- main facts about Litecoin;

- history of the Litecoin network;

- reasons of emergence;

- differences between Litecoin and Bitcoin;

- how the Litecoin network is used;

- whether it makes sense to buy Litecoin;

- where to learn about LTC capitalization;

- what the current Litecoin exchange rate is;

- history of sensational fake news about Litecoin;

- exchange rate forecasts.

Main facts about Litecoin

Litecoin is considered to be the first alternative cryptocurrency. It was introduced on October, 13, 2011, with the aim to become ‘silver to Bitcoin’s gold’ and is still one of the main cryptocurrencies with respect to market capitalization. Initially, Litecoin was intended to be not as a contender for leadership, but as a certain Bitcoin alternative. That is why Litecoin is one of the cryptocurrencies which are called altcoins. As well as Bitcoin (BTC), Litecoin operates on a blockchain with an open source code, which is not controlled by any central authority. Every operator of a Litecoin node has a copy of every block chain in order to guarantee that new transactions do not contradict the whole history and miners help to process new transactions, including them into mined blocks.

History of Litecoin emergence

Litecoin was developed by Charlie Lee, a graduate of the Massachusetts Institute of Technology.

Reasons of Litecoin emergence

Lee announced development of Litecoin on the Bitcointalk forum in October 2011 and noted that he wanted ‘to create a coin which would be silver to Bitcoin’s gold’. He used the best innovations of Bitcoin and other alternative cryptocurrencies, which were active at that moment. The cryptocurrency was developed after Lee ‘played with the Bitcoin code base’, trying to create a Bitcoin blockchain fork*. According to him, initially it was ‘mainly an interesting side project’ but later it received in-depth development. * Fork, in simple words, is a new network version which starts to develop in its own way after introduction of some changes in the previous version. Litecoin distinguished itself among other alternative cryptocurrencies due to innovations, which include a combination of higher speed of working with block chains and using the Scrypt hashing algorithm. He also largely avoided so-called premining, which allowed cryptocurrency developers to mine coins on the basis of the blockchain before a project was accessible to all. Initially, premining was used as remuneration to project developers and for financing its further development. At that time, many community members wanted alternative currencies with a fair start. Charlie Lee took heed of these motives and stated that one person or a small group of people, who control a big number of coins and use them at their own discretion, ‘contradict with a decentralized vision of cryptocurrency’. Nevertheless, Litecoin had a small premining. In general, 150 LTC were premined as genesis blocks (fundamental blocks in the network). When Litecoin was launched, the reward for mining one block was LTC 50, which was a very small amount at that time.Differences between Litecoin and Bitcoin

The main similarity is that Litecoin, as well as Bitcoin, is a peer-to-peer (P2P) cryptocurrency based on blockchain. The last Bitcoin and last Litecoin will be mined simultaneously. However, LTC was developed to eliminate some supposed Bitcoin shortcomings, that is why Litecoin and Bitcoin have some key differences. Besides, the 1:4 proportion is typical for them. Halving (decrease of remuneration for mining) takes place in the Bitcoin network every 210,000 blocks, while in the Litecoin network it takes place every 840,000 blocks. LTC supply is limited to 84 million coins, while only 21 million Bitcoins can be mined. Since Litecoin blocks are four times faster, the difficulty of mining in its network changes faster. Litecoin was designed in order to make it easier for sellers to receive payments, that is why transactions are performed faster than in the Bitcoin blockchain. On an average, one Litecoin block is mined in two and a half minutes, which is 4 times faster than 10 minutes for the Bitcoin network. It means that sellers, who accept only safe transactions, should not wait for one hour to get six confirmations in the network. While Bitcoin applies the SHA-256 hashing algorithm, Litecoin applies Scrypt. The Scrypt hashing algorithm was developed specifically to avoid potential attacks and to provide better protection from brute-force attacks. One more specific feature worth mentioning is that the Litecoin consensus algorithm requires more storage space.Litecoin as ‘a guinea pig’

Initially, Bitcoin and Litecoin are similar, that is why they may have similar upgrades. These improvements are often directed at providing scaling functionality for processing a bigger number of transactions per second without harming decentralization and confidentiality of transactions. Litecoin often implements them in the first instance, since a serious error in its network will bring less harm than in the Bitcoin network.Segregated Witness (SegWit)

One of the first functions, realised in the Litecoin blockchain before adding it in the Bitcoin network, was Segregated Witness (SegWit). Although SegWit was offered for the first time, namely, for Bitcoin in 2015, Litecoin was the first one which introduced this technology. SegWit significantly helps to scale operations with cryptocurrency, ‘dividing’ digital signature data for every transaction, allowing better functionality under the network constraint conditions. Litecoin introduced SegWit at the beginning of 2017. The technology was added to the Bitcoin network after its operation hadn’t shown serious incidents in LTC.Lightning network

Lightning network is yet another solution for scaling. It creates, sort of, an additional ‘layer’ over the blockchain, in which operations are quick and fees are very small. This additional ‘layer’ consists of payment channels created by users. Initially, Lightning was developed for realisation on the Bitcoin blockchain. However, as was the case with SegWit, it was realised for the first time on Litecoin in order to test the Lightning Network in a real economic environment.Does it make sense to buy Litecoin?

