Optimists in the world markets again turned out to be stronger past week. Support to bulls in the US stocks came from China, which poured in a significant amount of currency. The most charismatic moneybags of our time reap the harvest of the fast growth of their companies not without satisfaction. Elon Musk poses, elegantly joking over the failing fans to short Tesla. Jeff Bezos breaks one record after another on top of the list of the world richest people. It wasn’t also boring in the cryptocurrency market where yet another ‘altcoin season’ started.

- Calendar of economic statistics.

- Bullish holiday in the United States, the bills of which are paid by China.

- Elon Musk makes fun of Tesla ‘short traders’: the fans appreciated the joke.

- Bezos happiness: Amazon helped to achieve the never seen before wealth.

- Altcoins come back to life. What happened to the crypto from the second line?

Calendar of economic events

| Time | Event | Impact |

| Tuesday, July 14 12:00 Moscow Time | Eurozone. The German Economic Sentiment Index (ZEW) in July. | EUR. Forecast – 60, the previous value – 63.4. |

| Wednesday, July 15 16:15 Moscow Time | United States. Industrial production for June. | S&P 500. Expected – 4.4%. Previous value – 1.4%. |

| 17:00 Moscow Time | Canada. Report of the Bank of Cana on Monetary Policy and decision on the interest rate. | CAD. |

| 17:30 Moscow Time | United States. Crude oil reserves. | Oil. Forecast -3.114 М, the previous value 5.654 М. |

| Thursday, July 16 5:00 Moscow Time | China. GDP, industrial production and level of investments for the second quarter. | Industrial raw materials. CNY. AUD. |

| 14:45 Moscow Time | Eurozone. Decision about the interest rate and statement about the monetary policy. | EUR. European stocks. |

| 15:30 Moscow Time | United States. Retail sales in June (MoM). | S&P 500. USD. Expected – 5%, the previous value – 12.4%. |

| 15:30 Moscow Time | United States. Jobless Claims. | Previous value – 1,314K. |

| Tuesday, July 14 12:00 Moscow Time |

| Eurozone. The German Economic Sentiment Index (ZEW) in July. |

| EUR. Forecast – 60, the previous value – 63.4. |

| Wednesday, July 15 16:15 Moscow Time |

| United States. Industrial production for June. |

| S&P 500. Expected – 4.4%. Previous value – 1.4%. |

| 17:00 Moscow Time |

| Canada. Report of the Bank of Cana on Monetary Policy and decision on the interest rate. |

| CAD. |

| 17:30 Moscow Time |

| United States. Crude oil reserves. |

| Oil. Forecast -3.114 М, the previous value 5.654 М. |

| Thursday, July 16 5:00 Moscow Time |

| China. GDP, industrial production and level of investments for the second quarter. |

| Industrial raw materials. CNY. AUD. |

| 14:45 Moscow Time |

| Eurozone. Decision about the interest rate and statement about the monetary policy. |

| EUR. European stocks. |

| 15:30 Moscow Time |

| United States. Retail sales in June (MoM). |

| S&P 500. USD. Expected – 5%, the previous value – 12.4%. |

| 15:30 Moscow Time |

| United States. Jobless Claims. |

| Previous value – 1,314K. |

Main attention of investors will be arrested this week by the reporting season, which starts from the publication of PepsiCo and banks’ indicators. However, the most important economic events will also not stay unnoticed.

You should be careful with CAD positions on Wednesday due to a decision about the interest rate and statement of the Bank of Canada.

You should be careful with EUR positions on Thursday, since the ECB decision on interest rates and accompanying statement on monetary policy are expected.

Traditionally, the unemployment and retail sales US statistics will exert strong influence on stocks on Thursday.

Bullish holiday in the United States, the bills of which are paid by China

COVID-19 epidemic still holds the world. Several anti-records were registered the previous week. The United States is again among the leaders with about 70 thousand new cases.

