A new blow to the dollar, FED changes its strategy and other

August 2020 doesn’t allow investors to get bored. Let’s note the landmark speech of the Federal Reserve Chair Jerome Powell in the past week of the month. He declared a fundamental change of the FRS policy. Fears about the dollar destiny grow, while cryptocurrencies gain popularity among major investors as an alternative to the greenback. It is also not boring in the IPO market where the largest raising in history is brewing. Read details in our regular review.

Content:

- Calendar of economic events

- FRS changes its policy: what it means for markets

- Big wallets stock up on bitcoin

- The largest IPO in history is brewing: what you need to know

- Other important weekly events in brief

Calendar of economic events

| Date, Time (GMT+3:00) | Event | Impact and forecast |

| Tuesday, September 1 7:30 | Australia. The Reserve Bank of Australia decision on the interest rate. | AUD. Forecast – 0.25%, previous value – 0.25%. |

| 10:55 | Germany. Industrial PMI for August. | EUR. DAX. Forecast – 50, previous value – 53. |

| 10:55 | Germany. Unemployment level change in August. | EUR. DAX. Forecast – 43K, previous value -18K. |

| 12.00 | Eurozone. Consumer inflation level (CPI) in August. | EUR. Forecast – 0.2%, previous value – 0.4%. |

| 17:00 | United States. Industrial PMI in August. | USD. S&P 500. Forecast – 54, previous value – 54.2. |

| Wednesday, September 2 15:15 | United States. ADP Nonfarm Employment Change for August. | USD. S&P 500. Previous value – 167K. |

| Thursday, September 3 11:30 | Great Britain. PMI in the service sphere for August. | GBP. FTSE 100. Previous value – 60.1. |

| 17:00 | United States. PMI in the nonproduction sphere for August. | USD. S&P 500. Forecast – 57.1, previous value – 58.1. |

| Friday, September 4 15:30 | United States. Nonfarm Employment Change (Nonfarm Payrolls) in August. | USD. S&P 500. Forecast – 1.550K, previous value – 1.763K. |

| 15:30 | Canada. Employment Change in August. | CAD. Forecast – 400K, previous value – 418.5K. |

| Tuesday, September 1 7:30 |

| Australia. The Reserve Bank of Australia decision on the interest rate. |

| AUD. Forecast – 0.25%, previous value – 0.25%. |

| 10:55 |

Germany. Industrial PMI for August. |

| EUR. DAX. Forecast – 50, previous value – 53. |

| 10:55 |

| Germany. Unemployment level change in August. |

| EUR. DAX. Forecast – 43K, previous value -18K. |

| 12.00 |

Eurozone. Consumer inflation level (CPI) in August. |

| EUR. Forecast – 0.2%, previous value – 0.4%. |

| 17:00 |

| United States. Industrial PMI in August. |

| USD. S&P 500. Forecast – 54, previous value – 54.2. |

| Wednesday, September 2 15:15 |

| United States. ADP Nonfarm Employment Change for August. |

| USD. S&P 500. Previous value – 167K. |

| Thursday, September 3 11:30 |

| Great Britain. PMI in the service sphere for August. |

| GBP. FTSE 100. Previous value – 60.1. |

| 17:00 |

| United States. PMI in the nonproduction sphere for August. |

| USD. S&P 500. Forecast – 57.1, previous value – 58.1. |

| Friday, September 4 15:30 |

| United States. Nonfarm Employment Change (Nonfarm Payrolls) in August. |

| USD. S&P 500. Forecast – 1.550K, previous value – 1.763K. |

| 15:30 |

| Canada. Employment Change in August. |

| CAD. Forecast – 400K, previous value – 418.5K. |

The first September week will be very rich on important macroeconomic events, which will influence all markets. A special attention should be paid to the labour market and PMI indicators. High volatility is possible, due to which it makes sense to be strict with the risk management rules.

FRS changes its policy: what it means for markets

Investors actively discussed the speech of the FRS Chair Jerome Powell on Thursday, August 27. The official informed about the policy change in the sphere of inflation regulation, which will have long-term consequences for all financial markets. It is a good example of how it is important to understand news for profitable trading.

FRS refused the policy of strict inflation targeting at the level of 2%, allowing a corridor in the price dynamics. It means that the bulls in the stock market should not be afraid of immediate growth of interest rates when inflation accelerates. The Federal Reserve promises to support the economy as much as it will be required for the employment recovery to the pre-crisis levels.

The futures on the key American S&P 500 index was logically growing in anticipation of this piece of news. Stocks attack new historic highs. However, the bulls should pay attention to a strong RSI overbuying, which may result in a rather sharp retracement. We would like to remind you that, historically, September is the worst month for the US stocks.

While risky assets got a good incentive for growth, the FRS rules’ change is negative for the US Dollar and Treasury Notes. The soft monetary policy in a combination with the inflation growth may deliver a double blow to attractiveness of these assets.

