- What a trader is and what it means

- What a trader does

- How to become a trader

- How to study to become a trader

In this unusual article we would present you an interview with a professional trader from Europe. He would give you practical advice how to become a trader and avoid mistakes on the basis of his own personal experience.

But, first of all, let us find out (if someone does not know yet) – what a trader is.

Trader – what is it? Trader means a merchant. And, although trading has a broad sense, most often, they mean an exchange trader when they say “a trader”.

Traders buy and sell securities – shares, futures, commodities, currencies, bonds, etc. – on the exchanges. An exchange is a place of work of a trader. But, in reality, traders work at home or in a private office, connecting to the exchange via Internet.

DO YOU WANT TO TEST YOURSELF AND BECOME A TRADER?

Let us meet a professional trader in order to learn:- how he started to trade on the exchange

- what mistakes he did

- what his advice would be to beginners who want to become traders from scratch but still do not know how.

.

Michael, how did you become a trader?

I think my story is rather trivial. All financial markets and instruments are very interesting that is why I decided to try something personally. I started on ZuluTrade and also worked with some European CFD brokers. I made big money and I lost big money at the same time … I realized very fast that it was really difficult to trade without the information the professionals have, that is why I became interested in the futures markets in 2012. Since then I never came back to CFD trading again … Let us step aside to make some things clear:- what CFD is

- why Michael, a professional trader, does not recommend to work with CFD and started to trade futures contracts

- why the futures markets have information, which professionals possess

What CFD is, advantages and disadvantages

CFD is a Contract For Difference of prices. It is a financial instrument, which allows making profit from the underlying asset price change without owning this asset. The underlying assets are stock, currencies, etc. CFD trading is like betting. If a trader believes that the Apple stock would go up, he buys CFD AAPL and makes profit if AAPL go up.Main CFD advantages

- high leverage and, as a consequence, a low cost of market entrance. If one wants to buy 1 Google share, he needs to pay its real cost (this is more than USD one thousand), however, one needs to have 2% to 20% of the share cost (depending on a broker) on his account in order to buy CFD GOOG.

- global coverage. There are CFD on currencies, cryptocurrencies, stocks of companies from various countries, indices, oil, gold and other underlying assets. After connecting to a CFD broker, you can start trading from one platform in different markets immediately.

CFD disadvantages

- higher risk which is connected with a high leverage

- high spreadsbetween ask and bid (what ask, bid and spread are)

- despite the fact that CFD products are provided by reputable brokers, the market of contracts for difference of prices is poorly regulated.

Also, one of CFD disadvantages is deficiency valuable information in this market. We do not mean the information background, such as news, rumors and forecasts.

