- Calendar of economic statistics

- Reset of power in the US: how it threatens the dollar

- The Tesla stock boom made Elon Musk the richest man on Earth

- The raging bitcoin growth continues

- Investors move out of gold: the main reason

Calendar of economic statistics

| Date, Time (GMT +3:00) | Event | Impact, forecast |

| Tuesday, January 12 15:00 | United States. Energy Information Administration (EIA) forecast. | Oil. |

| Wednesday, January 13 16:30 | United States. Consumer Price Index (CPI) for December. | USD. S&P 500. Forecast – 0.1%, previous value – 0.2%. |

| 18:30 | United States. Crude oil reserves. | Oil. Forecast -2.133M, previous value -8.010M. |

| Thursday, January 14 15:30 | Eurozone. ECB statement on monetary policy. | EUR. |

| 16:30 | United States. Jobless claims. | USD. S&P 500. Forecast – 780K, previous value – 787K. |

| 20:30 | United States. Speech of Jerome Powell, the chair of the Federal Reserve. | All markets. |

| Friday, January 15 10:00 | Great Britain. GDP, industrial production, trade balance. | GBP. FTSE. |

| 16:30 | United States. Retail sales in December. | USD. S&P 500. Forecast -0.2%, previous value -1.1%. |

| 16:30 | United States. Producer Price Index (PPI). | USD. Forecast – 0.3%, previous value – 0.1%. |

| Tuesday, January 12 15:00 |

| United States. Energy Information Administration (EIA) forecast. |

| Oil. |

| Wednesday, January 13 16:30 |

| United States. Consumer Price Index (CPI) for December. |

| USD. S&P 500. Forecast – 0.1%, previous value – 0.2%. |

| 18:30 |

| United States. Crude oil reserves. |

| Oil. Forecast -2.133M, previous value -8.010M. |

| Thursday, January 14 15:30 |

| Eurozone. ECB statement on monetary policy. |

| EUR. |

| 16:30 |

| United States. Jobless claims. |

| USD. S&P 500. Forecast – 780K, previous value – 787K. |

| 20:30 |

| United States. Speech of Jerome Powell, the chair of the Federal Reserve. |

| All markets. |

| Friday, January 15 10:00 |

| Great Britain. GDP, industrial production, trade balance. |

| GBP. FTSE. |

| 16:30 |

| United States. Retail sales in December. |

| USD. S&P 500. Forecast -0.2%, previous value -1.1%. |

| 16:30 |

| United States. Producer Price Index (PPI). |

| USD. Forecast – 0.3%, previous value – 0.1%. |

In view of the growing inflation risks, the key issues for the markets at the beginning of 2021 are consumer and industrial inflation data. The price growth acceleration could make the FRS increase the key interest rate before 2023. Attention should also be paid to the retail sales statistics and employment rate change, which are key barometers of economic activity.

The reporting season for the 4th quarter of 2020 starts on Friday, January 15. Traditionally, the major US banks will present their reports first – JP Morgan (JPM), Wells Fargo (WFC) and Citibank (C). These reports will be the source of key corporate events and forecasts until the end of January.

Reset of power in the US: how it threatens the dollar

A political event, which will have a long-term influence on the whole world economy and politics, took place in the United States. After Joseph Biden won the Presidential election, the Democrats managed to win a majority in the Senate. The so-called ‘blue wave’ has come – this is when the Democratic party gets control over the Government and two Congress chambers, receiving all powers of government in the country.Many economists are wary of such a prospect due to a rather sharp movement of the democratic establishment to socialist ideas. Now, nothing may interfere with an increase of budget spendings for additional USD 1-2 trillion by the Biden administration and launching new social programs.

Most probably, the Democrats would increase corporate taxes for these purposes. It means shortfall in profits for companies and an additional argument in favour of the dollar devaluation in 2021. The risk of an inflation splash increases, namely that is why it is important to monitor this indicator.

