Calendar of economic statistics.

The US authorities get ready to ‘shoot’ a trillion dollars.

From stocks to bitcoin: why bulls celebrate victory again.

Purchase of the Slack messenger for USD 28 billion: what do you need to know?

Calendar of economic statistics

| Date, time (GMT +3:00) | Event | Impact/Forecast |

|

Tuesday, December 8 13:00 |

Tuesday, December 8 13:00 Germany. ZEW Economic Sentiment Indicator. |

EUR. Dax. Forecast – 41.7, previous value – 39. |

| 15:00 |

United States. Short-term forecast of the Energy Information Administration (EIA). | OIL. Gaz. |

|

Wednesday, December 9 18:00 |

United States. Job Openings and Labor Turnover Survey (JOLTS). |

S&P 500. USD. Previous value – 6.436M. |

| 18:00 |

Canada. Interest rate decision of the Bank of Canada. |

CAD. Forecast – 0.25%, previous value – 0.25%. |

|

Thursday, December 10 15:45 |

Eurozone. Interest rate decision of the ECB. |

EUR. Forecast – 0%, previous value – 0%. |

| 16:30 |

United States. Consumer Price Index (CPI). |

USD. S&P 500. Forecast – 0.2%, previous value – 0.2%. |

|

Friday, December 11 |

United States. Producer Price Index (PPI). |

USD. S&P 500. Forecast – 0.2%, previous value – 0.2%. |

|

Tuesday, December 8 13:00 |

|

Germany. ZEW Economic Sentiment Indicator. |

|

EUR. Dax. Forecast – 41.7, previous value – 39. |

| 15:00 |

|

United States. Short-term forecast of the Energy Information Administration (EIA). |

| OIL. Gaz. |

|

Wednesday, December 9 18:00 |

|

United States. Job Openings and Labor Turnover Survey (JOLTS). |

|

S&P 500. USD. Previous value – 6.436M. |

| 18:00 |

|

Canada. Interest rate decision of the Bank of Canada. |

|

CAD. Forecast – 0.25%, previous value – 0.25%. |

|

Thursday, December 10 15:45 |

|

Eurozone. Interest rate decision of the ECB. |

|

EUR. Forecast – 0%, previous value – 0%. |

| 16:30 |

|

United States. Consumer Price Index (CPI). |

|

USD. S&P 500. Forecast – 0.2%, previous value – 0.2%. |

|

Friday, December 11 |

|

United States. Producer Price Index (PPI). |

|

USD. S&P 500. Forecast – 0.2%, previous value – 0.3%. |

US authorities get ready to ‘shoot’ a trillion dollars

Optimism in the financial markets was supported this week by advance of the Congress negotiations with respect to the second package of the economy fiscal stimulus. Influential representatives of the Republicans and Democrats already announced their readiness to vote. A compromise amount is at stake – around USD 1 trillion.

This is the most long-expected event not only for regular Americans, who suffer from the corona-crisis, but also for Wall Street bulls. Growth of stocks would have been just impossible without massive fiscal stimuli, which ran at around USD 2 trillion in spring-summer 2020.

