Tokenomics: What Is It?

A token is a digital asset created and maintained by a project on a blockchain. While the term “token” is often used as a synonym for “cryptocurrency,” there is a subtle difference: each cryptocurrency has its own blockchain, whereas tokens can be issued on another blockchain, like Ethereum. Tokenomics, simply put, covers everything related to how a digital asset functions, including its creation, distribution, circulation, and its role in achieving the project’s goals. Tokenomics describes the ecosystem and conditions in which tokens operate. It also applies to cryptocurrencies like Bitcoin, encompassing all aspects of their operation.Tokenomics in Practice: A Real-Life Analogy

Imagine you start a fitness club (a blockchain project) and issue membership cards (tokens). When designing the “tokenomics of your club,” you would need to consider questions like:- How many membership cards will be issued?

- Will the number of cards change over time?

- Will the cards be different or identical?

- Who will receive them, and how?

- What value does the card represent?

- Can the card be given to others, and if so, how?

Why Is Tokenomics Important?

For investors and users, understanding tokenomics is crucial for making informed decisions about buying, selling, or using tokens. For project creators, tokenomics serves as a tool to encourage desired user behavior, generate interest in the project, and achieve various goals.Key Tokenomics Terms and Their Meanings

Inflation Rate — the rate at which new tokens are created, indicating the pace of inflation. Deflationary Mechanism — a system designed to reduce the total number of tokens in circulation, often through token burning. Token Burning — the process of permanently removing tokens from circulation to decrease the total supply, which can potentially increase their value. For example, 0.7 ETH is burned every minute:

Popular Types of Tokens:

Utility Token. A token that grants access to products or services within a specific project or platform. Examples:- Basic Attention Token (BAT) is used in the Brave browser to reward users for viewing ads and to facilitate payments from advertisers.

- Filecoin (FIL) is used to pay for data storage and retrieval in the decentralized Filecoin network.

Advantages of Well-Designed Tokenomics in Cryptocurrencies

Effective tokenomics can attract investors by offering transparency, stability, and growth potential for tokens. It also positively impacts: ✔ Maintaining token value. Good tokenomics helps keep token value stable through mechanisms like inflation and deflation controls, as well as opportunities for passive income (staking), and more. ✔ Community engagement. Tokenomics encourages early participation and keeps users, developers, and other members of the ecosystem active and involved over time. ✔ Ecosystem stability. Proper token distribution and management support project development. Tokenomics can also add extra value to tokens, further strengthening the project.Potential Issues with Poor Tokenomics

A poorly designed tokenomics model can deter investors, potentially leading to funding shortages and a slowdown in the project’s development. Other issues include: ✔ Volatility and instability. Ineffective token distribution can create vulnerabilities to manipulation, liquidity problems, and sharp swings in token value. This can undermine trust in the project and increase risks for participants. ✔ Inflation and devaluation. Without effective inflation control mechanisms, tokens can quickly lose their value. ✔ Lack of incentives: If participants do not receive adequate incentives to engage with and develop the ecosystem, it can lead to decreased activity and interest in the project. An example is shown in the screenshot below. The Cenit Finance tokenomics simulator illustrates the risks associated with poor tokenomics.

If tokenomics does not ensure token stability, it can ultimately result in the project’s bankruptcy.

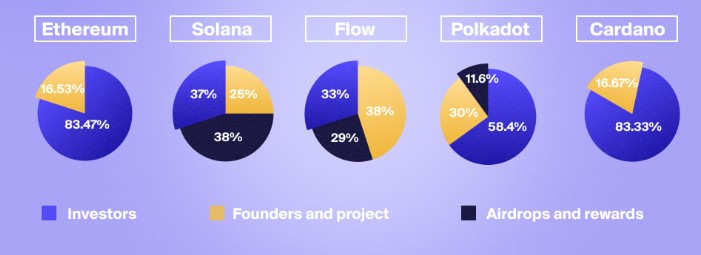

Comparing Tokenomics Across Leading Projects

The table below illustrates how different the tokenomics of top-10 cryptocurrencies can be:| Tokenomics Element | Bitcoin (BTC) | Ethereum (ETH) | Dogecoin (DOGE) | The Open Network (TON) |

| Maximum Supply | 21 million | Unlimited | Unlimited | 5 billion |

| Emission | Mining, halving every 4 years | Mining and validators (PoW and PoS) | Mining, fixed reward | Auctions, sales to investors |

| Distribution | Miners, investors, users | Investors (83.47%), creators (16.53%) | Miners, investors, users | Investors (98.55%), creators (1.45%) |

| Usage | Digital currency | Smart contracts, dApps, transactions | Payments, tips | dApps on Telegram, transactions |

Conclusions

Tokenomics is a crucial aspect of any cryptocurrency project. Information about tokenomics should be accessible and clear to all users of the project, which is why it is typically published even before the project’s official launch. Example. Bitcoin is widely known as “digital gold” due to its limited supply (21 million coins). This aspect of tokenomics, designed by Bitcoin’s creator Satoshi Nakamoto, makes BTC a popular choice for long-term investment, enhancing its appeal to investors. However, for short-term traders involved in crypto day trading, tokenomics is less likely to influence their trading decisions significantly. Download ATAS for free. This program enables you to trade tokens from successful projects with strong tokenomics that have been listed on reliable crypto exchanges. During the trial period, you will be able to experiment with various strategies using access to platform tools such as:- DOM Levels, market profiles, and other indicators;

- ATAS Smart DOM, ATAS Smart Tape;

- a Market Replay trader simulator;

- custom time frames, flexible settings, and much more.

Information in this article cannot be perceived as a call for investing or buying/selling of any asset on the exchange. All situations, discussed in the article, are provided with the purpose of getting acquainted with the functionality and advantages of the ATAS platform.