Calendar of economic statistics

Fears took the markets into possession again due to coronavirus

The Congress launches the dollar cannon

Tesla is in the S&P 500 index: what to expect next

Apple will enter the motor car market with a breakthrough technology

The stock growth helped: who made USD 110 billion

Calendar of economic statistics

| Date, Time (GMT+3:00) | Event | Impact, forecast |

| Monday, December 28 | Canada, Australia, Great Britain. Day-off. Boxing Day. The other leading markets operate in the standard mode. | Low volatility is expected on Forex. |

| Tuesday, December 29

18:00 | United States. Consumer confidence. | S&P 500. USD. Forecast – 97, previous value – 96.1. |

| Wednesday, December 30

18:00 | United States. Uncompleted sales in the real estate market. | S&P 500. USD. Forecast – 0.2%, previous value -1.1%. |

| Thursday, December 31 | Germany – day-off. Great Britain and Australia – a short trading day. | Low activity in all markets is connected with celebration of the New Year. |

| Friday, January 1 | Day-off. New Year. | Only the Chinese market will operate out of the major markets. |

| Monday, December 28 |

| Canada, Australia, Great Britain. Day-off. Boxing Day. The other leading markets operate in the standard mode. |

| Low volatility is expected on Forex. |

| Tuesday, December 29

18:00 |

| United States. Consumer confidence. |

| S&P 500. USD. Forecast – 97, previous value – 96.1. |

| Wednesday, December 30

18:00 |

| United States. Uncompleted sales in the real estate market. |

| S&P 500. USD. Forecast – 0.2%, previous value -1.1%. |

| Thursday, December 31 |

| Germany – day-off. Great Britain and Australia – a short trading day. |

| Low activity in all markets is connected with celebration of the New Year. |

| Friday, January 1 |

| Day-off. New Year. |

| Only the Chinese market will operate out of the major markets. |

| The market activity will fall to the minimum due to the coming New Year celebration. Adoption of the economy assistance package by the Congress creates not a bad background for a moderate growth of the US stock market. |

Fears took the markets into possession again due to coronavirus

The majority of the world stock markets went into retracement on Monday, December 21. The matter is that emergence of a dangerous coronavirus strain was officially acknowledged in Great Britain.According to the British authorities, contagiousness of the new virus strain could be higher by 70%. Due to this, a record-breaking splash of the disease incidence is observed in the country. The government declared a maximally severe lockdown. Germany, France and some other major countries stopped transport communication with Albion. Severe quarantine restrictions are introduced nearly everywhere in Europe.

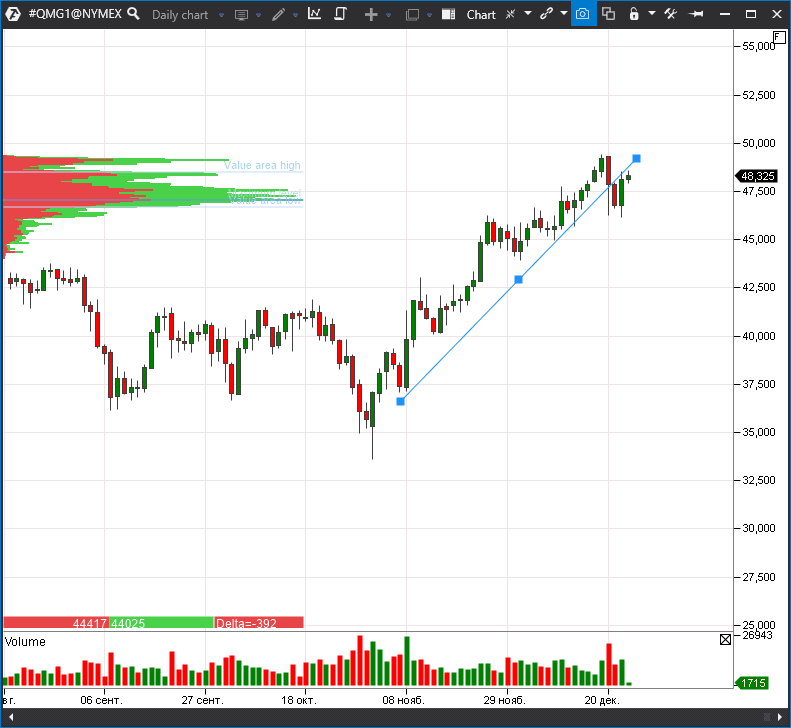

The retracement hit the oil market more than any other market. Investors are afraid that new restrictive measures will significantly reduce fuel consumption by transport. And this takes place against the background of the recent OPEC+ decision to increase oil production. As a result, the WTI futures (QMG1) value lost about 5% during Monday and Tuesday. The quotations won back a bit on Wednesday.

