What is a margin? This term is rather frequently used in economics, commerce and trading, but it means something different in each case. That is why, in order to avoid confusion and mess, this article explains all meanings of the term margin.

You will learn from this article what is:

- Margin in business;

- Margin in trading;

- Margin trading.

Margin (French ‘marge’ – border, reserve or page side). Margin is an economic term, which means a difference between the commodity prices, interest rates and currency rates.

Margin in business

Margin in business is a difference between the price and self-cost of a commodity. People sometimes confuse margin and extra charge. Let us find the difference using formulas:

Margin = (selling price – self-cost) / selling price * 100%

Extra charge = (selling price – self-cost) / self-cost * 100%

The extra charge can easily be more than 100% and margin cannot be more than 100%, since the self-cost in the profitable business is less than the selling price.

Let us consider an example:

| Self-cost, RUB | Price, RUB | Extra charge, RUB | Extra charge, % | Margin, % |

| 25 | 50 | 25 | 100% | 50 |

| 25 | 55 | 30 | 120% | 54 |

| 25 | 60 | 35 | 140% | 58 |

Margin and extra charge are interconnected – the extra charge increase results in the margin increase. We can calculate the extra charge and regulate the selling price of a commodity when we know the margin.

For example, an enterprise wants to have the 30% margin when the self-cost of a commodity is USD 25. Then the calculations for determining the extra charge would look as follows:

30%=(X – 25) / X * 100%

0.3X = X – 25

25 = 0.7X

Selling price = USD 35

Extra charge = USD 10 or 40%

Margin is also called the profitability of sales and the sales gain could be assessed with its help. If the self-cost and extra charge do not change, only increase of the number of sold positions results in the margin growth.

Margin in trading

Margin in trading is a difference between the prices of selling and buying securities, futures, spreads and options.

If a trader trades futures, his account is changed every day by the amount of the variation margin. If a trader made profit, the variation margin is placed to the trading account. If a trader made losses, the variation margin is written off the account. Placing to and writing off take place during clearing. Clearing (or a clearing session) usually takes place once or twice a day and trades are not executed during clearing.

The methods of calculation of the variation margin are given in specifications of instruments on the website of an exchange. For example, one of the formulas looks as follows for an RTS index futures contract:

2.1.3.1. In the course of a day clearing session:

- If calculation of the variation margin under the Contract has not been performed before:

BM1 = Round (CP1 * Round (W1 / R;5);2) – Round (CEP * Round (W1 / R;5);2)

where:

BM1 is a variation margin under the Contract, calculated in the course of a day clearing session of the current Trading day;

Round is a function of mathematical rounding with a set accuracy;

CEP is the Contract Execution Price;

CP1 is the current (most recent) Calculated Price of the Contract;

W1 is the cost of a minimum price increment;

R is a minimum price increment.

Calculation of a minimum price increment for the RTS index is done with the use of the USD exchange rate. This influences the financial result. If the USD value goes up, the cost of an RTS index futures goes down and vice versa.

You can get acquainted with specifications of futures contracts, traded on CME, on the CME website.

Margin trading

Margin trading is trading with the use of borrowed funds, provided by the broker. Brokers call the margin trading – “unsecured trades with the use of credit” or “uncovered stock and monetary positions”.

What is the margin trading for? It is a popular way for traders, who have small amounts of money on their accounts, to open opportunities for increasing their income. The margin trading is also called “the leveraged trading”.

If a trader has a small start-up capital, the broker will gladly offer him a credit leverage, since the trader will have to pay additionally for this operation. For example, BCS offers the credit leverage of 1:5 to all clients, while the Savings Bank offers 1:3 with a possibility to increase it up to 1:5. These proportions mean that, while having RUB 1,000, a trader can operate with the capital of RUB 5,000 (3,000).

The following concepts are closely connected with the margin trading:

- CSRL, CHRL, CERL (explanation will follow below);

- discounting coefficients or risk levels;

- portfolio cost;

- initial margin;

- minimum margin;

- forced closure or margin call.

What CSRL, CHRL and CERL are

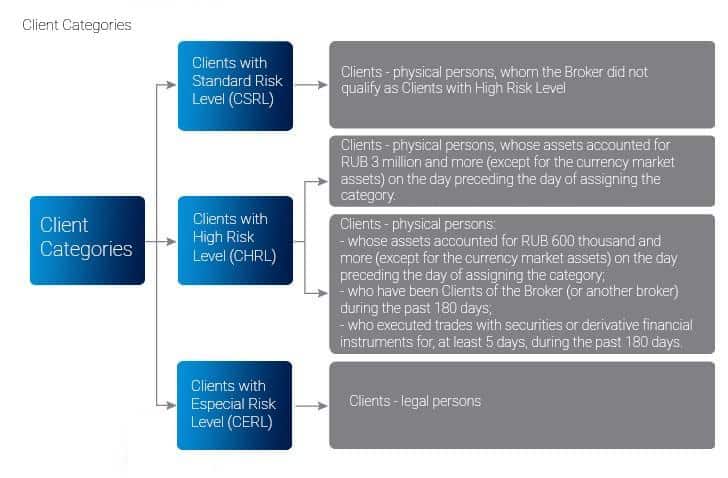

Brokers divide the trader-clients into categories, based on risk levels, and assess what amount of funds could be set for margin trading.

