Market Analysis up to 2024

The fluctuation in Bitcoin’s price over the year highlights the exceptional volatility of the primary cryptocurrency asset: 2011: +954% 2012: +272% 2013: +4500% 2014: -76% 2015: +69% 2016: +161% 2017: +959% 2018: -72% 2019: +89% 2020: +302% 2021: +40% 2022: -65% In 2022, the cryptocurrency market faced one of its toughest periods, commonly referred to as the ‘crypto winter’. During this time, Bitcoin’s price dropped over 70% from its historical high reached in November 2021 when its value first exceeded $68,000 US dollars. The price drop affected the entire range of cryptocurrencies and was driven by various factors, including intensified regulatory pressure and a wave of bankruptcies among key market players like Terra Luna and FTX. 2023: +155% Since the beginning of 2023, the BTC/USD price started to show signs of recovery, shifting investor sentiment in the market. Optimism was steadily increasing due to the expectation of approvals for Bitcoin ETF funds. A survey conducted by Nasdaq revealed that 72% of financial firms out of the 500 surveyed were ready to invest in Bitcoin if the SEC approved spot ETFs. By the end of 2023, Bitcoin reached levels around $40,000 US dollars, reflecting the positive expectations of investors for 2024.Fundamental Factors Influencing Bitcoin’s Exchange Rate in 2024

The start of 2024 lived up to the optimism – as early as January 11th, the US SEC regulator approved applications for the creation of Bitcoin ETF funds. Let’s delve into how this and other factors will influence Bitcoin’s price in 2024.

Approval of Bitcoin ETFs (exchange-traded funds)

The approval of Bitcoin ETFs by the SEC led to a significant influx of institutional investments into this digital currency, as ETFs offer a simpler and safer way for traditional investors to put money into cryptocurrencies.

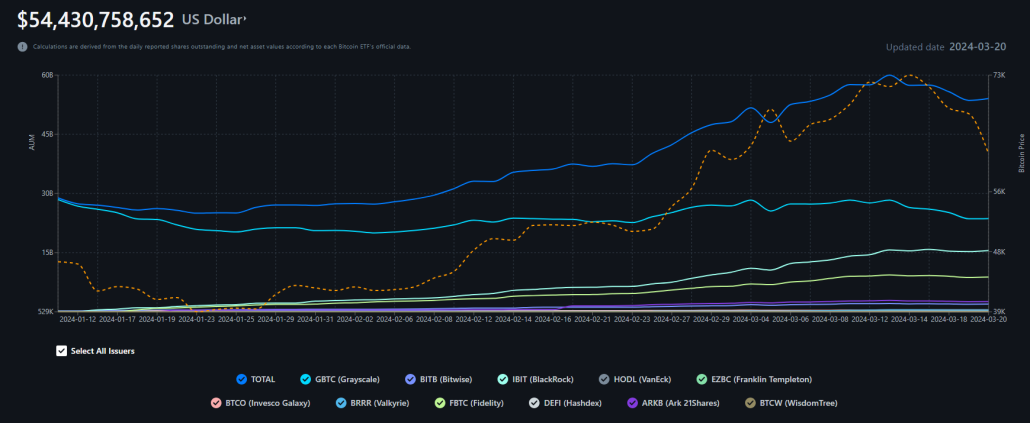

In the first 2 months alone, over $50 billion was invested in Bitcoin ETFs, reflecting strong demand forces (bullish driver).

Bitcoin Halving

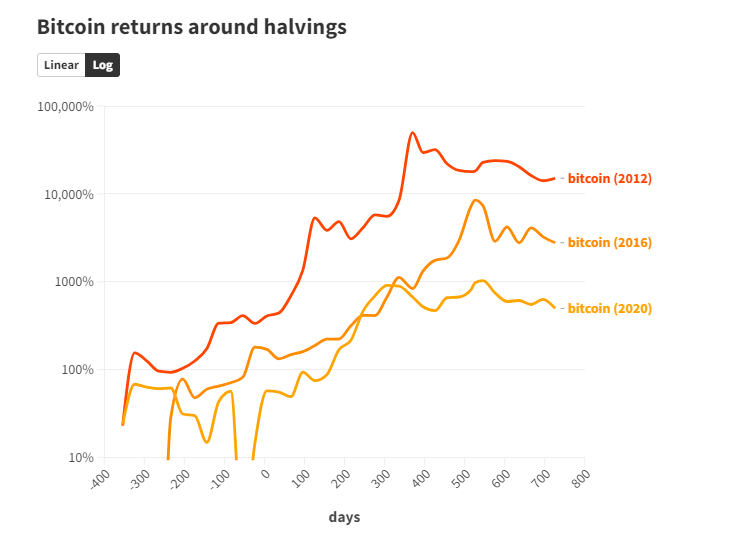

The next Bitcoin halving is set for around April 19, 2024 – an event that happens roughly every 4 years, reducing the block rewards miners receive by half. It is believed that halving contributes to the rise in the price of Bitcoin, as it leads to a reduction in the influx of new coins into the market amid constant or growing demand. However, there are concerns that the 2024 halving will once again increase interest in Bitcoin – pushing its price higher, as seen in previous instances.

