An important event took place on August 15, 1971, which exerted influence on the current financial system. President Nixon declared the United States refusal of exchanging dollars for gold. This refusal became unexpected for other countries, that is why a number of presidential economic reforms of those times are called ‘Nixon shock’ and they jeopardized relation to the dollar.

Nevertheless, 50 years have passed and the dollar still preserves the world reserve currency status. You will find information in this article about what a reserve currency is and how the US dollar retains the lead. Read in the article:

- What the reserve currency is.

- How the US dollar became the world reserve currency.

- How the US dollar and gold are connected.

- Establishment of the US dollar as the reserve currency.

- Reserve currencies today.

- Reasons for the dollar stability.

- Which currency can challenge the dollar.

- How to trade dollar futures with chart examples.

What is the reserve currency?

The reserve currency is the currency of a developed country, which is accepted by other countries and is used for world trading (oil, for example) and settlement of international debts and liabilities.

Central banks and major financial institutions have significant amounts of the reserve currency both for these purposes and for investing, hedging and implementing internal policies.

For example, central banks can buy / sell the reserve currency in domestic markets in order to balance their economies and alleviate exchange rate risks when conducting operations with other countries.

How did the dollar become the reserve currency?

Many countries supported the US dollar as the main reserve currency as early as in the middle of the 1940s. The United States was in a better position than other countries at that time because its territory wasn’t affected by the Second World War.

At that time, the US GDP constituted 50% of the world GDP. Taking into account stability of the US dollar, it was accepted as the official reserve currency in order to facilitate stability of other currencies and recovery of countries after the acts of war.

The US dollar status as the world reserve currency was settled in 1944 as the result of the Bretton Woods Agreement, which was signed by representatives of 44 countries.

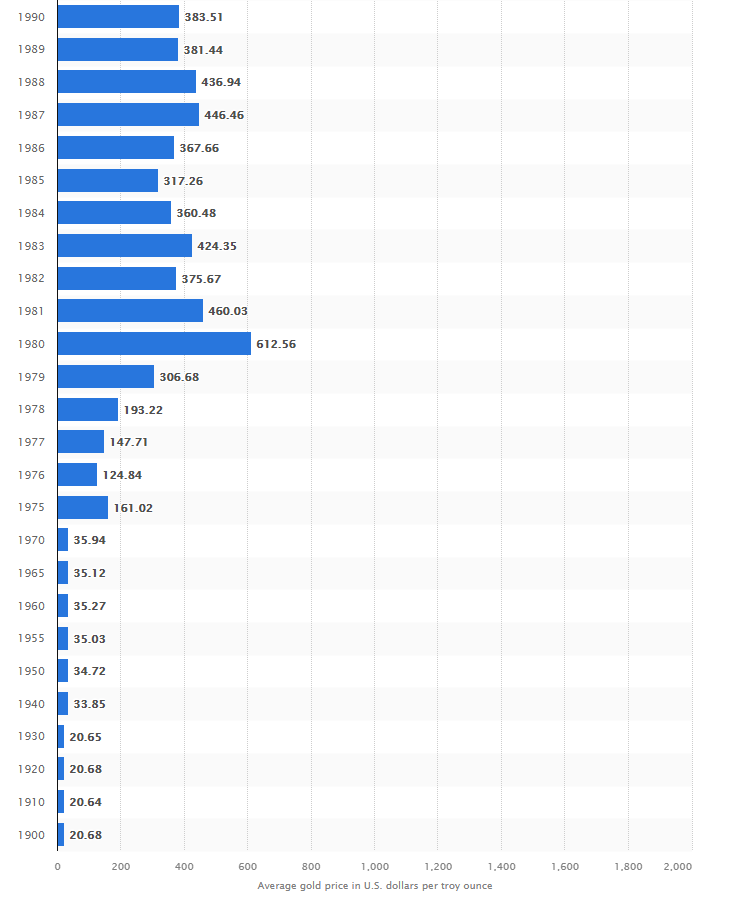

The agreement envisaged tying the dollar to gold and the gold price was about USD 35 per ounce. The dollar started to dominate in the world finances, trading and banking during the next 25 years and nearly all currency reserves were kept in dollars.

Untying from gold

However, the pressure on the dollar couldn’t be ignored by the end of the 1960s: the United States didn’t have enough gold to ensure convertibility. During the decades after the Second World War, the US Government printed more dollars, which were not secured by gold but by US Treasury Notes. Dollars flooded the economy – they were required for financing US state programs and conducting warfare in Vietnam.

That is why, the dollar was untied from gold during the Nixon presidency and the price of the ounce of gold sharply increased and has never returned back as it is shown by the Statista data below.

That refusal was declared as a temporary one but it turned out to be permanent.

Officially, the refusal of tying the dollar to gold was registered at the Jamaica conference in 1976. The world entered the epoch of floating currency rates.

