In this article:

- What factors influence forecasting of the silver futures prices?

- The USD influence on the silver price.

- Silver Thursday’.

- Advice for silver futures intraday trading.

What factors influence forecasting of the silver futures prices?

As it is with any other raw material, the fundamental factors that influence the silver price are the demand and supply. If we speak about demand, silver finds a wider application than gold, especially in the industrial sector. This is one of the most widely used raw material types, starting from automobiles and electronics to photography, being also a key component in jewelry manufacturing.

As regards the supply side, silver is produced mainly in the US and the cost of its production could play the decisive role. According to existing assessments, the cost of production of one ounce of silver is somewhere in the range of USD 22-30.

México, Perú, China, Chile and Australia are among the biggest silver producers. Despite the fact that China is a big silver producer, it is also its biggest importer in the world.

The table below shows statistics on 5 biggest silver producers in the world in 2016 in tonnes.

| Country | Production (in tonnes) |

| Mexico | 5,600 |

| Peru | 4,100 |

| China | 3,600 |

| Chile | 1,500 |

| Australia | 1,400 |

The usd influence on the silver price

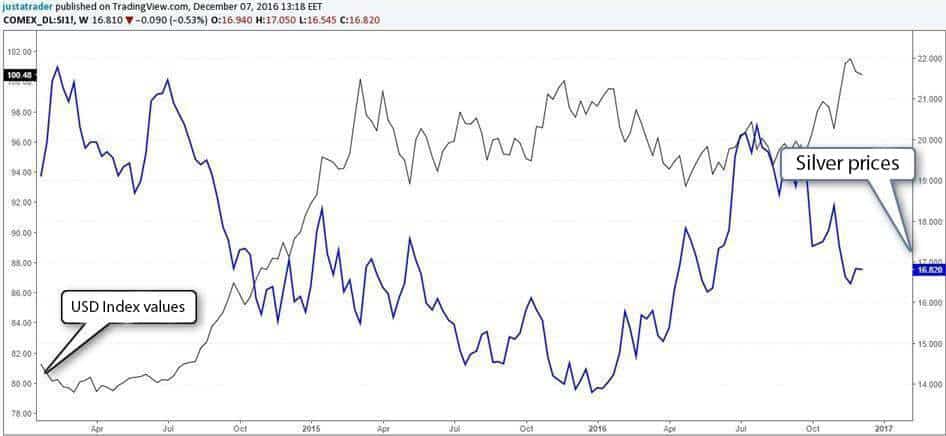

The silver price is set in USD and, as a result, strengthening or weakening of this currency influences it in the short-term perspective. The chart below shows the silver price to the right and the USD Index (U.S. Dollar Index, USDX, DXY) values to the left.

Comparison of the silver prices and USD Index

The growth or strengthening of the USD Index often results in the silver price decrease and vice versa, the weak USD facilitates growth of prices on this metal. Thus, the correlation between the USD and silver price is inversely proportional.

You also need to pay attention, when you trade silver futures, to the fundamental macroeconomic factors, which influence the USD exchange rate, which, in its turn, is reflected in the silver price.

You should attentively track the key economic reports, such as US GDP Report (published in three issues: preparational, preliminary and final) and the inflation and unemployment data, which, in the end, are connected with the FRS decisions on short-term interest rates. Usually, a stricter monetary policy facilitates the USD growth, which, in its turn, weakens the silver prices and vice versa.

‘Silver thursday’

