Review of the top 9 cryptocurrency exchanges

In this review, we will consider the most popular exchanges where cryptocurrencies are traded. The goal of the review is to help the reader to make a selection of what cryptocurrency exchange to open a trading account on.

Besides, we will not focus on technical issues, such as how to:

- register on the exchange;

- pass verification;

- move in/out funds;

- post orders.

We just want to share our own ideas about different exchanges, so that you could form your own opinion on each of them. We consider the following as the basic criteria:

- safety and protection of funds;

- commissions;

- ease of use of an exchange.

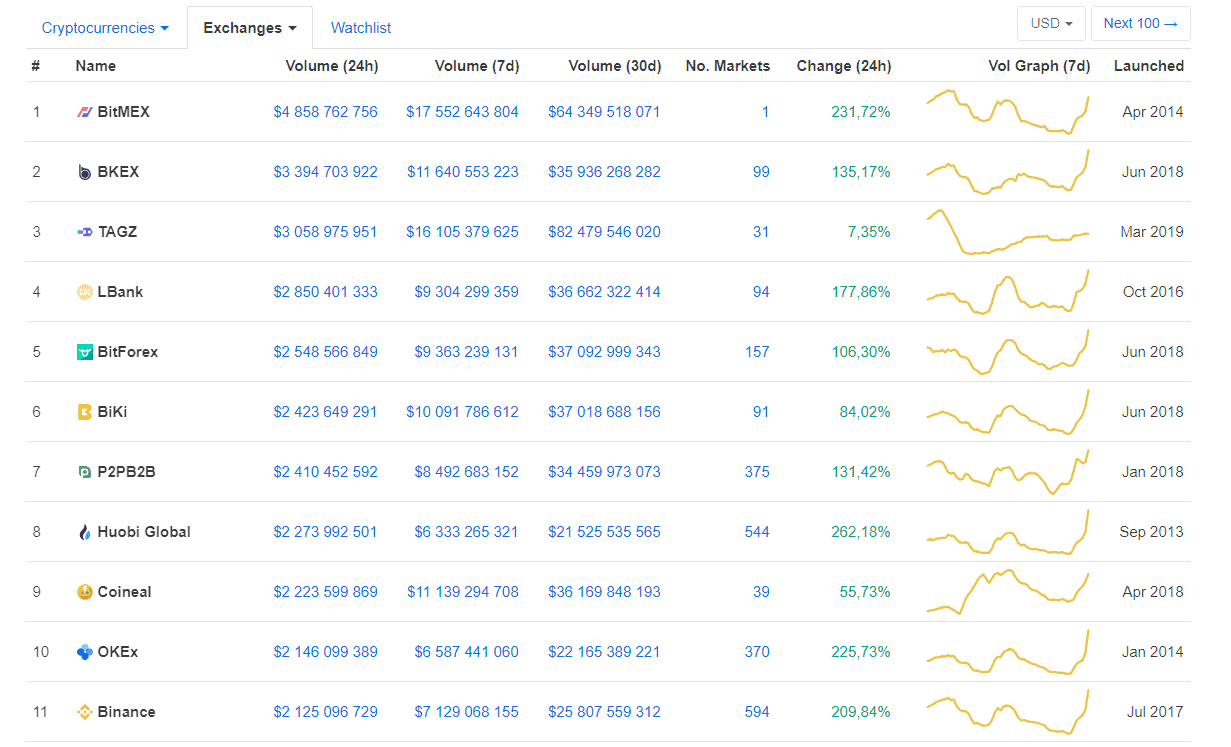

Popularity of a cryptocurrency exchange is characterized, as a rule, by high trading volumes. We can receive information about volumes of executed operations on the aggregator’s web-site: coinmarketcap.com. The Exchanges section contains data of the total trading volumes of exchanges (see the screenshot below).

In this article, we will consider the top 10 exchanges. The first one is Bitmex, which started to operate in 2014.

1. Review of BitMEX

Web-site: https://www.bitmex.com

As of the moment of writing this article, this is the most popular crypto-exchange in the world.

BitMEX fully belongs to and operates under control of HDR Global Trading Limited, registered in the Republic of Seychelles.

The main specific feature of the exchange is that it was one of the first ones that launched derivative trading. It means that the exchange trades financial derivative instruments, such as forward futures (what futures are) and perpetual contracts, rather than cryptocurrency itself. This type of trading could be compared with trading futures on the CME or Moscow Exchange.

