From interview with a trader:

– How did you achieve such a success? You have USD 100 thousand after a month of trading!

– Nothing special. I opened a deposit on one million a month ago …

How to stop suffer losses and achieve a success? Having generalized experience of 99 successful traders, we have noticed one interesting thing – all of them followed 5 simple rules and restrictions. We will describe these rules in order to help you making money on the online exchange every day.

Start using ATAS for free with no time limits! Or activate the advanced tariff right now to access the full range of functionality.

FIRST RULE IS A CAREFUL SELECTION OF A NICHE FOR ONLINE TRADING.

Exchanges are an unbelievably rich world. Both in the sense of money and diversity. In order to be successful and make money on exchanges every day, it is necessary to find your own place. We mean that ideal niche, which is your personal and which is in harmony with your natural qualities and a nature of a specific market.

For example, a futures on the RTS index is much more inconsistent than a futures on the MICEX index.

If you take on a risk easier than other people and make decisions faster, most probably, futures trading on the RTS index is more preferable for you.

There are many niches in trading on the online exchange. Some of them could match you perfectly and some could be absolutely inappropriate.

What type of trading do you like most of all?

- positional trading – holding positions from several days to several weeks. You can trade stock, futures and spreads;

- scalping – a special type of an intraday trading, which lies in fast opening/closing trades with a small profit. A scalping trade lasts from several seconds;

- intraday trading – all trades are closed during a day, but are held longer than in case of scalping;

- investing – long-term (from one year) position holding.

How do you make a decision – intuitively or logically?

For example, when selecting a technique:

- do you study all technical characteristics thoroughly

- do you call around showrooms in search for a better price offer

- do you spend a lot of time weighting all cons and pros?

Or do you make an instantaneous decision because you liked the technique from the first sight?

The way we make a decision is an expression of our cognitive style, that is, an ability of receive and process information. A trader will be successful sooner, if he would use those trading techniques that correspond better with his way of thinking.

A very simple and, at the same time, efficient variant to find yourself in online trading is to open several demo accounts at a broker and try yourself in various trading styles, assessing how comfortable you feel when you trade and how profitable your trades are.

Advice. Pass the Van K. Tharp or Brett N. Steenbarger test for understanding yourself and your niche in the online trading business.

Aim at the process and not result at the initial stage of online trading, when you are just looking for your niche. At this stage, it is more important to develop your trading plan and to learn how to follow it, than to make a pile of dough due to a dumb luck.

Thomas Edison said once “Genius is one percent inspiration, ninety-nine percent perspiration”.

You will not be able to produce perspiration long enough if the thing you do does not ignite you.

SECOND RULE OF SUCCESSFUL ONLINE TRADING IS THE USE OF THE RIGHT SOFTWARE

Operation in an advanced trading and analytical system creates a competitive advantage if compared to other traders.