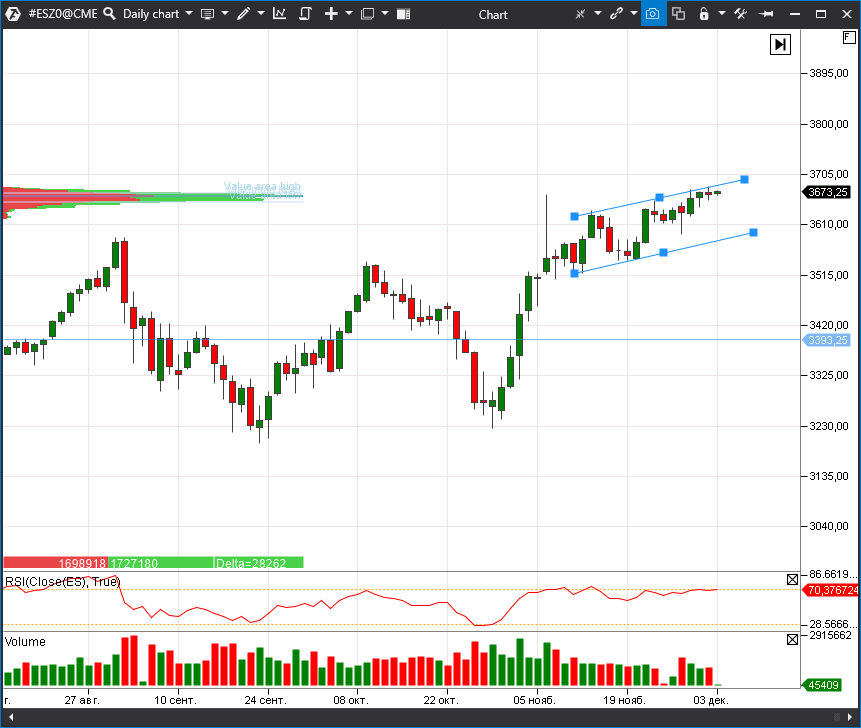

The S&P 500 index (ESZ0) renewed its historic high against this background in expectation of the Nonfarm Payroll, which publication is expected after lunch on Friday, December 4.