The chart above depicts the percentage increase in Bitcoin’s price relative to the day of the halving (marked as 0). You can notice that with each halving, the price growth slows down. There is a possibility that this year, the impact of the halving will be even less pronounced. Additionally, analysts at JP Morgan have suggested that following the halving, Bitcoin’s price could decline to $42,000. Given the ‘buy the rumor, sell the facts’ phenomenon, this scenario seems quite possible.

Easing of Monetary Policy by the US Federal Reserve

After a period of tightening monetary policy in response to inflationary pressures, there is a strong chance that the US Federal Reserve will shift towards a more lenient approach. This move, which might entail lowering interest rates or implementing other stimulus measures, could potentially prompt greater investment in alternative and risky assets, including Bitcoin. This happens because in a low-interest-rate environment, traditional investments like bonds become less appealing, driving up investor interest in higher-yield opportunities.

US National Debt

Michael Hartnett, Chief Strategist at Bank of America, highlighted in his weekly column ‘The Flow Show’ that the US government debt is growing by $1 trillion every 100 days. This poses significant risks of devaluing the US dollar. Meanwhile, gold and Bitcoin – assets that reached historical highs in 2024 – are proving their effectiveness as hedges against risks associated with the ongoing expansion of the national debt bubble, as well as other global disruptions.

Forecasts for the Bitcoin Exchange Rate in 2024

The listed factors and other reasons can significantly influence Bitcoin’s market dynamics in 2024, setting the direction for its future movement.

- Stanley Druckenmiller. Speaking at the Robin Hood NYC Fireside Chat, the billionaire expressed his opinion that Bitcoin is comparable to gold as a means of savings.

- Larry Fink, CEO of BlackRock. He used to call Bitcoin the ‘index of money laundering’. But then he changed his mind. ‘The advent of the Bitcoin ETF is an example that we are legitimizing this asset class‘ – said Larry.