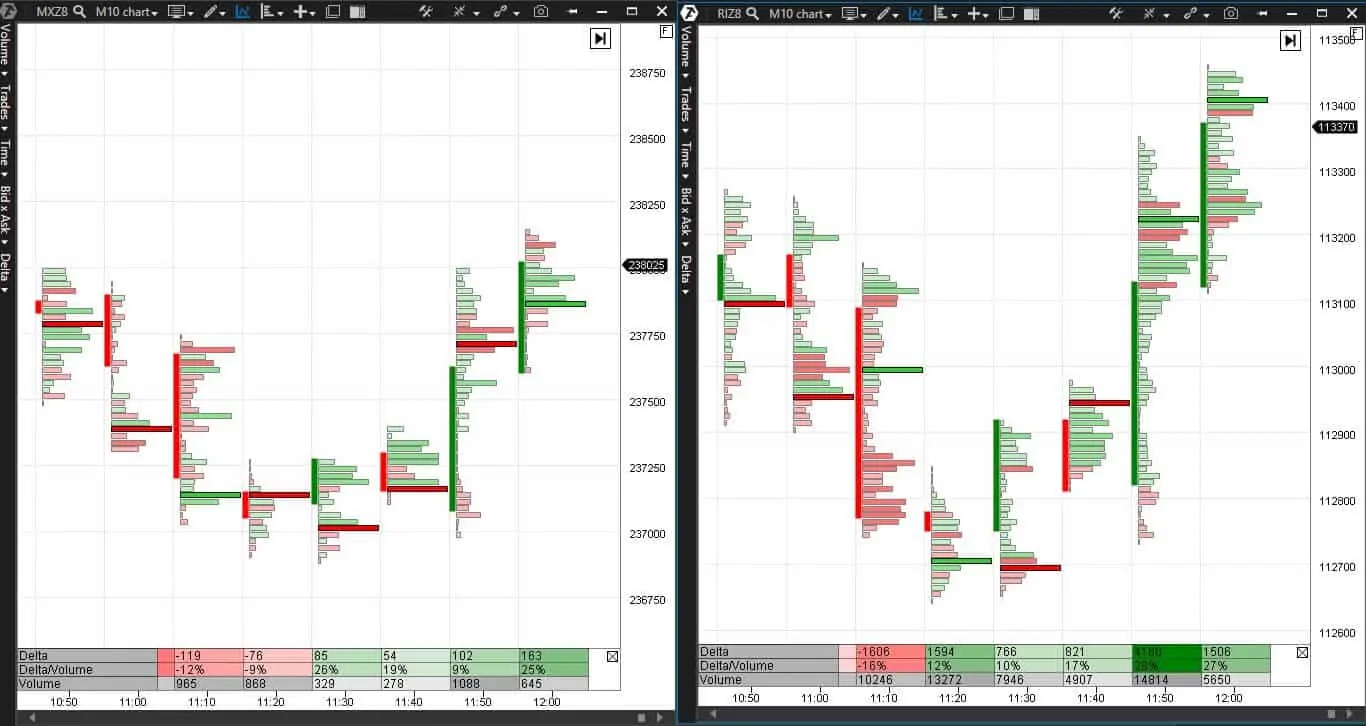

In the course of their development in understanding market processes, traders apply the cluster analysis with increasing frequency. This is the most advanced technique of the market assessment and it uses a footprint or cluster chart, which simultaneously reflects:

- price;

- volume traded at each price level;

- and direction of executed trades – buying or selling.

With the help of a color, the clusters inform a trader who exert more efforts at a certain moment and at a certain price level – sellers or buyers. The cluster analysis does not replace the technical or fundamental one, but allows seeing dynamics of change of supply and demand with bigger transparency.

Please, have a look at Picture 3 – it is a chart of oil futures at one of the trading days on the Moscow Exchange. You can clearly see the moment when the buyers took the lead.

After an unusually high volume at 11:00 with a clear negative delta (which is typical for intraday panics at lows), the price stopped falling and the delta gradually discolored to green. The market became clearly bullish showing the price increase on the background of buying activity.

If you experience difficulties reading the market on a cluster chart, try another type. Either classical candles or more rare RangeUS charts.

Here, for example, is one and the same market in different types of charts.

Time span is the same, but using range you can look at the market from a different angle, which would allow spotting the idea, which is not evident in another chart type.

THIRD RULE OF SUCCESSFUL ONLINE TRADING IS A TRADING SYSTEM AVAILABILITY

Permanent yield is ensured by a good trading system and not by individual successful trades.

Trading system is a set of well-defined instructions:

- entering a position;

- exiting a position;

- determining a trade amount;

- limiting losses and protecting profit.

The clearer and easier the instructions are, the simpler is to follow them and there is less space for amateur activity.

For example, a trader in a weak market (ETHUSD is used for this example) catches false upward breaks.

If the price exceeds the previous high (marked with a blue line), but then rapidly goes back to the previous range, this would be a simple and clear rule of entering a short position.

By the way, note the Delta Indicator. It marks a peak of buying, however, in spite of them the price goes below the clearance level. Why? Because these purchases are, most probably, activations of close stops of sellers, which is not a real power. That is why it is not surprising that the price goes down when the delta discolors to red (pressure of sellers).

Download ATAS now and study buying and selling behavior at false clearances. Perhaps this is just your niche in trading on online exchanges.

Make records of trades, observations and ideas in a log in order to analyze successes, correct mistakes and become better every day. Just imagine how in 10 years, when you reread your first trading log with your children, you will be very surprised to see that you had so strange trades.

