Investor’s life isn’t easy. An investor always has to make decisions under conditions of high uncertainty. The past week didn’t grant a respite. On the one hand, the second wave of coronavirus covers the world, on the other, the economic recovery has so high rates that even optimists are surprised. Read in our review what important things took place in the world and what the author of the legendary ‘The Black Swan: The Impact of the Highly Improbable’ Nassim Taleb thinks about the market prospects.

- Calendar of economic statistics.

- A gift on the Independence Day: even bulls are surprised with statistics.

- The second wave of coronavirus attacks.

- Facebook became a victim of fight for the freedom of speech.

- The author of the ‘Black Swan’ described how to prepare for the second wave of the crisis.

Calendar of economic statistics

| Time | Event | Impact |

| Tuesday, July 7 7:30 Moscow Time | Australia. Decision of the Reserve Bank of Australia on the interest rate. | AUD. Forecast – 0.25%, previous value – 0.25%. |

| Wednesday, July 8 12:00 Moscow Time | EU. Economic forecast of the European Commission. | EUR. DAX. |

| 17:30 Moscow Time | United States. Crude oil reserves. | WTI. Brent. Forecast -0.710 M. Previous value -7.195 M. |

| Thursday, July 9 15:30 Moscow Time | United States. Jobless claims. | USD. S&P 500. Previous value – 1.427K. |

| Friday, July 10 11:00 Moscow Time | United States. Report of the International Energy Agency (IEA). | WTI. Brent. Natural Gas. |

| 15:30 Moscow Time | Canada. Employment change in June. | CAD. Forecast – 800K. Previous value – 296K. |

| 19:00 Moscow Time | United States. Report of the United States Department of Agriculture (USDA). | Agricultural goods. |

| Tuesday, July 7 7:30 Moscow Time |

| Australia. Decision of the Reserve Bank of Australia on the interest rate. |

| AUD. Forecast – 0.25%, previous value – 0.25%. |

| Wednesday, July 8 12:00 Moscow Time |

| EU. Economic forecast of the European Commission. |

| EUR. DAX. |

| 17:30 Moscow Time |

| United States. Crude oil reserves. |

| WTI. Brent. Forecast -0.710 M. Previous value -7.195 M. |

| Thursday, July 9 15:30 Moscow Time |

| United States. Jobless claims. |

| USD. S&P 500. Previous value – 1.427K. |

| Friday, July 10 11:00 Moscow Time |

| United States. Report of the International Energy Agency (IEA). |

| WTI. Brent. Natural Gas. |

| 15:30 Moscow Time |

| Canada. Employment change in June. |

| CAD. Forecast – 800K. Previous value – 296K. |

| 19:00 Moscow Time |

| United States. Report of the United States Department of Agriculture (USDA). |

| Agricultural goods. |

Tuesday. AUD may experience a splash of volatility after announcement of the decision of the Reserve Bank of Australia on the interest rate and accompanying statement on the monetary policy.

Thursday. US employment statistics is the most important for investors today. Good data will support the optimism of bulls.

Friday. A volatility day is expected in commodities. The IEA report and forecasts could cause serious changes in the oil market. The USDA report will specify the balance of demand and supply in the key markets of cereal crops, soybeans, etc.

The most important Canadian statistics of the month – employment change in June – will be published on the same day. The report will show the country economy recovery rates after the coronavirus and could cause strong CAD fluctuations.

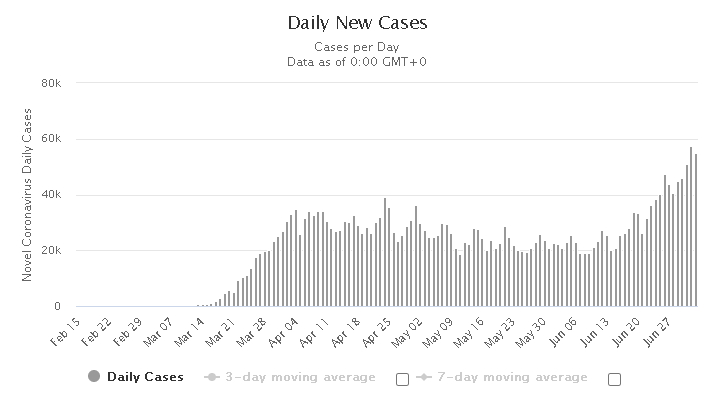

The second wave of coronavirus attacks

Coronavirus resembles a rifle in a classical theatrical piece (if there is a rifle on the wall it will shoot at some moment). Everybody understands that it is impossible to change the situation and you just have to watch the event development.