Strengthening of the dollar as the reserve currency

Although the Nixon statement meant unexpected devaluation and serious reduction of trust in the United States, it didn’t influence the demand on the dollar much – the share of the American currency in the world reserves stayed above 80%.

Soon after that, the second reduction of trust in the US took place, since inflation grew to double digits in the 1970s, which undermined the value of dollar assets. Nevertheless, dollar reserves continued to be stable even despite the growth of alternative currencies, such as Japanese Yen, British Pound and Deutsche Mark.

The US growing budget and external deficit could threaten the dollar reserve currency status. In the 2000s, the net debt of the United States sharply increased up to one fourth of the GDP in 2008 and up to two thirds by 2020 due to the spread of global production and distribution chains, especially after integration of China into the world economy. The state debt ceiling was moved up again in 2021.

Reserve currencies today

According to the 2010 report, published by the United Nations Conference on Trading and Development, there is a recommendation to create a global currency, which will replace the US dollar as the world reserve currency. This assumption is based on the opinion that the US dollar has become unstable from the point of view of its value in the world market.

Despite this assumption, the US dollar is still the world’s main reserve currency. The second most popular currency in the world economy is Euro, which was introduced in 1999.

Moreover, the International Monetary Fund (IMF) officially declared the Chinese Yuan as a reserve currency in October 2016.

Nevertheless, even in the face of competitors, represented by Euro and Yuan, and under conditions of extreme deficit and merciless printing, the dollar hegemony as the reserve currency doesn’t get ruined. As of today, the USD share in the world reserves is 60%, which corresponds with long-term indicators, and the total volume of dollar reserves in the world grew from only 1% of the world GDP in 1970 to 9% in 2018.

Reasons of the USD stability as the reserve currency

Stability of the dollar reserve currency status has many components and we will specify some of them, excluding the conspiracy theory.

First of all, let’s take into account the economic size of the reserve currency issuer. If the reserve currency status was exceptionally or predominantly the issue of economic size, the Chinese yuan would have a much bigger share in world reserves. Instead, it accounts for 2% only. Yuan has approximately the same share as the Canadian dollar has.

In fact, open markets play an important role. The ability to execute business transactions and invest in dollars easily and confidently (especially in times of crisis) is very important for preserving the reserve currency status. The dollar would have little chances to stay as the key reserve currency without significant, liquid, transparent and open markets. The United States will keep its dominating position in them in the foreseeable future.

Secondly, it is geopolitics. Politics, military alliances in particular, significantly influences distribution of reserves. Alliance members, especially those that are actively protected by the reserve currency issuer, tend to maintain the issuer’s status. Dedollarization of Russia or Saudi Arabia investments in Treasury Notes are good illustrations of it. The US has a significant advantage here since its alliances have complex links with economically developed big countries.

Trust in state institutions and credit ratings are also important. As of today, ratings and trust in the US have stayed at the highest level for a long time and this position requires significant efforts.

What currency can challenge the dollar?

Let’s briefly analyse what experts say about competitors of the dollar as the world’s reserve currency:

- Euro. It is a strong competitor, but a less demanding banking system should be established in the eurozone in order to challenge the dollar. Also, the countries that are on the Euro periphery (Greece, Italy and Spain) pose danger.

- Yuan. Beijing needs to open the capital movement market and ensure liquidity and protection of investors in order to challenge the dollar. The aim of becoming the reserve currency can move the Yuan exchange rate up, which will make Chinese exports less competitive. It means that the reserve currency status is a privilege and burden at the same time and, consequently, requires a strategic balance.

- Cryptocurrencies. Development of digital alternative currencies, which have become a significant market during the past decade, cannot be ignored any more. However, Bitcoin, Litecoin, Ethereum and other cryptocurrencies have a big number of problems: volatility, liquidity, reliability and capitalization. All cryptocurrency characteristics are not proper for reserve currencies.

Despite the fact that the Dollar was ‘buried’ several times during 50 years after the Nixon shock, its reserve currency prospects seem stable, at least, in the short run.

What is the Dollar index?

We have a big individual article about the Dollar index and Dollar index futures. We will just note that the Dollar index futures is a financial instrument, which reflects the Dollar strength with respect to a basket of other currencies.

Fluctuations of the futures contract price opens opportunities to make money for both intraday and middle-term traders.

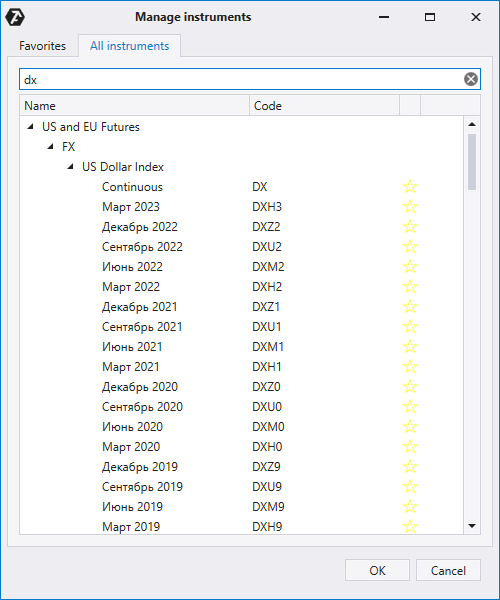

If you want to see the futures chart:

- Download the ATAS platform.