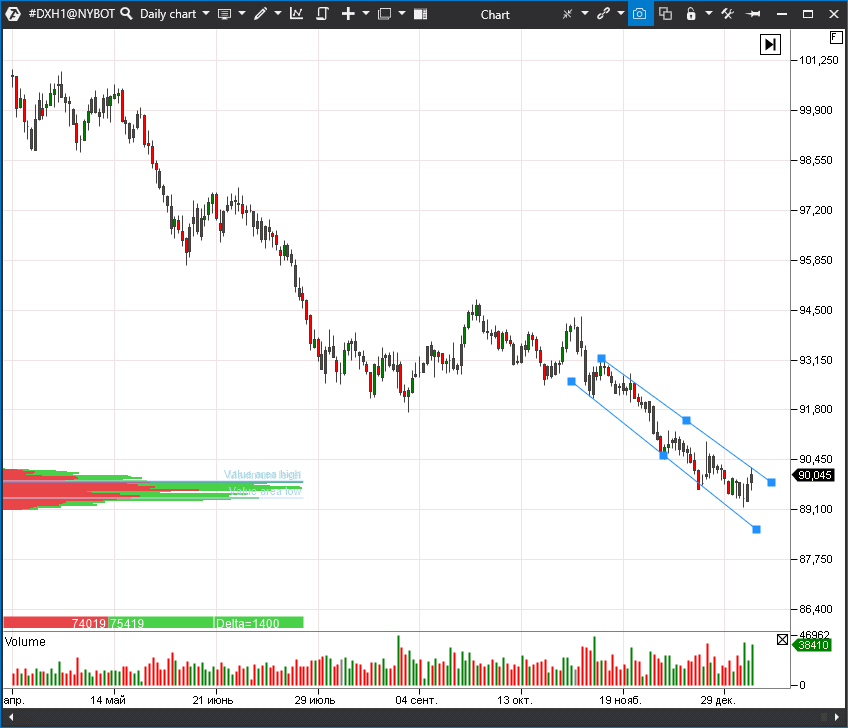

Meanwhile, the dollar index (DXH1) a bit retraced from the multiple year lows below 90.

Only the FRS policy in view of the inflation growth may stop the fall of the greenback. If the managers would give a tip that the key interest rate increase is possible before 2023, the dollar would become stronger and the stock indices would go into retracement.

Tesla stock boom made Elon Musk the richest man on Earth

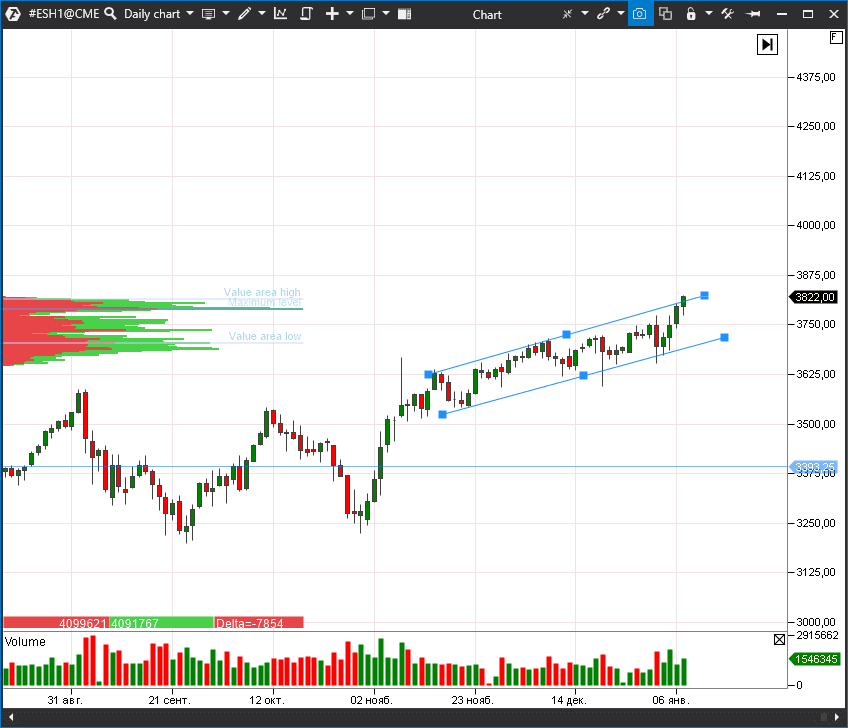

Meanwhile, the S&P 500 index futures (ESH1) continues to renew historic highs. The investors’ mood is, in general, relaxed and optimistic. Even the Capitol seizure by radical supporters of Trump didn’t shake the buyers’ confidence.

Although economic expectations from 2021 are, in general, encouraging, the signs of a bubble are already observed in some stocks. One of such stocks is Tesla (TSLA), the capitalization of which is approaching USD 1 trillion and soon may exceed capitalization of all other world automobile manufacturers taken together. And this is when the company’s share in the electric car market is about 18% and in the whole volume of automobile sales it is less than 1%.

The Tesla phenomenon has already led to a rather unexpected change of leaders on top of the list of billionaires. Elon Musk is on the very top for the first time ever, depriving Jeff Bezos, an Amazon co-owner, of leadership. The personal wealth of Musk reached USD 209 billion on January 9.

