Initial Coin Offering (ICO) is directed at attraction of investments through selling tokens (a token is a unit of value issued in the blockchain system) received in the result of a limited emission.

Attraction of investments is the main goal of ICO which makes ICO similar to IPO (Initial Public Offering) in the stock market, however, this is the only similarity. The main differences of ICO are that this market is not regulated by the state at this moment and the rights of the token buyers differ from the rights of the buyers that buy stocks through IPO.

The tokens acquired by investors could be utility tokens, which allow their holders to exchange tokens for the company commodities or services, or dividend tokens, which allow to receive economic benefits from the company activity through participating in its profit. The recent tendency shows that companies that attract investments through ICO prefer emission of utility tokens more often.

In the course of conduct of ICO, the companies receive investments in the form of widely spread cryptocurrencies (Bitcoin, Ethereum and so on) or fiat currencies (USD, EUR and so on), which allows them to finance their current activity or launch a new startup project.

In this article:

- ICO market in 2017

- Sometimes it is difficult to forecast the ICO market behaviour

- ICO market is more promising and risky

ICO market in 2017

Attraction of investments through ICO still takes strong positions despite increased attention from regulatory bodies and market saturation. The volume of funds attracted through ICO is still at a rather high level when compared with an average size of venture investments.

This can be easily explained. The majority of investors come to the ICO market not only from the cryptocurrency sphere, the participants of which possess quite a deep understanding (or confidence) in order to invest in projects which are connected with the blockchain technology. Investors also come to ICO from other industries on the wave of endorsement of the topic of cryptocurrencies and blockchain technology by mass media.

One way or another, all participants of this market manifest much more enthusiasm in regards to investing in projects, which relate to the New Economy, rather than in projects one can call ‘traditional’ and which often do not experience a need in cryptocurrencies or blockchain technologies. As regards fintech projects, the ICO direction became for them quite a natural platform of testing the blockchain technology potential in solving really existing problems.

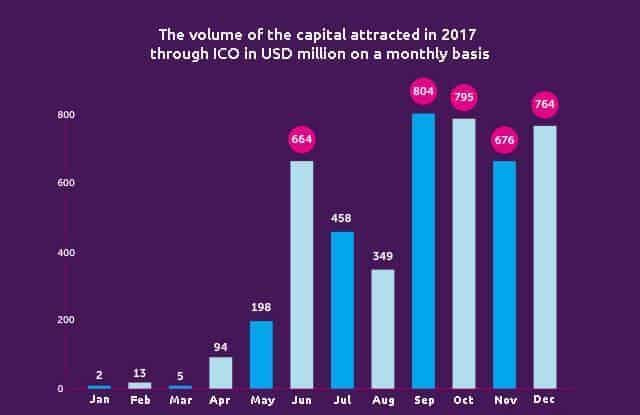

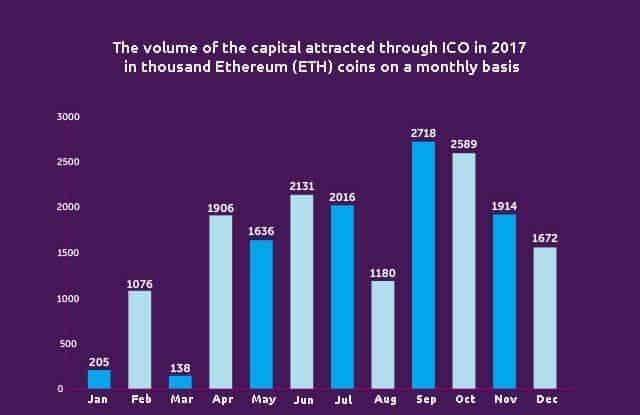

According to a study conducted by the BB Fund (Based on Blockchain Fund – a venture investment fund with capitalization of USD 200 million which invests in blockchain and fintech companies through acquisition of their securities and/or tokens), based on the tokendata,io data, more than USD 5.3 billion were attracted through ICO in 2017, USD 5.1 billion of which were collected during the past nine months of 2017. In general, 1,331 projects, which collected more than USD 1 million, were analyzed.

According to the study, 60% of all conducted ICO were profitable as of the middle of January 2018 and the median indicator of their profitability demonstrated the two-fold growth.