Positive Forecasts

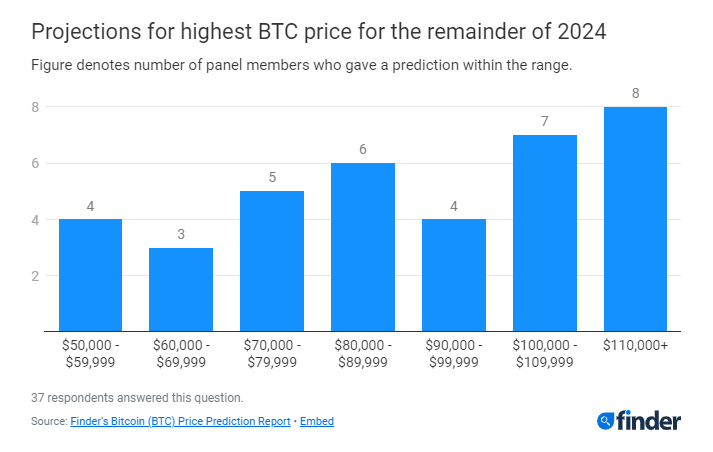

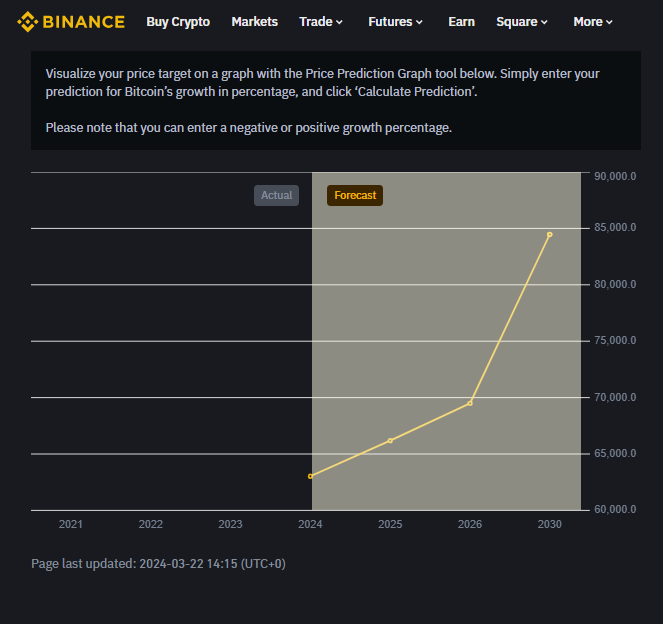

Michael Saylor, CEO of MicroStrategy – a company that holds over 214,000 Bitcoins on its balance sheet (as of March 2024) – suggested towards the end of 2023 that the price of Bitcoin could potentially reach an astounding $350,000 per coin in 2024. Cathie Wood, CEO of ARK Invest, believes that with the rise in institutional investments and innovative technological advancements, Bitcoin has the potential to reach $1,500,000 by 2030 in a bullish scenario. In a bearish scenario, the price could increase to $258,500, while in a base scenario, it could reach $682,800. Bernstein, a private asset management firm, predicts that by the end of 2024, the BTC price could hit $90,000, with the peak of the bull market in 2024-2025 reaching $150,000. This estimate was based on the potential approval of ETFs, which has already materialized and expects a gradual influx of investor capital. In March 2024, analysts at Standard Chartered Bank raised their Bitcoin price forecast for the end of 2024 to $150,000 (previously $100,000). The bank also anticipates that the BTC price will reach a peak during the bull market at $250,000 in 2025 before stabilizing around $200,000. Analysts at VanEck indicate that the Bitcoin price will reach a new all-time high in the fourth quarter amid the US presidential elections. Although they refrain from specifying an exact price, they suggest it could be around $100,000 per coin. The model developed by Binance takes a more cautious approach in its forecasts:

Negative Forecasts

JP Morgan, a prominent global investment bank, forecasts Bitcoin’s price to be $45,000 by the end of 2024, attributing this to the correlation between the rise in gold prices and cryptocurrencies. While analysts acknowledge the potential positive effects of the halving, their estimate falls considerably below the optimistic figures seen in other circles. Jim Rogers, a partner of George Soros at Quantum Fund, believes that cryptocurrencies will disappear and Bitcoin’s price will fall to 0, as he doubts the long-term value of this asset class. Peter Schiff, an economist and investor, shared his pessimism in a March tweet:‘Do you remember how bullish you all were in Nov. 2021 when Bitcoin traded $69K? I do. How many still have your laser eyes? A year later Bitcoin traded below $16K, almost 80% lower. Given that most are even more bullish now, an even bigger crash likely lies ahead.’

Possible Development Scenarios

Below you can see a Bitcoin price chart over 7 years. Looking at it (a logarithmic price scale has been used), it can be noted that the Bitcoin price is within an ascending channel (shown in blue):

- Growth remains steady. This represents the baseline scenario, anticipating a rise in the price towards the psychological threshold of $100,000 per Bitcoin. The price will reach the median line of the channel, which may serve as resistance.

- Growth accelerates. This optimistic scenario suggests that amidst prevailing optimism, the price will break into the upper half of the designated channel.

- Growth slows down or halts. This is a negative scenario, where bears may take control and push BTC/USD towards the lower boundary of the channel. Or even lower.

How to Trade Bitcoin in 2024

With the increasing interest in Bitcoin prices and the uncertain future ahead, you can take advantage of short-term fluctuations in the cryptocurrency market. Here is what you will need:- A cryptocurrency exchange account.

- Starting capital.

- Trading software.

- Connectors that provide a secure connection to crypto exchanges such as Binance, ByBit, OKX, and more. Instructions are available in the Knowledge Base.

