Do you want to know how to start making money in the stock market? A very right wish. Have a look at the most recent (at the time of this writing) Forbes rating – who are the richest people in the world?

Mainly, these are people who made money due to the growth of price quotes of the stocks they own:

- Jeff Bezos. He founded Amazon in his garage in 1994 for selling books online. The company developed fast since then. Due to the growth of the price quotes of AMZN stock in the US stock market, Bezos became the first person whose wealth exceeded USD 100 billion in 2017. His assets continue to grow since then even despite his divorce, which cost him USD 37.5 billion.

- Bill Gates. Although the Microsoft founder sold the main block of MSFT stock and owns only 1% of the company stock, nevertheless he keeps leading positions in the rating of the richest men.

- Warren Buffett. Perhaps, he is the most famous investor in the stock market. The main part of his capital is a block of stocks in Berkshire Hathaway, which owns shares in more than 60 companies such as Apple, Coca-Cola, American Express and others. Successful stock trading gives Buffett an opportunity to buy favourite ‘toys’ – he owns more than 90 jet planes.

So, a wish to start trading in the stock market is the correct first step on the way to personal independence. Of course, we should be realistic – a beginner in the stock market would hardly be able to move down someone from the Forbes rating. On the other hand, you can start making money in the stock market immediately after opening your brokerage account.

Read in this article:

- basics of the stock market for beginners;

- what to start the study of the stock market from;

- what to start investments into the stock market from;

- how beginners can play in the stock market.

Basics of the stock market for beginners

Everybody knows that the stock markets are platforms for trading, first of all, the company stocks. We wrote in our article about the organizational exchange structure that the first stock markets emerged in Europe in the 12th century. The exchange stock trading developed further since then.

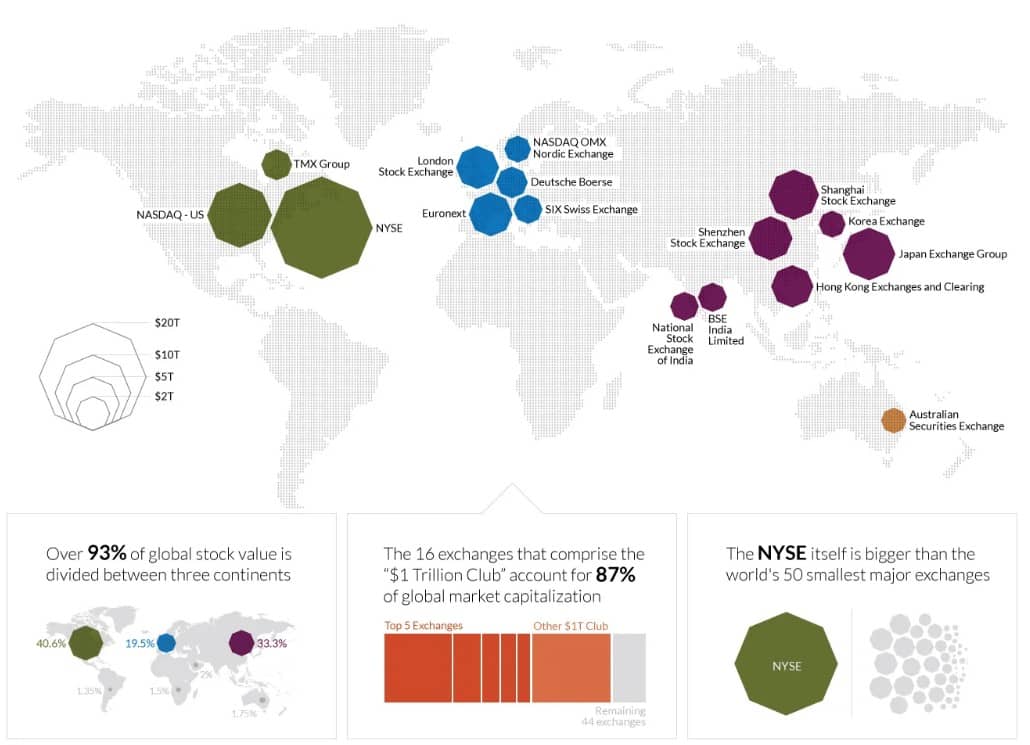

Below are the data about the stock market for 2016. This information is rather old but it would be useful for beginners to understand the global scale of stock trading at least approximately.

We can see from this infographics that:

- 93% of the stock value are located in the territory of the US, Asian countries and European Union.

- 16 exchanges have a capitalization of more than USD 1 trillion. Most probably, this figure became bigger after the bullish trend in the stock markets in 2019.

- The world’s largest stock exchange is the New York Stock Exchange (NYSE). It is larger than dozens of other major exchanges (such as the Moscow Exchange) taken together.

Thus, the US stock market could be the most attractive one for beginners for a simple reason – a selection of stocks is very big. It means flexibility when building a trading strategy. An investor could select stocks by different criteria:

- by value. The value of stocks is from several cents to thousands of dollars and even more per share;

- by industry. If you want to invest only in those industries which grow faster than the market, go ahead! You can find dozens of decent candidates for your portfolio within one industry.

- by a type of trading. There are both active stocks for intraday scalping and securities for long-term fundamental investors in the US stock market.