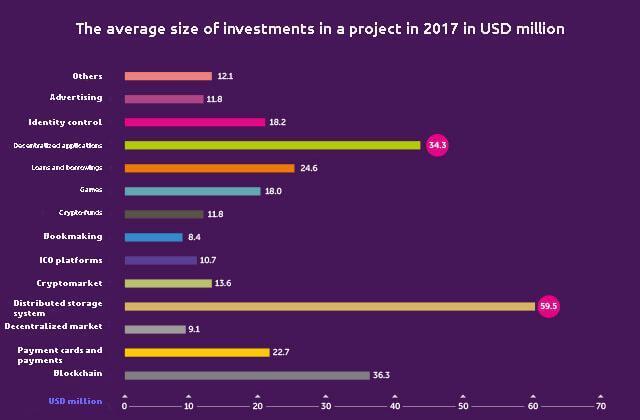

The classification is somewhat subjective and has the following structure:

The Blockchain category includes all projects that relate to the blockchain infrastructure.

The Payment Cards and Payments category includes a very wide range of projects that include both development of payment processors for the trading sphere and crypto-purse with built-in functions of p2p transfers and other options.

The Decentralized Market category consists of projects which usually correspond with the Decentralized XYZ description starting from the service markets (transportation, logistics, taxi and so on) and ending with commodity markets (real estate, electrical energy and so on) and also universal markets of any type of goods and services.

Although the majority of these projects doesn’t envisage introduction of the blockchain technology and improves already existing technologies and services, they still suffer from the lack of financing although some of them are of interest and have excellent prospects.

The Cryptomarket category includes all types of exchanges and similar platforms which work with crypto-assets.

The ICO Platforms category may include not only similar platforms, which offer decentralized crowdfunding through the ICO mechanism, but also business accelerators (social institutes for supporting startups), young entrepreneur clubs and any projects which declare that they deal with the development of an ecosystem for investors, teams of developers and crypto-enthusiasts.

Identity Control and Advertising also refer to the class of wide categories. The first segment includes projects with a focus on the control of human identity and identity of food products and content. The second one includes everything which is connected, one way or another, with advertising – from identification of a circle of potential clients and advertising events to the network of people that form the public opinion on brands.

We would like to place a special note on those commercial organizations in the Others category, which could be called ‘commodity-secured’. This term doesn’t always mean a traditional commodity such as gold or zinc oxide but also any tangible asset which could be considered or used as a security of a token emission.

This classification not only reflects an increased interest of investors to the blockchain infrastructure and fintech projects. It also demonstrates a higher cost of development of blockchain projects due to their increased operating load and a necessity to obtain a licence and expensive integration processes if we speak about financial technologies. Despite the fact that assessment of the company value and the volume of attracted investments are rarely justified, investors are more willing to invest in projects with high capital outlays.

Moreover, the year 2017 observed a sad tendency of emergence of low-quality projects in the bookmaking segment of the decentralized market, often without obvious diversity and original solutions.

Sometimes it is difficult to forecast the ico market behaviour

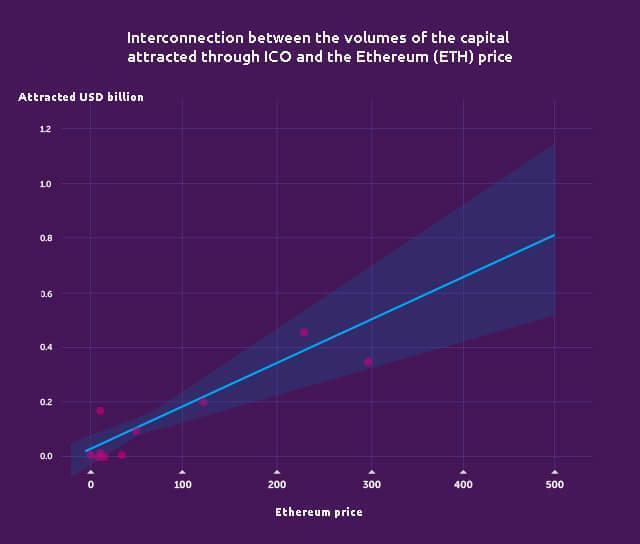

The linear equation system perfectly describes the crypto-asset price dynamics whether they are ‘traditional’ cryptocoins or new tokens issued within ICO. Moreover, the aggregate demand on crypto-assets is identified by intrasystem factors: mainly by the news, investor sentiments and market manipulations of ‘whales’ (holders of big volumes of cryptocurrencies – similar to institutional players in the traditional financial markets), who basically form the value of all crypto-markets.