WHY THE FUTURES MARKETS HAVE INFORMATION POSSESSED BY PROFESSIONAL TRADERS

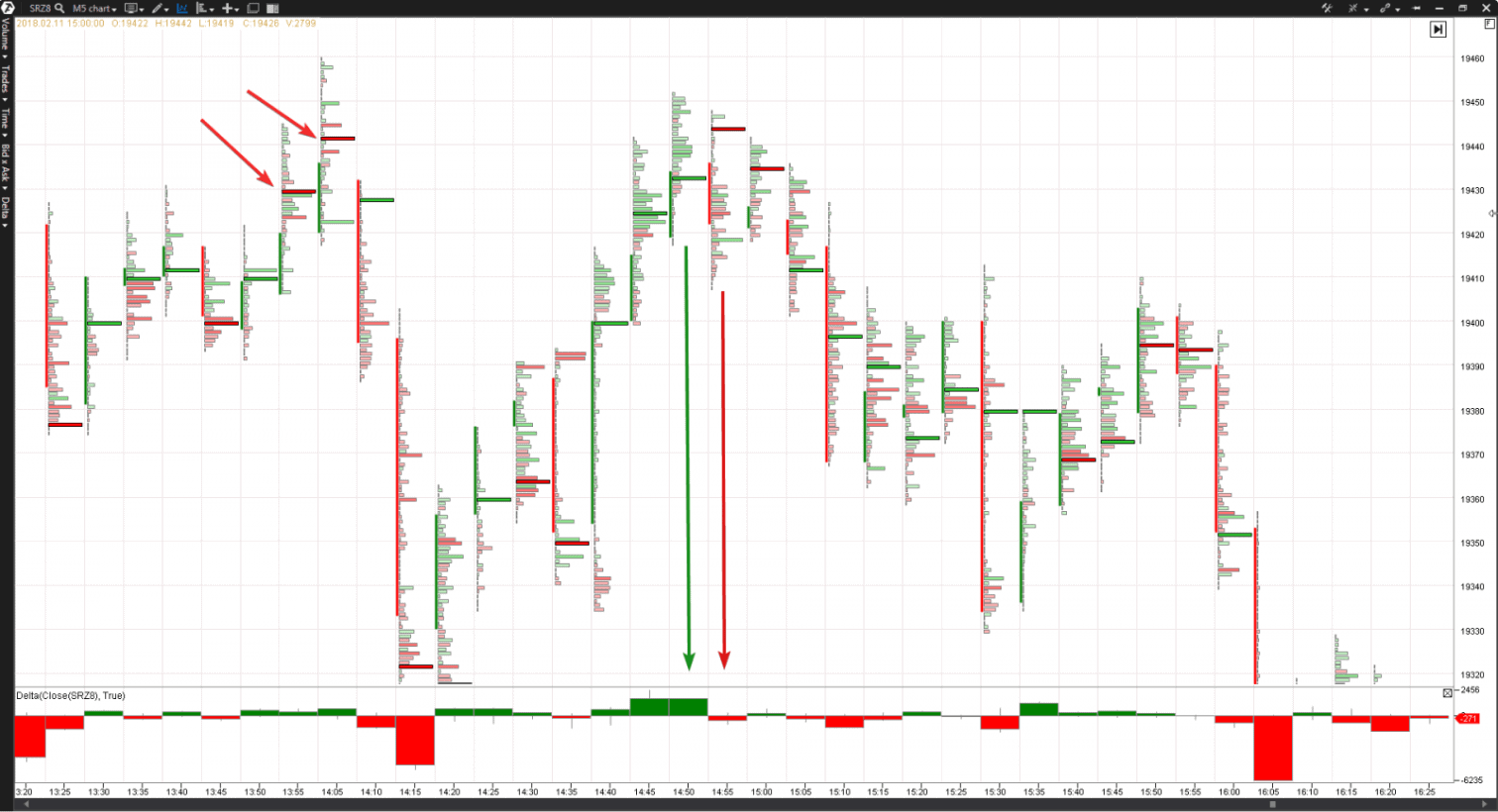

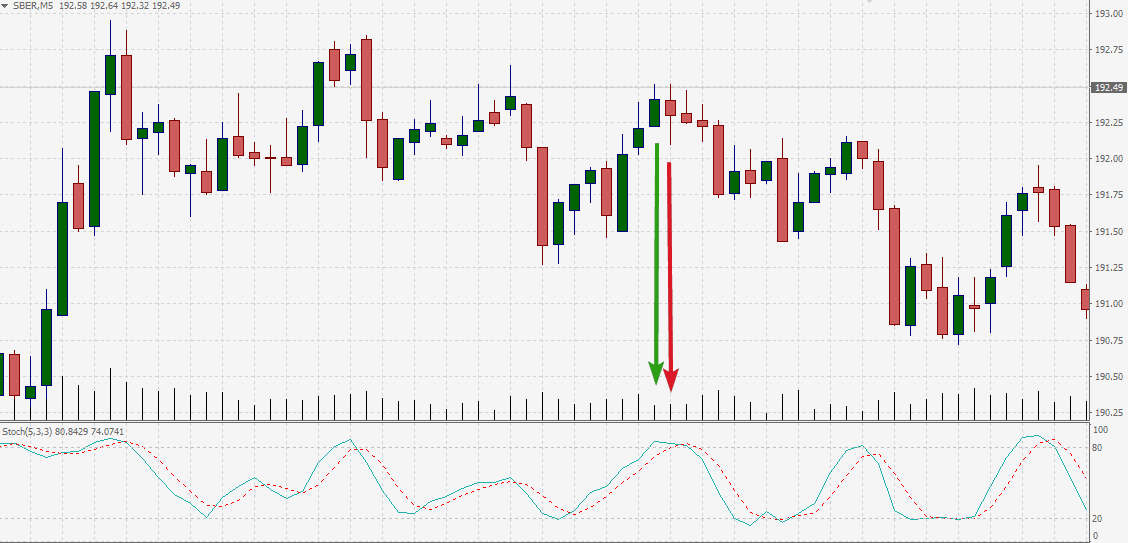

The forward market provides more information about the processes of buying and selling, which provides better possibilities for analysis and making decisions regarding the quality of supply and demand and search for support and resistance levels. Analysis with the help of professional instruments cannot be compared with very simple strategies the beginner traders use. In order to demonstrate what information we speak about, let us look at 2 charts.- The first one shows the process of trading futures contracts on the SBER stock; it is the cluster type of a chart.

- The second one shows CFD on Sberbank stock; it is the standard candle type of a chart.

Timeframes are 5 minutes. The charts cover a short period of time of the process of trading one and the same underlying asset on November 2, 2018.

My first mistake in this sphere was that I believed in simplicity of this business – just buy breaks and sell rallies.

I started to study markets and their structures. And I started to use ATAS sometime in 2011-2012. It was the period when I went deep into futures, volumes and order from techniques. Download a free test version of ATAS right now I can state that I tried practically EVERY product in this sphere and saw it for myself that there is no other software for traders, which would provide such a freedom of action and offered so many opportunities.

Another strong point of my decision is a personal support and a possibility to develop own instruments with the help of ATAS API.

In my work I mainly use my own developments and, of course, such basic instruments as Cluster Search and various market profiles.

- 6 settings of the CLUSTER SEARCH indicator, which not a single important volume can escape

- Why professional traders use the volume market profile