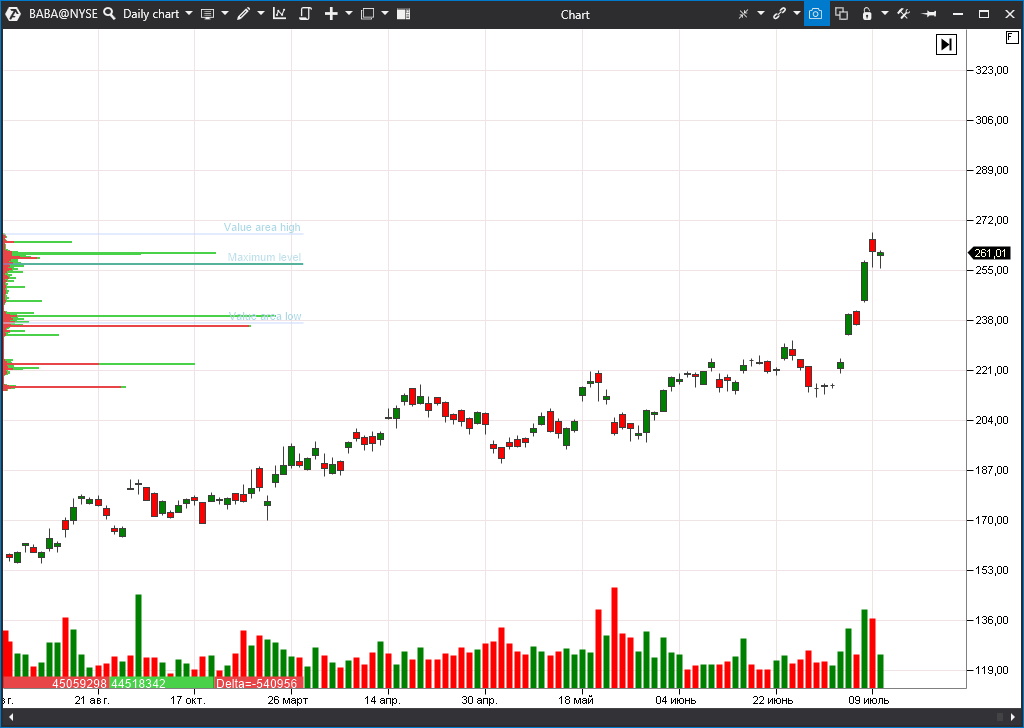

Nevertheless, the authorities clearly do not plan to introduce new strict lockdowns, which makes the stock market buyers happy. The S&P 500 index added a significant capitalisation of 1.76% during one week. One of the sponsors was Chinese government, which financed buy-out of the Chinese companies’ stocks from the American market.

Alibaba (BABA) stock increased immediately by 16.73%. American funds sell stocks to Chinese and buy the most liquid chips from the US technology sector, by which they provoke new waves of growth.