In fact, derivative trading is very similar to cryptocurrency trading with the exception that your account always stays in bitcoins on BitMEX. The prices on such derivatives move synchronously with the prices on basic cryptocurrencies.

The BitMEX list of traded derivatives is rather small compared to other exchanges. That is why, it might seem to you, at first sight, that a cryptocurrency trader has nothing to trade with on the exchange.

BitMEX offers two derivatives only, which serve as analogs of the cryptocurrency pairs – BTC/USD and ETH/USD and also six derivatives, which are similar to crypto-pairs:

- ADA/BTC;

- BCH/BTC;

- EOS/BTC;

- LTC/BTC;

- TRX/BTC;

- XRP/BTC.

However, the quantity here is inferior to quality, since these cryptocurrency based products are very attractive.The XBTUSD perpetual contract on BitMEX attracts so many traders not without reason. BitMEX itself calls this market the most liquid one in the world.

Apart from standard derivatives, BitMEX trades the bitcoin up and down contracts, which, in fact, are very similar to the option call and put contracts. Such contracts could be useful for those who don’t want to tolerate high risks but want to make high profit instead. A specific feature of each of such contracts is that the risk of the contract buyer is limited only to the premium paid for it, while the potential profit could be any, depending on how high or low the bitcoin exchange rate moved.

It might seem, at first sight, that such a scarce variety of trading instruments would scare away all traders, but, in fact, it is not so.

BitMEX offers its customers a possibility to trade with up to 100:1 leverage. Moreover, the exchange successfully supports:

- narrow spreads, which is important in cases of price slippage at stop losses. Also, narrow spreads (what spread is) are necessary for short-term trading;

- good liquidity in the BitMEX order book.

These features make the exchange attractive for experienced traders, whose goal is not a long-term investing but a speculative income on price fluctuations. That is why the exchange provides instruments with the best volatility and liquidity.

Depending on the type of the posted order, a commission on BitMEX could be either positive or … negative (!). For example, in the event a trader works on the exchange as a market maker (that is he posts limit / pending orders), the commission would be minus 0.025% when this order is activated, which means profit. If a trader prefers to enter ‘with the market’, the commission would be 0.075%, which falls on the trader’s shoulders. If you want to learn more about the difference between the market and limit orders, read the article about order matching.

It makes sense to pay attention to the fact that the exchange infrastructure uses high-rate databases and functionality written in kdb+. Just for your information – this database is used by the top 10 investment banks and many hedge funds. High rate of the exchange operation makes the introduction of algorithmic trading attractive.

It should be noted that developers pay due attention to the friendly interface of the exchange. To achieve it they minimized the working space, made it easy-to-understand and convenient and reference materials allow to clear out any issue with respect to trading and derivative financial instruments themselves. Moreover, this information is available in different languages.

The exchange assigns a significant role to the risk management system. Thus, BitMEX established an insurance fund for ensuring:

- stable operation;

- reasonable level of a guarantee of receiving a profit.

