- What is hedging?

- Advantages of hedging.

- Difference between diversification and hedging with futures.

- Hedging with futures.

- Conclusions. What to do in practice?

What is hedging?

The goal of hedging in the financial markets is protection of investments. Hedging is an investment method, which is directed at reduction of possible losses. Instruments, which do not correlate with each other, can be used for hedging. A hedging example from everyday life is purchase of an automobile insurance policy. Insurance can cover a part of possible losses in the event of a car accident or damage. The same approach is applied in the financial world. Hedge funds, investment funds and private traders actively use hedging for reducing various risks. Hedging cannot protect from losses completely, but can reduce them. It is possible to hedge various markets and events:- Stocks. The stock market is actively used for investing in individual stock, stock portfolios and stock indices.

- Commodities. Oil, gold, silver, wheat, coffee and so on are important commodities in the world economy, and it is important for many companies to hedge their price fluctuations.

- Interest rate market. This field includes lending and credit rates, and respective risks.

- Currency market. This field is connected with investing in currencies of various countries (we have an individual article about hedging currency risks).

- Weather. It is possible to hedge even weather risks, which can be interesting for agricultural producers.

Advantages of hedging

Hedging is getting more and more popular, that is why new derivative instruments, which help to control risks, emerge all the time. Various financial derivatives are used for hedging:- Forward contracts.

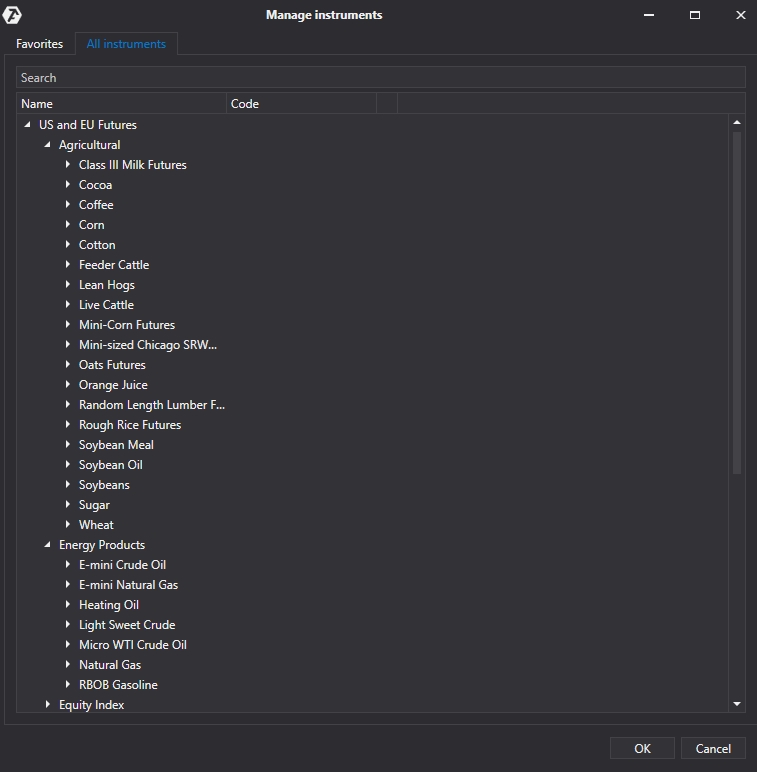

- Futures contracts. Here’s the list of some agricultural and energy futures available for hedging in the trading and analytical ATAS platform:

- Options.

- ETF.

Difference between diversification and hedging with futures

In order to understand the difference between diversification and hedging, first of all, it is important to discuss what risks an investor can face. In fact, you expose yourself to a risk when you buy a company stock. Actually, there are two types of risk:

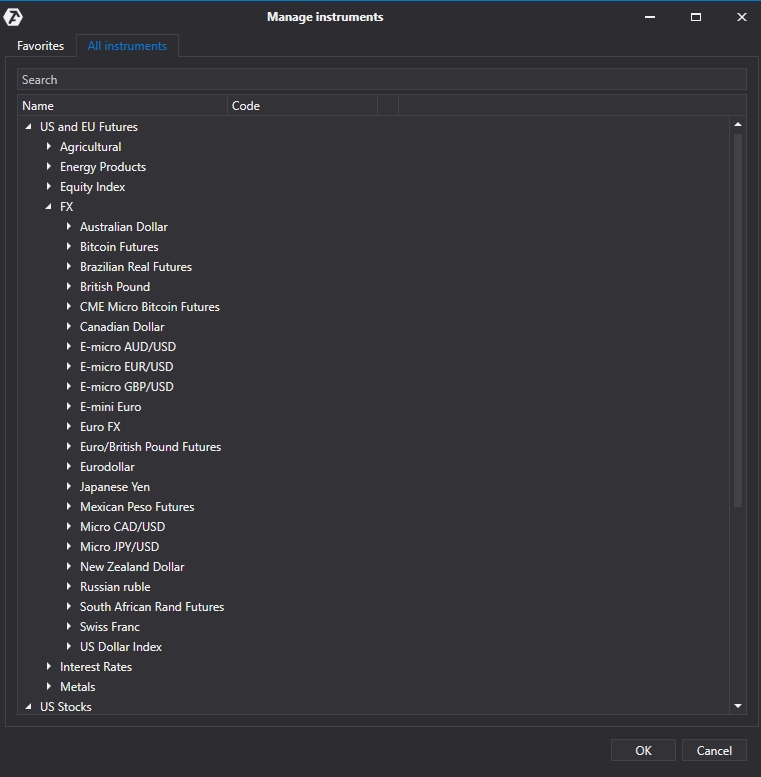

- Australian Dollar,

- British Pound,

- Canadian Dollar,

- Euro Fx,

- Japanese Yen,

- Swiss Franc.

Conclusions. What to do in practice?

Hedging risks with futures is what major companies and rich people do, that is why it is important for a private trader and investor to:- study instruments available for hedging;

- study strategies, which are used for hedging risks with futures;

- use a currency futures basket for hedging their own currency risks;

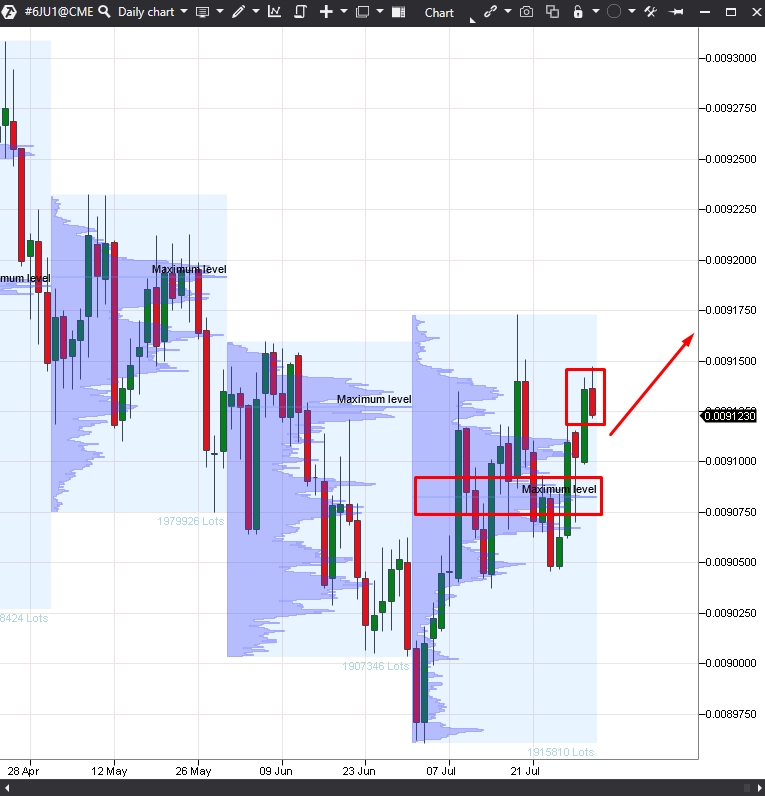

- use the trading and analytical ATAS platform for identifying optimum entry points.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.