The short week turned out to be volatile and interesting in the financial markets. Of course, the main question for investors is whether the continuing stock sell-out is the trend reversal or just a retracement? Let’s also try to find out whether Elon Musk has to shed bitter tears for the lost wealth and would SoftBank share the destiny of Lehman Brothers.

- Calendar of economic events

- Sell-out in the stock market: retracement or reversal

- Elon Musk lost dozens of billions

- How a Japanese bank launched Apple and Amazon stocks ‘to the Moon’

Calendar of economic events

| Date, time(GMT + 3:00) | Event | Impact/Forecast |

| Tuesday, August 14 05:00 | China. Industrial production in August. | Oil. Copper. AUD. CNY. Forecast – 5.1%, previous value – 4.8%. |

| 11:00 | United States. Monthly report of the Energy Information Administration (EIA). | All energy products. |

| 12:00 | Germany. ZEW Germany Economic Sentiment Indicator in September. | EUR. DAX. Previous value – 64. |

| Wednesday, August 15 15:30 | United States. Retail sales for August. | USD. S&P 500. Forecast – 1.1%, previous value – 1.2%. |

| 21:00 | United States. Decision on the interest rate and FRS press conference. | USD. S&P 500. Forecast – 0.25%, previous value – 0.25%. |

| Thursday, August 16 12:00 | Eurozone. Consumer Price Index for August. | EUR. Forecast – 0.4%, previous value -0.2%. |

| 14:00 | Great Britain. Decision of the Bank of England on the interest rate. | GBP. Forecast – 0.1%, previous value – 0.1%. |

| 15:30 | United States. Permissions for construction in August. | USD. S&P 500. Forecast – 1.530M, previous value – 1.483M. |

| Friday, August 17 09:00 | Great Britain. Retail sales in August. | GBP. Forecast – 2%, previous value – 3.6%. |

| 13:30 | Russia. Decision of the Bank of Russia on the interest rate. | RUB. Forecast – 4%, previous value – 4.25%. |

| Tuesday, August 14 05:00 |

| China. Industrial production in August. |

| Oil. Copper. AUD. CNY. Forecast – 5.1%, previous value – 4.8%. |

| 11:00 |

| United States. Monthly report of the Energy Information Administration (EIA). |

| All energy products. |

| 12:00 |

| Germany. ZEW Germany Economic Sentiment Indicator in September. |

| EUR. DAX. Previous value – 64. |

| Wednesday, August 15 15:30 |

| United States. Retail sales for August. |

| USD. S&P 500. Forecast – 1.1%, previous value – 1.2%. |

| 21:00 |

| United States. Decision on the interest rate and FRS press conference. |

| USD. S&P 500. Forecast – 0.25%, previous value – 0.25%. |

| Thursday, August 16 12:00 |

| Eurozone. Consumer Price Index for August. |

| EUR. Forecast – 0.4%, previous value -0.2%. |

| 14:00 |

| Great Britain. Decision of the Bank of England on the interest rate. |

| GBP. Forecast – 0.1%, previous value – 0.1%. |

| 15:30 |

| United States. Permissions for construction in August. |

| USD. S&P 500. Forecast – 1.530M, previous value – 1.483M. |

| Friday, August 17 09:00 |

| Great Britain. Retail sales in August. |

| GBP. Forecast – 2%, previous value – 3.6%. |

| 13:30 |

| Russia. Decision of the Bank of Russia on the interest rate. |

| RUB. Forecast – 4%, previous value – 4.25%. |

Attention should be paid to the meetings of the US FRS, Bank of England and Bank of Russia during the next week. Their decisions and statements may significantly influence the Forex market. Investors will be expecting the industrial production statistics from China and also the EIA report in the raw material markets. Also, the retail sales statistics from the United States and Great Britain will be published next week.