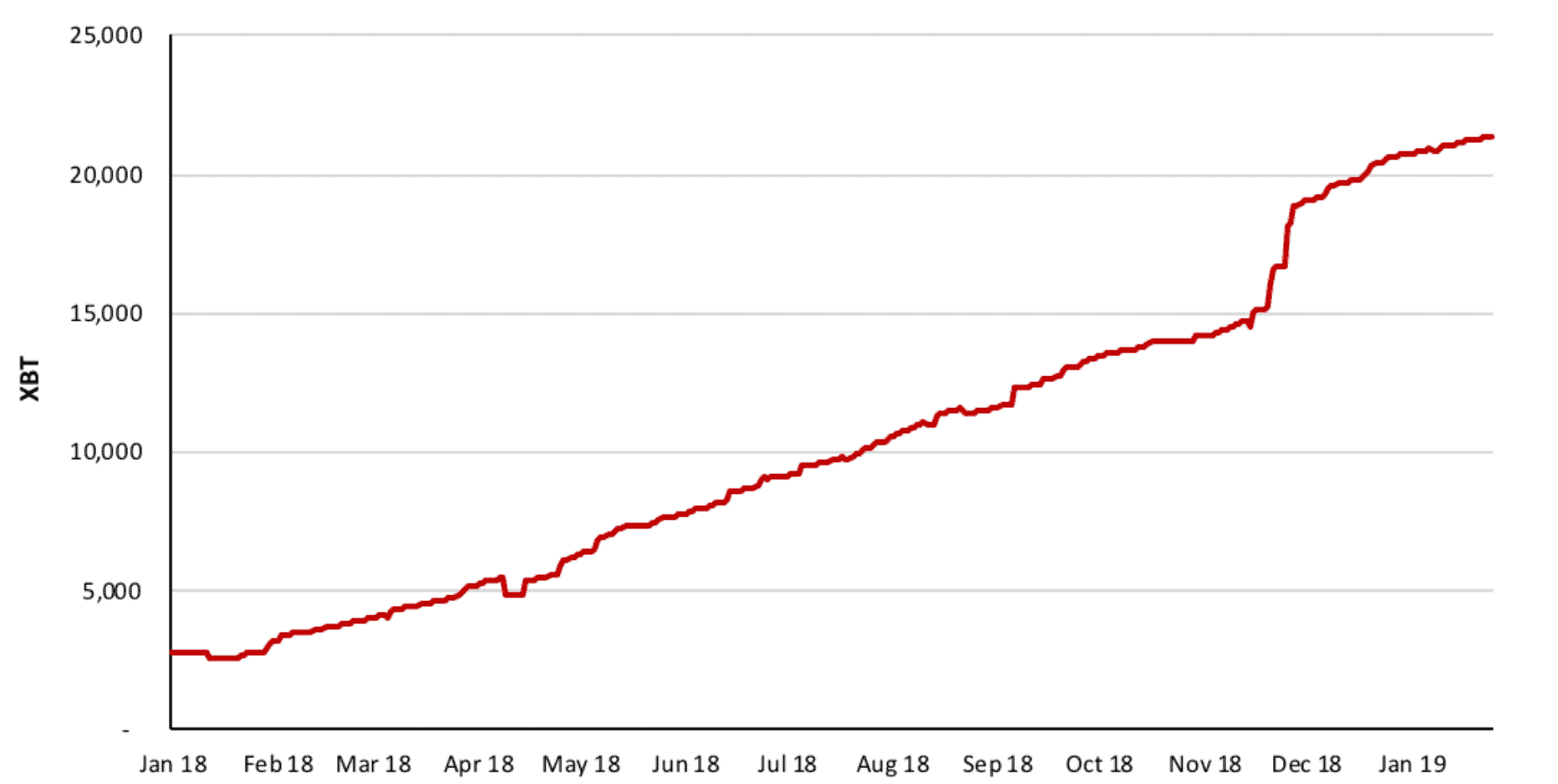

Similar measures are applied on major commodity and futures exchanges, such as CME, which have clearing houses. The volume of the BitMEX insurance fund is increased every month and it can be seen in the chart below, which presents information from the exchange’s official web-site.

The constant growth of the insurance fund shows that the BitMEX management attracts new funds, the sources of which are interested in supporting the exchange stability and developing trade in the cryptocurrency market.

We just want to add that the exchange developers are maximally focused on strengthening safety, due to which there haven’t been any cases of hacking and bitcoin stealing from the user wallets. The BitMEX security system guarantees that even in the event of a complete system hacking, a hacker will not have access to a sufficient number of keys required for stealing funds.

2. Review of BKEX

Web-site: https://www.bkex.com

BKEX was launched in June 2018. BTC King Technology Limited, which manages the exchange, is registered in the British Virgin Islands, however, judging by abundance of the Chinese language in the exchange interface, the main market of the exchange is China.

The exchange offers more than 100 cryptocurrency pairs for trading and new coins are constantly added to the listing. The exchange circulation takes top places every day on Coinmarketcap, however, you can find information on the Internet that the exchange artificially boosts the trading volume.

In fact, many exchanges did the same, even the famous ones. High competition among cryptocurrency exchanges forces new exchanges to use prohibited methods to get into the first lines of ratings. However, we think that to start relations with deception is a bad manner and disrespect to a customer.

BKEX envisages the same commission of 0.2% both for makers and takers, which testifies to a good appetite of the exchange owners, since you may find exchanges, which work for smaller commissions.

The English language interface has many inaccuracies.

You can deposit your account in any traded cryptocurrency, which allows using the exchange as a currency exchange office. Perhaps, this is the only advantage of the exchange among all its disadvantages.

Having analyzed other sources, we are convinced that this exchange could be used only for exchanging cryptocurrencies and is not good for systematic trading.

