A financial bourse is a centralized platform where market participants can make trades using various financial assets, including securities, currencies, commodities, and derivative financial instruments.

This article is for beginners interested in the prospect of becoming a trader on a financial bourse.

Read more:

How Financial Bourses Work

Financial bourses play a crucial role in the economy. They assist companies in raising capital and enable investors to generate profits.

Financial bourses operate on the principle of supply and demand. When there is high demand for an asset, its price increases. Conversely, when the supply of an asset is abundant, its price decreases. Bourses help establish the fair price of assets, allowing buyers and sellers to find each other and make trades.

Types of bourses based on the instruments traded there:

- Stock Exchange is a place where securities like stocks, bonds, and shares of investment funds are traded.

Example: New York Stock Exchange (NYSE)

- Currency Exchange is a place where currencies are traded. In most cases, the term “currency exchange” implies the interbank forex market, known as FOREX.

- Commodity Exchange is a place where commodities such as grains, metals, and energy sources are traded.

Example: New York Mercantile Exchange (NYMEX)

- Cryptocurrency Exchange is a place where financial instruments from the world of cryptocurrencies are traded.

Example: Binance

Financial bourses can also be used to trade derivatives (financial instruments derived from underlying assets), including futures, options, and others. For instance, on the Binance exchange, you can buy actual Bitcoin on the spot market or trade Bitcoin futures without physically owning the cryptocurrency.

As time goes on, bourses are becoming more versatile, offering clients a broader range of opportunities. You can trade various types of assets within a single bourse and brokerage account.

Useful links:

Working Principle of a Financial Bourse

The bourse provides investors with the opportunity to buy or sell stocks, futures, or other instruments. However, there is no direct access to the bourse for an individual. To participate in trading, one needs to engage with a broker — a mediator who profits from commissions on trades.

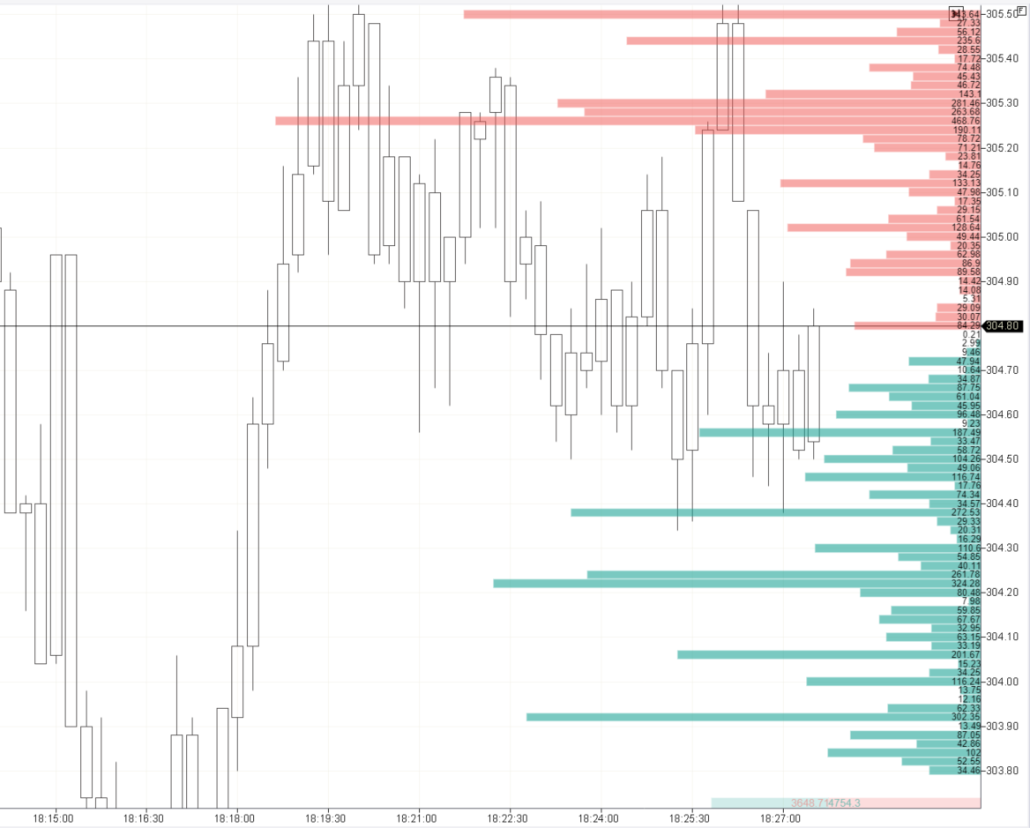

In the chart below, the DOM indicator (Depth of Market) is presented, showing:

- orders to buy below the current price (Buy Limits) in green;

- orders to sell above the current price (Sell Limits) in red.

Modern technologies enable bourses to process all orders quickly and find the best way to connect buyers and sellers.

A bourse is an open platform where traders and investors work with brokerage firms to place orders for buying or selling stocks, currencies, commodities, index funds, and other assets.

The financial bourse has several goals:

- Organizing trades by admitting assets from issuers, developing specifications, monitoring transactions, etc.

- Efficiently connecting buyers with sellers by establishing fair asset prices;

- Ensuring transparency, preventing manipulation, and avoiding market crashes;

- Providing trade information, including real-time quotes and daily volume data.