‘Long fall’ in the stock market: retracement or reversal

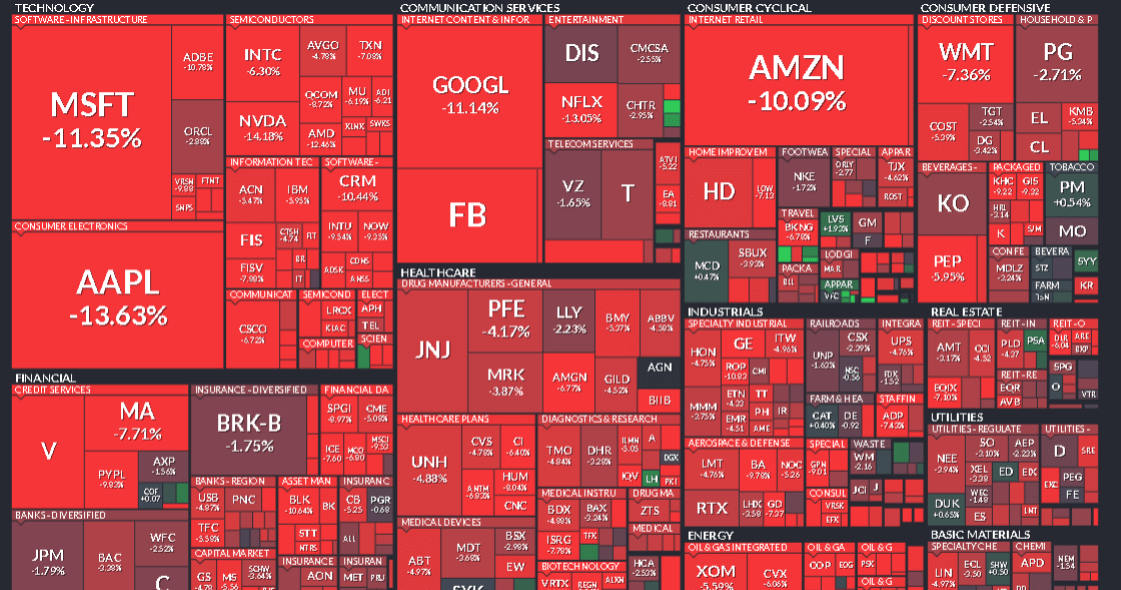

September confirms its reputation of being the worst month for the US stock market. Bears took the lead practically from the first days and sell-outs of the technology sector stocks sometimes look like bull surrenders.

Thus, Apple fell by 8% a day early in September, which is absolutely non-typical for this ‘heavyweight’. The other recent growth leaders fell at similar rates. Traders call this phenomenon a ‘long fall’ (opposite to a short squeeze), which means a massive closure of long margin positions, which provokes closure of other longs.

As it often happens, there were no obvious reasons for the fall. It’s true that the labour market recovers slowly and the economic risks are still big. But it was quite clear a month ago.

So, what’s next? On the one hand, the majority of top stocks are still strongly overbought, on the other hand, the FRS continues to ‘print’ money, which is a very bullish factor. Nobody knows what would happen in reality. We can only assume that the bulls will make at least one surge after the retracement in order to test previous highs.

