Cryptocurrency Staking in Simple Terms

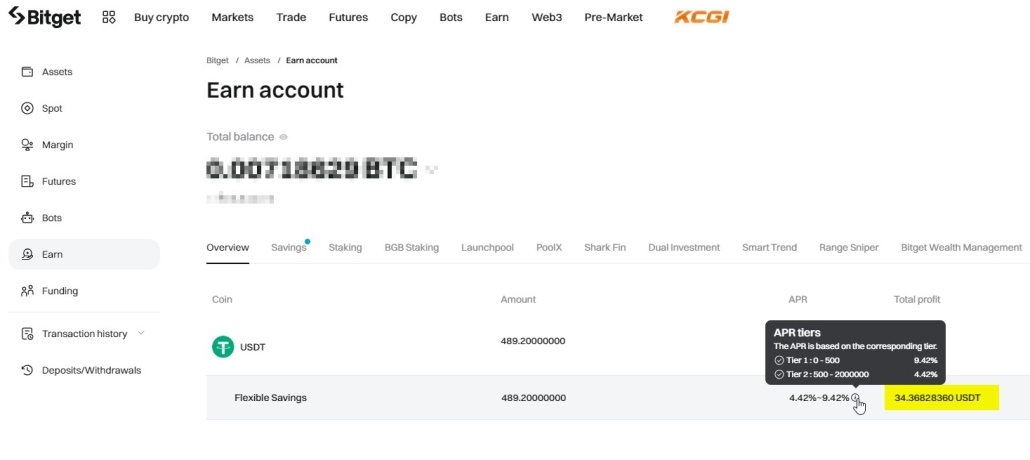

Cryptocurrency staking is the process of holding a certain amount of cryptocurrency in a wallet to support the functioning of a blockchain network. In return, a guaranteed reward is paid out, typically in percentages. In cryptocurrency contexts, “stake” refers to the amount of cryptocurrency you are willing to invest to participate in the functioning of the blockchain network. For instance, depositing 489 USDT into BitGet exchange’s staking account could yield almost 35 USDT in earnings without much effort.

How Cryptocurrency Staking Works

Blockchain technology is versatile and, when applied to finance, has led to the emergence and development of the world of cryptocurrencies. To understand how crypto staking works, let’s break down key concepts like blockchain, validators, and consensus.How Do Cryptocurrencies Work?

Imagine a chain composed of numerous links called blocks:- The chain. Blocks are linked in a precise order, forming an endless sequence.

- Blocks. They store the transaction history between wallets (which anyone can create). When people trade cryptocurrencies, these transactions are recorded in new blocks.

Who Are Validators?

Someone needs to verify all new transactions to ensure they are fair and correct. This role is performed by validators. Validators are individuals or computers that create new blocks in the chain. They ensure there is no fraud (for example, you cannot send more coins than you have in your wallet). Validators are rewarded for their work with new coins.What Is Consensus?

Consensus is an agreement among all network participants that transactions are correct, and corresponding blocks should be added to the blockchain. Imagine a group of friends agreeing on which movie to watch – everyone must express consent. There are different ways to achieve consensus in blockchain. One of them is Proof of Stake (PoS) – with “Stake” being the key term. This mechanism is used by Ethereum 2.0, Solana, Toncoin (TON), Solana (SOL), Cardano (ADA), Polygon (MATIC), and other cryptocurrencies. Becoming a validator in a blockchain operating on the PoS consensus mechanism is open to anyone interested, but they must meet certain conditions to become a validator:- Staking. Different blockchain networks have varying minimum staking requirements. For instance, in Ethereum 2.0, the minimum stake is 32 ETH.

- Technical requirements. Validators must run and maintain a network node. This requires specific knowledge and skills. The validator node must be reliable and consistently operational to participate in the continuous process of transaction validation and block creation. Node downtime can lead to income losses and penalties.

- Additional conditions. These may include having specific experience or reputation, adhering to network rules, and participating in network governance.

- Exchange. Handles all the organizational, technical, and operational aspects of managing nodes, like setup, support, and ensuring their smooth operation.

- User. Contributes their funds as stakes. This makes the user a delegator, not a validator (since the exchange is the validator, and the user assists it). Users receive rewards for staking, which are divided between them and the exchange (the exchange might charge a fee for its services).

How Does Staking Work?

Now that we know about blockchain, validators, and consensus, let’s put it all together to understand how staking works:- You choose a cryptocurrency exchange (validator);

- Select the cryptocurrency for staking;

- Deposit into the staking wallet – become a delegator;

- Validators verify new transactions and create new blocks. You earn rewards for aiding in transaction verification and block creation.

How Much Can You Make From Crypto Staking?