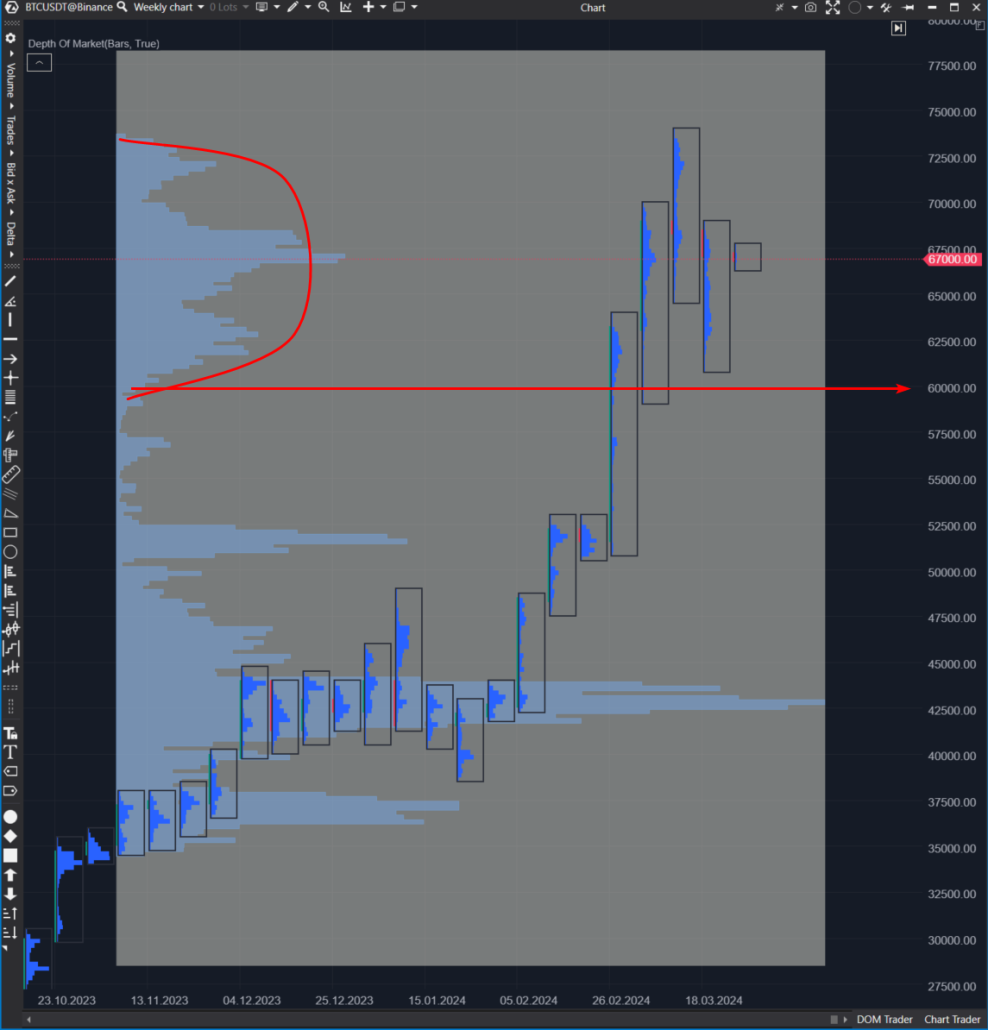

- Footprint Charts. Cluster charts offer filtering options and delta display, providing hundreds of variations.

- Crypto Chart Trader. Trading panel equipped with volume calculation functions, margin adjustment, and automatic exit strategy settings.

- Advanced indicators: Big Trades, DOM levels, Market Profiles, Cluster Search, Speed of Tape, and others.

- Additional features: Smart DOM, Smart Tape, Following Manager.

- Market Replay. A trading simulator then enables you to trade not only Bitcoin but also other cryptocurrencies using a detailed historical database. You do not risk your real capital.

FAQ

How can I check the Bitcoin exchange rate online? Just ask Google, it will show you a simple chart of the exchange rate fluctuations and a Bitcoin price calculator in your local currency. What is the Bitcoin exchange rate for today? Refer to the answer above. Download ATAS for free, and you will not only be able to check today’s exchange rate but also analyze its historical changes across different exchanges. Now you know where to track the Bitcoin rate. What is the actual Bitcoin exchange rate? The exchange rate of a cryptocurrency (like any other financial asset) is determined by the balance of supply and demand. While the production cost (mining) may suggest a different rate, the actual exchange rate is typically determined by the price of the most recent transaction on the spot market. How to forecast the Bitcoin to dollar exchange rate? Apply volume analysis – this method enables you to assess the balance of supply and demand forces. If they are imbalanced, it signals a potential trend development. If they are balanced, the market tends to stay within a range, indicating that the price satisfies both buyers and sellers. By monitoring volume fluctuations, you can identify significant support and resistance levels and make reasoned forecasts, particularly in the short term.Conclusions

The Bitcoin exchange rate in 2024 and the overall state of the cryptocurrency industry will continue to be topics of intense scrutiny and discussion. Considering the ever-changing nature of the market, investors should approach their investment strategies with caution and diversification. It is important to recognize that none of the forecasts can guarantee accuracy, and 2024 might represent a pivotal moment for Bitcoin’s acceptance as an asset on regulated financial markets. To improve your chances of success in the cryptocurrency market, consider using a specialized trading platform like ATAS. It offers a powerful toolkit for Bitcoin trading, including professional cluster charts, helpful indicators, and numerous other benefits. Download ATAS. It is free. During the trial period, you will get full access to the platform’s tools to experiment with the DOM and footprint charts. Moreover, you can continue using the program for free even after the 14-day trial period is over, whether it is for cryptocurrency trading or volume analysis. Do not miss the next article on our blog. Subscribe to our YouTube channel, follow us on Facebook, Instagram, Telegram or X, where we publish the latest ATAS news. Share life hacks and seek advice from other traders in the Telegram group @ATAS_Discussions.Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.