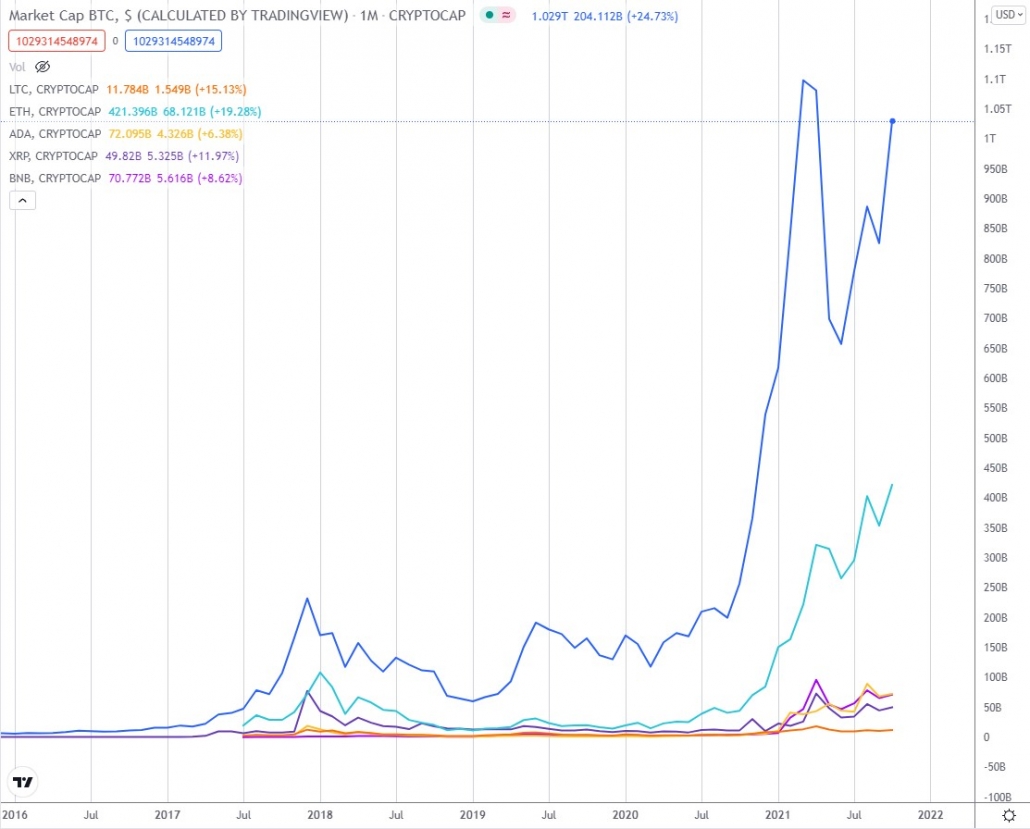

One Litecoin cost less than USD 2 in 2013 and 2015, while in October 2021, at the time of its 10-year anniversary, its value rose to USD 170. The Litecoin chart below shows the progress for 8 years (a logarithmic scale is used).

| December 2017 peak | Spring 2021 peak | |

| Bitcoin | USD 20,000 | USD 64,000 (+220%) |

| Ether | USD 1,400 (January 2018) | USD 4,380 (+210%) |

| Litecoin | USD 370 | USD 410 (only +11%) |

Where to learn about Litecoin capitalization

In order to see the current value of Litecoin capitalization (total value of all coins), we recommend that you use the ‘coinmarketcap.com’ web-site. The name stands for Coin Market Capitalization (it tracks capitalization and other data of 6 thousand cryptocurrencies). You will find more useful resources on cryptocurrencies in this article.