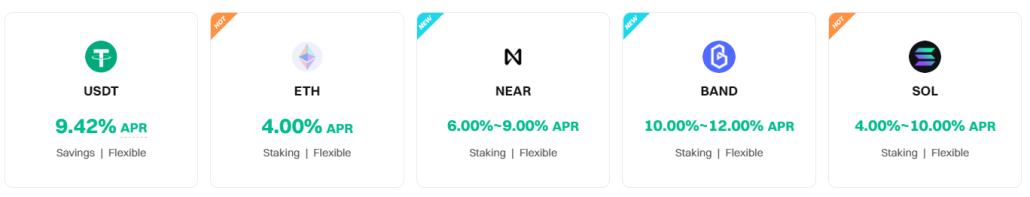

The earnings from staking cryptocurrency can fluctuate based on several factors, such as the cryptocurrency type, network conditions, exchange terms, current inflation rates, the number of stakers, and how rewards are distributed.

- APR (Annual Percentage Rate) considers only the annual percentage income without reinvestment (compound interest).

- APY (Annual Percentage Yield) factors in compound interest, meaning the income from reinvesting the earned interest.

- Ethereum 2.0 (ETH): around 3-5%.

- Cardano (ADA): around 4-6%.

- Polkadot (DOT): around 10-12%.

- Tezos (XTZ): around 5-7%.

How to Choose a Cryptocurrency for Staking

Let’s say you:- Have registered on a cryptocurrency exchange;

- Have funded your account (deposit is credited to your spot wallet);

- Want to choose a cryptocurrency for staking. But how?

- earn rewards from staking;

- benefit from potential price growth in the long term (if the market is bullish).