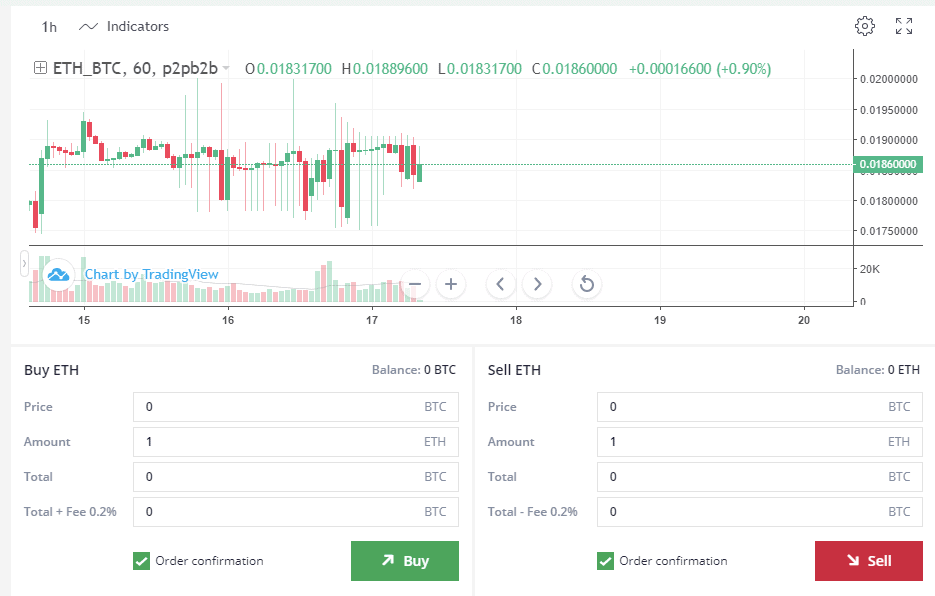

3. Review of P2PB2B

Web-site: https://p2pb2b.io

The exchange was established in 2018 and registered in Estonia with the headquarters in Switzerland. The exchange got into the top 10 cryptocurrency exchanges in trading volume only several months after its launching.

Such a powerful start should set on the alert since gradual taking of the market would be normal under conditions of such a strong competition (there’s no room to swing a cat in the cryptocurrency market). It suggests that the trading volume doesn’t reflect the real situation. However, we haven’t found any specific information about it and the exchange hasn’t been involved in large scandals.

The exchange web-site supports 8 languages, which means that the exchange owners seriously plan to conquer a share of the world market.

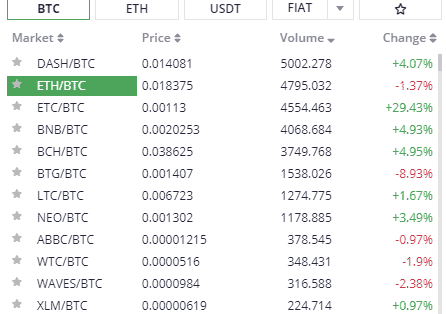

More than one hundred various cryptocurrencies are traded on the exchange to Bitcoin, Etherium, USDT and Fiat. Fiat includes both USD and EUR.

The exchange interface is developed in the ‘reserved’ style and the working space is organized in an easy-to-understand and convenient manner.

Software modules, used by the exchange, provide a high speed of transaction processing and support of 1,000,000 TCP-connections.

The exchange security system takes into account previous experience when hackers stole user funds from Bitstamp, Binance, Bithumb, Bitfinex and other exchanges. According to the exchange owners, 95% of all currencies are stored in cold wallets and a firewall protects funds from hacker attacks. However, we cannot check this information and award this task to hackers. There is no information about stealing funds from this exchange from the moment of its launching until the moment of writing this article.

The exchange commission for any operation in the market is 0.2%. The exchange also envisages a commission when moving funds out of the cryptocurrency wallet in the amount of BTC 0.001 and ETH 0.015. You can find more detailed information about commissions on the exchange web-site.

Having analyzed various sources, we have come to a conclusion that the exchange fits well both for intraday trading and for holding long positions.

4. Review of fatBTC

FatBTC exchange was launched in 2014 in the Chinese market. As of now, the exchange interface has 11 different languages, however, the quality of translation leaves much to be desired. The main exchange circulation falls on Bitcoin, Ethereum and Bitcoin Cash.

The commission is the same both for takers and makers and is 0.2%. The general sales tax in the amount of 0.25% is taken additionally. There is also a commission for withdrawing funds, which depends on the coin type. For example, the commission for withdrawing bitcoins is BTC 0.0005.