The Congress launches the dollar cannon

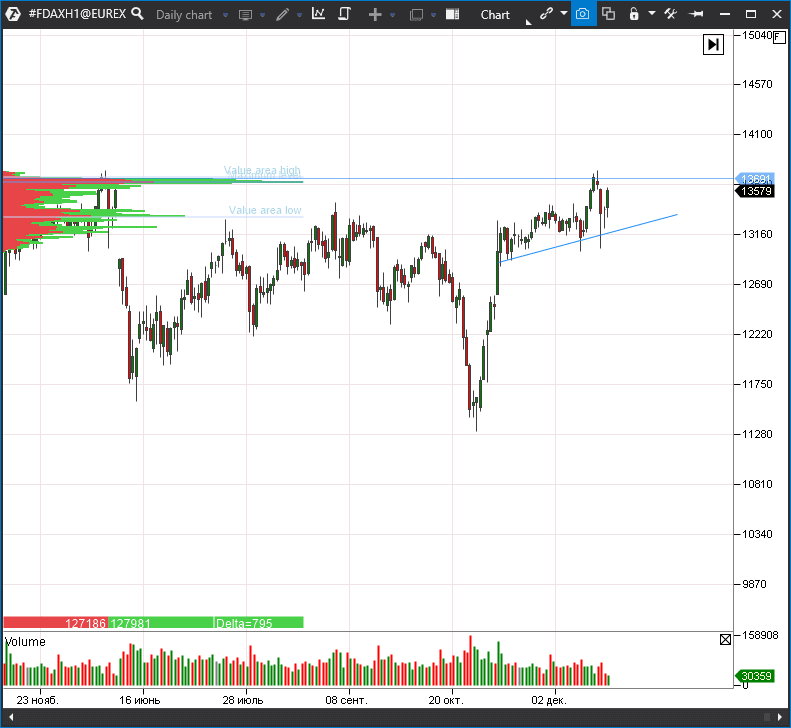

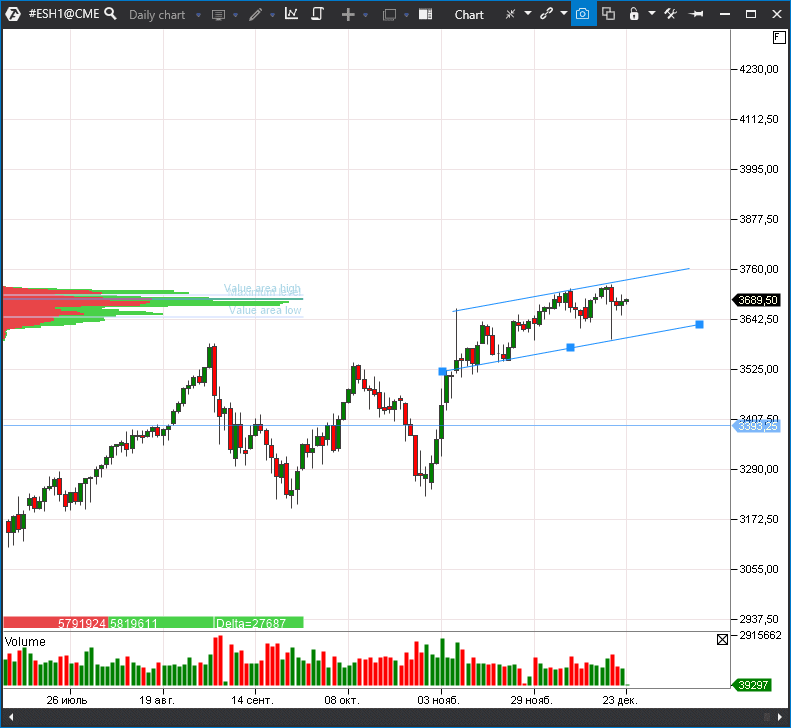

The investor confidence is also fed by the US Congress decision to allocate the economy assistance package in the amount of USD 900 billion. The markets had waited for the budget support even before the Presidential election and its absence slowed down the after-crisis recovery rates during the recent months.Now the markets may breathe freely since the Democrats and Republicans again showed their ability to reach an agreement in a situation of extreme urgency. This creates a rather good background for a quiet completion of the year. The S&P 500 index futures (ESH1) continues to fluctuate near the historic high.