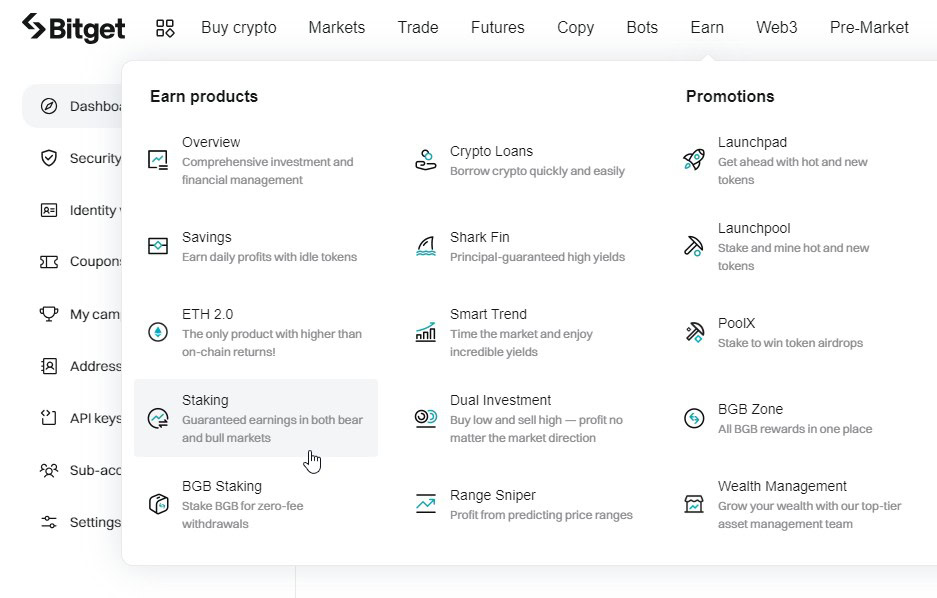

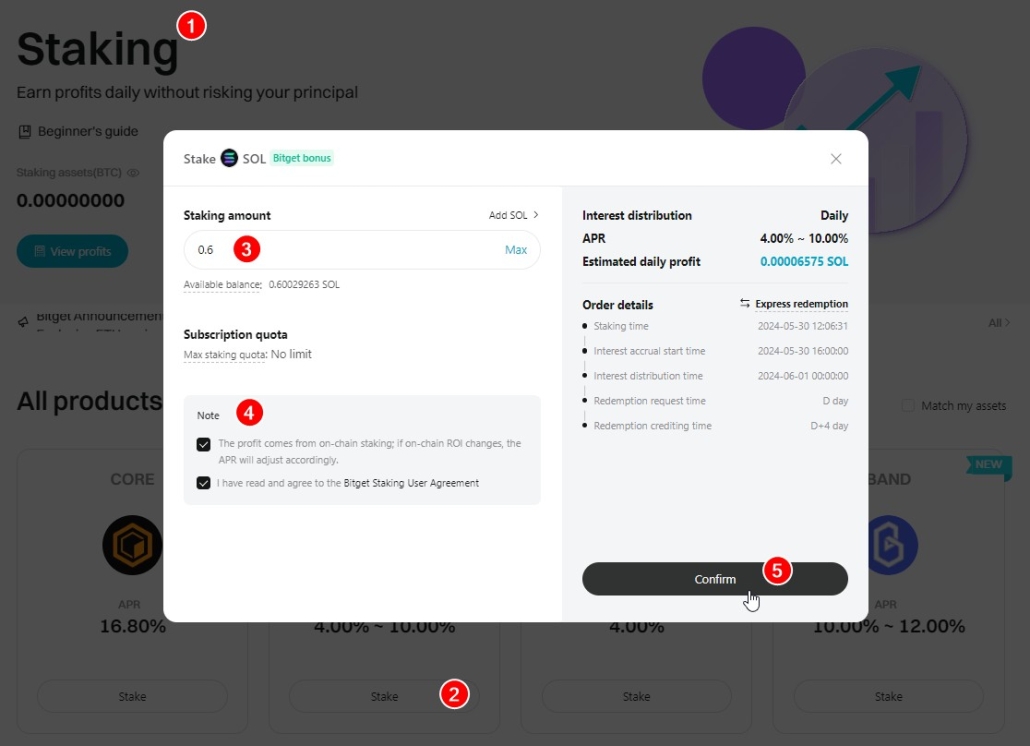

Step-By-Step Instructions. How to stake crypto

Let’s say you have an account on the BitGet exchange and you have decided to stake Solana.

| Staking | Trading | |

| Risk | Low to medium (depends on market conditions) | High (depends on market conditions) |

| Income Potential | Low, predictable passive income | High, but unpredictable and risky |

| Time Commitment | Minimal, requires less attention | Requires constant monitoring and market analysis |

| Knowledge and Skills | Basic knowledge of cryptocurrencies needed | Advanced trading knowledge required |

| Access to Funds | May be limited by fixed staking periods | High, quick access to funds |

| Suitable For | Long-term investors seeking stability | Active market participants ready for risks |

How to Train as a Cryptocurrency Trader?

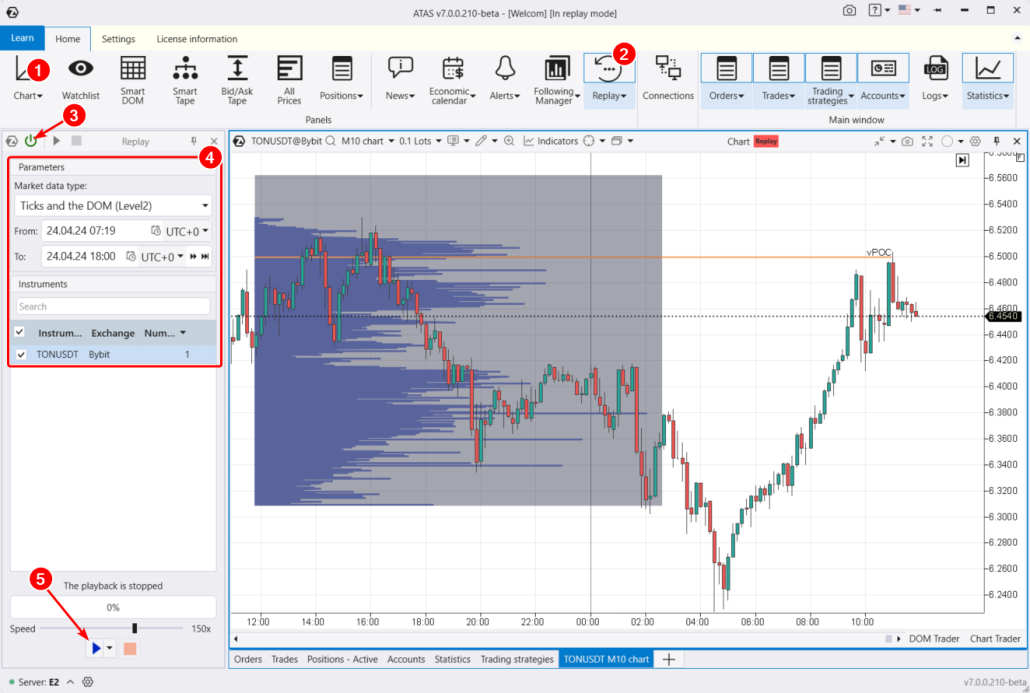

You can learn how to trade cryptocurrencies using the ATAS Market Replay simulator without any risk to your capital. Stable trends happen nearly every day, offering earning potential that surpasses even the best conditions offered in staking. To start using the cryptocurrency trader simulator, download, install, and launch the ATAS platform for free – then:

- adjust the playback speed, and pause;

- test your strategies, monitor signals from over 400 indicators;

- of course, use Chart Trader and other features to trade on the built-in demo Replay account and then analyze your performance;

- use drawing objects, for example, mark support and resistance levels;

- use various chart types (e.g., non-standard Range XV);

- use exit strategies;

- analyze volumes in the Level II order book, for instance, using the DOM Levels indicator;

- perform other activities that will help you quickly become an effective trader from scratch.

Conclusions

According to Benzinga and other sources:- in 2024, the number of cryptocurrency users worldwide ranges from 850 to 950 million,

- this number increases annually by 47.8-65.2%, indicating a high level of interest in cryptocurrencies.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.