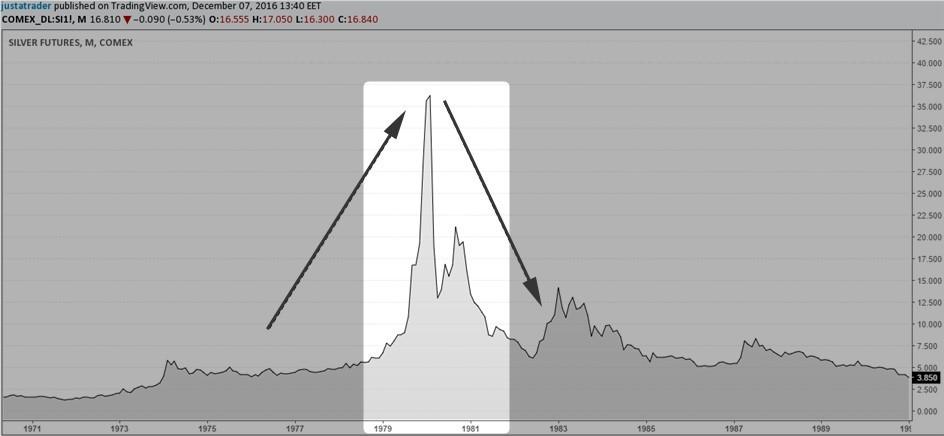

The event, which was later called the ‘Silver Thursday’, took place in 1980, when Hunt brothers (Nelson Bunker Hunt, William Herbert Hunt and Lamar Hunt) tried to corner the silver market and become monopolists in this market to impose their price on industrial consumers of this metal. All this resulted in a sharp decrease of the silver price and in panic sells on the commodity futures exchanges.

Until then, the Hunt brothers had actively invested in the silver futures contracts having opened a number of big trades with different brokers. After some time, the Hunt brothers held minimum 1/3 of all the world silver reserves, which were estimated in billions of USD. Those buys drived up the price of one troy ounce of silver from USD 6 to USD 50.

Approximately at the same time, the Commodity Exchange Inc. of New York (COMEX) started to introduce new provisions, which set restrictions on buying silver contracts having increased the margin requirements twice, while the government introduced restrictions with respect to money borrowings for the futures markets. All together, this resulted in a margin call on the silver futures contracts of Hunt brothers. The brothers received an order to pay in additional USD 136 million, given that they already had invested billions. However, they had no money and their brokers had to cancel the Hunt’s positions. The silver price dropped from USD 20 to USD 10.80 per ounce by the end of March 27, 1980, since there were no people who wanted to buy silver. The Hunt brothers had thousands of long-term contracts. In order just to pay off these debts they had to sell eight and a half million ounces of silver plus oil and gas for the general amount of nearly USD 400 million.

Advice for silver futures intraday trading

Trading the silver futures contracts could be extremely risky due to the size of the minimum price change (tick) and its price. It is not recommended to relax if you trade silver since even open profitable trades may quickly turn into loss-making ones and bring serious financial losses. That is why, be very careful and attentive when you trade these contracts.

Below are some issues, which you need to take into account while trading silver futures:

- The silver futures contracts are actively traded from 17:00 until 16:00 of the next day Central Standard Time (Chicago) on working days and Sundays with a daily 60-minute break which starts from 16:00;

- Since silver also behaves like a shelter asset, the sharp fluctuations of its price could happen at any moment, especially after the news, which were undervalued by the market;

- The trading volume, as a rule, increases from 7:00 CST (Chicago) on regular days. During this period, traders could apply short-term trading strategies, designed for the intraday trading in the silver futures market;

- Attentively monitor the weekly Commitment Of Traders (COT) Report (published by the Commodity Futures Trading Commission – CFTC), which may provide you with an insight into open positions of major traders on the eve of a new trading week. A necessity of this report lies in the fact that all market participants, divided into several groups (minor speculators, major traders, hedgers or operators who really accept delivery under the contracts), provide reports about their open positions. Speaking about dates, please, note that the report is published on Friday at the end of the week but presents the segment of data as of Tuesday. And although traders receive these data with an approximately 3-day delay, the extreme values of the positions, taken by the speculative money, could often signalize about a short-term change of the trend;

- The silver futures prices are, as a rule, the most volatile during the input of the key US economic data and even more volatile when the Federal Open Market Committee (FOMC) members make reports and make decisions on the interest rate.

The silver futures trading also could become a real possibility to make money. However, do not deceive yourself that it is easier to trade silver than gold only because it’s cheaper. In fact, the situation is quite opposite, since, due to the fact that a standard silver futures contract has the volume of 5,000 troy ounces, the sharp price fluctuations could often send your equity deep into the red.

The disciplined traders with a tested profitable trading strategy, along with good skills of money management, without doubt could consistently make profit from trading the silver futures.