Elon Musk makes fun of Tesla ‘short traders’: the fans appreciated the joke

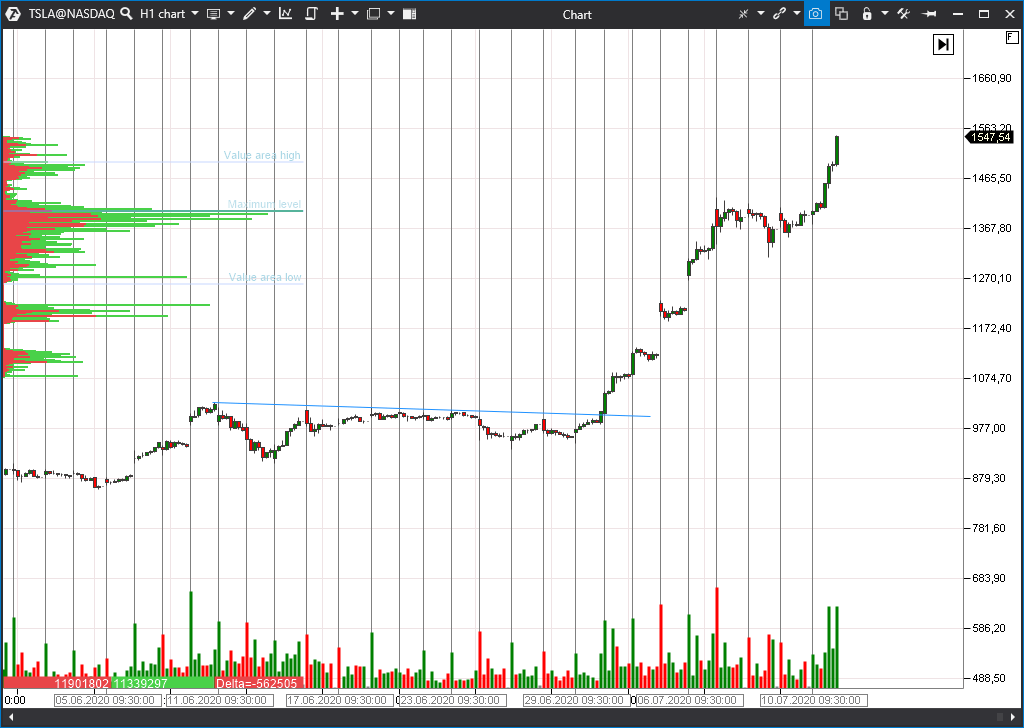

Tesla stock (TSLA) shows impressive results and, it seems, it will go Mars before the Elon Musk spaceship will do. The quotes jumped from USD 1,000 to USD 1,544 during two weeks.

What is the reason? Mainly, it is the excessive market liquidity and a stable high optimism of buyers. Companies periodically provide information about production successes and plans for the future. However, plans still have to be realised and the companies are still on their way to get out of chronic losses and debts.

The stock is especially popular among ‘robin hoods’ – market newcomers. It is quite clear that the majority of sceptics try to short Tesla, for which they were already punished many times.

Meanwhile, Elon Musk made fun of those who like to trade Tesla short. All of a sudden, sales of red shorts were announced on the web-site of the premium electric car manufacturer. Fans appreciated the joke and shorts are sold out like hot dogs. By the way, the shorts cost around USD 70.

Bezos happiness: Amazon helped to achieve the never seen before wealth

Not only Elon Musk’s wealth swells like a balloon from the liquidity inflow. The capital of one more adherer of space travels and the richest man on Earth Jeff Bezos is skyrocketing. His Amazon stock breaks records one after another and estimates of the wealth of the monebag number 1 skyrocket faster than sky rockets of his second creation – Blue Origin.

According to Forbes, the largest Amazon stockholder possesses USD 189.2 billion. The company’s capitalization nearly reached USD 1.6 trillion. The price/earnings ratio is already 152, which obscurely hints at a bubble formation. But who is interested now in such trifles?!

Altcoins come back to life. What happened to the crypto from the second line?