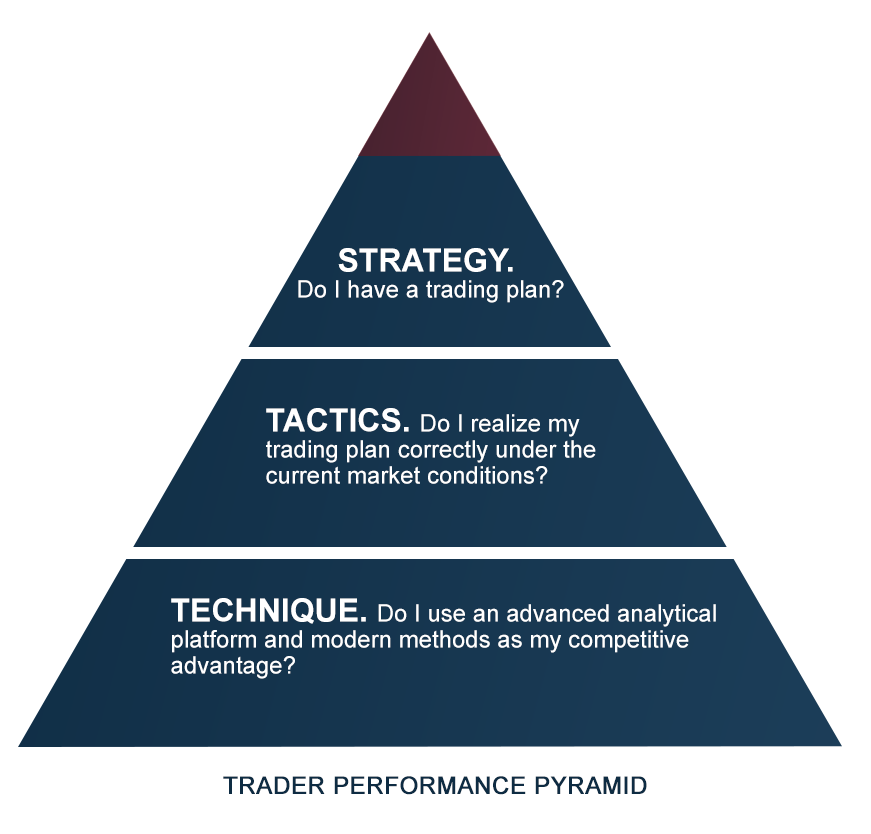

Trader performance pyramid.

FOURTH RULE OF SUCCESSFUL ONLINE TRADING IS MONEY MANAGEMENT

We believe that money management is the most frequent recommendation of the trading professionals on online exchanges, to which the beginners pay the least of attention.

It is believed in the world practice that the risk must be calculated for each trade beforehand and it must not exceed 1-2% of the capital. Total losses on all open trades shall not be more than 5-6% of your trading account. You have to stop trading when you achieve these limits. You also could limit losses with time frames, that is, calculate maximum day and week losses.

Professional trader John F. Carter said once: “Amateur traders turn into professional traders once they stop looking for the “next great technical indicator” and start controlling their risk on each trade.”

Under conditions of uncertainty, only the market decides whether we make money or not, but we ourselves decide how much we lose. Feel the convenience and reliability of protective strategies, built into the ATAS terminal, in order to control your money management strategy automatically.

FIFTH RULE OF SUCCESSFUL ONLINE TRADING IS A PSYCHOLOGICAL AND EMOTIONAL CALMNESS.

Emotional excitement interferes with a balanced information processing and results in tiredness and loss of concentration.

The greatest speculator Jesse L. Livermore considered his habit to get up very early to analyze markets as his advantage. His emotional background was smooth at that time and his thoughts were clean for new ideas of market campaigns.

Sometimes it is sufficient just to restore your breath in order to calm down your thoughts during a trading session.

Sometimes it is better to hold back from trading:

- under stress. After a quarrel with your wife, traffic jam or call of a seller of banking products you might just miss a barely noticeable detail in the chart;

- in the state of physical exhaustion – when you did not get enough sleep, got tired to interpret interaction of price and volume, when your head is heavy, you lack concentration and thoughts scatter there is a higher risk of making a wrong decision;

- immediately after a loss trade you have a strong wish to recover your losses and take revenge on the market. The moment this thought comes to your head, cuff your hands and run away from the terminal;

- immediately after a very profitable trade when you consider yourself Bruce Almighty or King Midas and all your trades will be profitable from now on. Be careful, you can easily come down to earth from the clouds.

- when you are watching news and high volatility and wide price movements inspire you to enter a position and make a quick buck. However, the increased activity in the market often means a wider use of stop losses. Which means a higher risk.

Conclusions

The above list of rules is not sorted out by any criterion, since all the rules are similarly important for successful online trading on the exchange.

You cannot be one hundred percent sure, where the price, the next moment, would go to. Nobody can. However, observance of the described 5 rules for trading on online exchanges would significantly increase the probability of your successful performance.

Remember that “great results come from small improvements that are implemented with consistency” Brett N. Steenbarger