Useful links:

How the First Bourse Appeared

The first bourse appeared in Europe in the 12th to 14th centuries. Back then merchants conducted trade expeditions to various countries. Promissory notes became popular as those securities enabled the holder to claim a specific sum in the local currency. Merchants gathered in specific areas or specialized spaces to make trades involving these promissory notes. Those gatherings were called bourses.

A bourse in Bruges, Belgium, is considered to be one of the first bourses. It was founded in 1309 and was called “Bourse”. It primarily traded promissory notes, but over time, other financial instruments, such as commodities and currencies, became commonplace.

FAQ

What is a bourse in simple terms?

How is a bourse different from the market?

Can one trade on the bourse without a broker?

How to Become a Trader on the Financial Bource

You have two options:

- Treat trading as an additional activity. This approach involves making trading (investment) decisions based on 4-hour/daily/weekly charts with the aim of holding positions for the long term (swing trading), preserving and growing funds.

- Make trading your primary profession. This approach requires active day trading (scalping), focusing on frequent trades. It is considered a more challenging option.

Trading on the bourse is a competitive business with the risk of losing your investments. Simply hitting the “Buy” button on an app is the easy part, but what about the results? To get consistent profits, you’ll need to exert significant efforts:

- undergo training;

- understand your competitive advantage, develop a trading strategy to capitalize on it, and refine it as you gain trading experience;

- trade with discipline.

ATAS will help you at every step. Of course, you can use platforms provided by brokers. However, they often lack advanced functionality and sophisticated tools for in-depth analysis to determine the reasons behind market price movements.

How to Use ATAS for Trading on the Bourse

ATAS Platform is top-notch software. By installing the platform, you will be able to:

- conduct a comprehensive analysis of financial markets based on data provided by bourses;

- place orders to buy/sell financial assets.

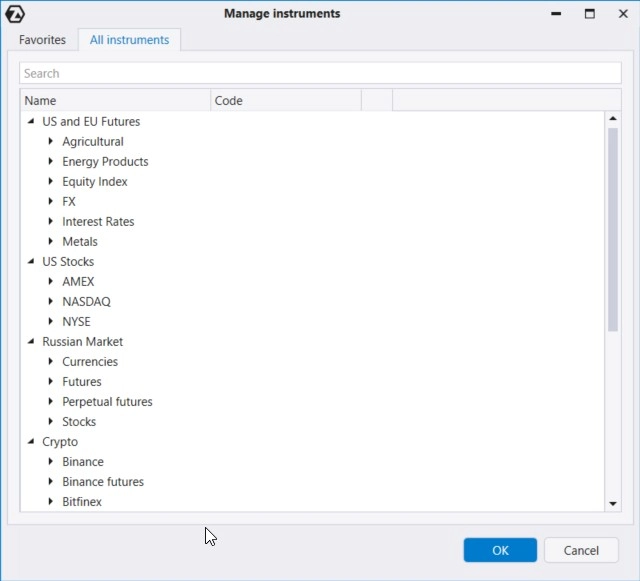

The screenshot below shows the ATAS Platform’s instrument manager. It provides an understanding of how exchange categories and financial instruments are represented on the platform.

Firstly, let’s consider what you can do on the platform without a broker:

- analyze markets — open charts with real-time price and volume data, apply indicators;

- use Market Replay— a market simulator that enables you to replay historical data and practice trading on the financial bourse as if it were happening in real-time. This way, you can gain the necessary experience without risking real capital.

After connecting to the bourse through a broker, you will be able to:

- receive Order Flow data, market depth, and other information from financial exchanges;

- execute trading operations (if you have sufficient funds in your brokerage account).

The tools provided by the ATAS platform will give you significant advantages in developing and implementing your strategy:

- Indicators. ATAS offers tick-level granularity, enabling market analysis with maximum accuracy. This is particularly crucial for day traders. Some of the most useful indicators include Cluster Search, Big Trades, and Speed of Tape.

- Cluster charts or footprints. By accessing information inside candlesticks, you can make more informed decisions compared to traders who only see 1-minute candlesticks. Additionally, you can experiment with different timeframes.

- Working with the Tape and the DOM. Useful ATAS tools for working with Level II and Order Flow include Smart DOM, DOM levels, and Smart Tape. Do not forget the indispensable tool for scalpers — DOM Trader.

- Educational resources. The blog, YouTube channel, and Knowledge Base provide specific instructions on setting up and working with charts, applying indicators, developing strategies, and other valuable information for day trading. Additionally, ATAS platform users can rely on responsive customer support.

Conclusions

Financial bourses work for the benefit of the economy, enhancing its efficiency. They help companies raise capital and provide investors with opportunities for both short-term and long-term gains. Exchanges also contribute to setting fair prices, ensuring transparency, and reducing risks.

However, trading on financial bourses comes with the inevitable risk of losing money due to price fluctuations. To enhance your chances of success, use specialized software.

Download ATAS. It is free. During the trial period, you will get full access to the platform’s tools to experiment with stock trading. Moreover, you can continue using the program for free even after the 14-day trial period is over, whether it is for cryptocurrency trading or volume analysis.

Do not miss the next article on our blog. Subscribe to our YouTube channel and follow us on Facebook, Instagram, Telegram, or X, where we publish the latest ATAS news.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.