Big wallets stock up on bitcoin

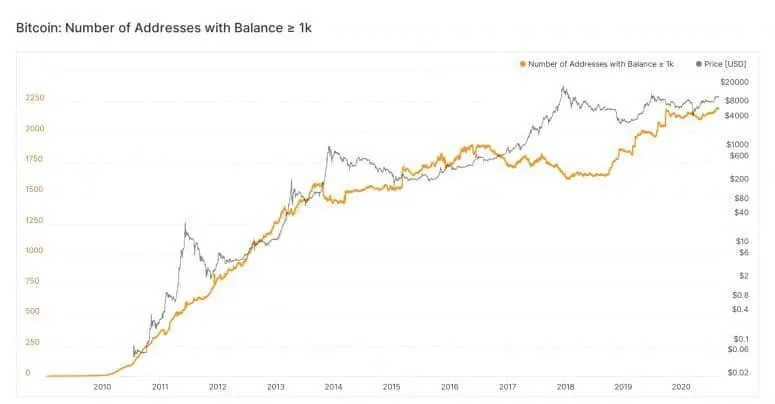

Cryptocurrencies become one of the interesting alternative assets in the times of economic uncertainty growth. The stable growth of the number of wallets with the balance above 1,000 bitcoins (more than USD 11 million at the current exchange rate) testify to this. The indicator reached a new historic high at the end of August.

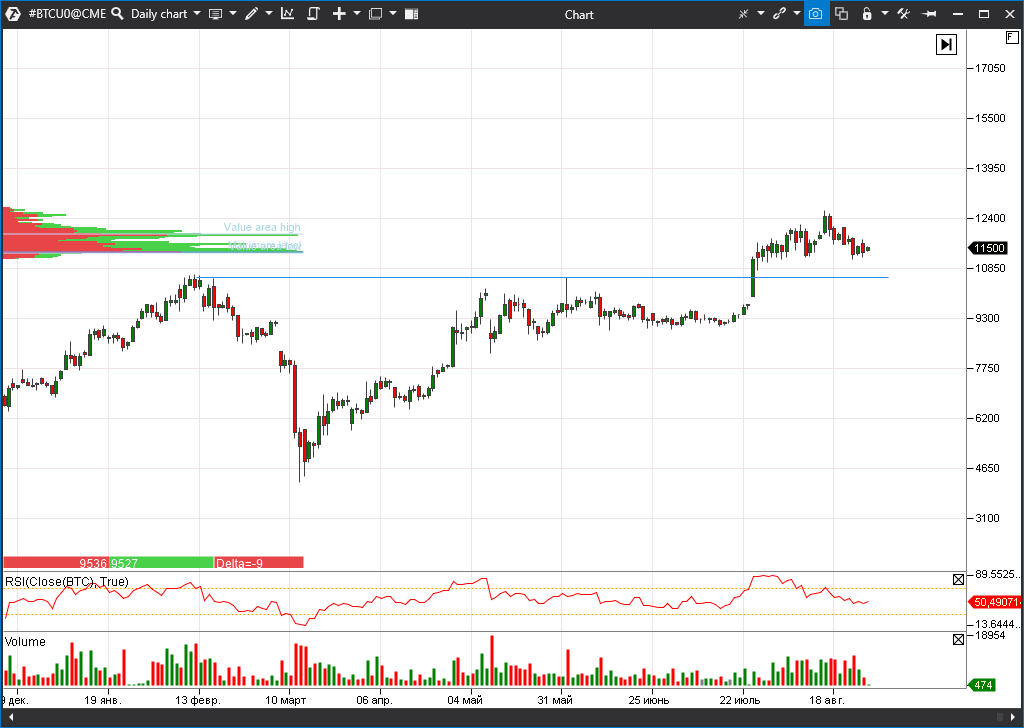

It is also worth mentioning that bitcoin in many respects repeats dynamics of gold in 2020. The main cryptocurrency still also stays in consolidation after a powerful growth, preserving good chances for the trend development. However, you should always remember about the volatility of this asset and shouldn’t invest all your savings into it.

The largest IPO in history is brewing: what you need to know

There is a boom in the market of raising money through IPO. We already wrote about the coming Airbnb rental service stock offering. However, it is far from being the only example.

The Ant Financial stock offering on the Shanghai and Hong Kong exchanges may become the real champion for the whole IPO history. The daughter company (payment service) of the Alibaba Group holding filed an application on August 24, according to which the amount of attracted funds could be USD 29 billion. The company capitalization, in this case, will reach USD 200 billion. Earlier, the IPO record belonged to the Saudi Aramco oil company (USD 26 billion).

We may distinguish the following companies out of the other big IPOs of the coming weeks:

- Palantir. Software developer in the Big Data sphere for the US government and largest banks prepares to raise from USD 1 billion to USD 3 billion. The company capitalization is estimated at the level of USD 26 billion.

- DoorDash. It is yet another food delivery service. The company plans to raise USD 2 billion having capitalization of USD 13 billion.

- Didi Chuxing. The Chinese taxi booking service is estimated at USD 57 billion and plans to raise several billion in Hong Kong.

Other important weekly events in brief

- Коронавирус в США несколько снизил интенсивность распространения. В разных странах ситуация сильно различается, однако, похоже, что о жестких локдаунах больше речь нигде не идет. Мир переходит на шведскую модель мягкого адаптивного карантина.

- Microsoft находится на завершающей стадии переговоров о покупке американского подразделения социальной сети TikTok. Сумма сделки может составить $20-30 млрд. Акции Microsoft (MSFT) на этой новости добавили 2.46%. Однако исход переговоров не предрешен. У техгиганта появились влиятельные конкуренты – Walmart (WMT) и Oracle (ORCL). Они также заинтересованы в покупке.

- Акции Tesla продолжили практически экспоненциальный рост накануне готовящегося сплита. Капитал Илона Маска благодаря этому факту впервые достиг $100 млрд.