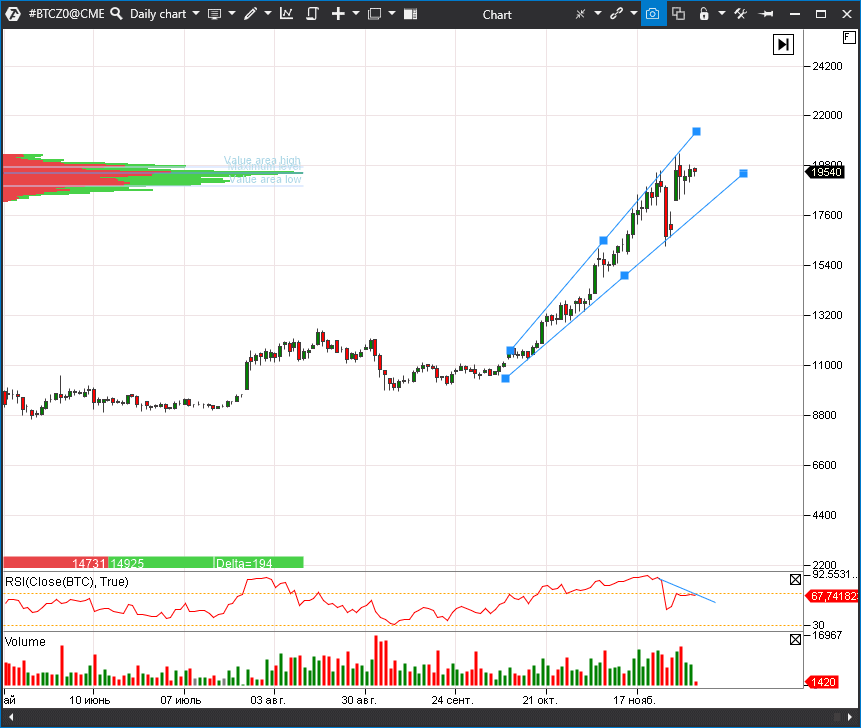

From stocks to bitcoin: why bulls celebrate victory again

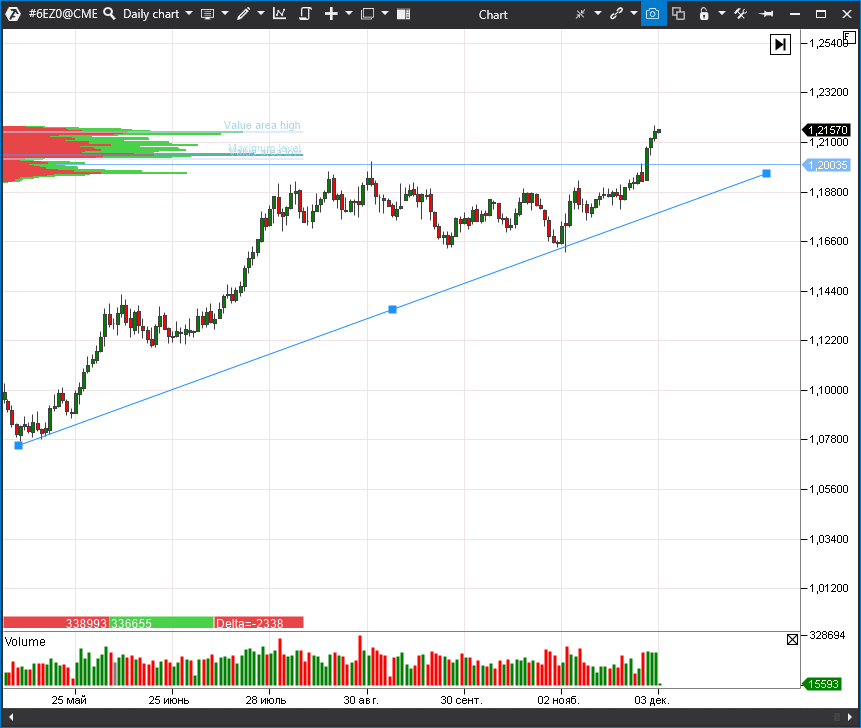

Successful advance of the Congress negotiations plays against the American dollar, since the fiscal stimuli will be supported mainly by an additional emission. Moreover, there is a risk of an inflation shock in 2021.Prophecies of ‘apocalypse messengers’, represented by some well-known economists, about the coming devaluation of the greenback by 20-30% do not look too overconfident against such a background. The EUR/USD (6EZ0) pair established the 2-year high, overcoming the psychologically significant level of 1.2. The next goal of 1.23 is quite possible.

The Slack messenger purchase for USD 28 billion: what do you need to know?

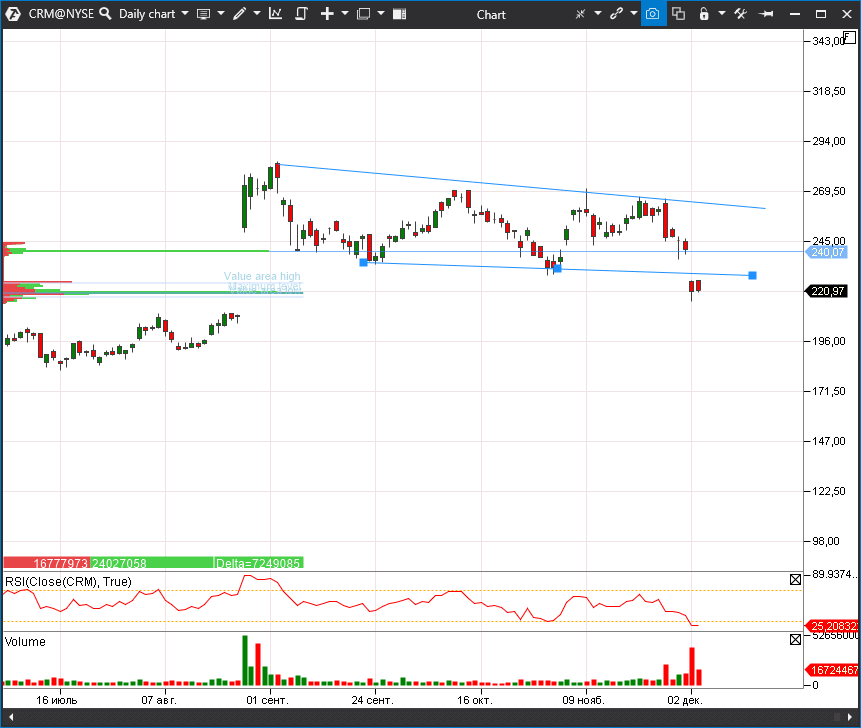

Many companies try to take advantage of cheap loans and high stock prices. On Wednesday, December 2, the American developer of the business process automation systems – the Salesforce (CRM) company – announced a purchase of a popular corporate messenger (Slack) for USD 27.7 billion. The goal of the merger is to unite the company efforts for development of a branched software ecosystem for business.In the last few years, Salesforce has been one of the most active players in the merger and takeover market. The company acquired the Tableau visual analytics service in 2019 for USD 15.7 billion and several dozens of smaller companies. The Salesforce ambition is to join the elite group with capitalization of more than one trillion dollars, becoming a peer to Google and Microsoft in the software market. The company was worth USD 200 billion at the moment when this review was written.