The raging bitcoin growth continues

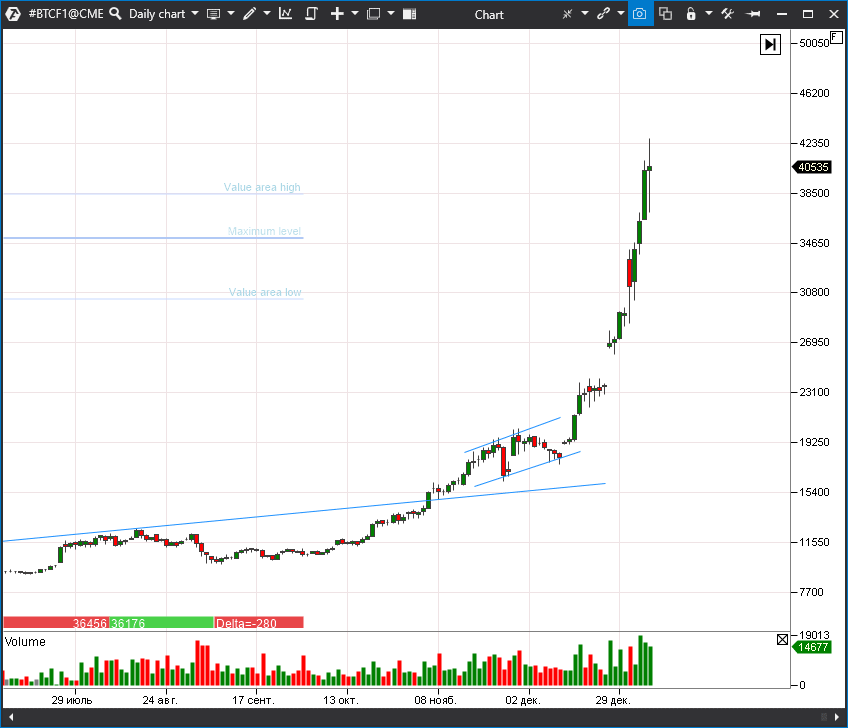

The cryptocurrency agiotage continues at the beginning of 2021 and could be compared with the events at the end of 2017. The bitcoin futures (BTCF1) needed less than a month to double its value from USD 20,000 to USD 40,000. And all these things happen on record-breaking volumes.

It is difficult to say to what level the crypto would shoot up. Thus, Bloomberg predicts USD 50,000 in 2021 and JP Morgan Chase forecasts USD 146,000 in several years. However, it is important to remember about the volatility of digital assets, which played a cruel trick with many investors. You can read more about the bitcoin value forecasts for the year 2021 in our new article.

Following bitcoins, altcoins also fly ‘to the Moon’. Nevertheless, the general cryptocurrency market capitalization is just a bit higher than USD 1 trillion, which is relatively not much when speaking in terms of the world financial market. For example, Apple (AAPL) completed the previous week with capitalization of USD 2.26 trillion – and this is only one of the biggest US companies.

However, bitcoin started a retracement in the morning January 11, falling in momentum to USD 33,000. Let’s see what happens next.

Investors move out of gold: the main reason

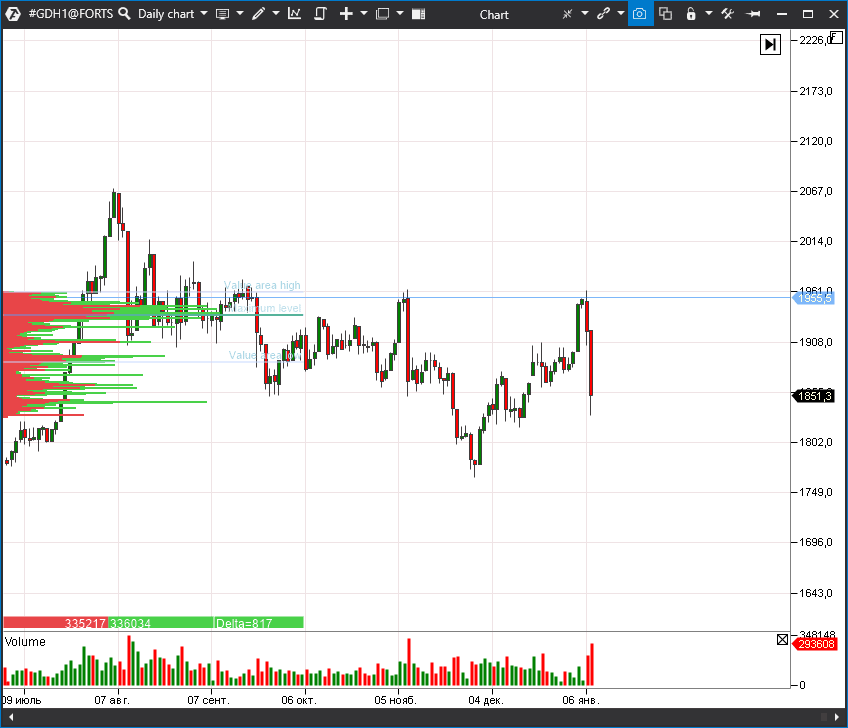

Meanwhile, a real capitulation from gold was observed at the end of the previous week. The gold quotes fell down on Friday, January 8, by 3.43% and silver – by 6.8%. There also was a serious fall the day before. Such a behaviour could be connected with relocation of major fund capitals at the year beginning and reconsideration of long-term strategies.

Gold, traditionally, is used as a protective asset in crisis times. According to the majority of forecasts, the world economy will grow by about 5% in 2021, and this is a very strong growth. Consequently, investors prefer to get rid of the protective asset in favour of stocks and industrial raw materials.

However, a new wave of the gold value growth is still possible if the significant dollar devaluation forecasts will come true.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.