Results of the presidential election in the US historically exert strong influence on the stock market behaviour. A simple example – the market grows substantially faster if presidents are Democrats than if presidents are Republicans. Is it just a coincidence? We do not think so. We can say one thing for sure: if you understand what to expect from the current candidates, you can ‘calibrate’ your future investment strategy better.

Content

- The market history speaks in favour of Democrats

- Why Wall Street likes Trump

- Three scenarios for stocks after the 2020 election

The market history speaks in favour of Democrats

According to bookmakers, chances for the presidency of the Democrat candidate Joe Biden by the middle of October 2020 are 61% against 38% of the Republican Donald Trump. Although it might seem that this is bad news for Wall Street, where Republicans are in favour of the major business privileges, the historic data speak about the opposite.

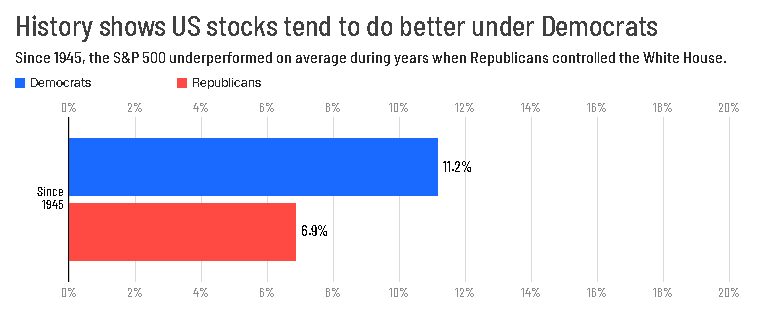

Analysis of statistical data since 1945 shows that the S&P index grows, on the average, by 11.2% annual under Democrats while it grows by 6.9% annual under Republicans. The GDP grew since 1945 by 4.1% annual under Democrats compared to 2.5% under Republicans.

Why Wall Street likes Trump

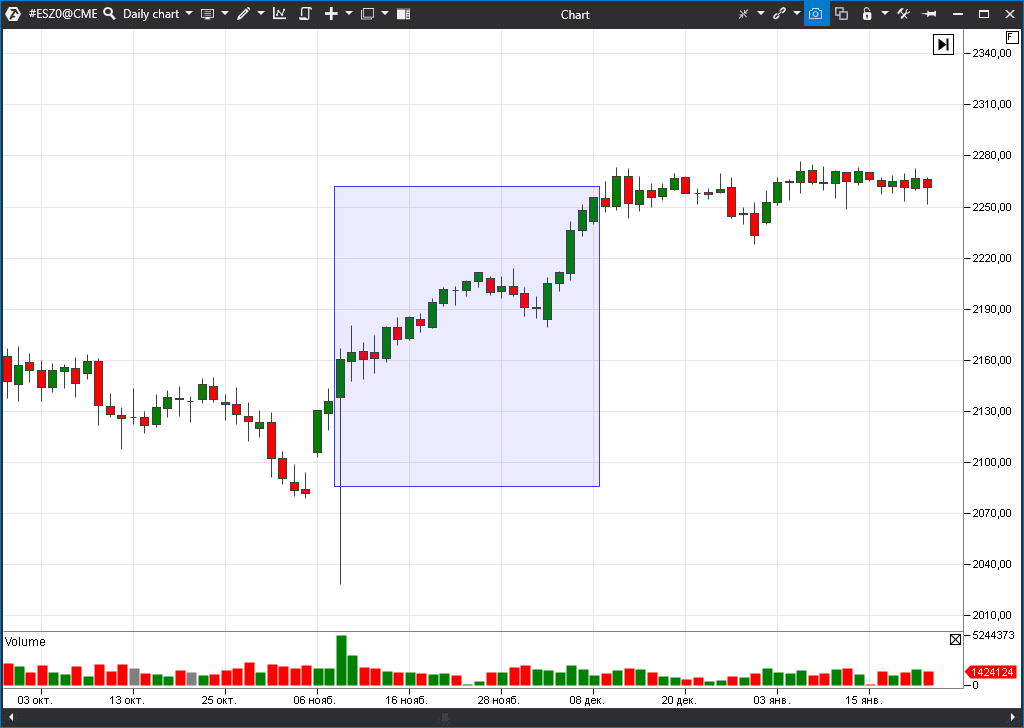

Despite the disappointing statistics of Republican presidents, the history, sometimes, makes exceptions. The most recent example is the current President Donald Trump, during the presidency of whom the market confidently grew during most of the time.

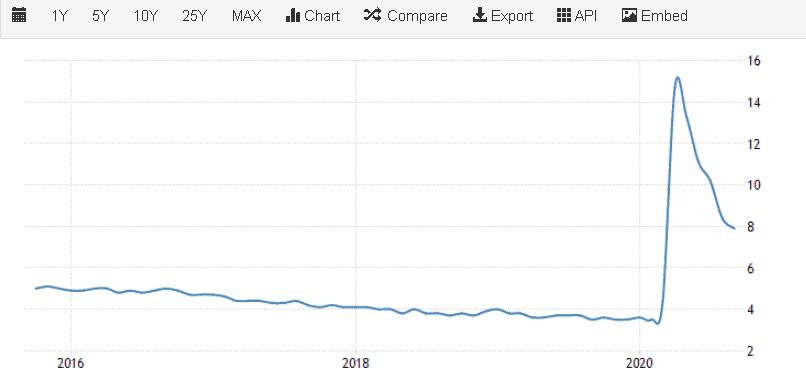

So, if we take the period from Trump’s election in the fall of 2016 until the middle of October 2020, the growth of S&P 500 has been more than 50%. And this is despite coronavirus and the sharp fall of stocks in March 2020! The chart below shows dynamics of the index during the first Trump’s term.

Three scenarios for stocks after 2020 election

In general, it is a positive outcome, although the initial reaction could be negative. We already know that Democrat presidents are better for the US stock market. Economists explain this phenomenon by major programs of the budget support of the economy, which resulted in the population income growth and, consequently, in the corporate income growth.

The markets also expect from Biden de-escalation of the trading war with China, which Trump unleashed. This topic ‘harasses’ the markets for several years already and it would be nice to establish a fragile but peaceful relationship with the second largest world economy.

The ‘black side’ of Biden is a probable growth of the companies’ income tax from 21% to 28%. Americans with an income above USD 400 thousand annual would also suffer. Someone needs to sponsor the budget goodies!

Scenario 2. Trump’s victory

This is a neutral scenario. Although sociology is not in favour of Trump, it’s too early to discard him. He came to his first election victory also against the lower rating background.

If Trump continues to be the President, it means that nothing, actually, changes for Wall Street. Corporate taxes would stay low. And stability of the taxation system is excellent news.

Scenario 3. Black swan

Some US experts do not exclude escalation of the civil unrest after the presidential election. Protests, which shook the United States in summer 2020, might turn out to be a Sunday-school picnic. Thus, Trump already announced that he may not accept the election result if he doesn’t win, which may threaten with a political crisis and activation of his followers. The liberal part of the American society, in its turn, may not accept Trump’s victory, who is well-known for his intolerance, rudeness and conservatism.

If conflicts escalate in the United States and blood is shed, the economic recovery may take a very long period of time. This scenario is a catastrophe for Wall Street. However, its probability is not very high.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.