- Install and launch the platform (how to launch on Mac).

- Open the Chart window and select the DX instrument (see the picture below).

What is the Dollar index?

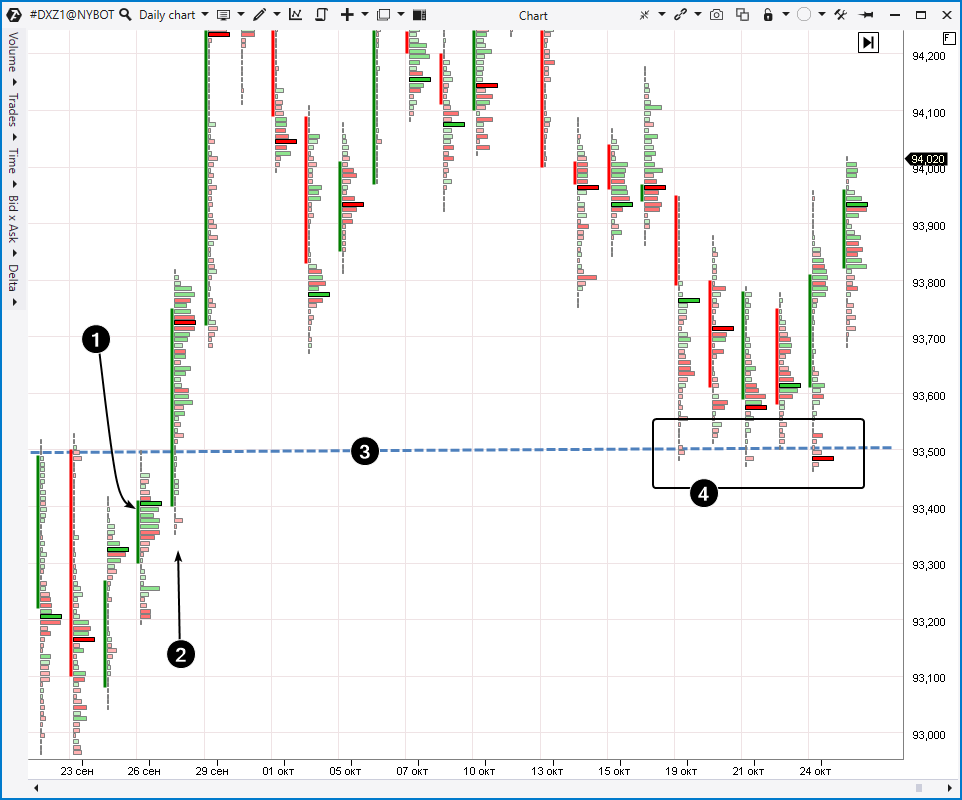

The dollar index futures is a specific market, which strongly depends on political and macroeconomic news. Nevertheless, ATAS cluster charts help to assess a situation correctly and find setups for an entry with a low risk and high profit making potential.

Cluster charts show the following story.

Number 1 marks the cluster, which testified to a high buyer activity. Most probably, it was ‘preparation’ for breaking the 93.500 level, which was resistance at that time.

Number 2 marks the day on which this breakout actually took place. A strong bar closing and narrow profile at the moment of breakout testify to the buyer predominance and give ground to assume that the level will serve as a serious support further on.

The price returned back to the 93.500 level in a couple of weeks and the market, as it was expected, received support. Minor splashes of activity, marked with red clusters on the day’s lows, most probably reflect intraday selling climaxes, which, in their turn, can be used by traders to enter a long position.

Cluster charts helped them to read the market and buy dollars at a good time.

Note. We recommend that those who wish to trade currencies read the How to select a currency pair for trading article.

Conclusions:

Reserve currencies allow conducting international trading and making settlements between countries. The US Dollar has been the world’s main reserve currency since the middle of the 1940s.

If you want to start trading the US dollar futures, you will need:

- Start-up capital.

- Registration of a brokerage account to have access to futures trading exchanges.

- Knowledge, strategy and discipline.

We recommend that you use a professional trading terminal for fast execution of trades and situation analysis with the help of modern methods. Download ATAS – this platform has a lot of functions and provides a real advantage.

ATAS shows buyer and seller activity in real time with the help of convenient cluster charts. Read our blog and subscribe to our YouTube channel to learn about useful ATAS platform indicators and various trading strategies.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.