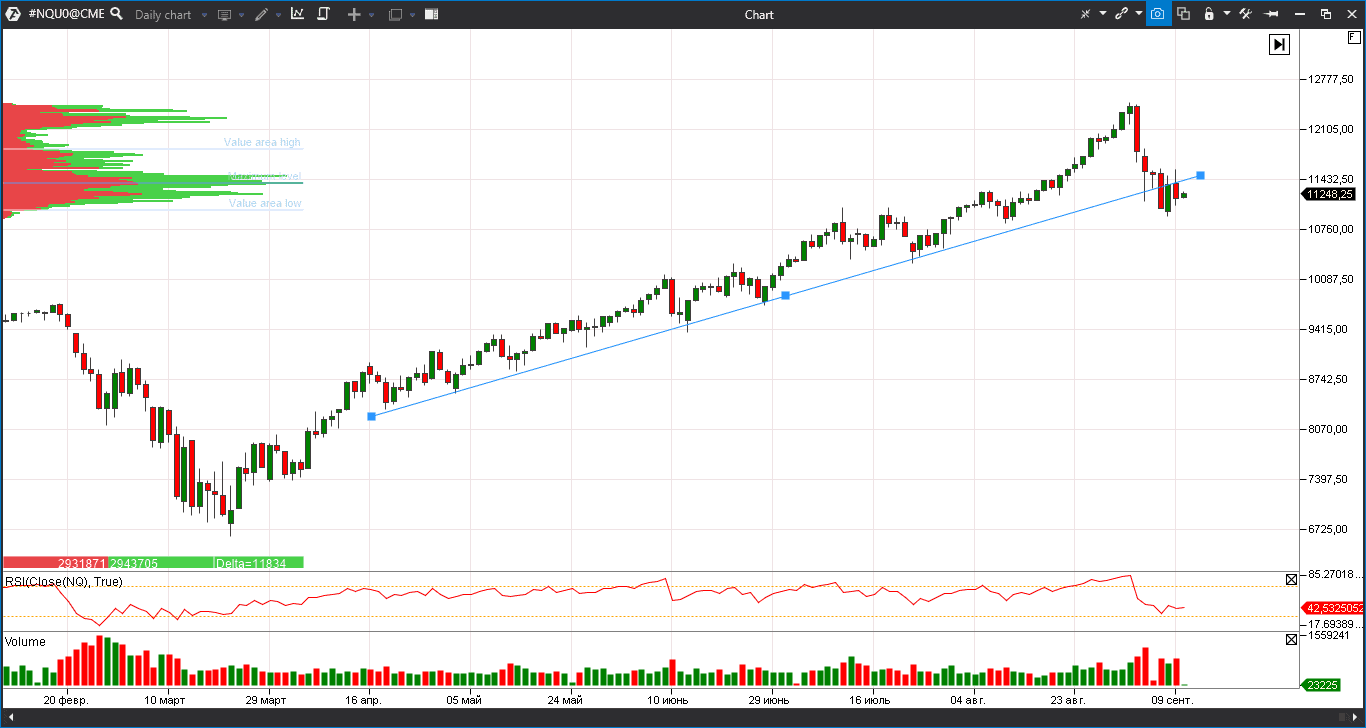

Meanwhile, the Nasdaq index futures broke the uptrend, falling during the previous week at the March rates.

Elon Musk black day: how to lose USD 16 billion in one day

The Elon Musk capital in 2020 is, probably, one of the most volatile things in the Universe. Mass media were full of headlines during the past months about how his wealth skyrocketed to yet another high following the Tesla stock (TSLA) value.

The September retracement started the countdown. Tesla lost one third of its capitalization just in a couple of days and its owner lost USD 16 virtual billion just in one day – on September 8.

A famous specialist on corporate finance David Trainer points to the fact that the price is unreasonably high even if Tesla implements all its Napoleonic plans. ‘This is a huge and one of the biggest houses of cards of all times and it is about to crash’, – Trainer said. However, the speculative seesaw may continue to swing.

How a Japanese bank launched the Apple and Amazon stocks ‘to the Moon’

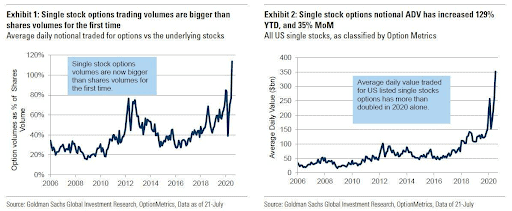

Meanwhile, one of the main ‘initiators’ of the grand US technology sector stock rally came to the surface. It turned out to be a big Japanese financial holding SoftBank, which acquired big positions in stocks with a high beta (such as Amazon, Google and Netflix) and call options for billions of dollars. Besides, the bank wasn’t too scrupulous in using borrowed funds.

Such a strategy not only supported the powerful growth of these stocks in the summer non-liquid market but also resulted in a huge volume leap in options on some stocks, which, for the first time ever, constituted more than 100% in the underlying asset.

Volatility of the SoftBank stock sharply increased following the market fall. Some experts believe that the bank may share the destiny of Lehman Brothers if the market falls. As of now, the situation is still far from being catastrophic: SoftBank positions are on the positive side and everything is well with liquidity in the world markets. However, the negative scenario cannot be excluded completely.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.