- CSRL – Clients with Standard Risk Level. Physical persons with a small start-up capital and absence of experience.

- CHRL – Clients with High Risk Level. Physical persons with a bigger amount of money (from RUB 600 thousand) and bigger experience (from 180 days of active trading).

- CERL – Clients with Especial Risk Level. Legal persons.

Here is, for example, how a BCS broker explains division into categories.

Use of borrowed funds in margin trading is a paid service. Brokers specify the cost of use of borrowed funds on their websites and in brokerage servicing contracts. Here is an example from the Savings Bank website.

Execution of SpecREPO trades

| Transfer of an unsecured monetary position (longs) | 17 % annual | 17 % annual |

| Transfer of an unsecured securities position (shorts) | 15 % annual | 15 % annual |

Brokers take securities as surety. The list of margin securities is also available on the broker’s website. These are the most liquid papers – blue chips – Savings Bank, Gazprom, Rosneft and Lukoil.

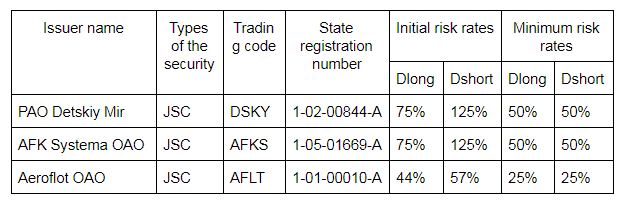

A broker sets discounting coefficients or risk levels for each security. Risk levels are required for identification of initial and minimum trader’s margin (you can read about initial and minimum margin below).

Here is an example of three margin securities of a BCS broker for clients with standard risk level.

The list of Russian securities for clients with standard risk level (CSRL)

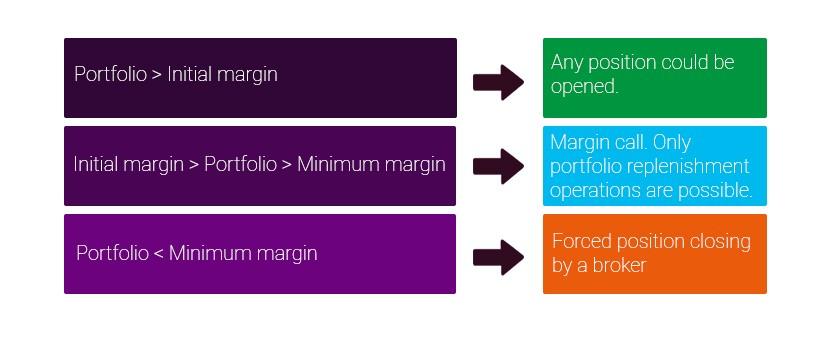

Initial margin = cost of the security * initial risk rate of this security.

Initial margin is a part of the cost of a margin security, which should be available on the trading account of a trader. It is not necessary to pay 100% for margin securities. It is sufficient to pay the initial margin.

Minimum margin = cost of the security * minimum risk rate of this security.

Minimum margin is a threshold, approaching which the broker will start asking to replenish the account. The broker becomes anxious about solvency of a trader and his further trading on the exchange, when the trader reaches the minimum margin level.

Example. Let us take Aeroflot stock and calculate the levels of initial and minimum margin.

| Cost of Aeroflot stock, RUB | Number of shares, items | Initial risk level for opening long positions Dlong 44%, RUB | Minimum risk level for opening long positions Dlong 25%, RUB |

| 114 | 100 | 5,016 | 2,850 |

Portfolio cost = market cost of liquid securities + money – margin debt.

A broker will not include non-liquid securities into the portfolio cost. In other words, if you have 100 shares of AO Beluga for the amount of RUB 49,000 and 100 shares of AO Aeroflot for the amount of RUB 11,000 and 3,000, the broker would assess your portfolio at RUB 14,000. This amount will be compared with the initial and minimum margins.

The scheme below shows what actions are possible in case of a different portfolio cost with respect to the initial and minimum margins:

Advantages and disadvantages of margin trading

| Advantages | Disadvantages |

| It is possible to buy a bigger number of securities | Risks are higher |

| Absence of additional expenditures for intraday trading | Additional expenditures for position traders |

| Liquid securities are margin ones | Not all securities are margin ones |

Margin trading requires serious attention to initial and minimum margins and portfolio cost. Traders make more money using the credit leverage, however, they increase risks and reduce the number of their nerve cells at the same time. Use margin trading consciously and responsibly.