How many hours a day do you devote to study trading?

We mean study of the volume analysis, price structures, charts and any other information, which is required for trading. You didn’t notice how the time passed by but you didn’t manage to learn much, did you? Then this article is for you!

When it comes to the study of something new (or even repetition of something already familiar), the quality should prevail over the quantity and it is a crucial point.

In this article:

- Use efficient methods of trading study.

- Limit the trading study time.

- 25 minutes of intensive attention.

- Mind your state.

Use efficient methods of trading study

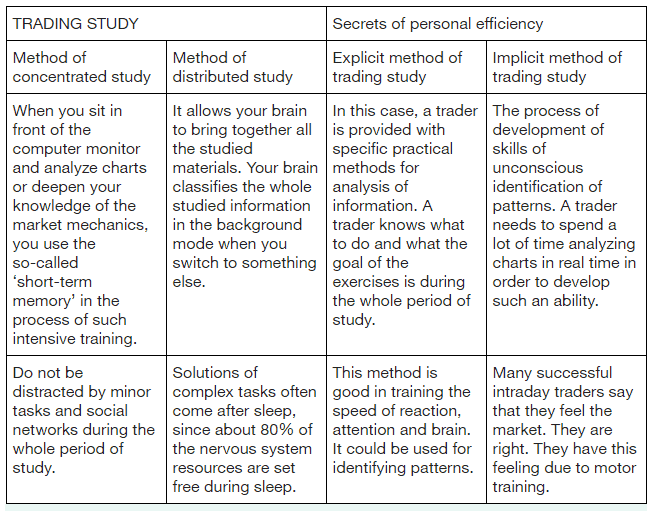

There are several different approaches to the study and all of them are required not only for starting to understand the studied material but also for its real mastering.Method of concentrated study

You use this method when you sit in front of the computer and analyze charts or deepen your knowledge of the market mechanics. It is a process of strong concentration of attention, which shouldn’t be interrupted by checking your email box or messages in social networks during the whole time, which you devote to the study. Remember that multitasking is an undesirable method of the serious study of any material.

In the process of such an intensive study and immersion into the material you use the so-called ‘short-term memory’. Imagine that the short-term memory is a notebook with only a few sheets. This type of memory is capable of holding only a limited amount of information.

The problem is that like a thin notebook has only a few sheets your short-term memory can hold only a limited amount of information. After some time, while the knowledge which you got during a day dissipates, your concentration on the study transforms into a waste of time and effort.

And another study method comes into action.

Method of distributed study

The distribution method is opposite to the concentration method. It allows your brain to link together the whole studied material. Imagine that you turned off your computer and had a walk or a cup of coffee, but your brain keeps classifying the whole studied trading information in the background mode.

I am sure that many of you faced a situation when you went to bed trying to find an answer to a question or a solution to a problem and got up in the morning with an answer or solution. The matter is that the major part of the nervous system resources is spent for processing signals received from our sense organs when we do not sleep. We spend up to 80% of them only for analyzing visual information.

Namely that is why many people close their eyes when they try to solve a difficult task, think over some important problem or try to remember some necessary information. It allows them to direct a part of the nervous system’s resources to the solution of this task. Our sense organs stay in the passive state during sleeping and react only to the strongest stimulants, which allows setting the main brain resources free in order to analyze the available information and solve important tasks. Namely that is why there are many stories about situations when a person remembered while sleeping where he put something, which he couldn’t find during daytime, or when he managed to solve a task, which he couldn’t solve during daytime.

So, what does it have to do with trading? Dear friends, it does have much to do with trading!

Explicit and implicit methods of trading study

Let’s assume that you decided to study one of the cluster chart patterns (footprint). This pattern is just a part of a more complex brain twister, but you decided to start with focusing on the visual perception of this pattern and its quick identification.

Below is an example of exercises, which will help you to increase accuracy and speed with which you will be able to interpret the data from the exchange in the form of cluster charts. Just don’t allow the simplicity of these exercises to deceive you. They are designed for brain training in order to be able to notice important patterns and do it with the ever increasing speed.

- Select a trading instrument, time-frame and certain trading period for analysis.

- Print out the cluster chart of the selected time period. Select one of the footprint patterns described in the Learning to read the footprint: what every novice should know article and circle them with a marker in the chart. Return back and check whether you missed anything. Then print out one more copy of the same period and repeat the exercise, but only for another pattern. Repeat the same actions for each selected pattern.

- Study the selected trading period on several time-frames. For example, build a cluster chart on the basis of the following time-frames: 5 minutes, 15 minutes, range frame with the value of 1.0, volume frame with the value of 5,000 and tick frame with the value of 610. Make sure you selected several alternative types of frames, which are based not on time only. Compare these charts in order to see how footprint elements and patterns are similar or differ on different frames. This exercise will allow you to thoroughly study the pattern and its fractal nature.