The exchange security system has proved its efficiency and there haven’t been cases of hacking and fund stealing on the exchange.

The exchange disadvantages:

- low liquidity of many cryptocurrencies;

- non-transparency of the exchange and its team.

5. Review of Coinsbit

Web-site: https://coinsbit.io

The exchange web-site started its operation in August 2018 and belongs to EXRT Services OU legal person with registration in Estonia. Despite the relatively recent launching, the exchange quickly attracted the first million of users. It provides information in 14 languages.

There are several specific features of the Coinsbit cryptocurrency exchange:

- support of fiat currencies, which allows using the exchange as a currency exchange office;

- availability of IEO – an instrument for collecting funds for startups;

- availability of an instrument for creating unique payment codes;

- full-fledged operation of a P2P platform for cryptocurrency lending;

- possibility of making passive income by means of depositing funds on the exchange.

The exchange software is designed for a fast speed of transaction processing and 95% of all user funds are stored in cold wallets. Web Application Firewall (WAF) provides secure connection.

Margin trading is not envisaged on the exchange and trading commission is 0.2%.

6. Review of LBank

Web-site: https://www.lbank.info

The exchange was launched in Hong Kong in 2017.

The exchange web-site is translated into 5 languages – 4 of them belong to the Asian group and the 5th one is English. So, a conclusion could be made that the main market of the exchange is Asia. The exchange doesn’t support margin trading. The exchange commission is 0.1% in every trade. There is no information about hacking or user fund stealing on this exchange.

7. Review of Binance

Web-site: https://www.binance.com

Despite the fact that Binance is not in the top 10 in trading volumes at present, this exchange stayed in the top 3 for a long time. Today, Binance takes 20th-30th positions in the rating.

The exchange started its operation in 2017 with the headquarters in Shanghai and quickly gained weight due to:

- professional team;

- progressive web-site;

- translation into 16 languages;

- low commission – the commission for one trade is 0.1%;

- high speed of transaction processing.

Safety should be mentioned separately. Binance was hacked in May 2019 and users lost, in general, BTC 7 thousand. There were a lot of rumors afterwards that the attack was a pretence. However, the Binance management paid compensations to all affected by means of the insurance fund. New security measures were introduced after the attack and they are designed for providing better protection.

Other specific features of the Binance cryptocurrency exchange:

- The Binance Launchpad platform for conducting ICO was launched in 2019.

- Own blockchain lies in the basis of the exchange.

- Margin trading on cryptocurrencies became available.

- More than a hundred cryptocurrencies are presented.

8. Review of Bitfinex

Web-site: https://www.bitfinex.com

This exchange is already assessed as a gold standard of surviving.

It emerged in 2012 and managed to get through several hacking attacks. Despite the fact that the exchange was hacked in 2016 and bitcoins in the amount of USD 72 million were stolen, Bitfinex continues to stay popular and much-in-demand even today.

Measures for strengthening both passive and active security were introduced after a number of hacking attacks. Today, the exchange can offer:

- two-factor authentication;

- blocking if funds are withdrawn from a non-standard IP;

- possibility of setting secret phrases for fund withdrawing operations.

Apart from standard trading, the exchange envisages a possibility of margin trading, however, the leverage is small – just 1:3.

Specific features of Bitfinex:

- Exchange provides a possibility to use fiat both in trades with cryptocurrency and when withdrawing funds to a bank account.

- There is a possibility of massive income through financing free funds on the account.

- The exchange commission for cryptocurrency trading is 0.2%.

9.Review of Deribit

Web-site: https://www.deribit.com

Deribit is a bitcoin futures and options exchange, which was founded in Holland in 2017. This exchange could be compared to BitMEX, which also offers futures and options trades. Deribit trades not only forward contracts but also a perpetual swap for the BTC/USD pair.

There are certain differences between the two exchanges in the methods of processing profits and losses on perpetual swaps. Deribit controls the swap price changes in real time, while BitMEX carries out recalculation every 8 hours. Traders have a possibility of margin trading with the 100:1 leverage.

Selection of options is much wider on Derebit. Thus, if BitMEX offers an option higher or lower, Derebit offers options at strikes from 5000 to 12000 with a 500 step.

As regards commissions, Derebit provides for perpetual swaps a 0.025% discount for makers and takes 0.075% from takers. Also, Derebit provides for futures a 0.02% discount for makers and takes 0.05% commission from takers.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.