Current Litecoin exchange rate

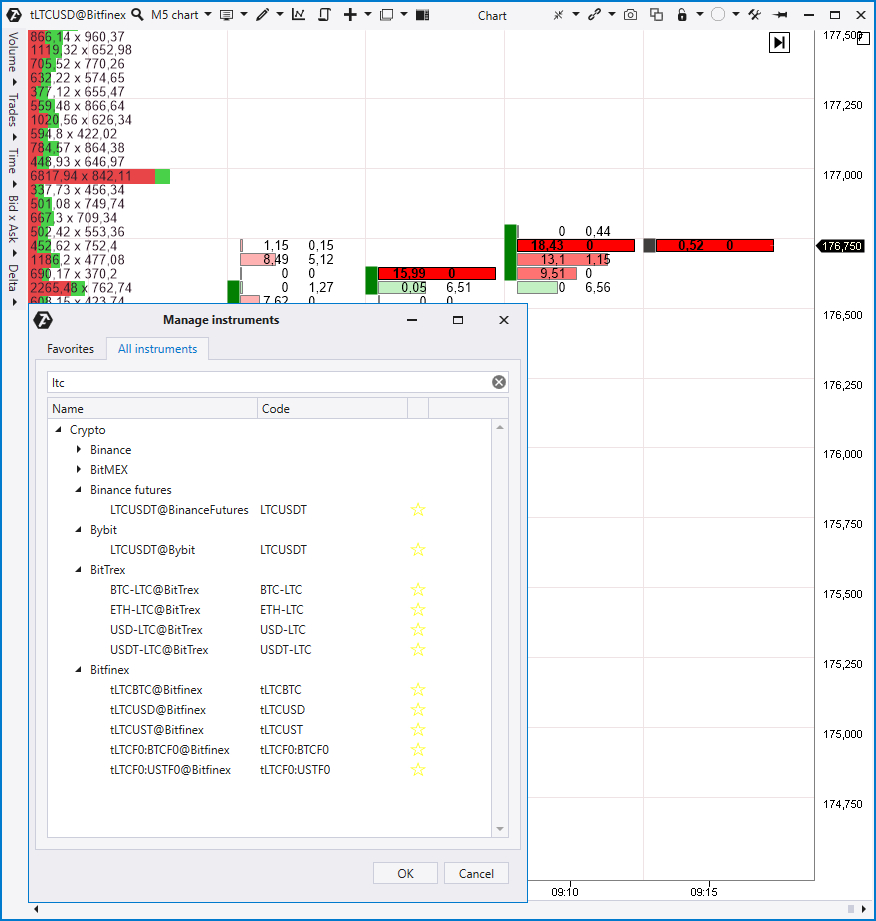

In order to get real-time data about the current value of Bitcoin, Ether, Litecoin and other digital assets directly from cryptocurrency exchanges, you can download the professional ATAS platform.

Sensational fake news about LTC and Walmart

News appeared on Monday, September 13, that Walmart, one of the biggest retailers in the world, plans to start accepting Litecoin as a means of payment. The Litecoin value exploded. Cryptocurrency fans were mad with joy. The news was accepted as a true one, because there had been a lot of discussions on cryptocurrency resources that Walmart opened a cryptocurrency specialist vacancy. The main mass media, such as CNBC and Reuters, circulated this sensation about Walmart and Litecoin.

- Number 1 marks the area when the price grew above USD 220, but the growth stopped after that, despite the fact that market sells were registered. Green clusters confirm the demand availability. However, inability of the price to grow under conditions of demand availability is a bearish sign.

- Number 2 marks the area where sellers clearly emerged. They efficiently overcame demand leftovers and pushed the price down.

Litecoin exchange rate forecasts

There are very many factors that influence the Ether value. In total, they compose demand and supply forces. The value changes as soon as one force outweighs another. That is why the LTC price goes up and down from time to time. Investment banks and blockchain specialists do not pay much attention to Litecoin, that is why we didn’t find trustworthy points of view with respect to Litecoin price forecasts on the Internet. We will try to formulate our own opinion. This skill is more important than the ability to google forecasts of investment bankers. The trading and analytical ATAS platform with direct connections to cryptocurrency exchanges will help you to assess the market. The platform allows building cluster charts which clearly show buyers’ and sellers’ behaviour.

- 130 (marked with number 2);

- 180 (marked with number 3);

- 220 (marked with number 4).

Conclusion. How to make money trading Litecoin.

Despite the fact that Litecoin is not among top 10 cryptocurrencies by capitalization, the LTC/USD market is very active and its cluster charts periodically ‘draw’ setups for entry with a low risk and high profit potential. Pay attention to the cryptocurrency exchange futures, if you want to speculate on LTC/USD exchange rate fluctuations. They allow to derive benefits ‘with leverage’ both on the price increase and decrease. Moreover, futures are traded with lower commission fees and are very liquid. In order to start trading LTC/USD futures on a cryptocurrency exchange, you will need:- Startup capital. Since trading small Litecoin fractions is accessible to all, you will need USD 100 and even less to start with. Moreover, you can trade on your demo account without any risk for your real capital.

- Registration on a cryptocurrency exchange.

- A professional trading terminal for a quick execution of trades and situation analysis. Download ATAS – this platform is free for trading cryptocurrencies and has a lot of advantages.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.