- Run the cluster chart backward and conduct its bar-by-bar analysis, detecting the pattern on the selected trading period. It will allow you to bring these conditions closer to the trading ones and will give you time for reflections. Reduce the time devoted to identification of the pattern step-by-step in the process of conducting this exercise.

- Note down elements and patterns, which you see, together with other relevant observations in the log in the process of trading on the demo account. After that, return back and analyze your notes and assumptions and also what happened in reality. Did you monitor the market closely? How accurate are your notes? Did you miss anything? Did you detect anything?

The above example of exercises is the so-called explicit study. In this case, a trader is provided with specific practical methods for analysis of information. A trader knows what to do and what the goal of the exercises is during the whole period of study.

Nevertheless, there is another method of study, which is known as implicit study. Implicit study in trading is, in fact, a process of development of the skills of unconscious identification of patterns. In order to develop such an ability, a trader has to spend a lot of time analyzing charts in real time.

The most important thing is that this type of study is not one of the variants of the uptake of some facts and numbers as it is in the standard study process. It is a motor training or, in other words, formation of a connection between the perception and answer. Perhaps, this is why many successful intraday traders cannot boast that they have deep book learning knowledge. They are absolutely right when they say that they feel the market.

We recommend you to read the book of the Doctor Brett Steenbarger on trading psychology if you have a serious attitude to development of your own system of trading study and want to learn more about the implicit method.

Limit the trading study time

Sitting for hours in front of the computer monitor or immersion into books or blogs about trading could be compared with rote learning a day before the final school exam. Rote learning doesn’t guarantee you a proper training and exam passing. Moreover, it will not give you the required knowledge in order to legitimately become a part of the extraordinary world of trading.

Why?

When you study trading or anything else, you should study the material step-by-step, splitting it into components and repeating it during a long period of time rather than study it greedily during one day. Of course, you should understand the studied material but understanding of the material doesn’t guarantee the ability of its application in practice at all.

Note:

People suffer from the ‘competence illusion’ in trading far too often. They believe that if they understand the concept they are able to apply it. This is one of the reasons why many traders start trading using real money long before they are ready for this. As a rule, such actions lead to deplorable results.

All these components, gathered together, form the knowledge about trading which we accumulate and are able to realize in the real-life market.

However, the focus on ‘studying to trade’ is also not the best variant.

This is the final result of your actions but there are a lot of stages between the beginning and end.

And this is exactly what you should pay attention to.

25 minutes of intensive attention

We should thank Francesco Cirillo for this simple idea. Divide the training process into 25-minute periods, so-called ‘tomatoes’, accompanied with short 3-5 minute breaks. Have a long 15-30 minute break after every 4th ‘tomato’.

The method of concentrated study (in which you will apply the ‘tomato’ method) is an intensive and serious shakeup for your brain. When you decide to spend 25 minutes for intensive concentration on the studied subject, you already start sending the received information into the long-term memory.

Spend not more than 25 minutes for the study and have a break after that. Or just stop the study on that day and do something else realizing that now the training process goes under control of the method of distributed study.

The method developer encourages a low-technological approach with the use of a mechanical timer, paper and pencil. Physical wind up of the timer underlines user’s readiness to start solving the task, the timer ticking reminds the user that the time moves on and the ring informs about a break. The flow and attention are associated with these physical stimulants.

What to do with all this information?

You should understand that the study is not the process which you should conduct forcing yourself. You should systematically approach the trading study and guarantee that when it’s time to study, you do study.

However, do not go too far.

Use the ‘tomato’ timer in order to control the mode of continuous concentration on the study for not more than 25 minutes. Have breaks in order to involve the distributed study method, which would start gathering together everything you had concentrated on just before the break.

Constantly check yourself during the whole process of study.

Do you study a new pattern? Draw it, marking all of its basic elements and also the places where this pattern emerges in the chart.

Analyze the charts step-by-step and monitor the price behaviour near the key areas. For example:

- Draw the support/resistance lines using your method of their identification.

- Think about what could happen when the price approaches these areas.

- Move the chart in the screen bar after bar making assumptions about possible scenarios of the market situation development.

Mind your state

Mind your health. Results of different studies showed that metabolic toxins, which are accumulated in the human brain during the day, are removed from the brain only during sleep, when the brain cells usually contract. Do not begin to study if you are tired because tiredness creates unfavourable conditions for the study.

Regular physical exercises could also increase your abilities for the study.

You may also get a job in a trading company with a good reputation or find local trading groups. Business schools have such groups for a good reason.

Working in such a group would help you to get rid of the one-track mind and open the door to new opportunities.

Develop a training schedule and seriously think over the material of the present article. Do not think that understanding is similar to practice. Take your time to really understand trading and learn to apply all the received knowledge in practice.

The market will not run away from you and will be ready to bring you profit when you are ready for it.