Not all Wall Street analysts are happy with these new purchases. As a result, the company stock (CRM) reacts to the news with a crash on a big volume.

Technology. The company has been on top of the Forbes The World’s Most Innovative Companies rating for several years, developing CRM systems on the basis of cloud computations and a lot of accompanying products.

Investors’ trust. The company estimates are extremely high and stay at the Tesla level.

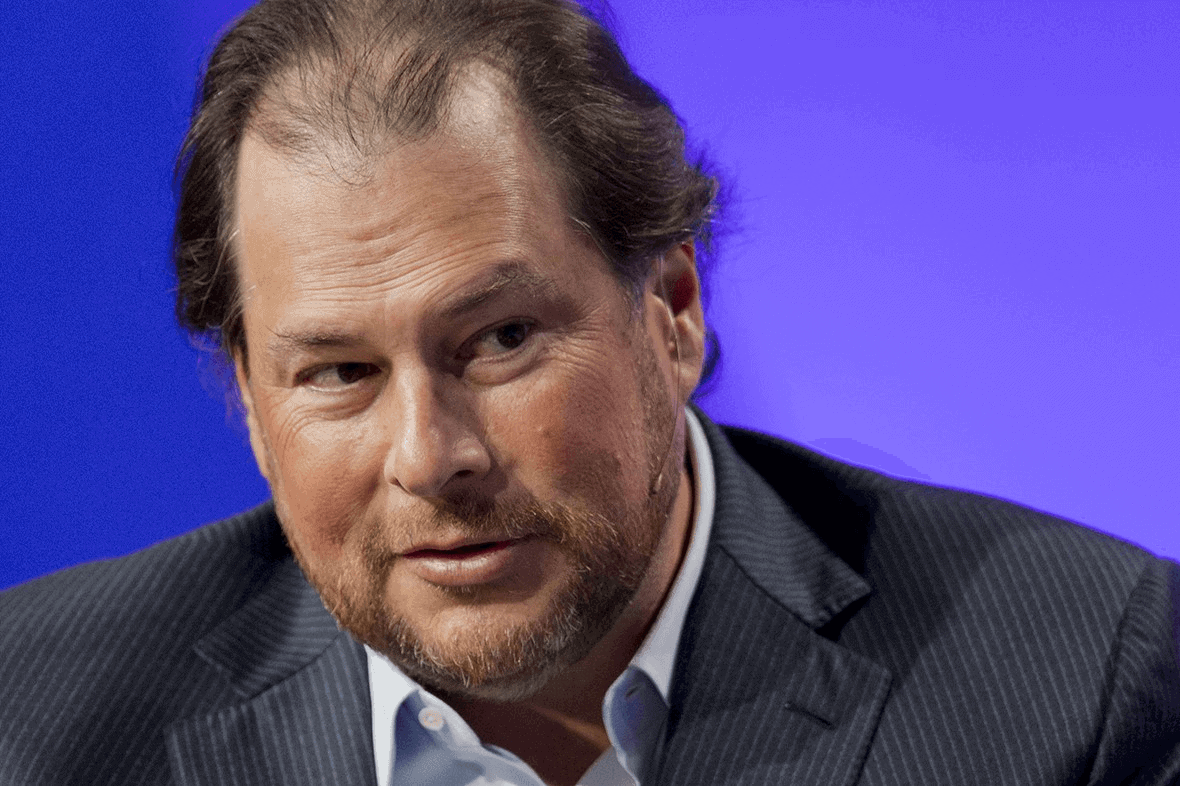

Charisma of its Director General, billionaire Marc Benioff, who is well-known for his social activity and weight among colleagues.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.