Even if you are not properly acquainted with the correlation concept, you probably paid attention to the fact that every time the main amount of assets, except for some of them, as a rule, moves in one direction. This phenomenon is well-known to stock investors, especially those who trade assets in the markets with a high degree of political instability. You will easily find interconnection between the volumes of the funds attracted through ICO for one separate month and the Ethereum (ETH) price since these assets mutually influence each other. Interdependence is also very characteristic for the Bitcoin and Ethereum prices.

At the same time, it is difficult to attract long-term investors through ICO at present promising them income at some stage of the company development in the future. A startup, which attracts financing this way, should have a plan of how to achieve this future as soon as possible at a steady pace.

Although the blockchain technology, ICO and tokenized economy bring absolutely new technologies and business models to the world, the investing principles stay the same: long-term prospects, satisfaction of the real market demand and solution of pressing problems.

Vitalik Buterin, a co-founder of the Ethereum cryptocurrency project, wrote recently:

“The whole crypto-society needs to differ making hundreds of digital billions, circulating in this sphere, from creating something really important for the society”.

The ICO market offers many opportunities for speculations and fast income, especially by means of already existing presell discounts and premiums at an early stage of the primary placement of coins. Only a few participants are ready for a long-term game under the current conditions in the ICO market. Nevertheless, the investing approach should be built namely on a long-term strategy.

The key stages of realization of the New Economy strategy are:

- introduction of new technologies, including the blockchain technology, in the developing Asian, African and Latin American markets;

- execution of infrastructural changes with the aim to introduce the ‘new’ or reform the traditional banking system;

- mutual penetration of the cryptocurrency and traditional financial worlds including introduction of the blockchain technology by the state authorities.

ICO market is more promising and risky

We’ve observed a number of initiatives in this field recently and made sure that its main participants are interested in its further development. They managed to provide conditions for the blockchain connected companies to achieve the decisive success in their spheres of activity. As a result, investors that invested their funds in them through ICO made profit.

Not only representatives of the commodity and raw material sector but also some advertising, payment and credit companies move on the way to success due to the attraction of financing through ICO. Here are some recent examples: ETHLend (lending), Ripio (microlending), UTRUST (crypto-payment service), BitClave (smart advertising and promotion) and NVB (‘natural’ video ads in videoblogs and the platform for the search of content).

However, smart contracts (self-executable contracts in the blockchain environment) and tokens cause annoyance in a big number of other companies and it is unlikely that they would be able to benefit from the blockchain technology or, at least, to stay satisfied by a completely decentralized system.

Venture investment funds, family funds, banks and investment firms start to invest in projects and companies that are connected with the blockchain technology and also in Bitcoin funds and cryptocurrencies. It is impossible to list them all, that is why we will mention only the biggest of them: USV, Y Combinator, Foundation Capital, Wells Fargo, Jefferson River Capital LLC and Forsters LLP, Citi, JP Morgan and Goldman Sachs, Thomson Reuters, BoA, Winklevoss Capital, Lux Capital, HSBC and Temasek Holdings. In any case, the liquidity flows into the blockchain ecosystem at an extremely swift rate compared to many other currently existing ecosystems.

Unlike those who easily collected small amounts by way of fraud through ICO and absent-mindedness of investors, the major ICO market participants are forced to look for new methods of monetization of their services, invent new products and business models in order to stay in this rather expensive business sphere. The biggest of them, most probably, will soon become investors themselves looking for profitable projects for their investments which will not have the best effect on the holders of their tokens but will be favourable for the Bitcon ecosystem in general. It seems crazy, but when there are huge amounts of received investments at stake and incomes of such companies often depend on the buying capacity of their own tokens, they are simply forced to look for ways of increasing their own welfare as never before.