There is one good way to compare my trading with ATAS and without it: put a plastic bag on your head and say what the weather is like outside. The same is judging the futures market without ATAS. The platform provides me with additional information, based on which I apply a completely different trading approach – it helps me to make a correct decision – when to enter the market or when to exit the market. ATAS is good various trading styles. The platform provides you with such an arsenal of instruments that you can develop any types of strategies.

Can I recommend ATAS to my friends? Yes, I do it for a long time. As I already said, this is the best trading solution for me. Well, we came to conclusion that on the way from a beginner to professional trader one needs to:

- trade on professional markets. For a trader this means to connect to regulated official exchanges, which provide full data about volumes of purchases and sales with up to one transaction accuracy.

- to use professional software for analysis and trading.

But there is a question: how much time will it take to cover this path? Let us listen to what a professional trader says. It is difficult to say how much time you need to start positive trading. I think it all depends on a person. Not only on person’s ability to study technical things, but also on a psychological type of a person.

What I can state with 100% guarantee: the trading is not a thing you can study in two weeks … Technical part is the simplest one, while the most complex one is psychology. Speaking honestly, during my first 4 years of trading I always tried to beat the market, now I trade together with the market. I would give three advice to every beginner trader who wants to approach the professional level:

- study how the futures markets work and don’t waste your time on CFD

- do your own research

- do not trust everyone who gives you advice – 90% of trading trainers are cheaters.

Summary from the professional trader interview

- do not think that trading is a piece of cake. The “buy when the price goes up” rule does not work;

- choose professional platformsfor trading on official exchanges;

- devote more time to the trading psychology

- use professional softwarefor analyzing and trading.