And events develop more and more dramatically. The nightmare of the American business develops in Miami. Some local companies that started to work again recently have to close their businesses again. The reason is the same – the virus doesn’t want to go. Florida hospitals are overloaded and the quantity of new cases goes through the roof.

The same picture is in a number of other states. The daily new case statistics in the country breaks all previous records and already is higher than 50 thousand cases.

Brazil, India, Russia and South Africa. These countries are far away from each other but one thing unites them – epidemiologic situation in them is still difficult. Governments are afraid of introducing new strict lockdowns in order not to kill the economies dead and they look at scientists with hope.

There are some healthy signs at this stage of the action development, which give some hope for the happy end. The WHO experts informed that 17 vaccines are already tested on people all over the world. Perhaps, production of the new medicine would start at the beginning of the next year. However, nobody can give a guarantee that the rifle will not shoot until then.

A gift on the Independence Day: even bulls are surprised with statistics

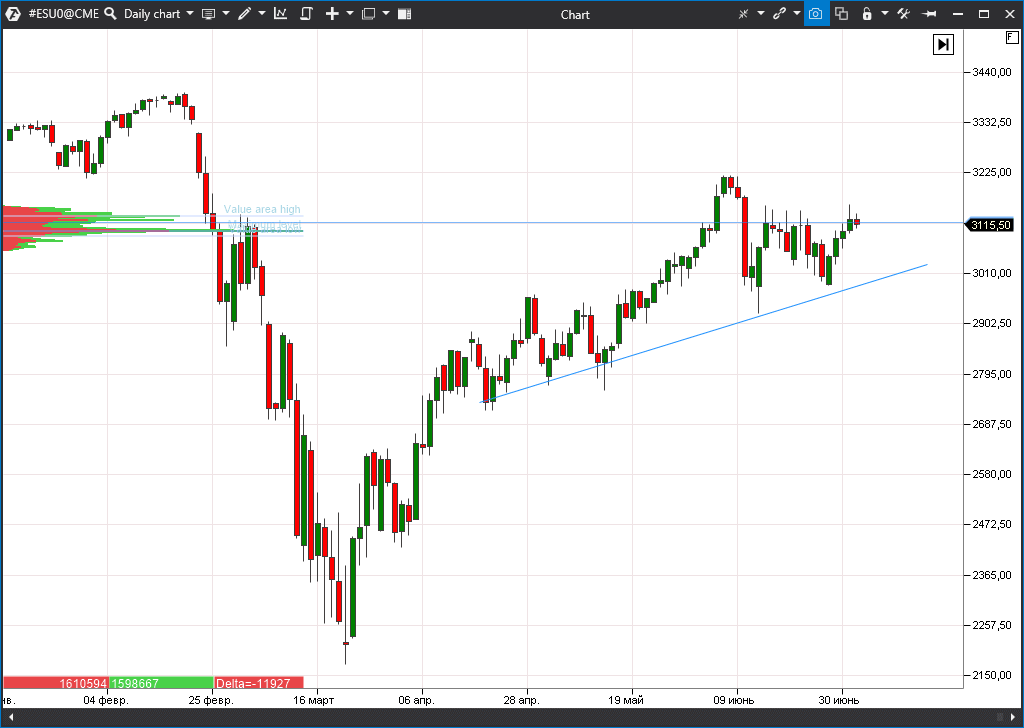

Despite the epidemic, the markets are full of optimism. Bulls have two reasons to be happy. First, of course, is the FRS printing press, which works like a beaver. The US Central Bank started to buy corporate bonds this week. New liquidity in the debt market would help the S&P 500 index companies to pass the crisis with minimum losses.