Tesla is in the S&P 500 index: what to expect next

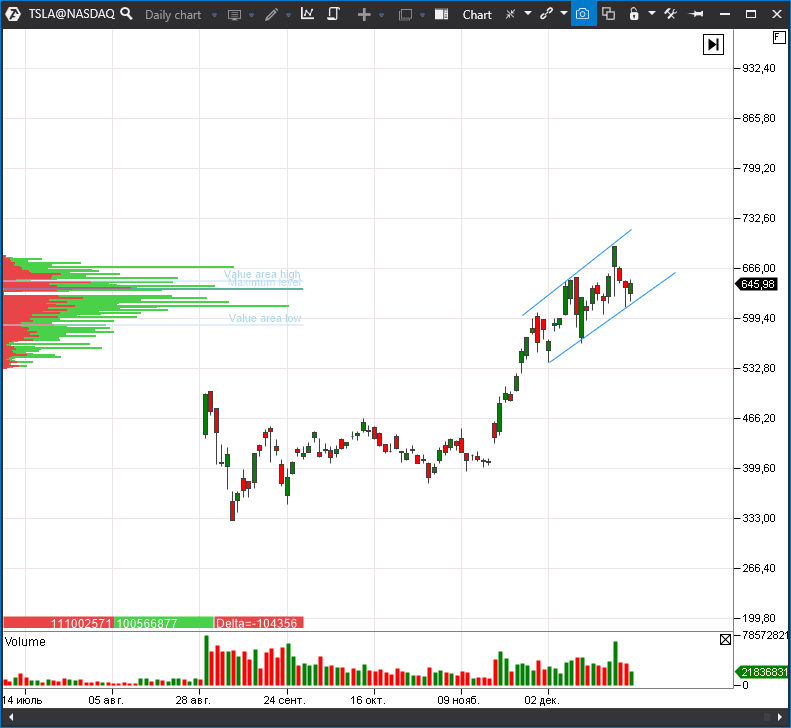

Tesla (TSLA) continues to be one of the main newsmakers in the stock market, showing miracles of volatility. Thus, the news was published on Friday, December 18, that the Standard and Poor’s agency increased the company’s rating to BB from BB-. This resulted in the stock jump by 6%.However, the stock lost 6.5% as early as on Monday, December 21. And it was the next day after the company was included into the S&P 500 index! The Elon Musk company took 1.5% in the index, which is the record among the index newcomers. It means that the Exchange Traded Funds (ETF) were actively buying the company’s stock during the whole day, but didn’t stop the retracement.

Apple enters the electric car market with a breakthrough technology

Meanwhile, the above-mentioned leader in the consumer electronics manufacture plans to manufacture its own self-driving electric car. There is already some information available about the Apple development. The Apple company plans to make a breakthrough in production of batteries, radically improving their basic characteristics, such as availability, driving range and charging speed at the account of the innovative technology. All this will allow reducing the final product (cars) cost.

There are only rumors about the official presentation and beginning of sales. According to some sources, it will take place together with the iPhone 13 presentation in the third quarter of 2021, while other sources say that it would happen only in 2024 or even 2025.

Elon Musk already commented on the competitor’s plans and confessed that some time ago he offered Tim Cook, the Apple CEO, to buy Tesla but Tim Cook didn’t even want to listen to him. This closely reminds the story with the might-have-been selling of Google for USD 1 million.

The stock growth helped: who made USD 110 billion

And, in the end, a bit more about Elon Musk and Co. The year 2020 turned out to be super successful for him in many respects. The Tesla stock (TSLA) value growth by 665% allowed Musk to become the billionaire of the Year, according to Forbes.According to the magazine, about 60% of more than 2,200 world billionaires boosted their fortunes and Elon Musk, whose fortune increased by USD 110 billion, is the number one among them.

These are really extraterrestrial fortunes!

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.