk follows the route of the legendary Steve Jobs. The businessman decided to present the Tesla key technology novelty products in the format of a large-scale international event. The show was named the Tesla Battery Day. The presentation was conducted on September 22 and new company plans were announced about development of new batteries, which are designed to strengthen Tesla leadership in the market.

Second, Tesla plans to refuse from the complex chain of the battery suppliers and build yet another plant in the United States, which would make the cars significantly cheaper and increase production volumes. In the future, the Tesla car should not cost more than USD 25.000 and the number of produced cars should increase to 20 million a year, given that the current number is 370 thousand.

Despite the bright prospects, the Tesla stock responded to the news with a fall. Investors were disappointed that construction of the new plant will be completed at the end of 2022 at the earliest, and investors already included the Tesla total superiority on all automobile fronts already here and now.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.