The second reason is a surprisingly good labour market statistics. Nonfarm Payrolls were published on Thursday and showed a growth of working places in June by 4.8 million, which is two times better than the most optimistic forecasts. Growth in employment is the main indicator of the fact that the US economy recovers under the V-shaped scenario.

As a result, the S&P 500 index ended the week with a confident growth, which was an excellent gift to the Wall Street inhabitants on the eve of the week-end and Independence Day.

The uptrend stays in force and the situation would hardly change much before the start of the reporting season on July 13. The markets would be completely absorbed by the company reports and their forecasts for the 3rd and 4th quarters during the second half of the month.

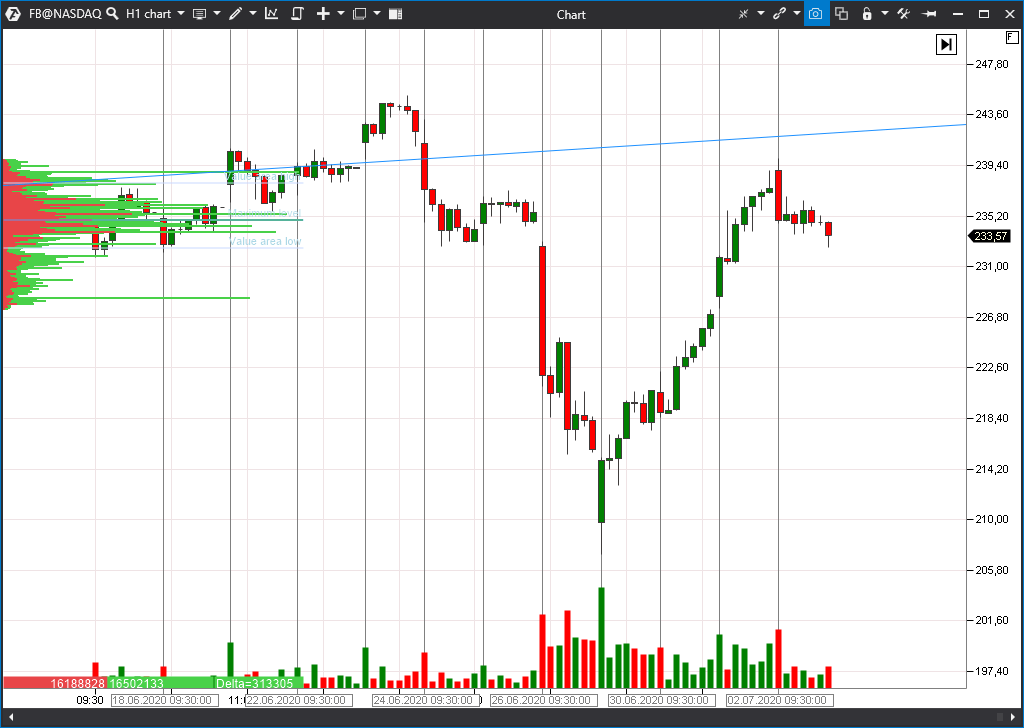

Facebook suffered for the freedom of speech

Facebook (FB) stakeholders went through not the best period in their lives. The matter is that Mark Zuckerberg took a principled stand and stated that the company will not strictly censor posts on the racial and public and political subjects. Many activists and politicians require this from the media giant.

Understanding came to the market during the next two days that everybody would forget about the scandal soon and the stock won back the majority of losses.

The ‘Black Swan’ author explained how to prepare for the second wave of crisis

The author of the cult bestseller ‘The Black Swan: The Impact of the Highly Improbable’ an options trader and researcher of probability theory Nassim Taleb gave an interview to the CNBC business portal. Among other things, he shared his opinion with respect to the risks of the second wave of the crisis and stock crash.

Talib believes that the US FRS has very few options left for saving the economy from possible new disturbances. Investors need to have insurance in this context. These could be options or other instruments of risk hedging. In general, Taleb believes that the most reliable tactics in the current situation is defensive, which is directed at capital protection rather than on its fast increase.