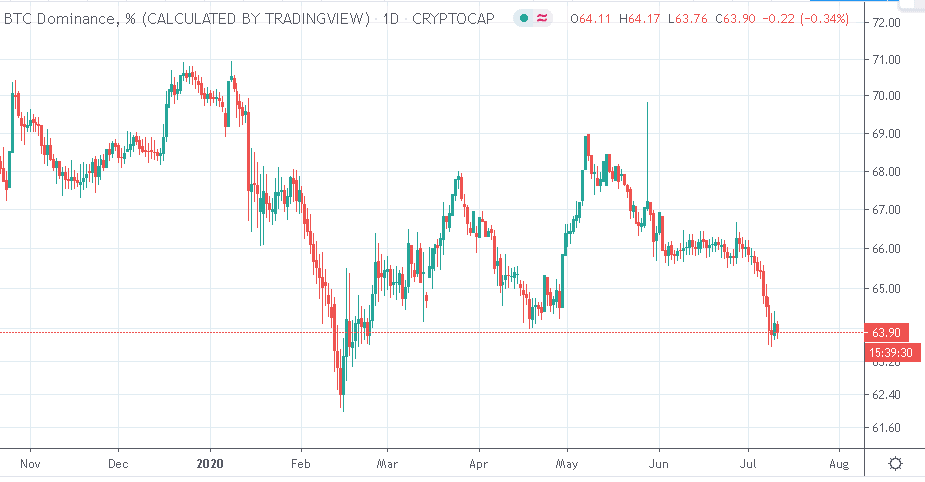

It is also not boring in the cryptocurrency market. While Bitcoin got stuck in a flat between USD 9,000 and USD 10,000, some altcoins as if remembered their wild youth and showed miracles of volatility.

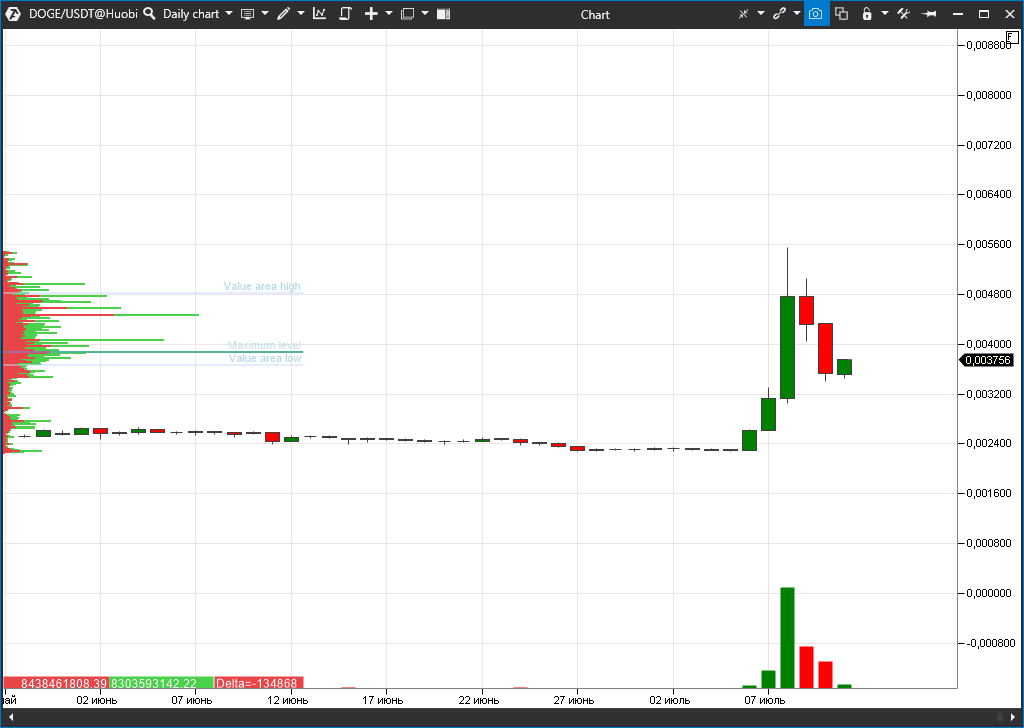

One of the leaders was Dogecoin, which was pumped by a social network TikTok company. Local inhabitants actively urge to buy the coin while it hasn’t reached the value of USD 1. It is still far from that level, however, due to the ‘hooker-ins’ efforts, the coin value rose from 0.0023 to 0.0055 on the growth peak. Judging by volumes, there’s also no shortage of those who wish to get rid of the ‘doggy’.

Periodically, some other altcoins also become active. Such a phenomenon is called ‘altcoin season’ in the cryptocurrency trader language. This happens when ‘younger brothers’ show a stronger growth than Bitcoin. This phenomenon is reflected in the chart, which shows the correlation of BTC capitalization to the value of the whole market. When the correlation falls, it means that altcoins are of higher demand.