Disadvantages of trading on the NYSE:

- a big volume of information in the English language. It will be difficult for you to trade there if you do not know English well;

- a more expensive threshold for entering the game. Minimum deposit requirements, commission fees and cost of real-time data are higher than on the Moscow Exchange.

- the time difference could also bring inconveniences.

You can find more basic information for beginner investors in our following articles:

- read about the stock market participants and functions in the what the stock market is article;

- read about the methods of the stock market analysis, income history and trade examples in the Is it real to make money trading stock article;

- what the company stock is and what stock indices are;

- pros and cons of online trading.

What to start the study of the stock market from?

Trading in the stock market is a risky enterprise for beginners. That is why we recommend, first of all, to study the risks. If a beginner knows how losses are formed, it would be easier for him to protect himself from them. Play defense first.

The main advice the successful traders give to beginners with good reason is stop losses quickly and strictly.

Study attentively the expenditures connected with the stock market trading. After you understand how the outgoing part of your trading is formed, start working on the incoming part. The goal is simple – income should exceed expenditures. The idea of trading in the stock market is not different from the basic commercial principle.

To buy cheaper and sell more expensive a stock trader needs to have vast knowledge from different spheres:

- classical technical analysis, standard and advanced indicators;

- chart and candle patterns;

- modern footprint, Smart Tape and Smart DOM analyses;

- fundamental stock market analysis;

- modern exchange technologies and software;

- exchange price formation and order matching;

- trading psychology.

A beginner should consistently study each of the subjects from the above list and do not hurry to put his capital at risk trying to make fast and easy money.

Example. Do you know how Jesse Livermore started his career? He is considered to be the greatest speculator in the history of the stock market. Now then.

He ran away from his home when he was 14 to avoid working on the father’s farm. Jesse found work in Boston in a ‘bucket shop’ – a ‘grey’ brokerage office. Jesse wrote the latest stock quotes, which arrived on the exchange telegraph ticker tape, on a board with chalk for five dollars a week.

Young Jesse absorbed the price dynamics, looking for regularities (especially near psychological levels), and started to keep a log, where he noted down the price patterns, which attracted his attention.

He executed his first trade when he was 15. He put USD 5 on the growth of the ‘Chicago, Burlington and Quincy Railroad’ stock and made a profit of USD 3.12. Then his career grew into a great and dramatic story (described in the Reminiscences of a Stock Operator book, 1923. Trading books you must read).

What conclusions can we draw from the beginning of the career of the financial genius Jesse Livermore (he is up close and personal in the picture above)? He spent a year studying the price movement every day before he put real money at risk.

Do not hurry. Every single day provides opportunities in the stock market. However, it is impossible to use them without proper training.

You can find more useful information for stock market beginners in our following articles:

- 5 advice for beginner traders. How to read the order flow.

- The first steps on the exchange.

- How to study the exchange trading market.

- Is it possible to study trading from scratch?

- Learn to read a footprint.

How to make money in the stock market from scratch?

How to make money in the stock market from scratch? What do we mean by ‘scratch’?

If you think that you can start making money without having a single cent in your pocket – you are in for a disappointment. ‘In order to sell something, you need to buy it first’. Otherwise, how can you make money on the price difference?

Although, trying to attract new customers, the brokers in the ‘troubled’ forex and binary options markets offer bonuses and start-up deposits. They promise beginners that they would be able to move out the profit after they make a certain amount of it on the start-up deposit. But we warn beginners against ill-considered decisions.

If ‘scratch’ means knowledge – everything is in your hands. No one has yet been born a successful trader. Everyone makes his or her own way. There is no direct and easy road to profit making in the stock market, but it is quite possible to achieve success.

You can find examples of it in the following articles:

Conditions of success

Trading in the stock market – what should you start investing from? Let’s check the advice of Warren Buffett whom we already mentioned at the beginning of this article.

Warren recommends to beginners:

- not to invest into projects you do not understand. The stock market is a pool of traps. You should know what you do and be responsible for your decisions. Investing in the stock market requires a scientific approach, working with the assessment of probabilities and risk control. Do not gamble hoping that you are the lucky one;

- use a price fall as a possibility to buy a strong asset with a discount. The most perspective opportunities emerge when the news are terrible and the market is in panic. An example – the fall of stock prices known as the Christmas Plunge that took place in December 2018. The US stock market seemed to be not a very good idea for beginners to invest, but the prices moved upward during the whole 2019.

Summary

We hope that you get ideas how to start trading in the stock market after reading this article.

At the end, we call you to reason and sense. Many deposits were lost in the stock market just by mistake or due to recklessness, negligence and loss of control over emotions. A beginner would be successful in the stock market if he is able to keep discipline and carefulness. And the knowledge and valuable experience will follow.

Trading in the stock market is not easy for beginners. Here are some more links to useful articles on our blog, which would help beginners to move in the right direction from the very beginning:

- Strategies of trading by volumes.

- How to organize your trading correctly.

- Series of articles about VSA and cluster analysis.

Remember that the money does not come to the stock market from nowhere. Draw a parallel with the law of conservation of energy. There are no engines with the degree of efficiency higher than 100%. The same is true for the money in trading. Someone has to lose money for you to make it. And there will be no brokers and market makers among losers.

Be self-critical and clearly understand your competitive advantage. The trading and analytical ATAS platform will help you to be one step ahead of the majority of the other stock market participants.